The methods I have been discussing and the results displayed on other pages have given no consideration to what a company does to produce earnings. Trading buy signals give no reasons “why” a share is performing as it is. Systems are often based on momentum of price and volume.

However, some people are deeply concerned about a company’s effect on the environment and the social impact of a company's policy. Our trading rules may trigger a buy in a gambling company - you may be passionately opposed to gambling. You may also feel strongly opposed to alcohol and consider it a social problem and do not want to support companies in this sector. If so you can do your own screening of stocks to suit your personal beliefs.

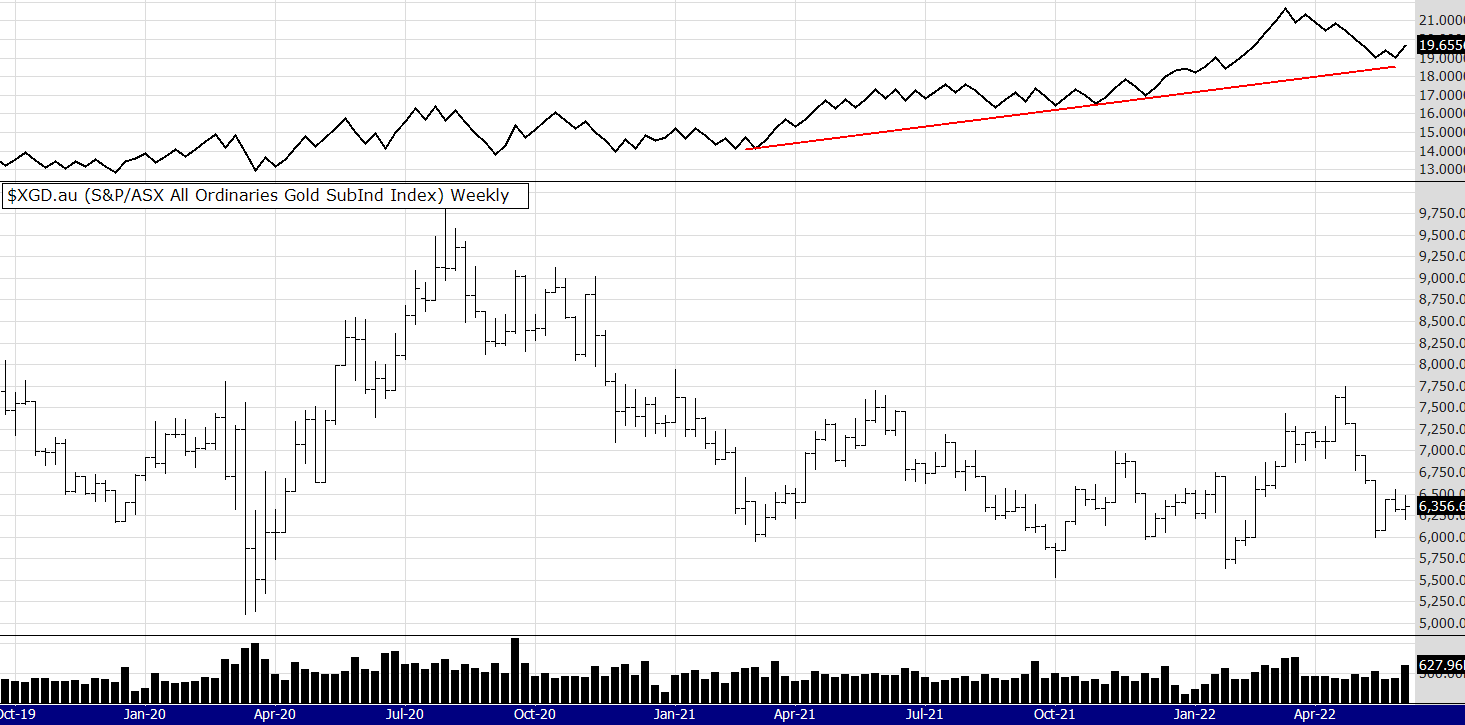

For example, for many years I traded the gold market particularly gold shares.

Mining is a controversial issue and I agree with the concerns of many. For example some years ago Newcrest Mining of Australia bought out Lihir gold of Papua New Guinea. Lihir has a horrid environmental record in that country in regard to polluting river systems and for that reason I would not buy it. Hopefully Newcrest is doing a better job.

As a child I lived in New Guinea and remember swimming in the rivers with children of that country. I don’t like the thought that no longer will those rivers be pollution free, because we in western economies support a company with little concern for social liberties.

This is my choice, we all need to make our decisions and live with them. It is possible to still make money and trade well by being a little selective.

Below is a guideline as to what to look for before deciding to invest in a company, more information can be found on the ASX website or by googling a companies website for its ethical protocol.

Ethical Criteria

|

Your trading needs to be easy, simple and as stress free as possible.

Reduce the stress, feel in control and you will trade well.

Trade well and you make money.

Follow the three sections of this site to learn more

- Have an Objective

- Its about YOU

- Keep it Simple

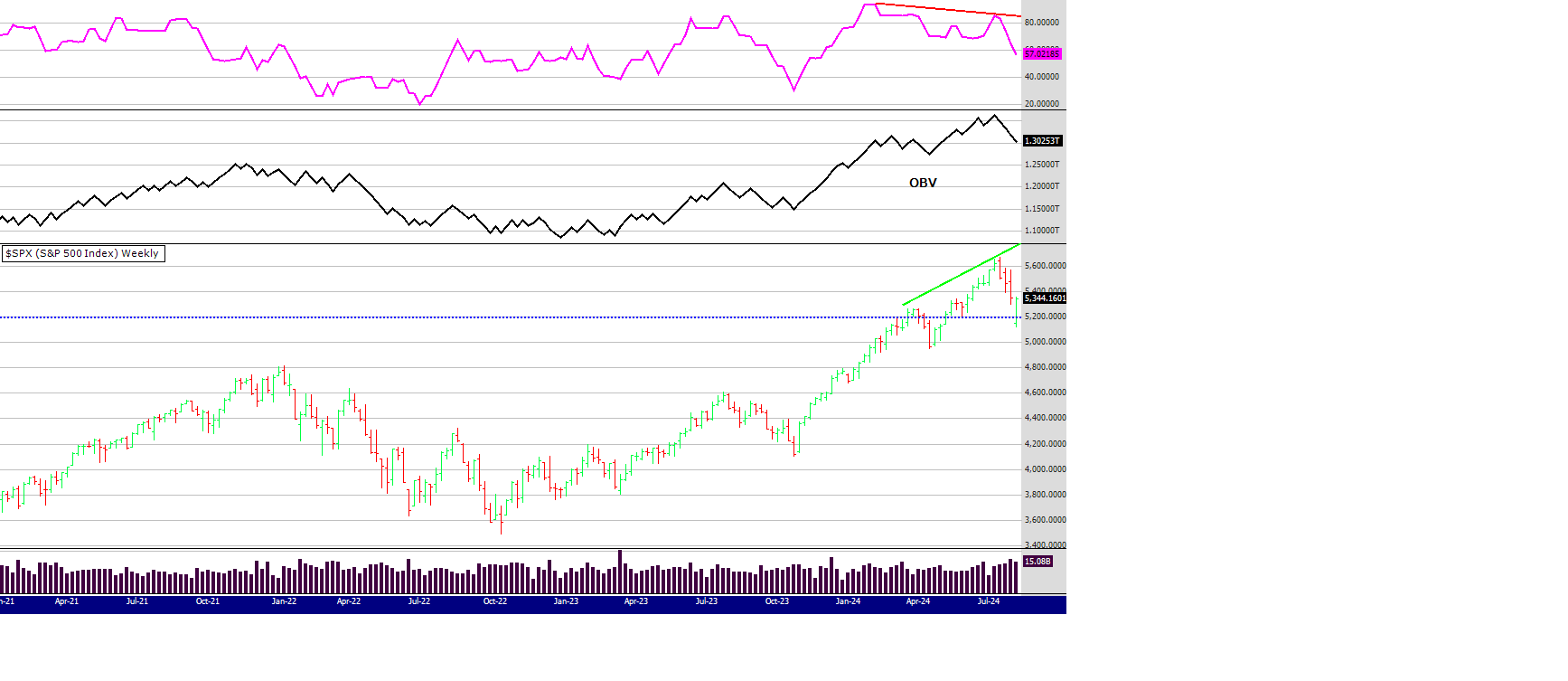

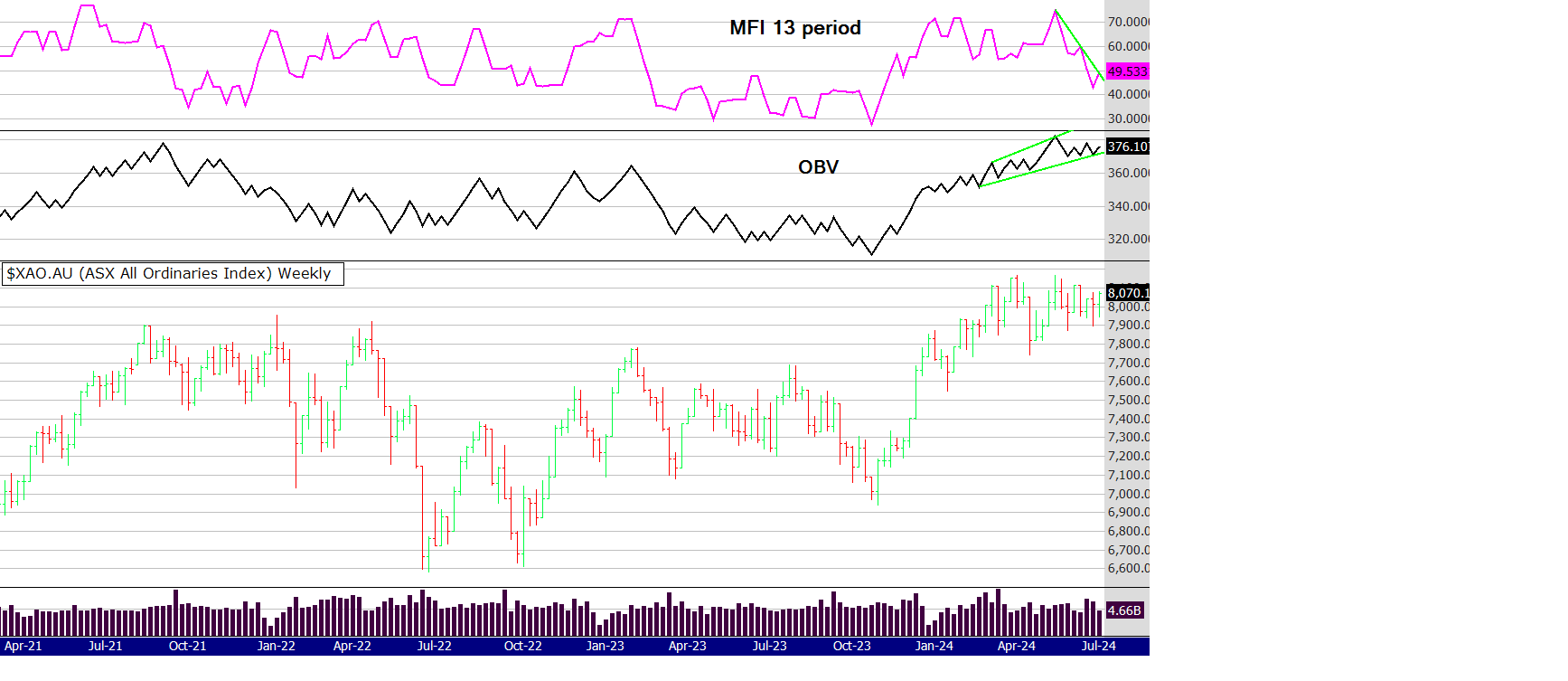

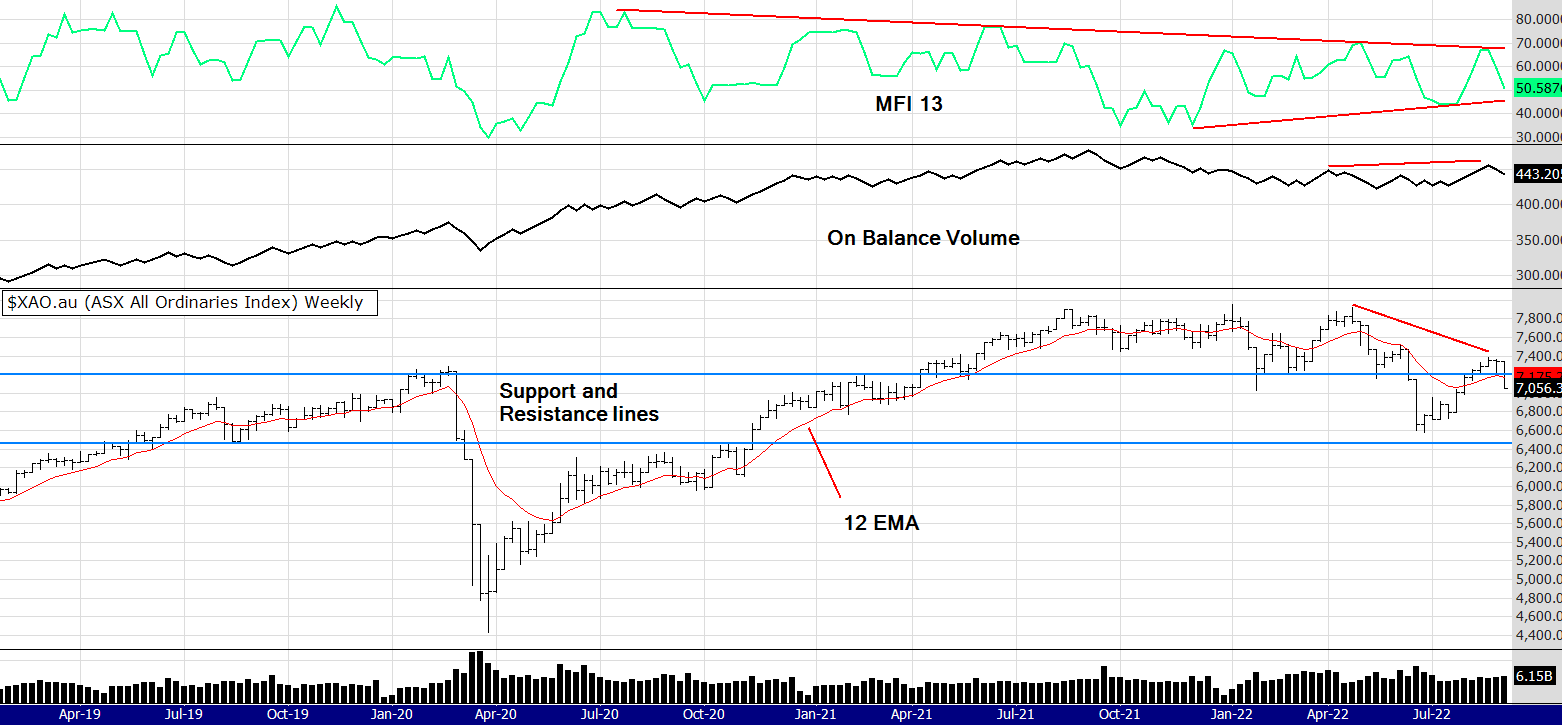

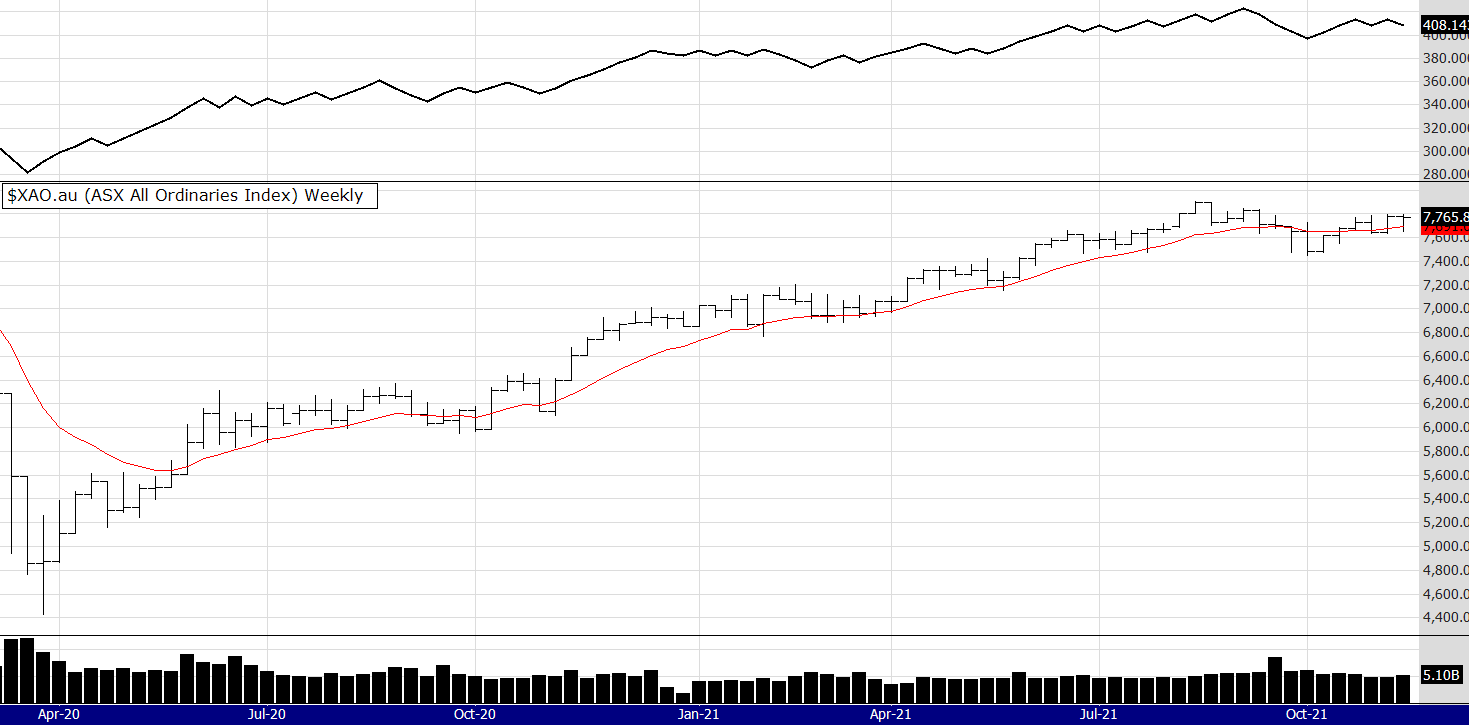

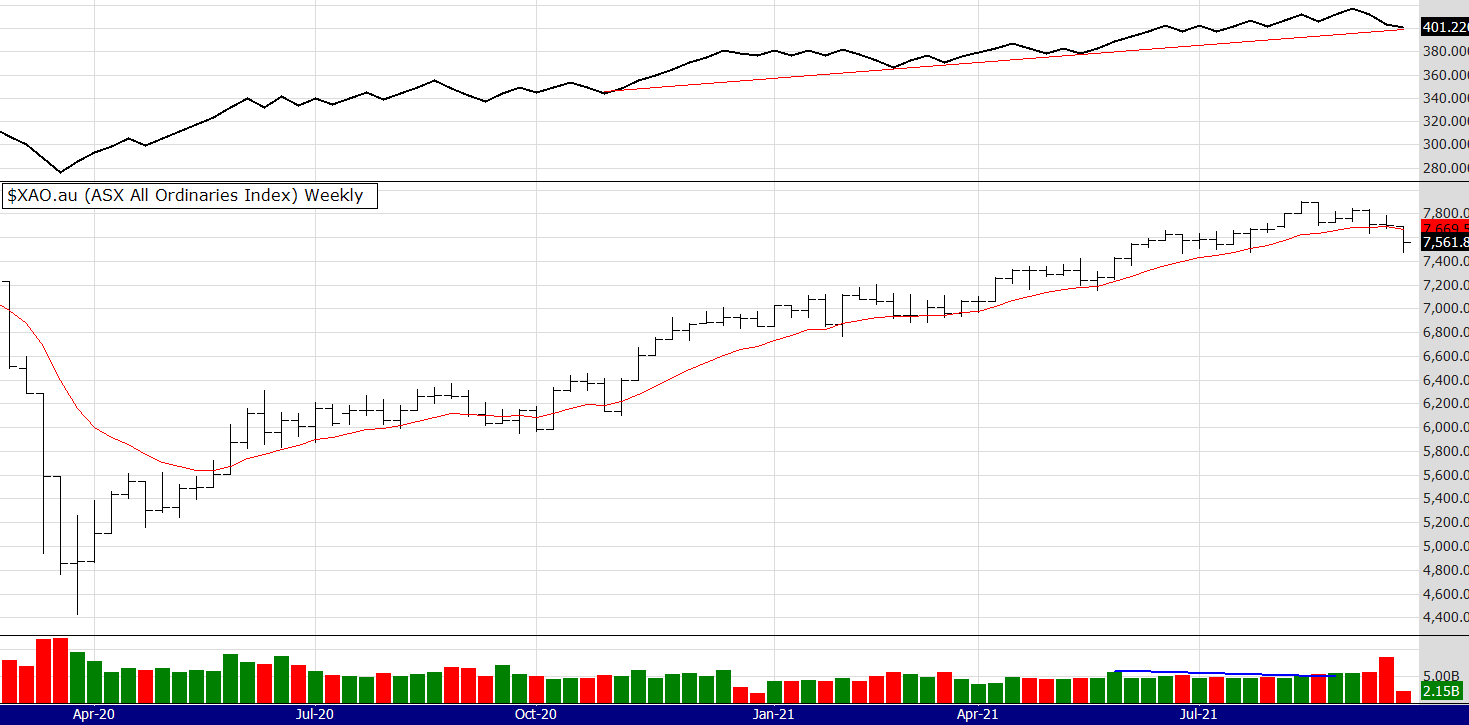

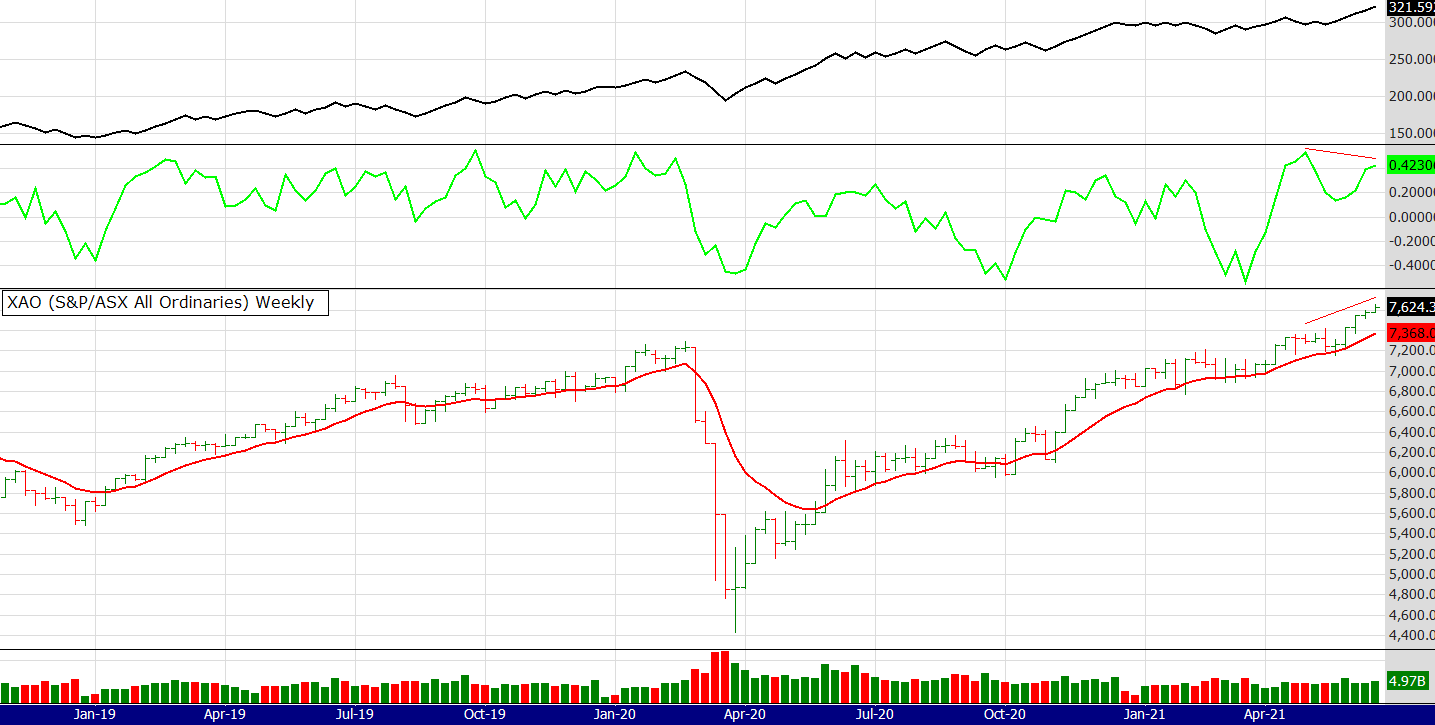

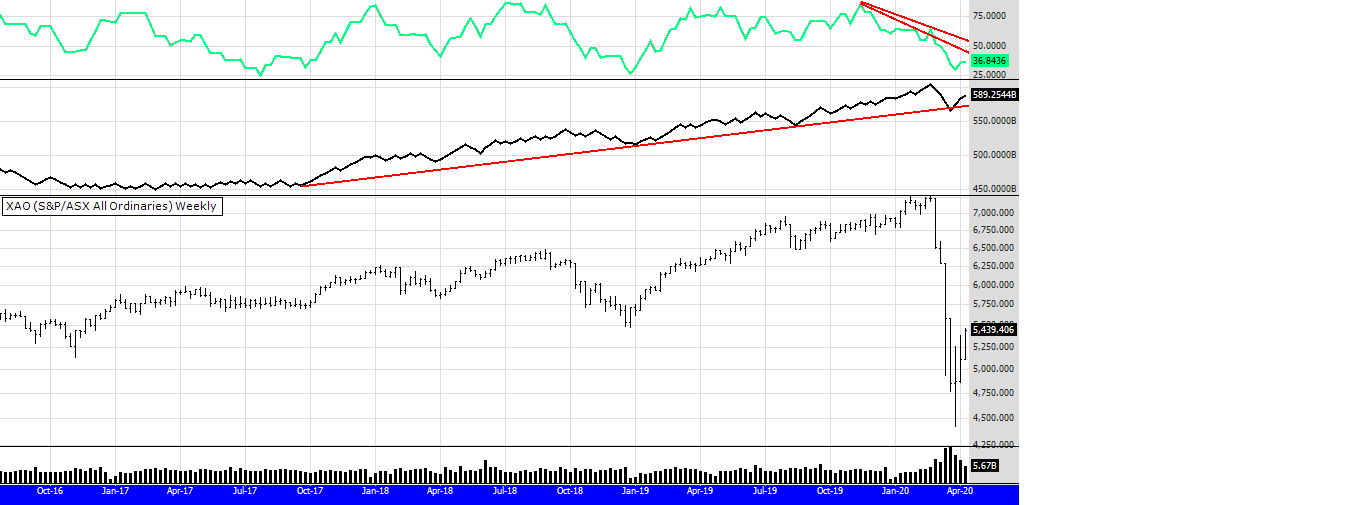

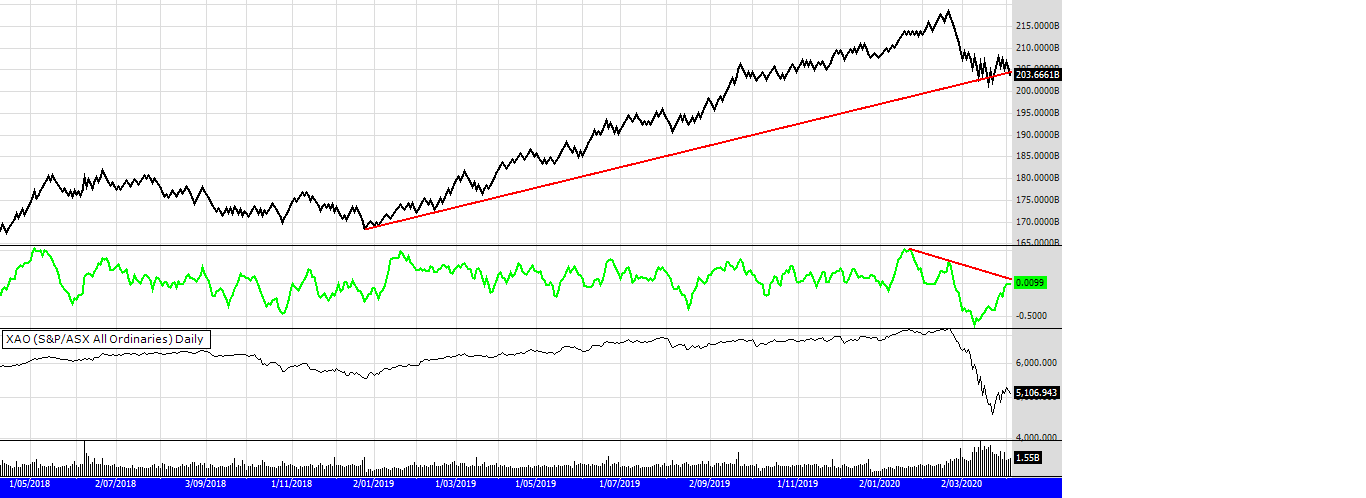

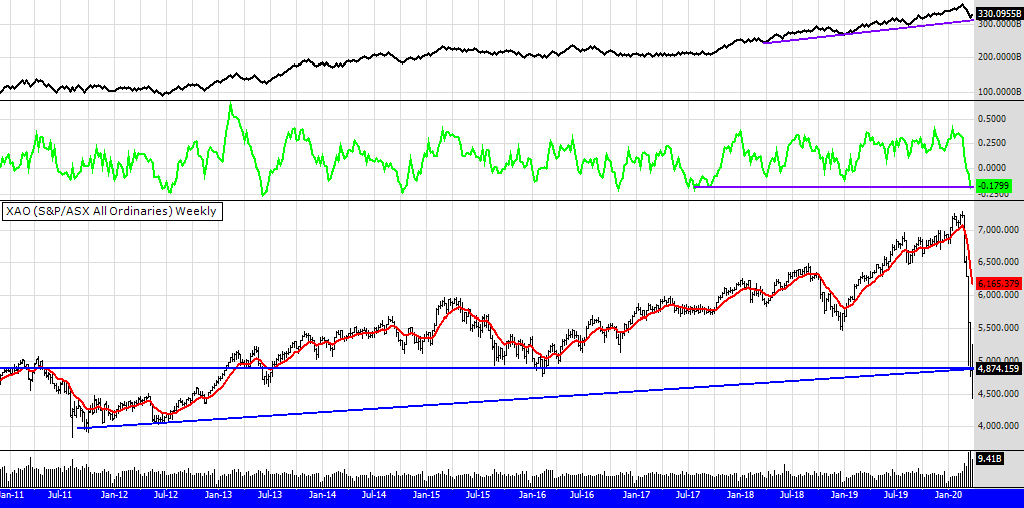

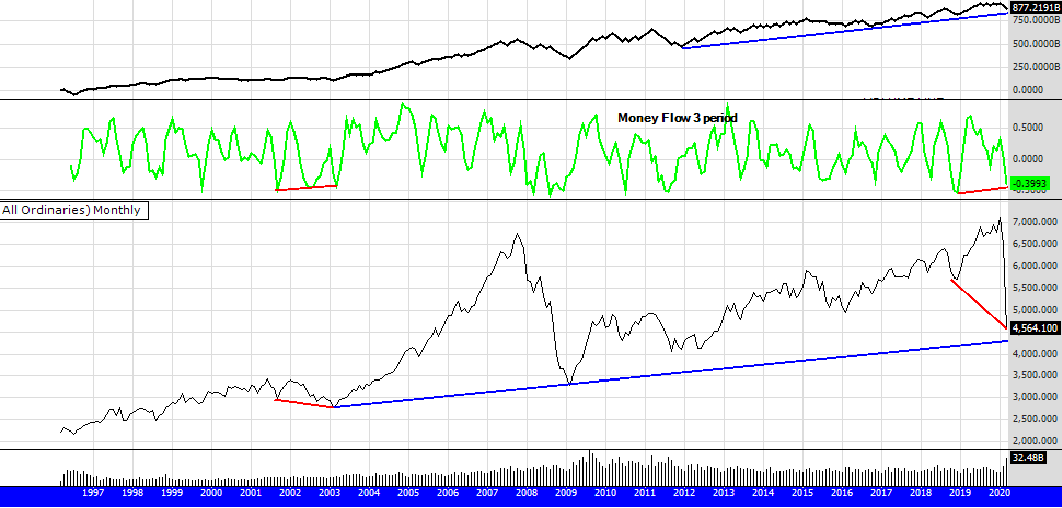

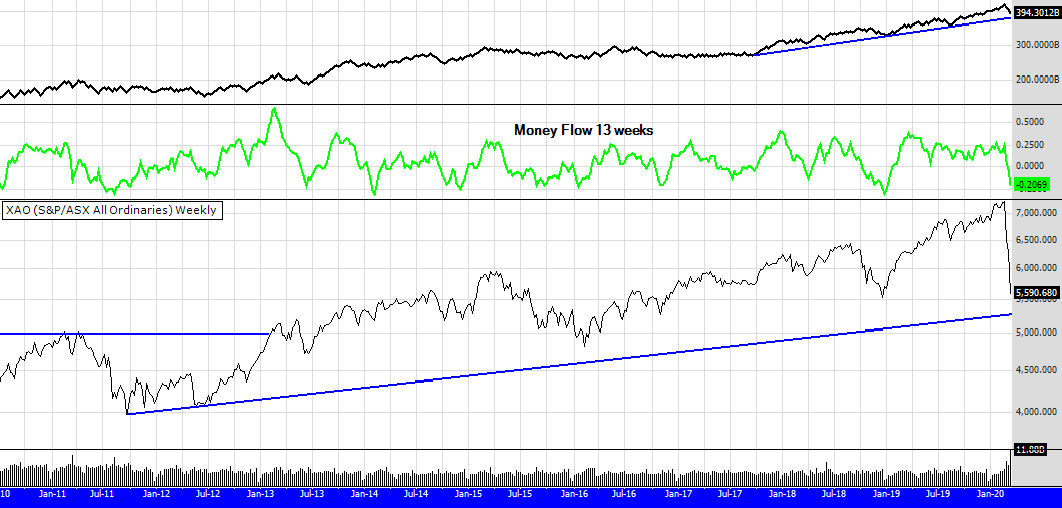

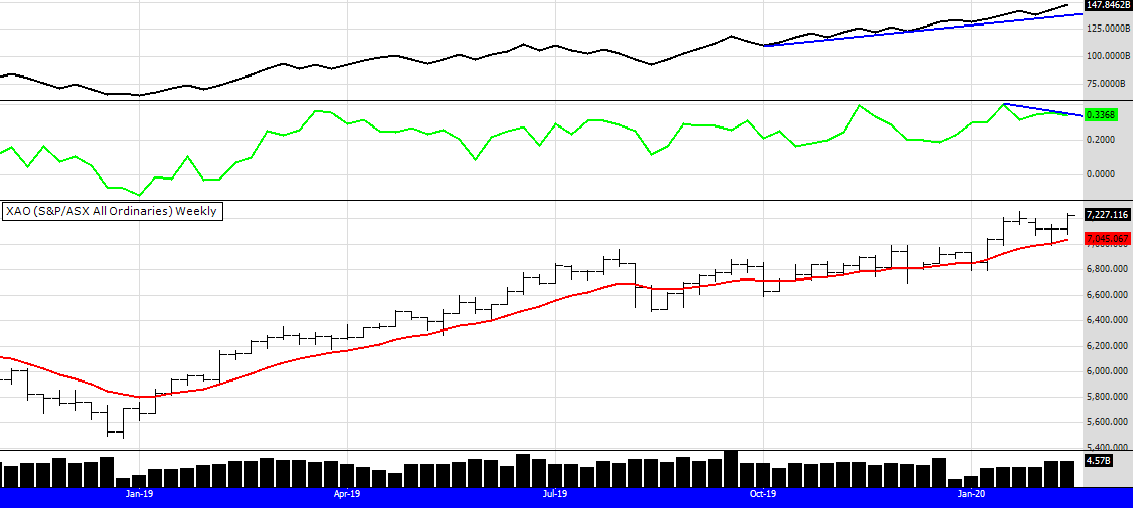

MARKET COMMENTS: As of the close on Friday 16/8/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

The big news this week is that after last week not having any 52 WH signals (for as long as I can remember - probably back to Covid 2020) this week there is eleven in the 300 and two in the 300 to 500. So the bulls went hiding last week and this week are back with a vengeance.

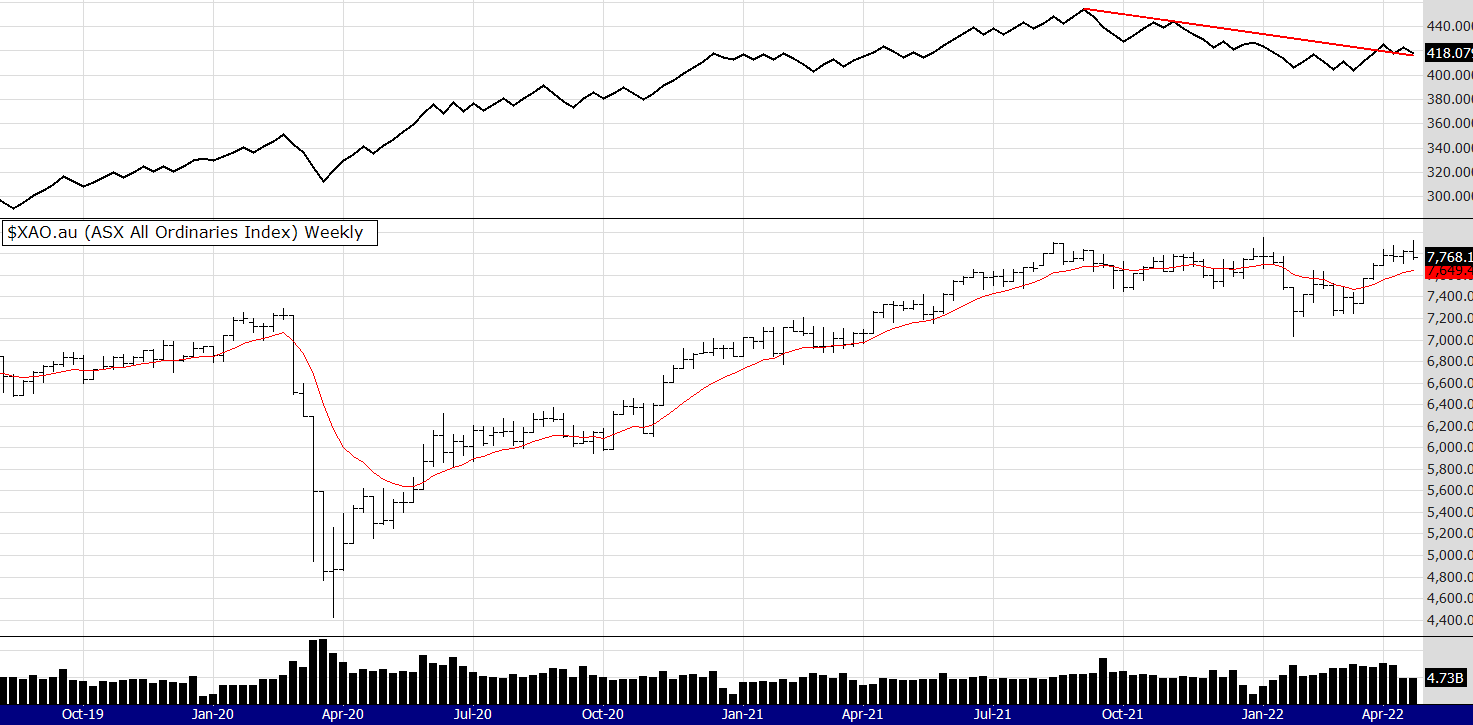

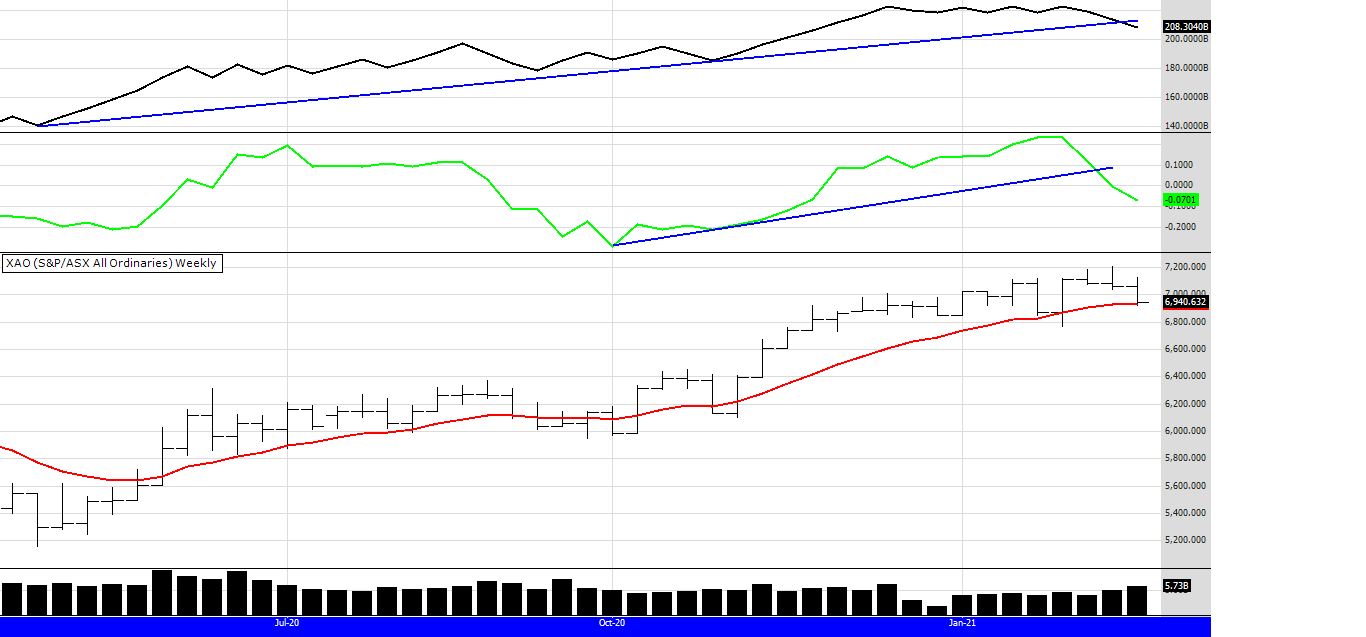

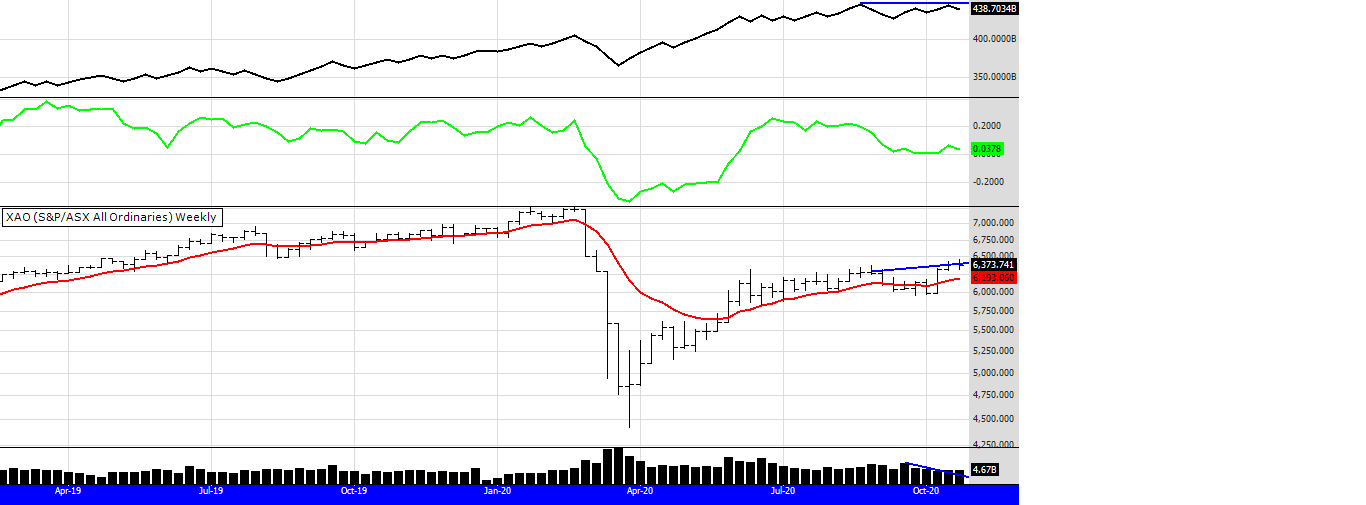

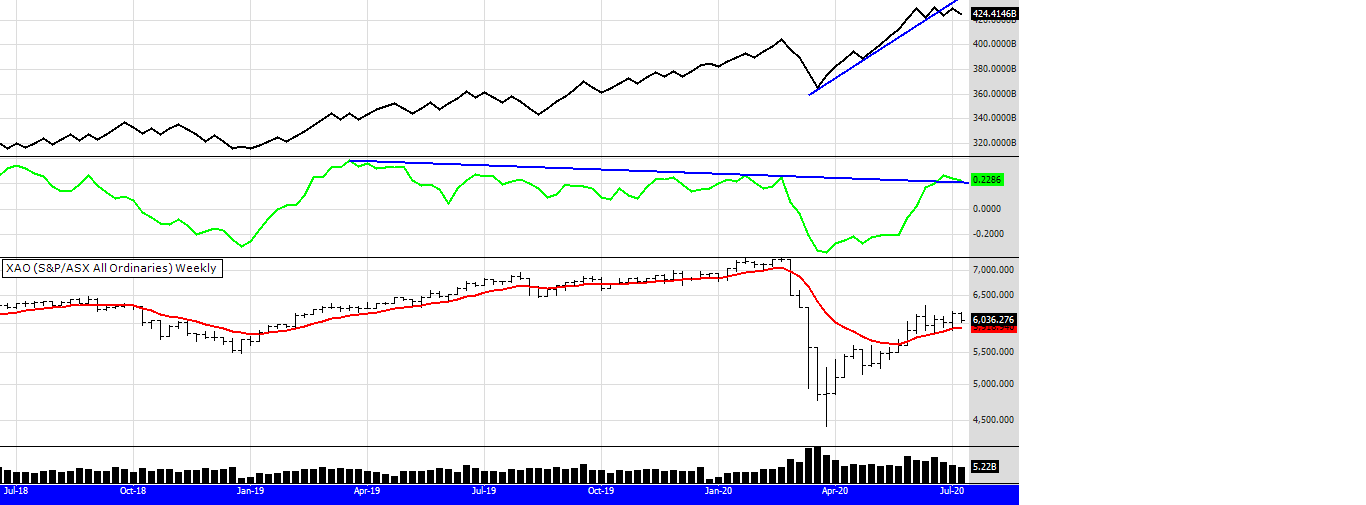

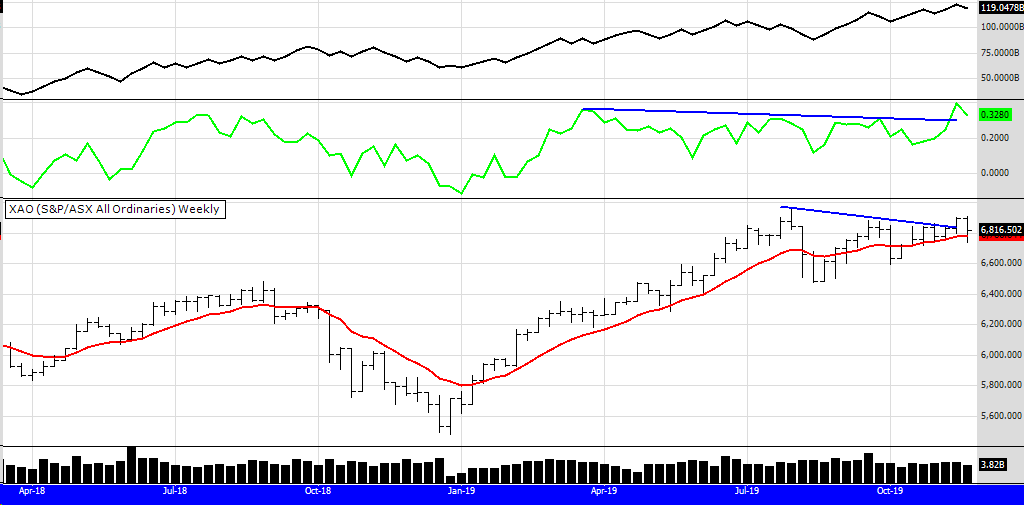

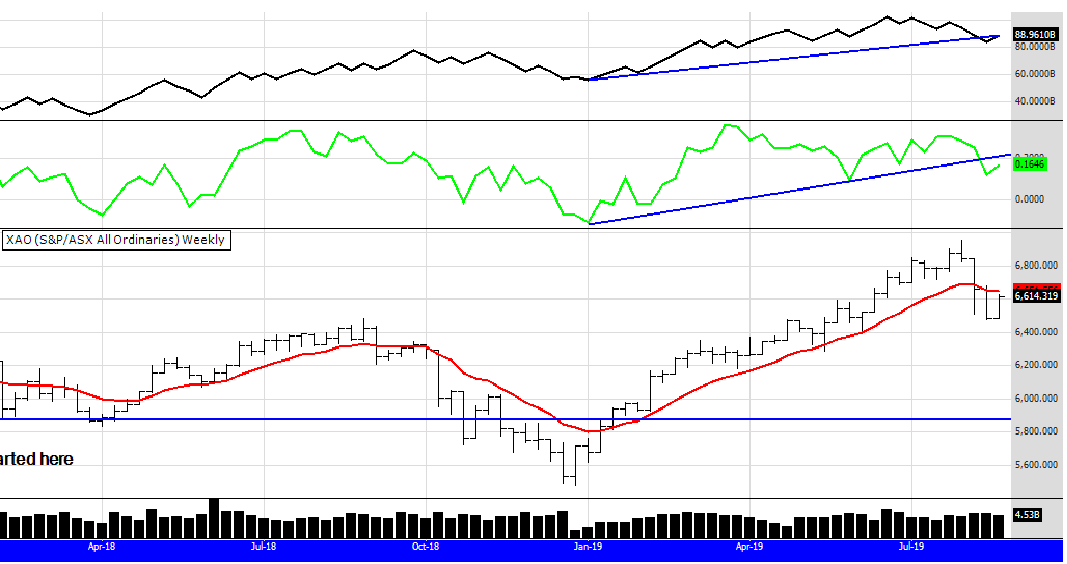

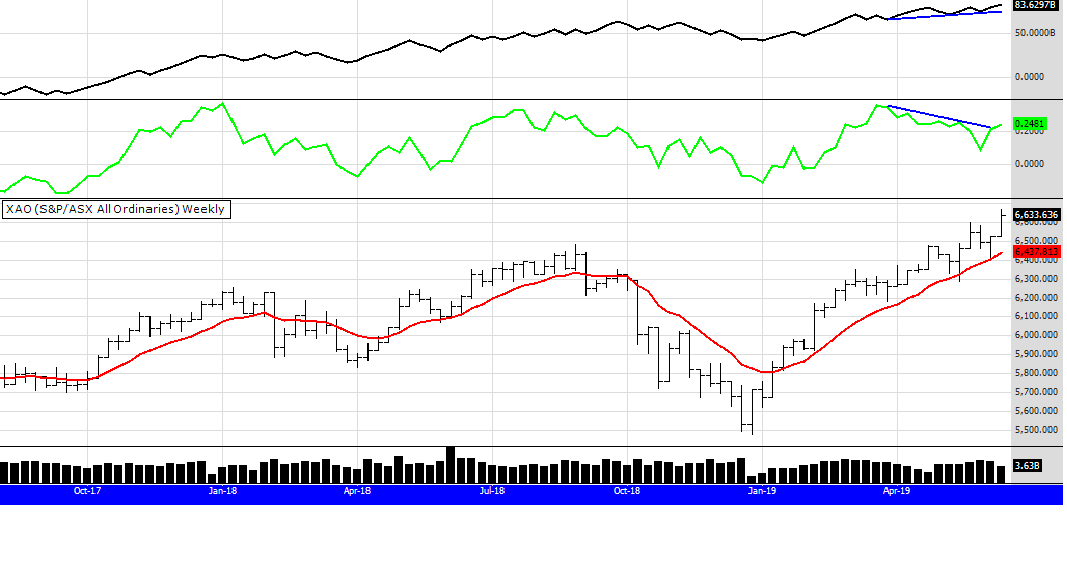

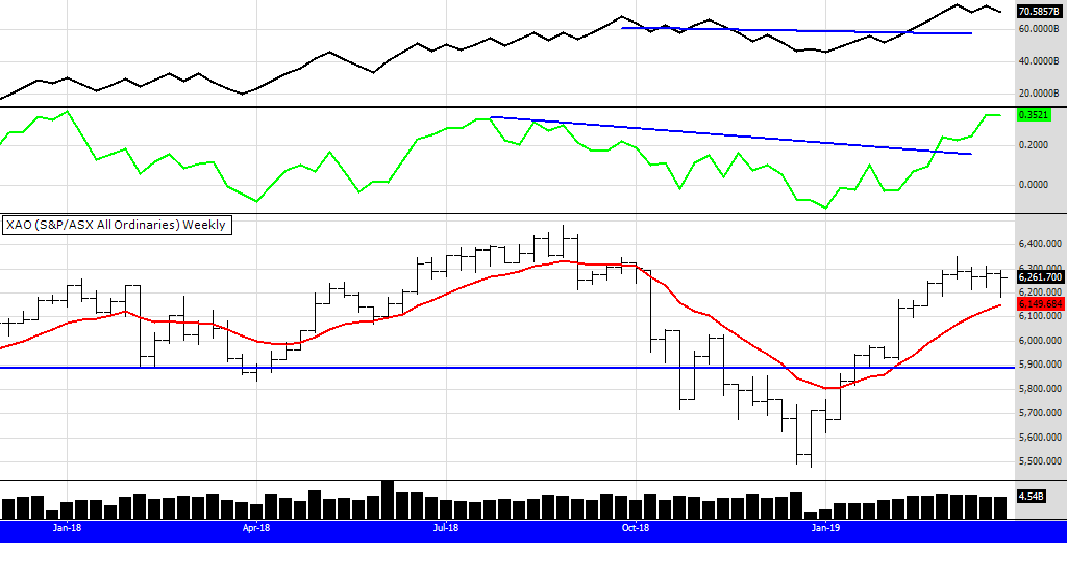

Moving to the chart above you can see the OBV still looking strong - it never really weakened signalling the probability the market was correcting not crashing. The MFI 13 period (one calendar quarter) looks a little hesitant by putting in a double bottom. However if the overhead down trend line breaks to the upside, which may happen as soon as tomorrow, this could give the bulls more conviction to keep buying. I would like to post something I said back on the 26/7/24.

My experience and intuition tell me this market is similar to the late 1990's. A period when the market produced gains beyond peoples wildest dreams. It's also a very difficult market to trade because moves up, and down, are fast and unsettling. Dips are to be bought (which takes nerve) and big gains after fast rises are to be sold. A strategy I have used over the years is to sell 50% of my holdings after a stock has risen 70% - by tightening the stop, after that I let the rest ride until my primary stop has been hit. I do not re-enter the trade, gnash my teeth over "what may have been" " I should have " "I could have" etc. Rather than re-enter I move on to the next trade. Like a pro tennis or golf player we play one shot at a time. One trade at a time. Let the bad trades and shots go.

I do think this volatility and rapid change in the market will continue for a while (maybe years). There is a lot at present to unsettle the markets, two weeks ago it was the Yen carry trade and the BOJ raising rates. Next it will be? Who knows.

As I have said repeatedly here over the last 13 years, one of the best ways to trade is to have a method and stick to it. Review often, work on your mindset, particularly the temptation to predict or need to know.

All the best in the coming weeks and months as this market deals with the many "what ifs?"

may the force of peace of mind be with you.

Peter

52 week closing highs as of the Fridays close 16/8/2024

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: AGL AMP CGF CPU EVN GPT IFL MFG PMV RMD VCX

300- DUG FID

Please note: in the eBook I wrote in 2016 (available for purchase on this website on the link below) I have made some changes to the system. If you have bought the eBook I am happy to email you a PDF explaining the changes I made, which from testing and trading does improve the system.

Here is the link to the eBook Mindful Trading using Winning Probability written in 2016 -

and the internationally published The Zen Trader (2022) - now in three languages, English, Spanish, German and in 2025 Traditional Chinese.

IMPORTANT POINTS TO CONSIDER

A new 52 week high for this system is classified when the stock price is at its highest close (or equal to the highest close) counting back 52 weeks.

If a stock continues to make new highs, for example in the 53rd and 54th week, they are now regarded as ROLLING highs, not NEW 52 week highs.To clarify again, the buy signal for THIS system discussed is a NEW 52nd week or 1 year closing high, not a rolling high as is often given elsewhere.

The signals provided are WITHOUT A BULL FILTER.

The exit used FOR THIS METHOD is the 5/12 EMA crossover. Therefore, some stocks will be re signalling a new high buy signal if they have been recently exited by using the 5/12 exit within the last 12 months. This is important and you need to understand this.

Of course the 5 EMA needs to be above the 12 EMA to make the 52 week high valid, (otherwise we would be selling straight away) nearly always this is the case, but rarely if a stock spikes it is not.

So to repeat, the rules are: USING WEEKLY PARAMETERS!

Entry:

Share price to make a 52 closing (or equal to) week high (when selecting a buy, favour the cheapest stock)

The 5 ema to be above the 12ema

Exit:

if the 5 ema crosses below the 12 ema

The above system contains no position sizing, bull or bear filters or fundamental stock selection, these are discussed and taught to private clients or at my courses.

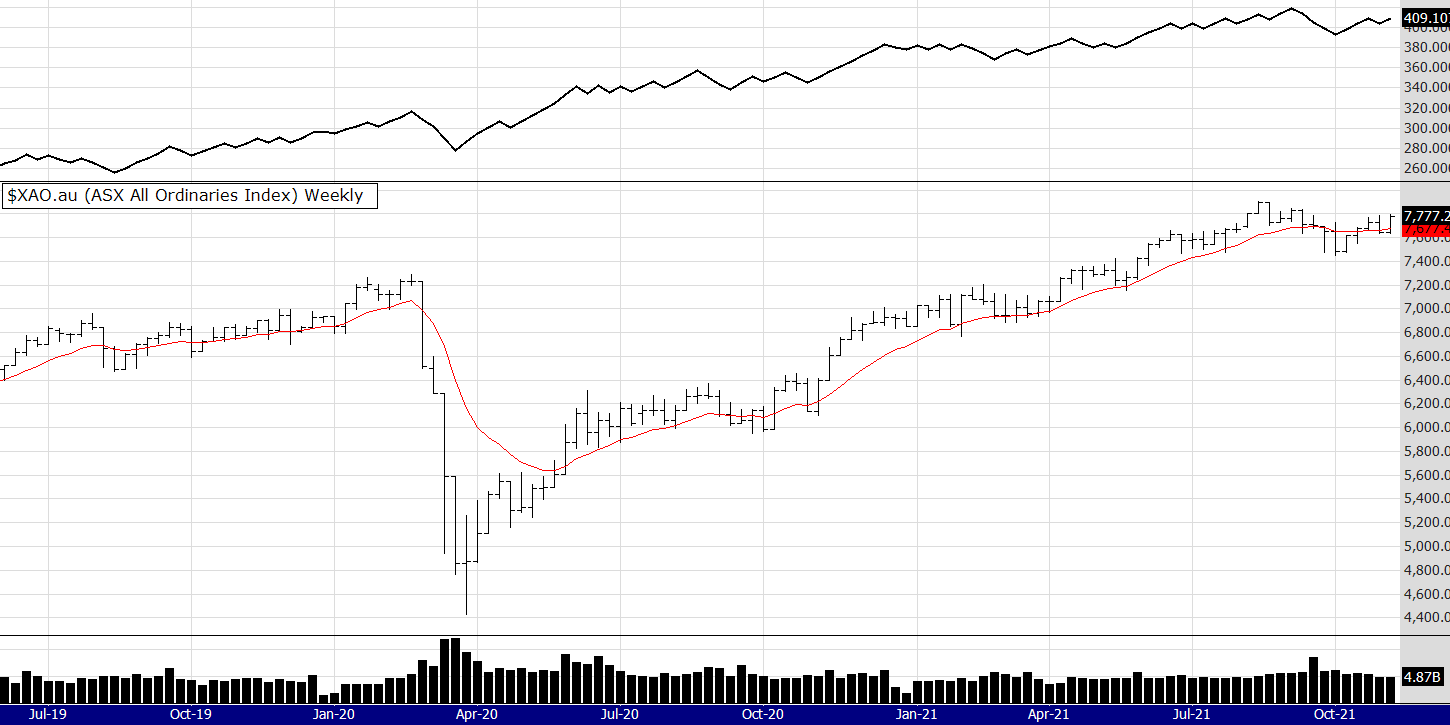

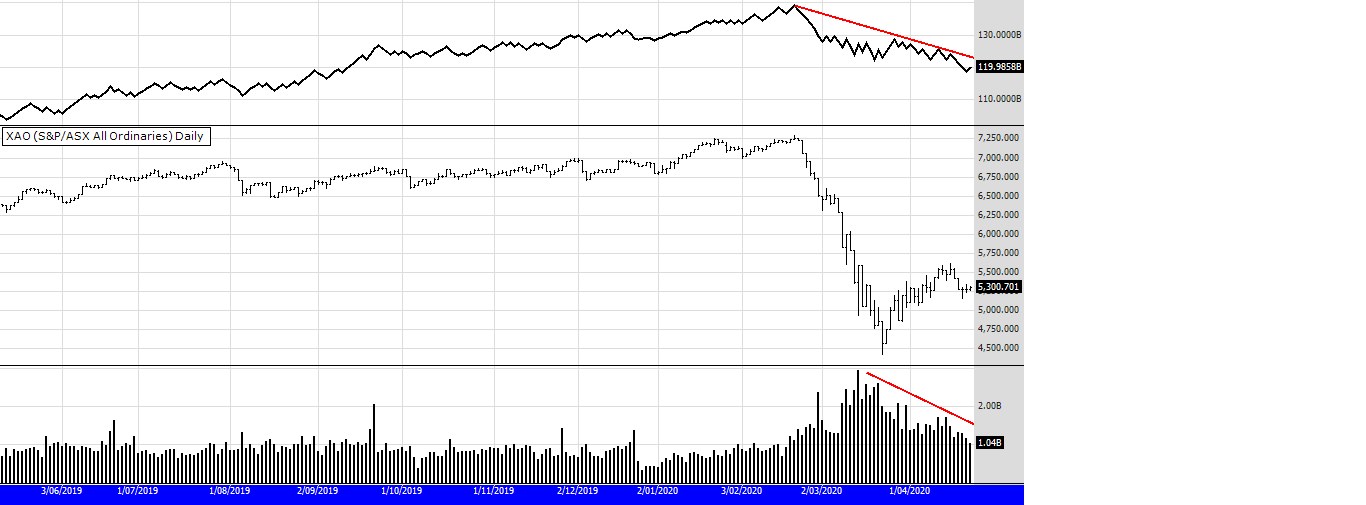

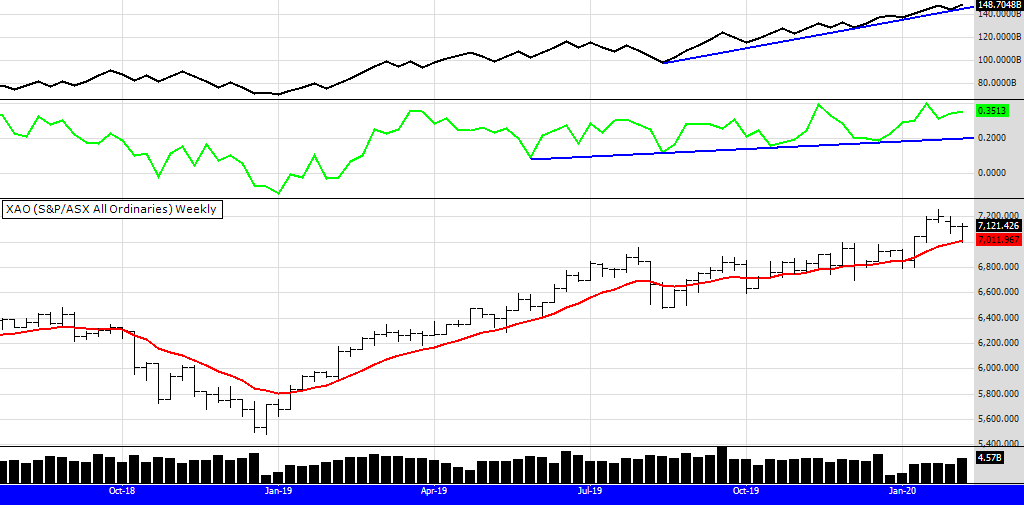

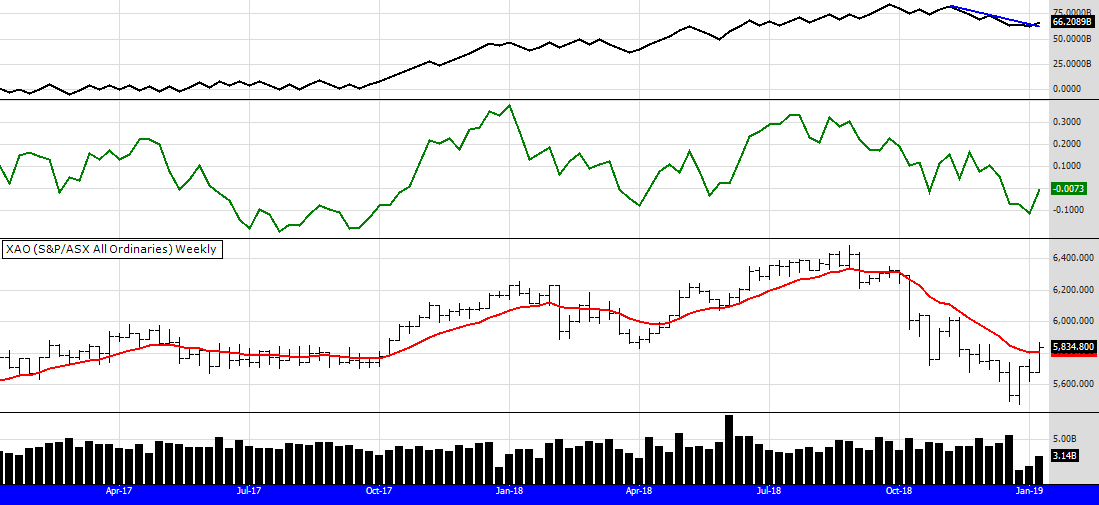

MARKET COMMENTS: As of the close on Friday 9/8/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

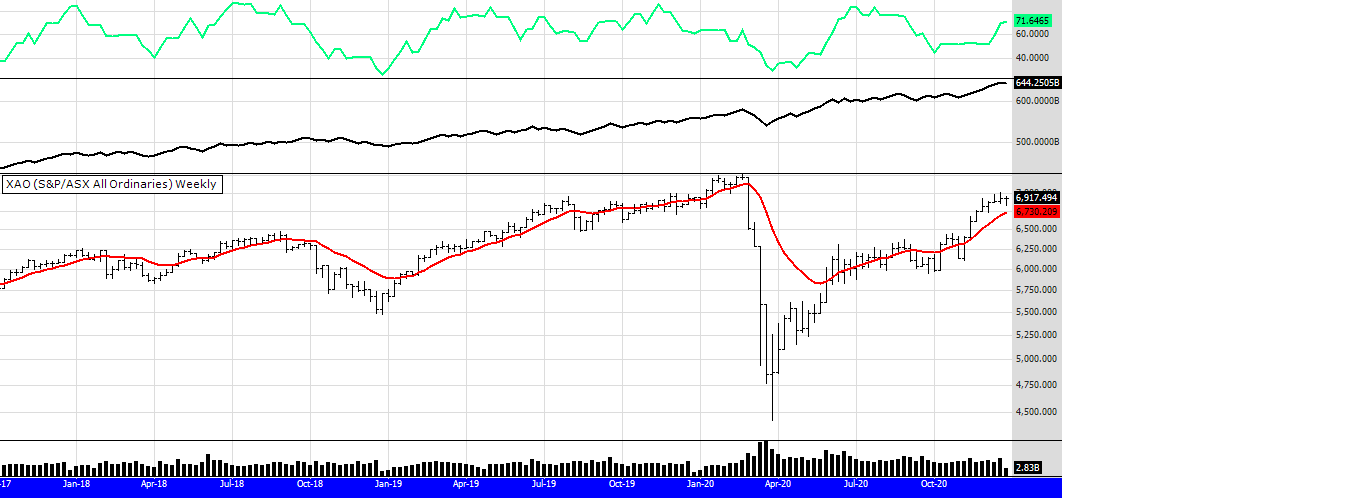

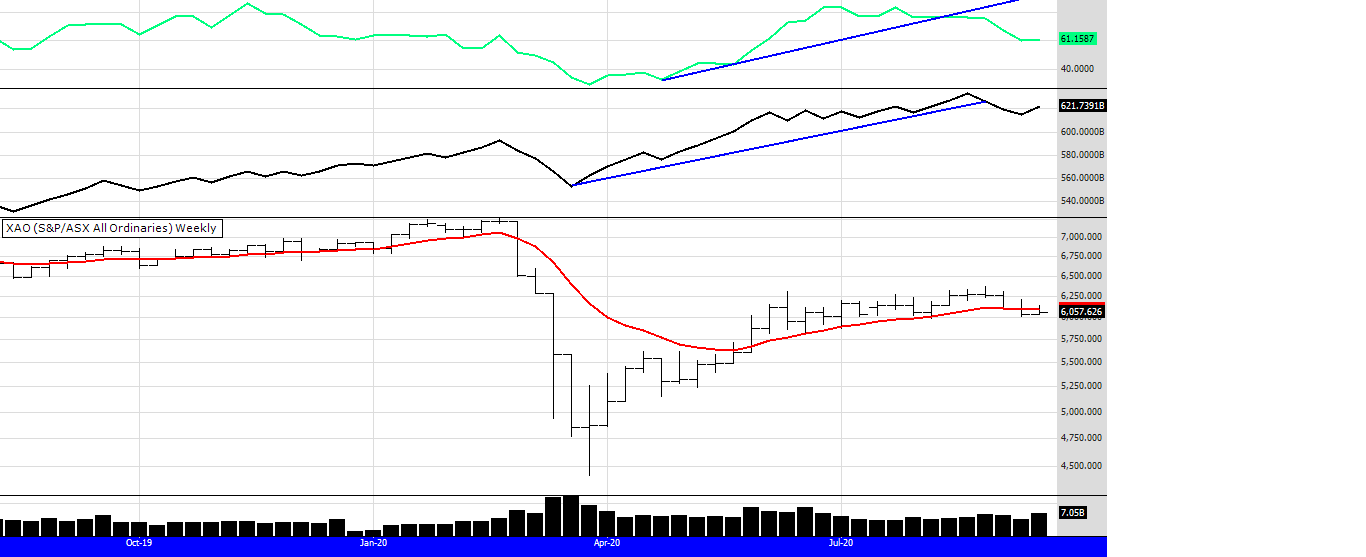

This week I will keep it brief. The XAO had a reasonable week considering the big falls on Monday. Volumes are holding OK. It's a wait and see game now as to how next week trades and if buyers return to support the market.

A lot of that will depend on how the US markets perform on Friday their time.

I will update this page on the weekend.

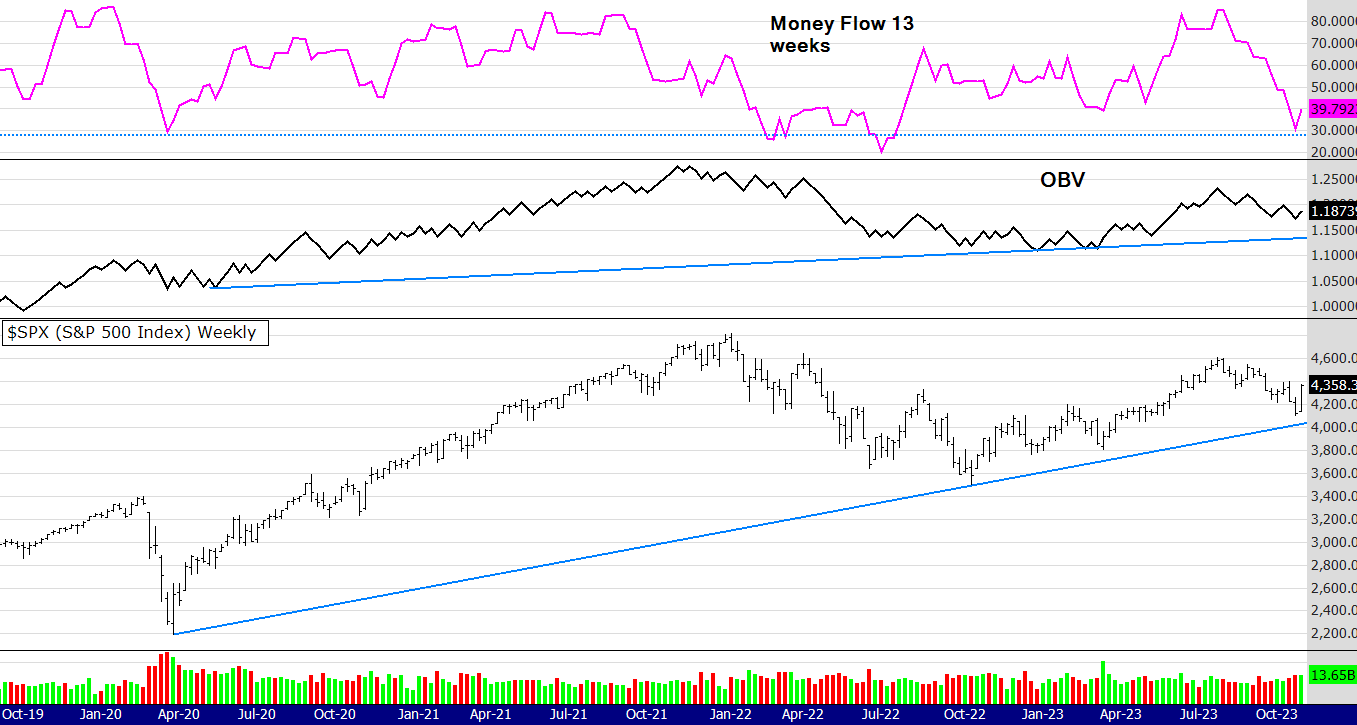

So I wrote the above on Friday night before US trading - and how did it go and how did the indexes close for the week? Below is a chart of the globally dominant SPX.

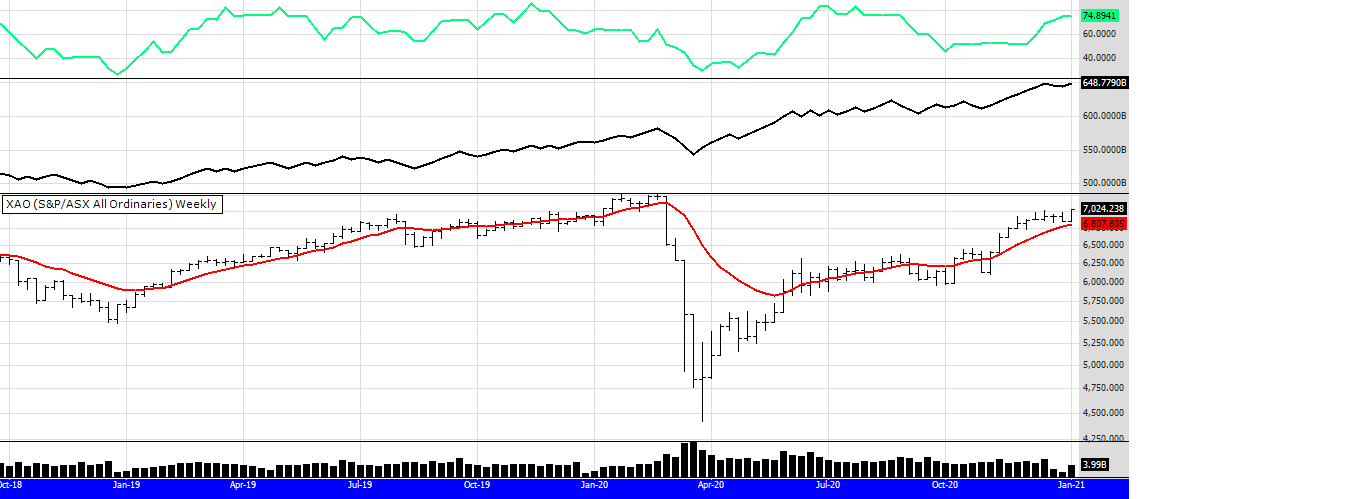

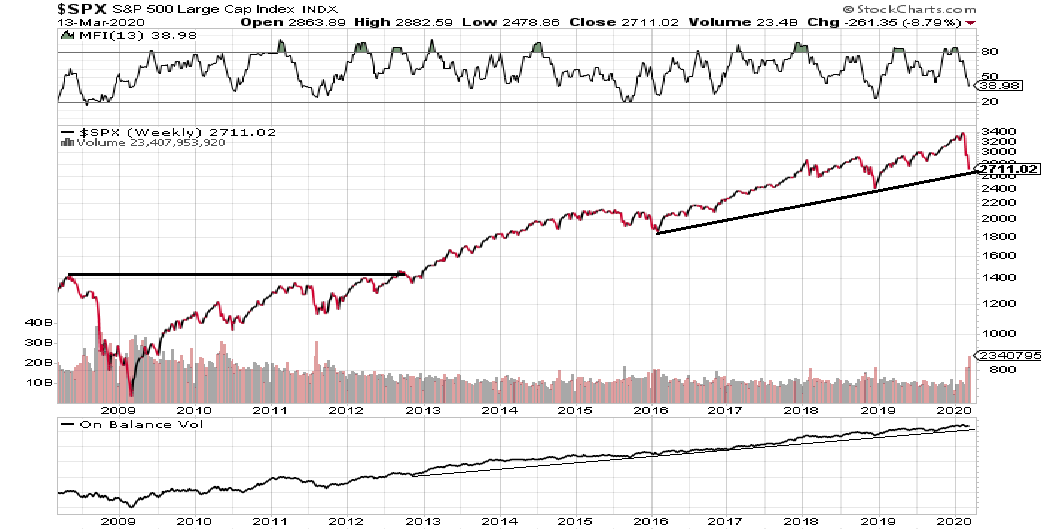

The MFI 13 period was showing a negative divergence, markets were nervous and all it was going to take for a fall was an event. Well we got one, the Japanese raising rates. However that is the past, what about the present? In my opinion until this index breaks below the low in April of 4953 it is still in a weekly uptrend. Others may disagree but that is the level I think is critical.

The MFI on the SPX is still pointing down but if you change it to a shorter time frame (6 weeks) it is in over sold territory. Also, I like to remind people that "one bar does not make a trend". Although this weeks bar is very positive, the index has more work to do to convince the bears and those nervous about the "what ifs".

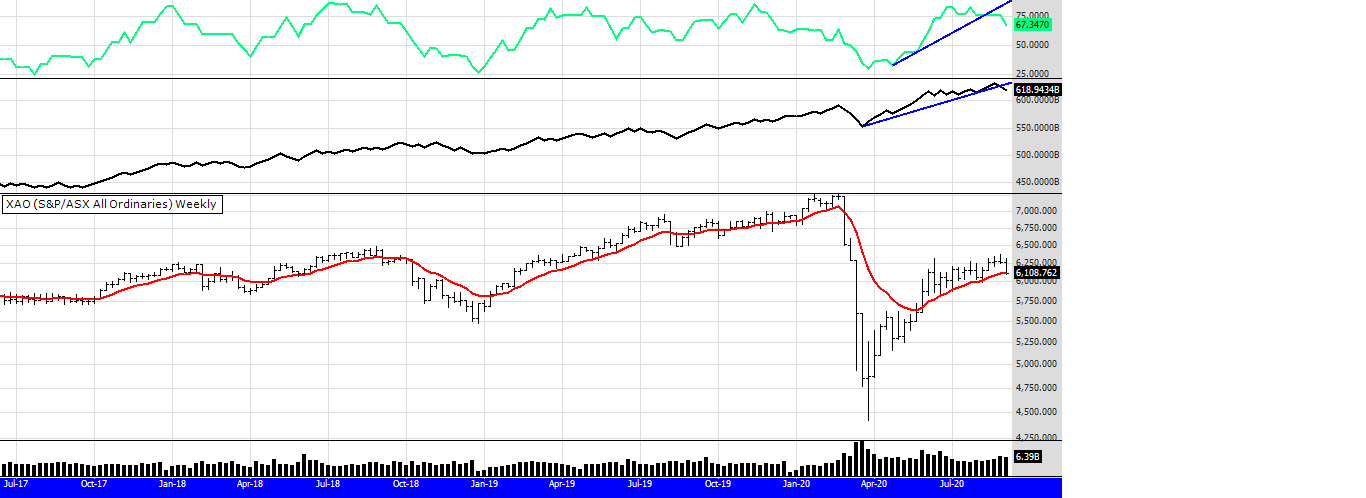

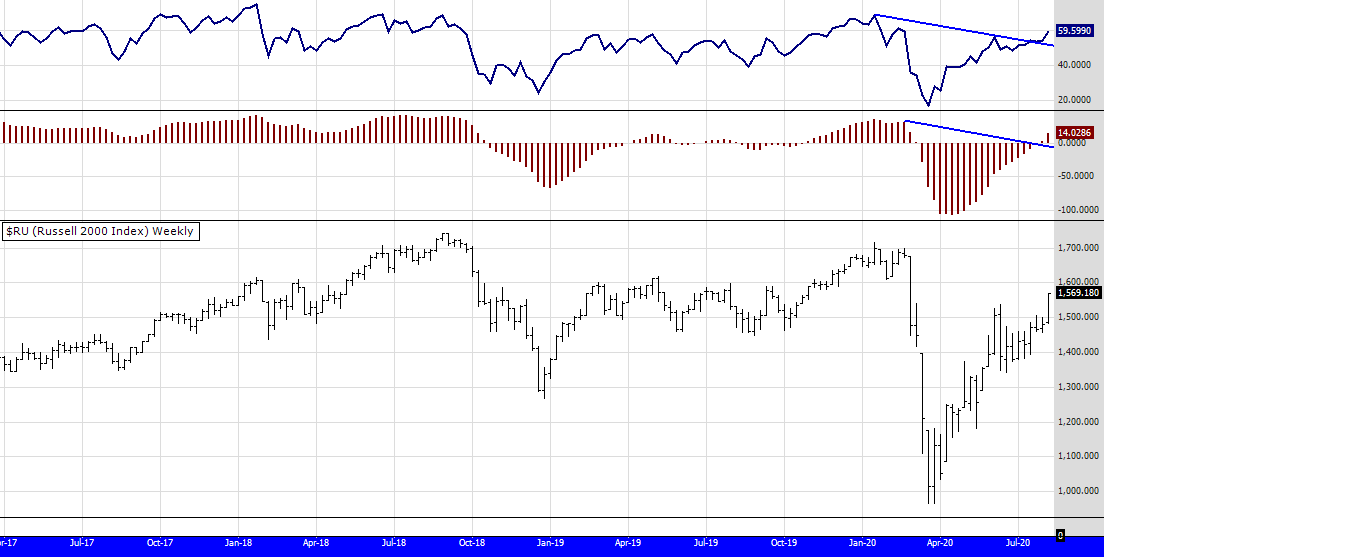

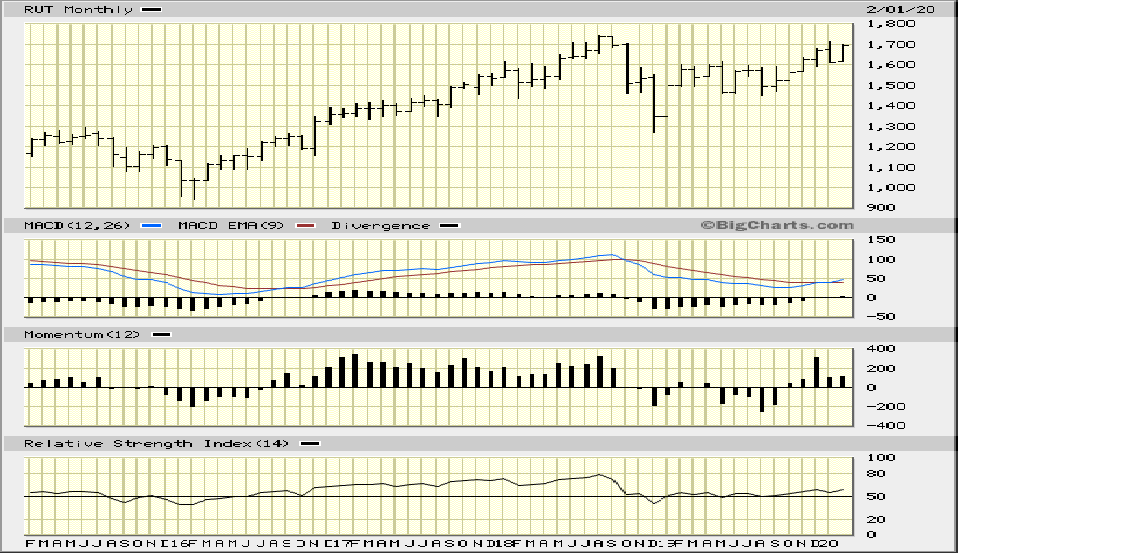

Let's now turn our attention to the Russell.

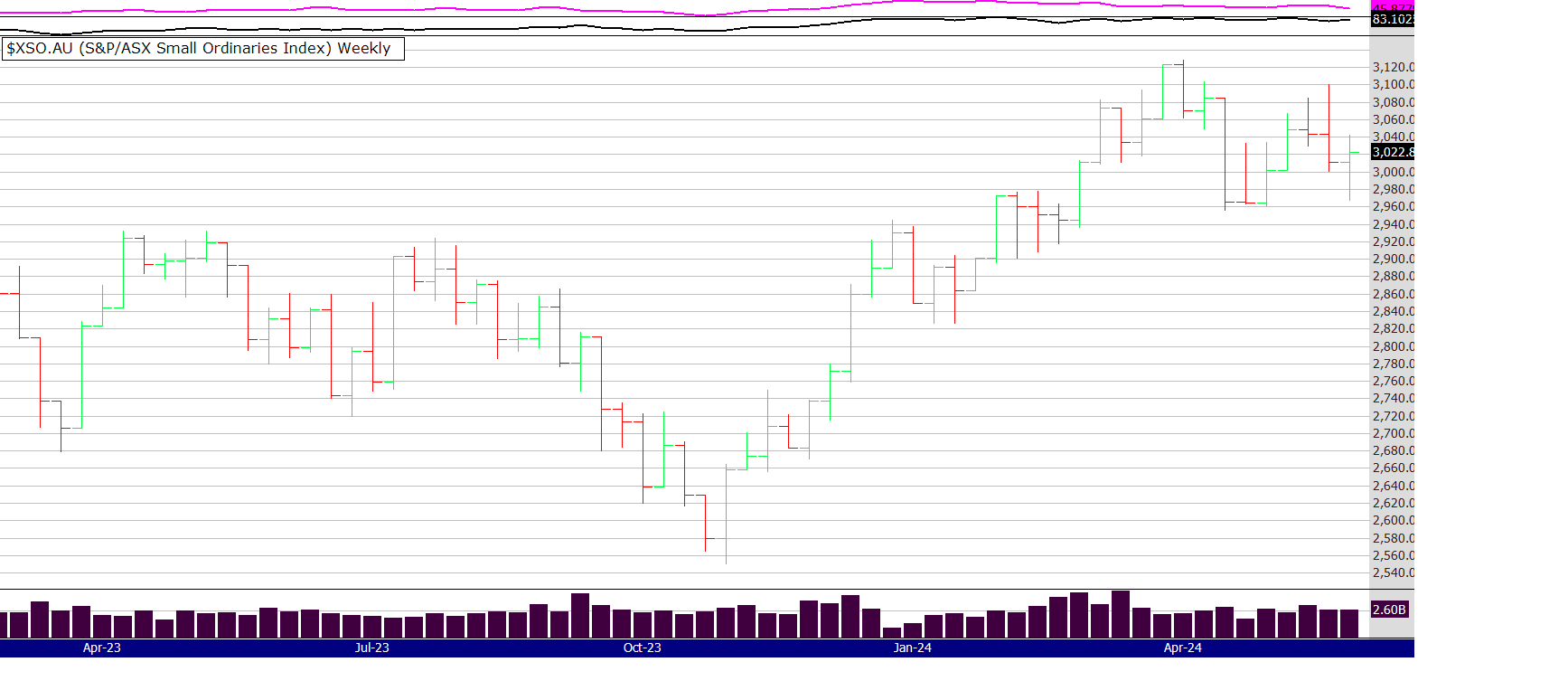

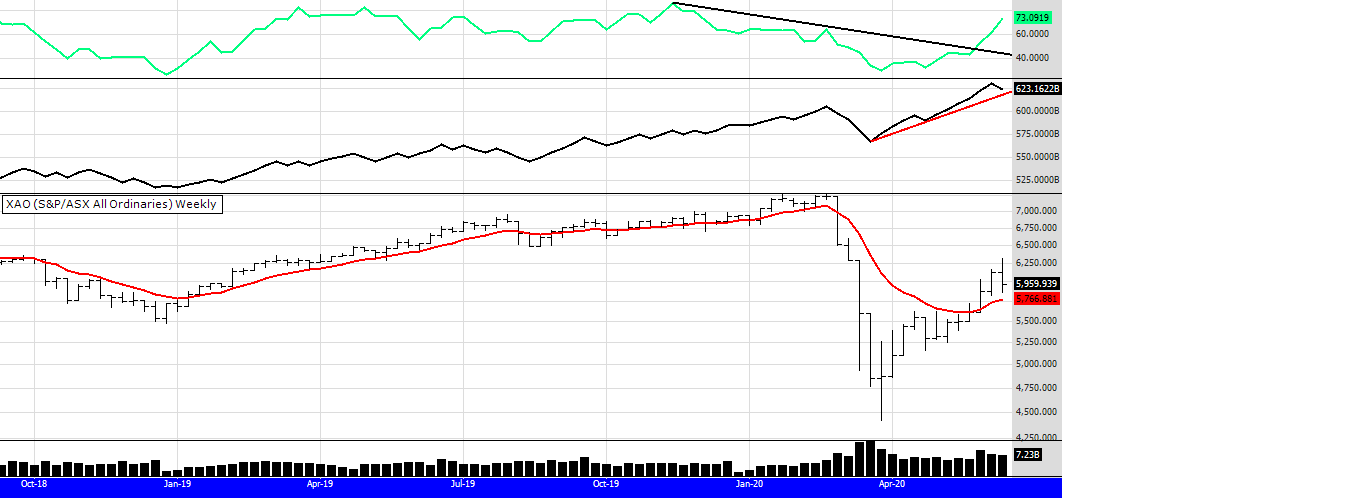

Before this recent correction the focus of many was on the rotation from big caps to small and medium cap stocks. How quickly people forget the current narrative and move to the next! Looking at the chart above it appears that the rotation is still healthy and alive. Which will be good for the ASX as the Aus market is closely correlated with the Russell - as discussed many times here in these comments. (scroll below through previous weeks to find that)

Volume support on the Russell appears stronger that the SPX. This makes sense as the SPX contains the Gorilla stocks (Tesla, Nividia, Apple - the magnificent 7 etc) that were being sold off and funds rotated into the Russell. For example, compare the volume bars of this week between the SPX and the Russell. For every seller there is a buyer and there is obviously many buyers active in the Russell.

I notice too last night in the US that the futures for XJO (top 200) outperformed the US SPX -a sign of things to come? One bar does not make a trend :)

Gold: no chart today but the trend continues up. The GDX in the US was up another 1% last night and one would expect (be careful using that word) that the Aus gold stocks will rise again on Monday.

As you can see there were no 52 WH alerts this week - not surprising. Stepping aside when the market is not giving signals is a feature of that system.

Thats it! Have a great weekend and I am off to help organise a 21st birthday party.

Cheers!

Peter

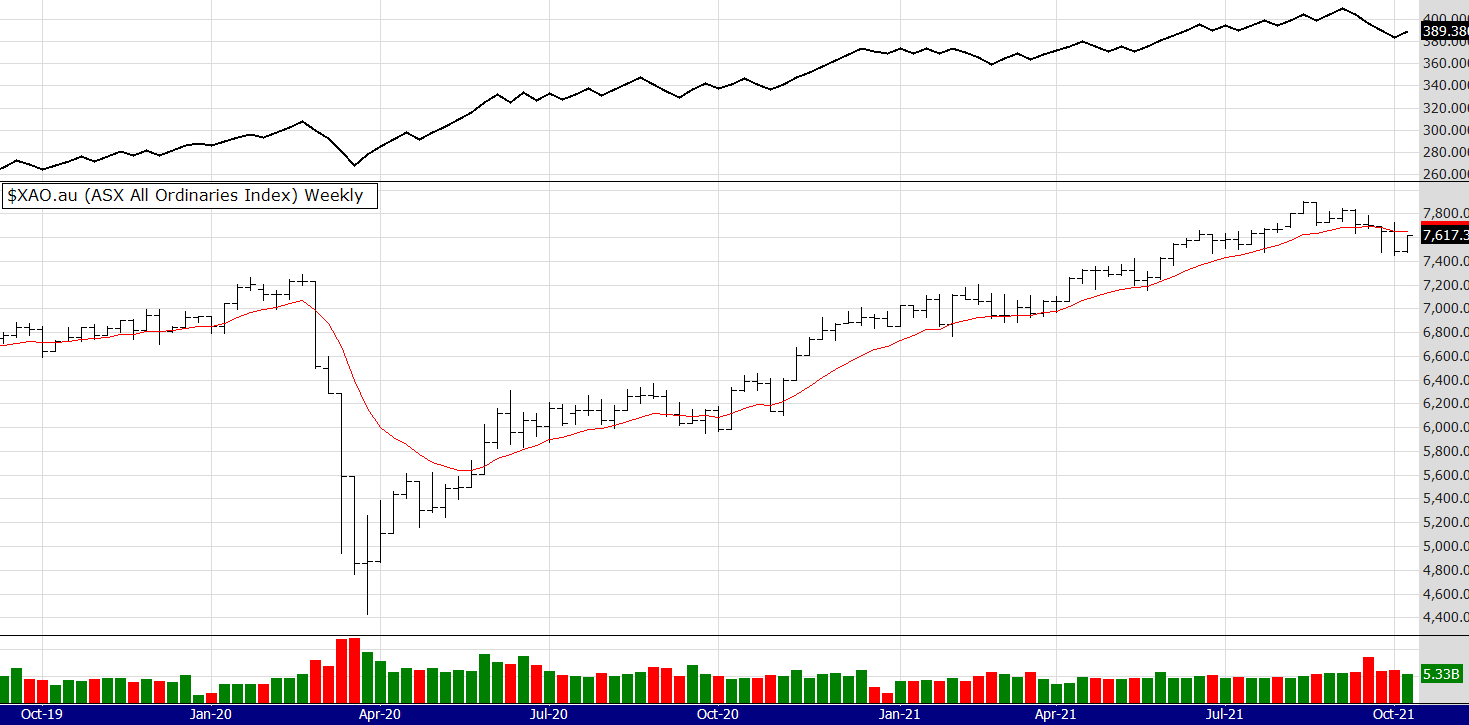

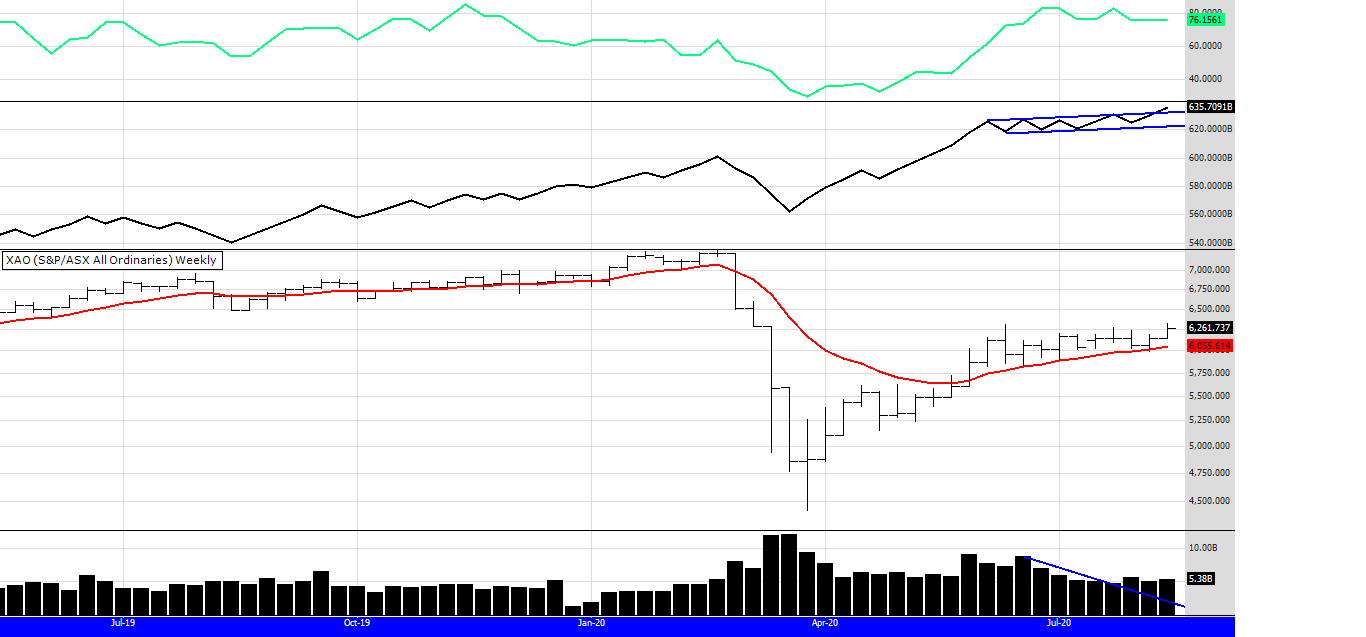

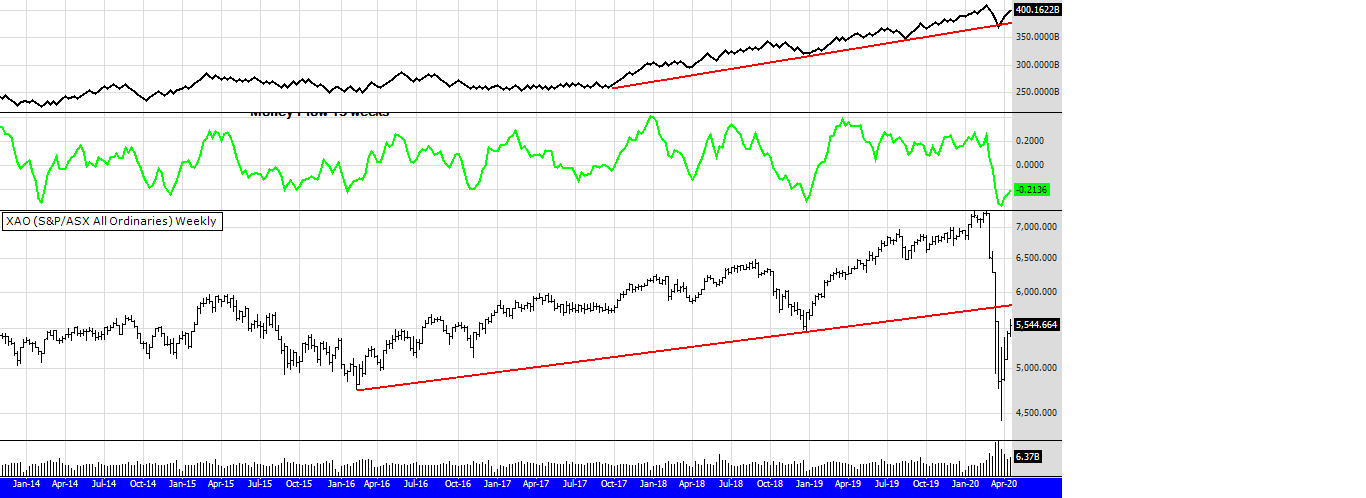

MARKET COMMENTS: As of the close on Friday 2/8/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

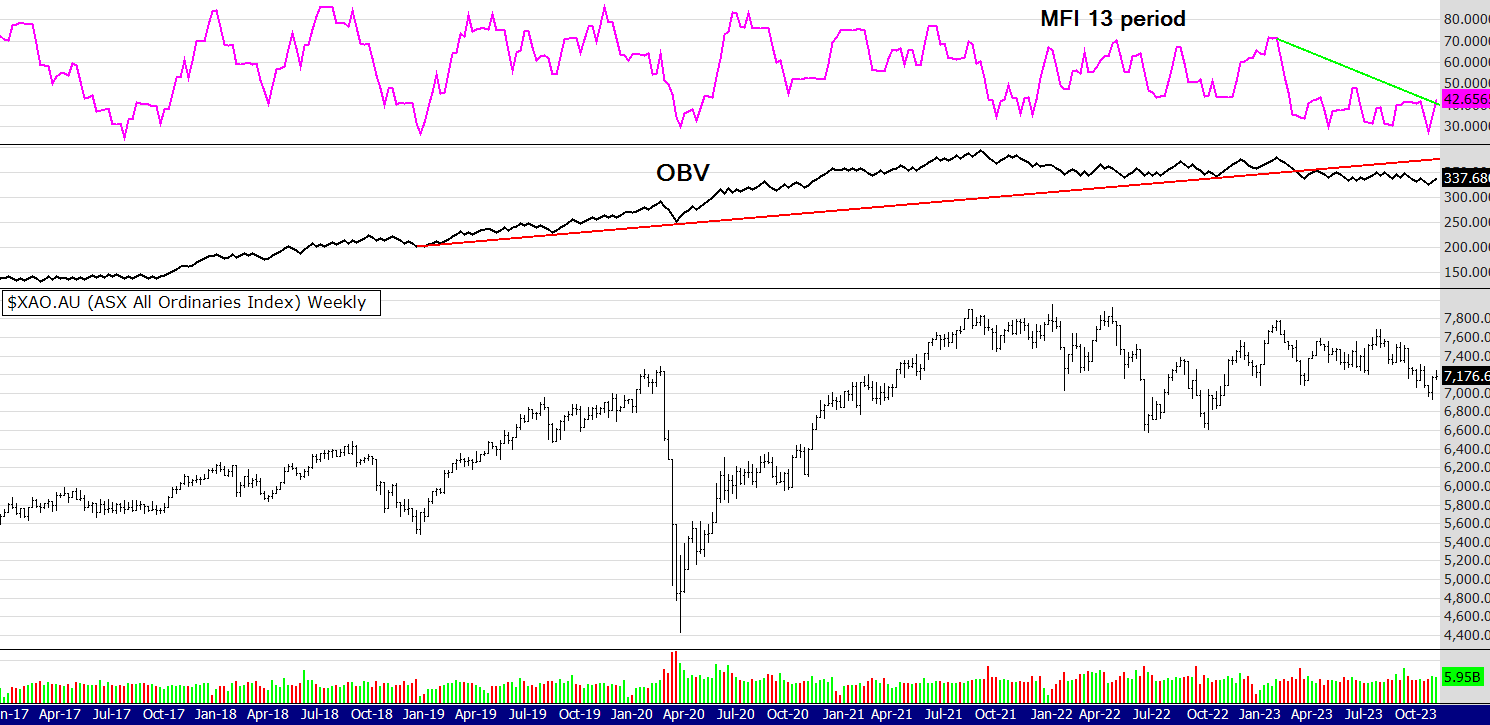

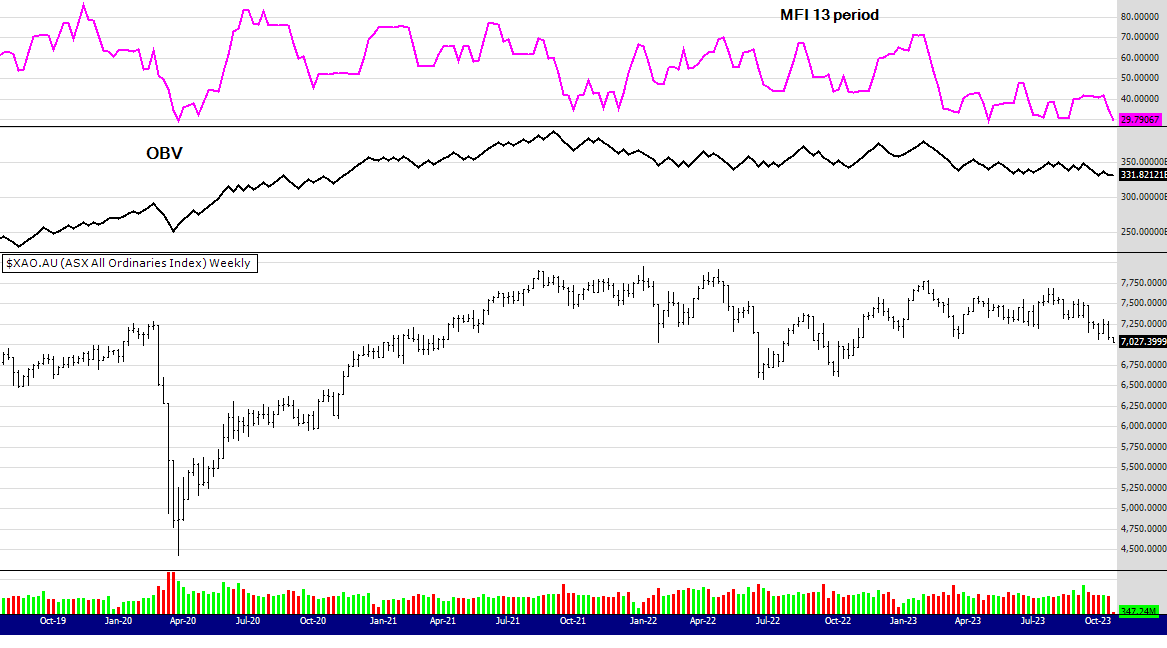

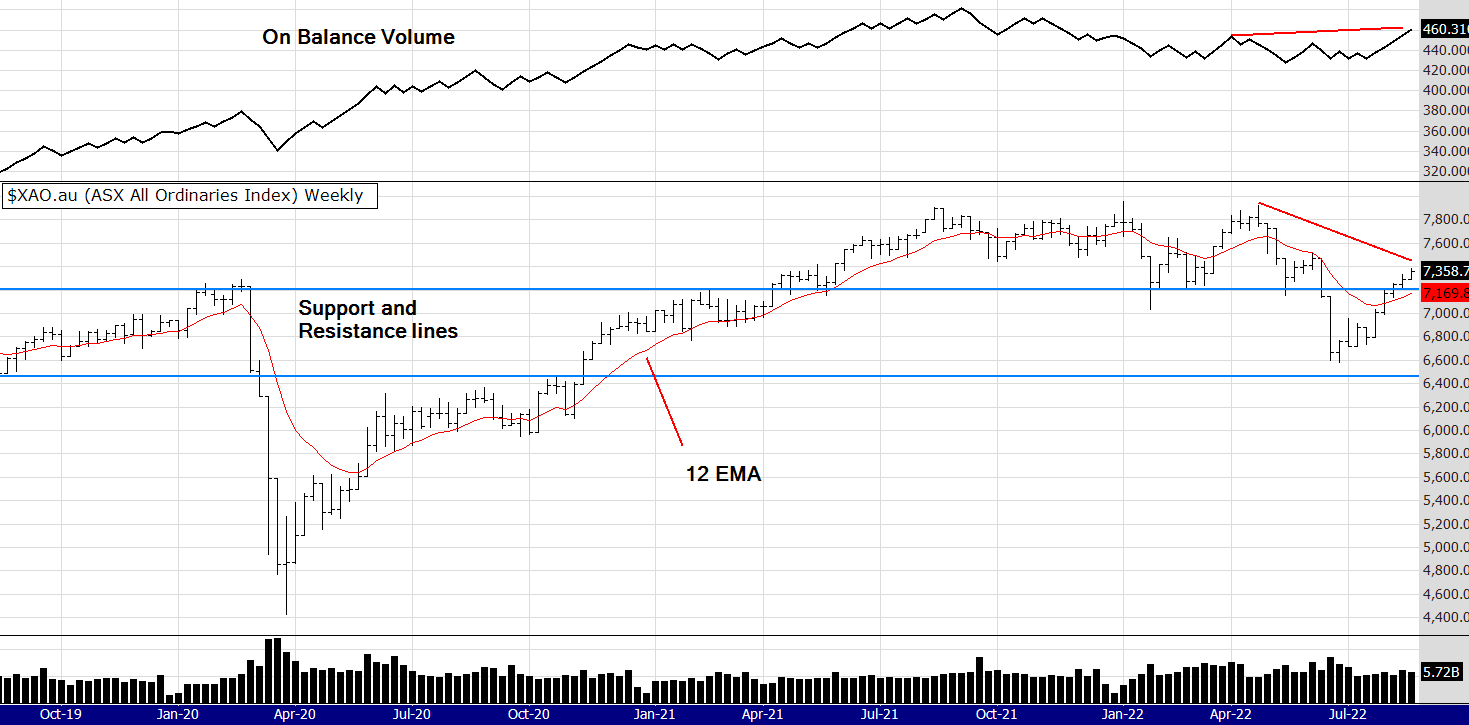

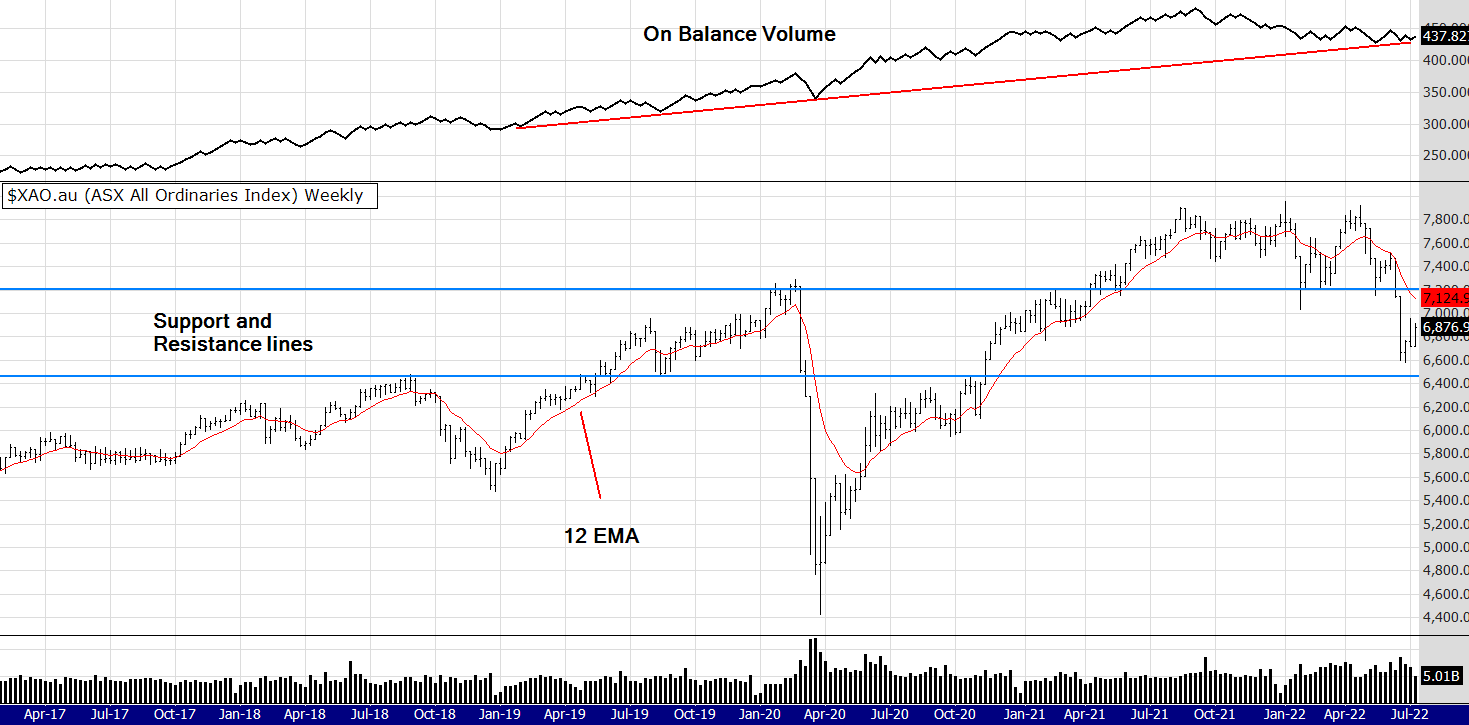

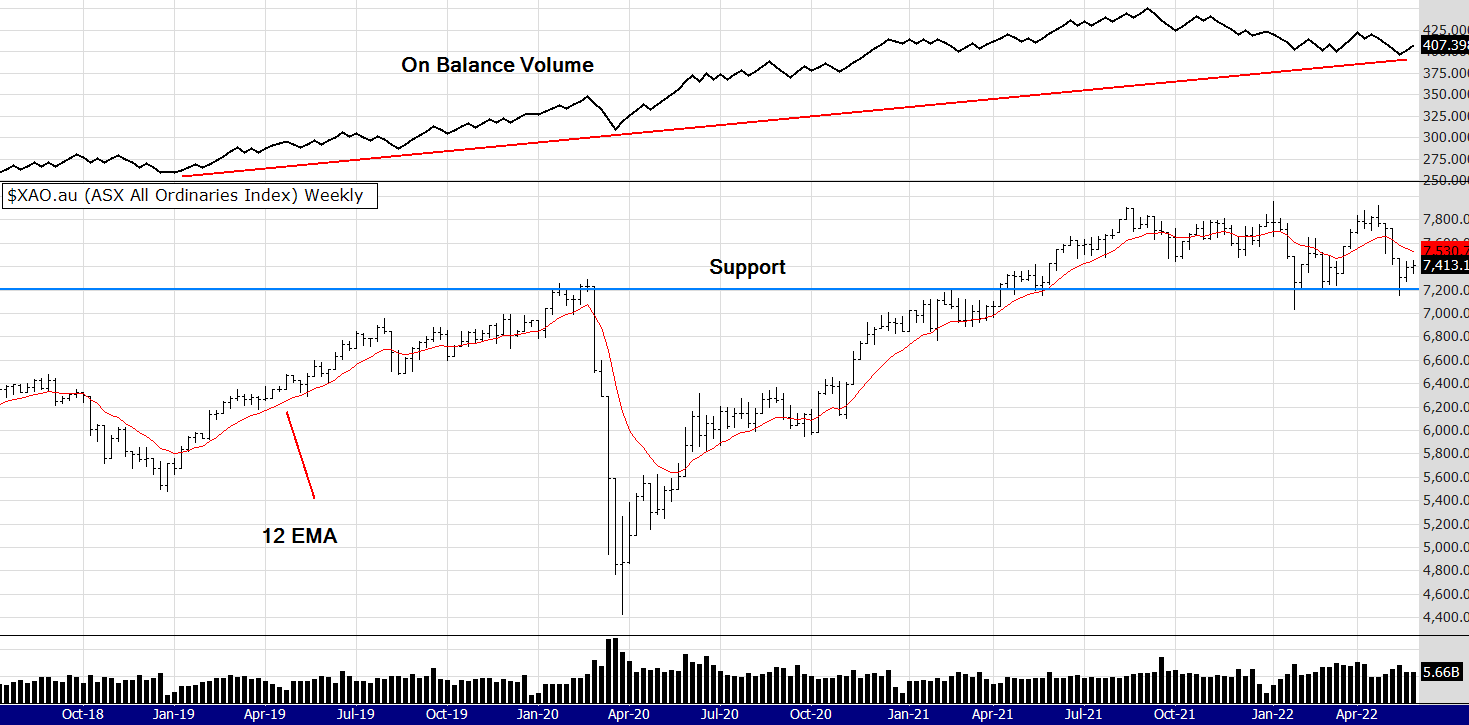

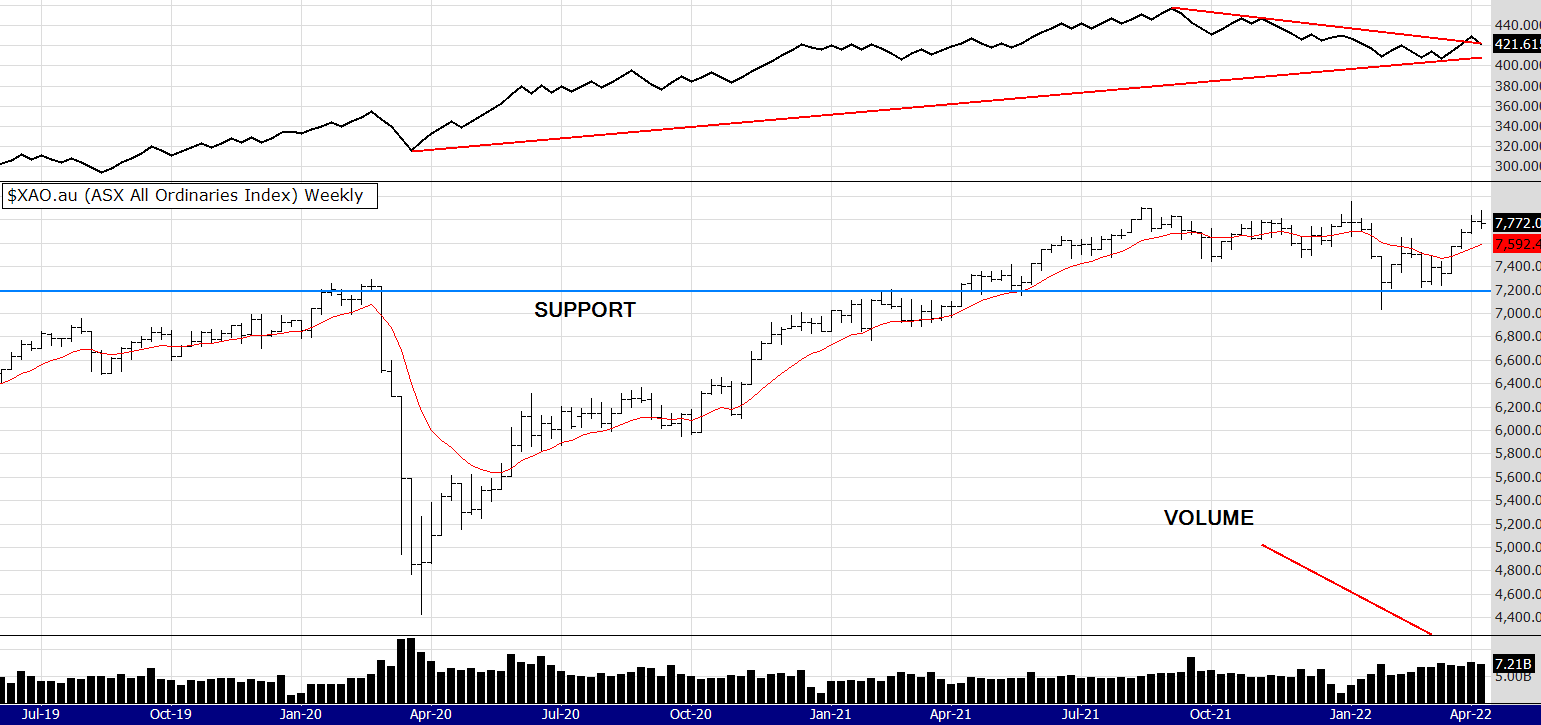

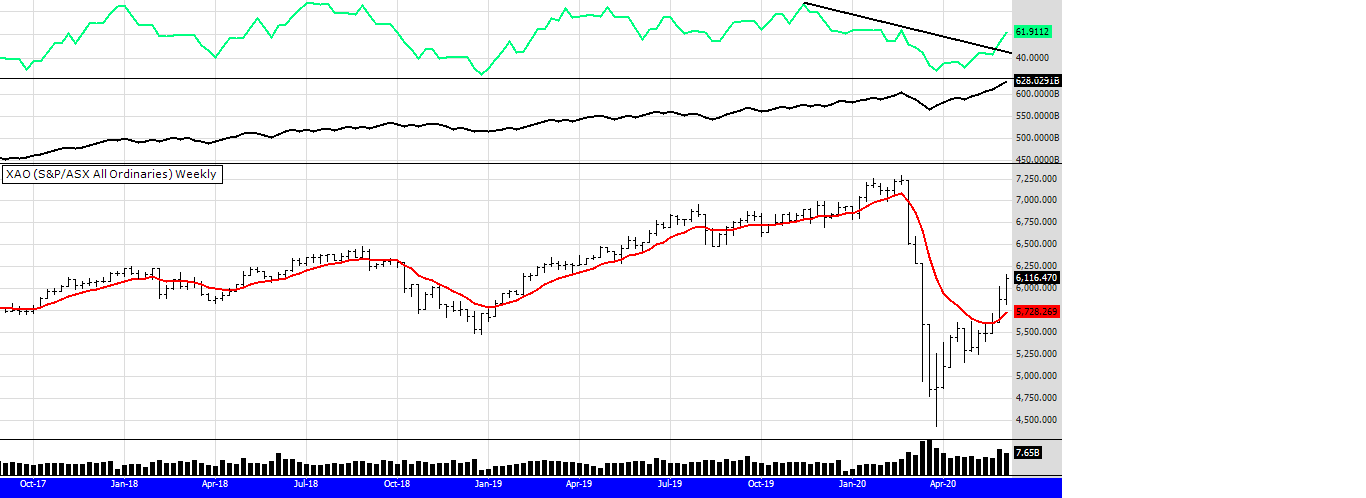

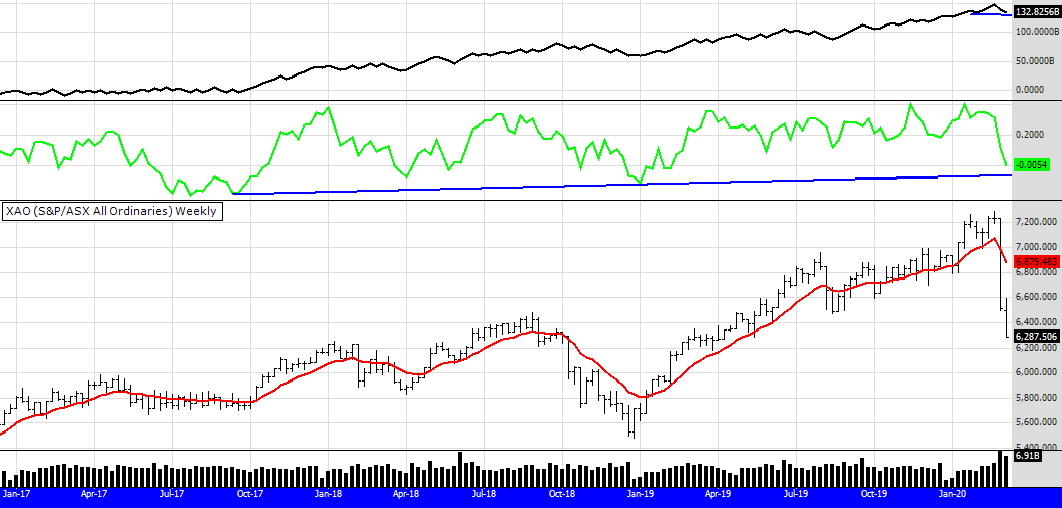

Lets talk about the chart of the XAO. One bar does not make a trend IMO. Sure, its got a bearish look to it - this weeks bar, but I repeat, one bar does not make a trend so we need more information to make a bearish or bullish call. Probably the most difficult thing about being a market participant is uncertainty. All we really have is the present because no one knows what the future holds, there is probability and you can manage your portfolio around that, but no one knows whats going to happen. If you want to read a little about my thoughts of "what if" and "don't know" click on the link for a newsletter I wrote back in 2015.

https://www.easysharetradingsystems.com.au/products-and-services/archive/listid-1/mailid-79-what-if

So whats happening in the now? Coming back to the chart we can see its still trending up, volumes are holding and despite this weeks volatility, this weeks low and this weeks close, are still higher than the week before. Also there are 6 stocks making 52 week closing highs this week in the ASX 500, so some stocks are performing well.

Last week I said " Its also a very difficult market to trade because moves up, and down, are fast and unsettling.

And

"So! Have a plan in mind how you will manage your trades ............."

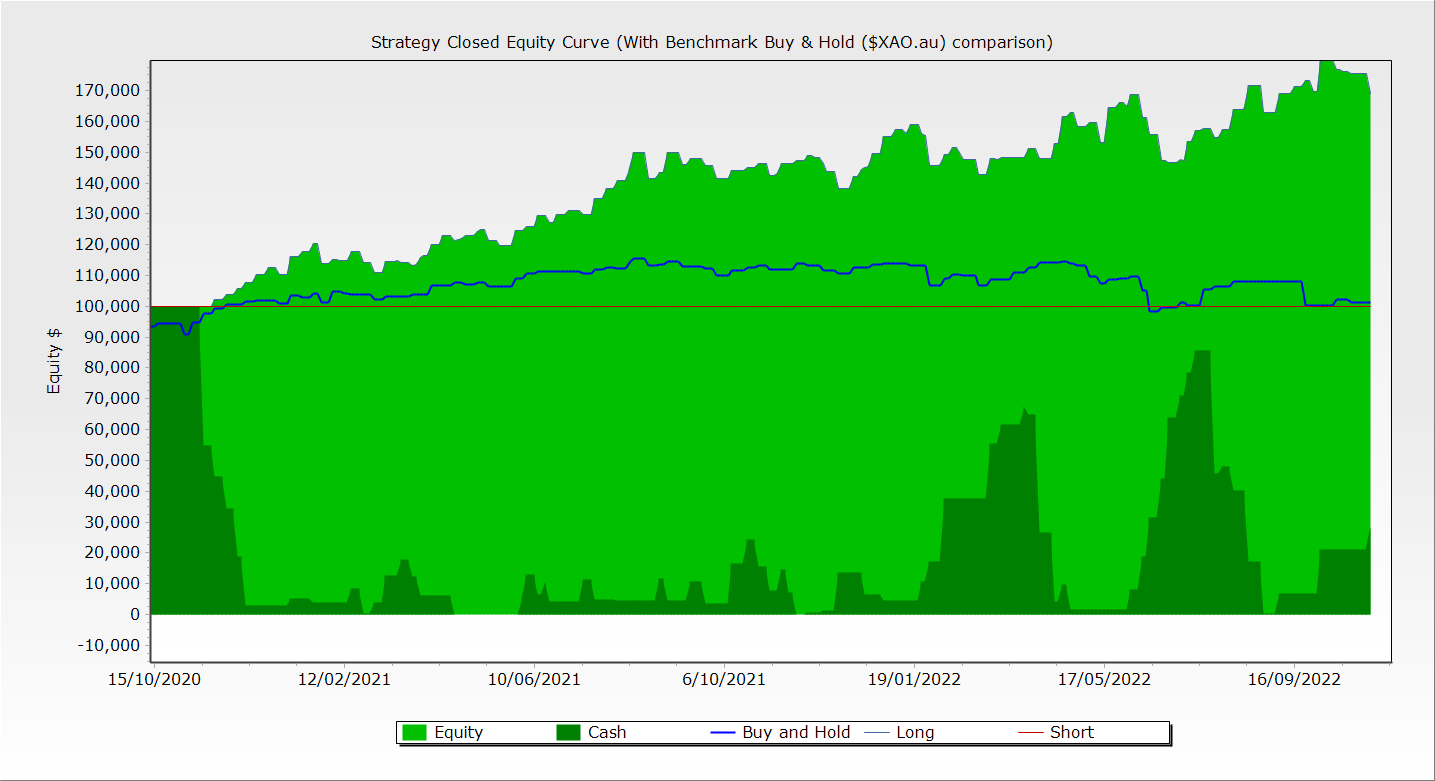

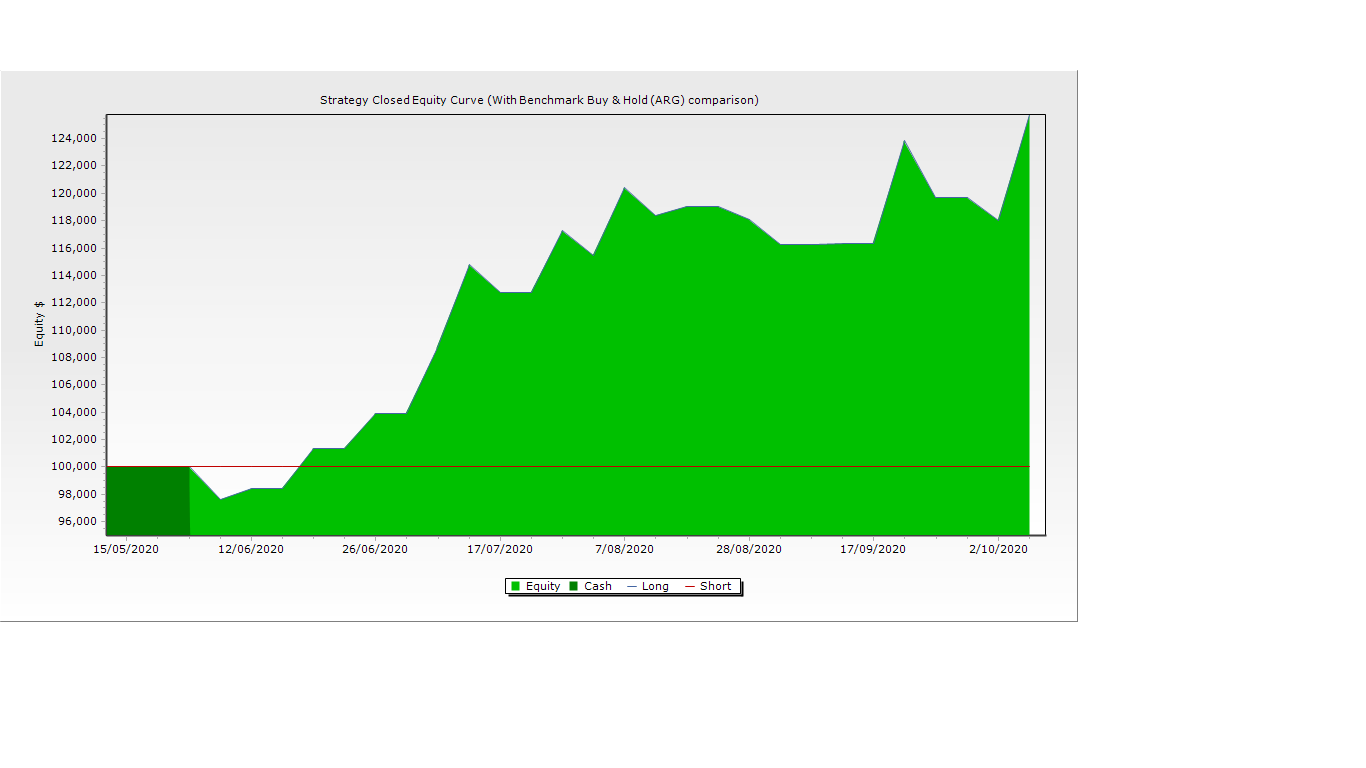

Speaking of plans here is the performance of the eBook system on the ASX 500 the last 12 months. 16% without dividends included.

I acknowledge its not knocking it out of the park, but its not losing either. I checked my recent 3 month portfolio performance last night, up 2 % since late May. It was up 7% , but this week it got knocked around. Its been a tough time and I admit to feeling exasperated as I am sure many are.

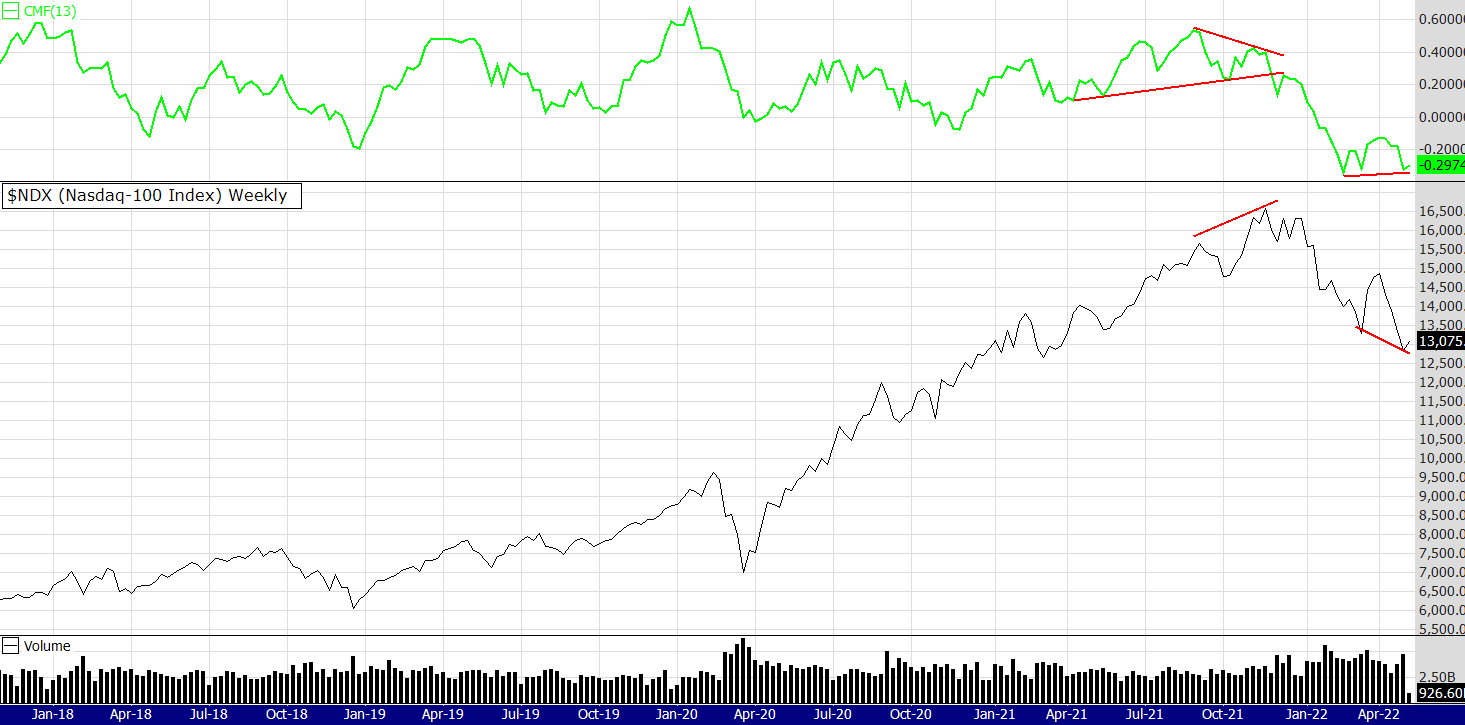

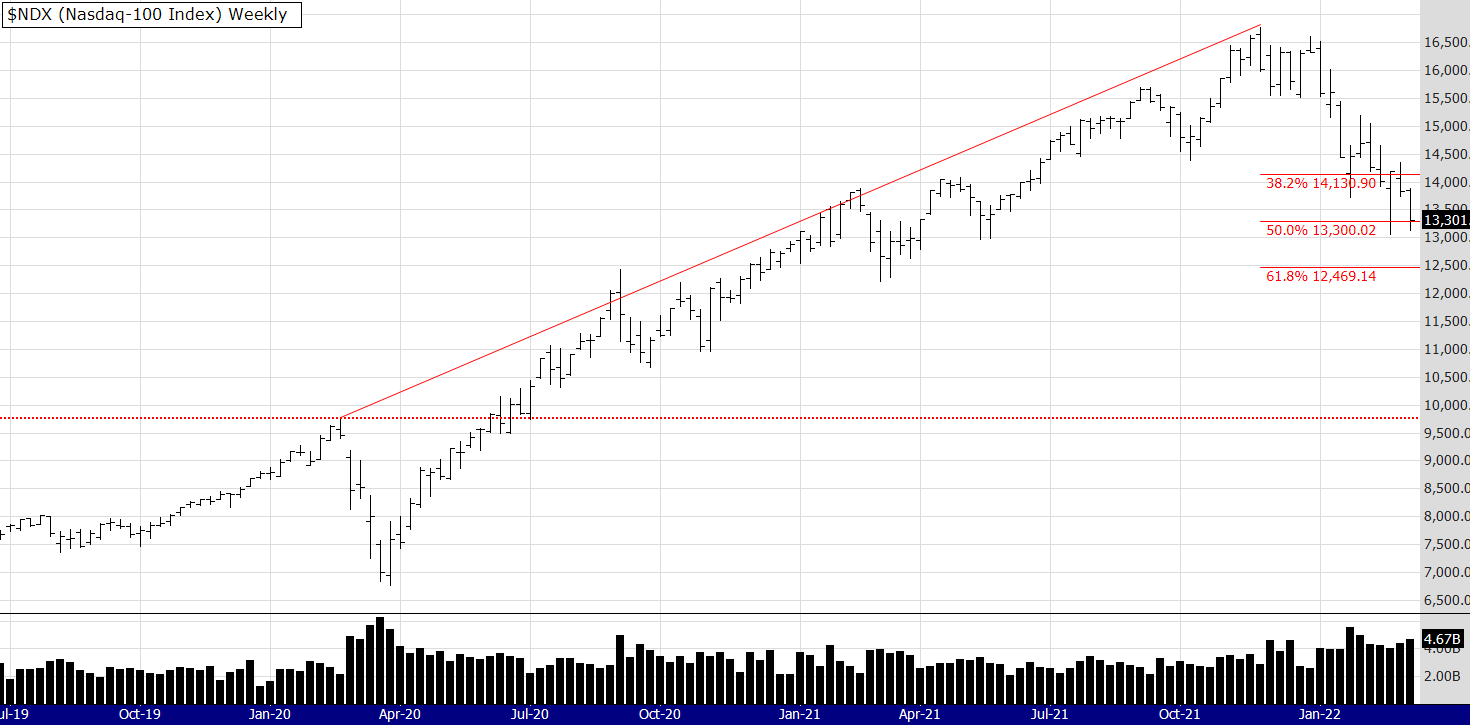

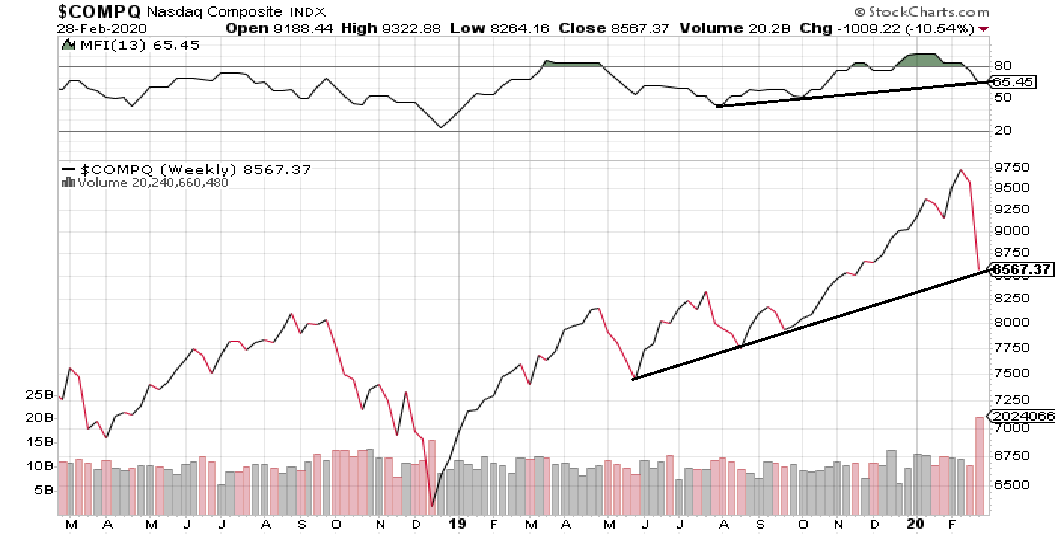

Lets look at arguably the most important index. Nasdaq 100.

You can see by looking at the negative divergence of the MFI that the index was overbought - nothing new, analysts have been discussing that for some time and charts don't lie. The price is on support and the OBV is yet to break into a downtrend, if that happens the chart will look weaker. However, in the present, IMO, we have a correction, not a crash. Price could fall to the next level of support and to the previous low on the OBV. Technically speaking the downtrend won't be in play until the low in April 24 is taken out, because that's the last pivot low when analysing a weekly chart. A little disclaimer here.........I am not the best T.A. analyst in the land, others may see it differently, but that's what I see.

One more chart and I am done for today..........

There has been more talk (by myself too) about rotation of stocks out of big caps to smaller caps. Looking at the chart above you can see the more dynamic MFI volume indicator was warning perhaps that theory had got ahead of itself, it was flashing a big divergence. However the OBV is in a solid uptrend and so is the price action. Yes, the chart has past price resistance to work against and it's going to take more belief from investors that the rotation philosophy has legs, that its not a "fly by night" event. The price has pulled back to a 2 year support level so it remains to be seen if it can hold.

Summary: if you don't have a solid system that you are committed to, its probably a good time to sit out for a while and see what happens over the next few weeks. Regroup and re-plan.

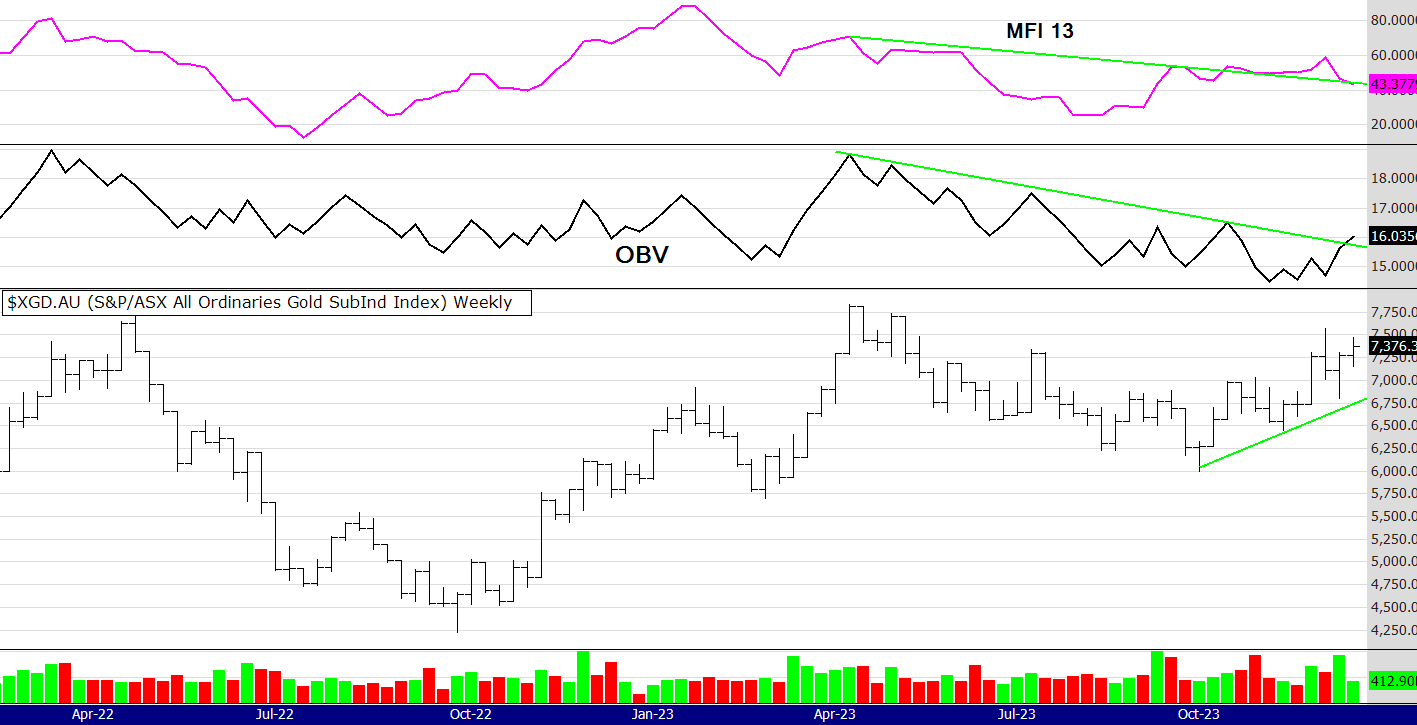

I said i was done but I will mention gold stocks.

Similar to the other indexes the GDX in Aus may have got a little ahead of itself, its flashing volume divergence - but the trend is up, the divergence is not that bearish and as I said a few weeks ago I hold core positions in gold stocks and I wouldn't be shorting them!

That's a long read, if you got this far congrats!

Until next week

Peter

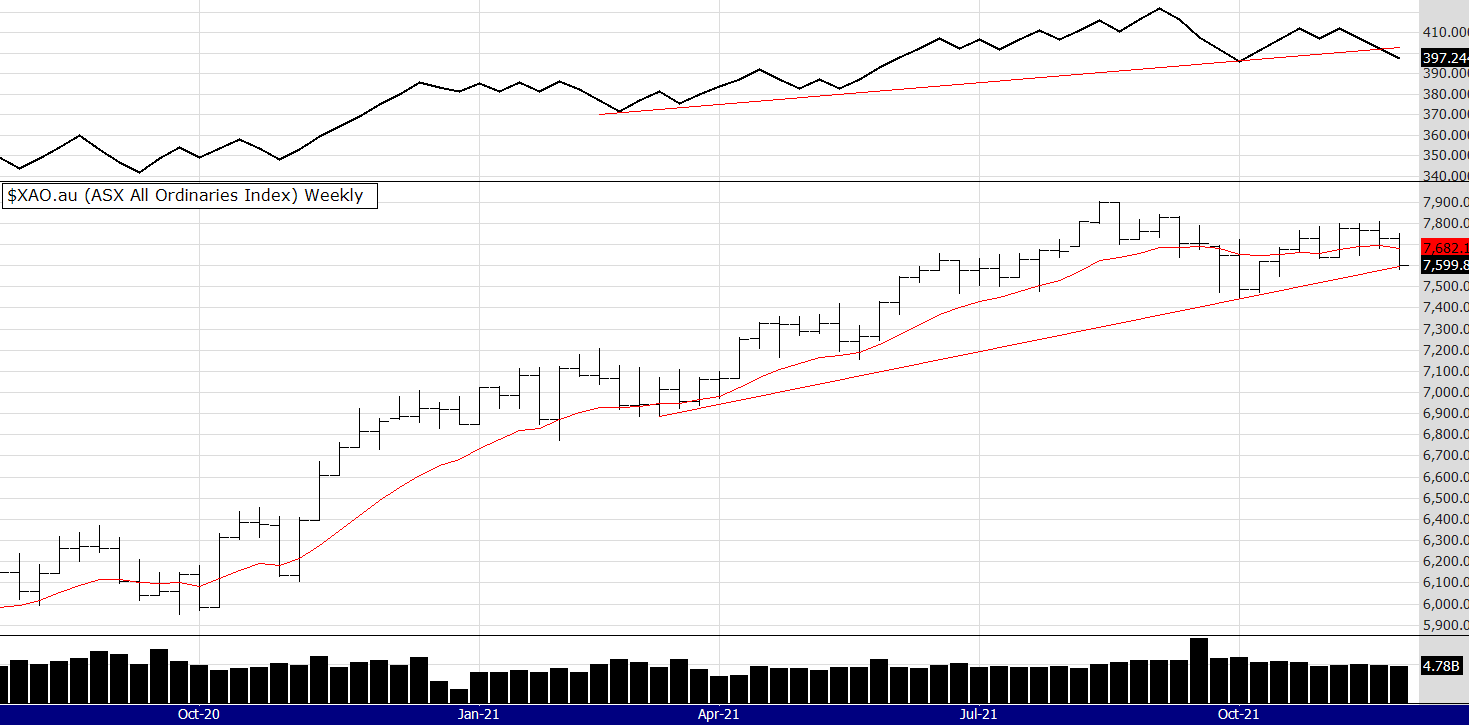

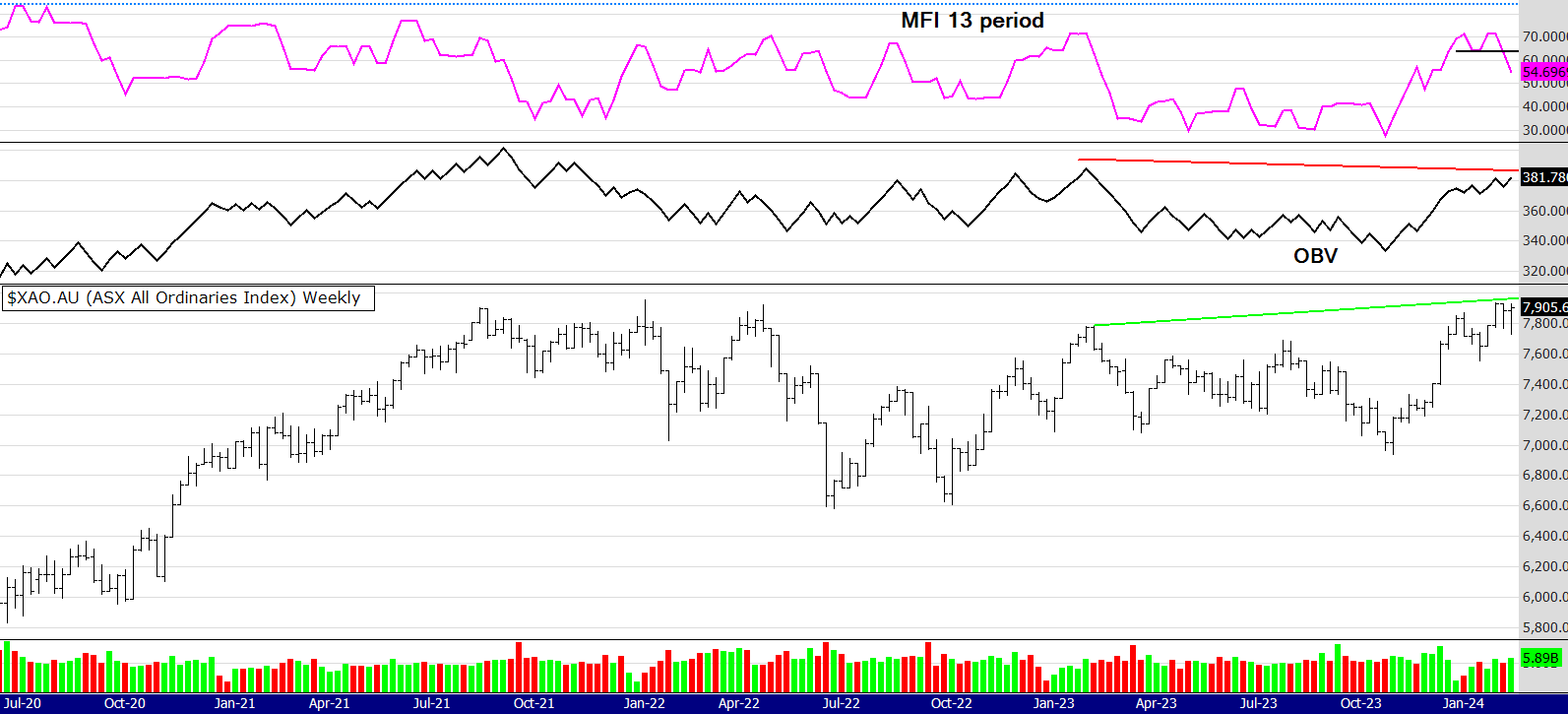

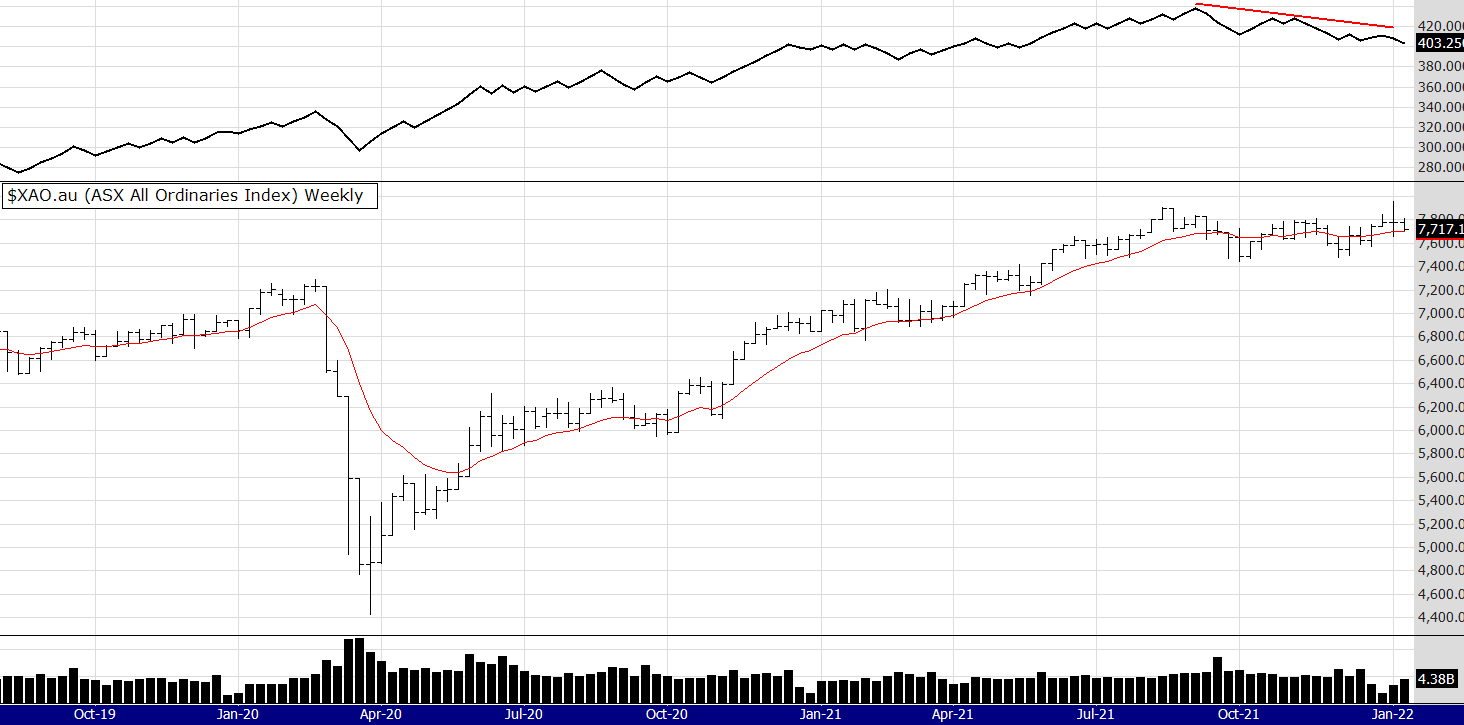

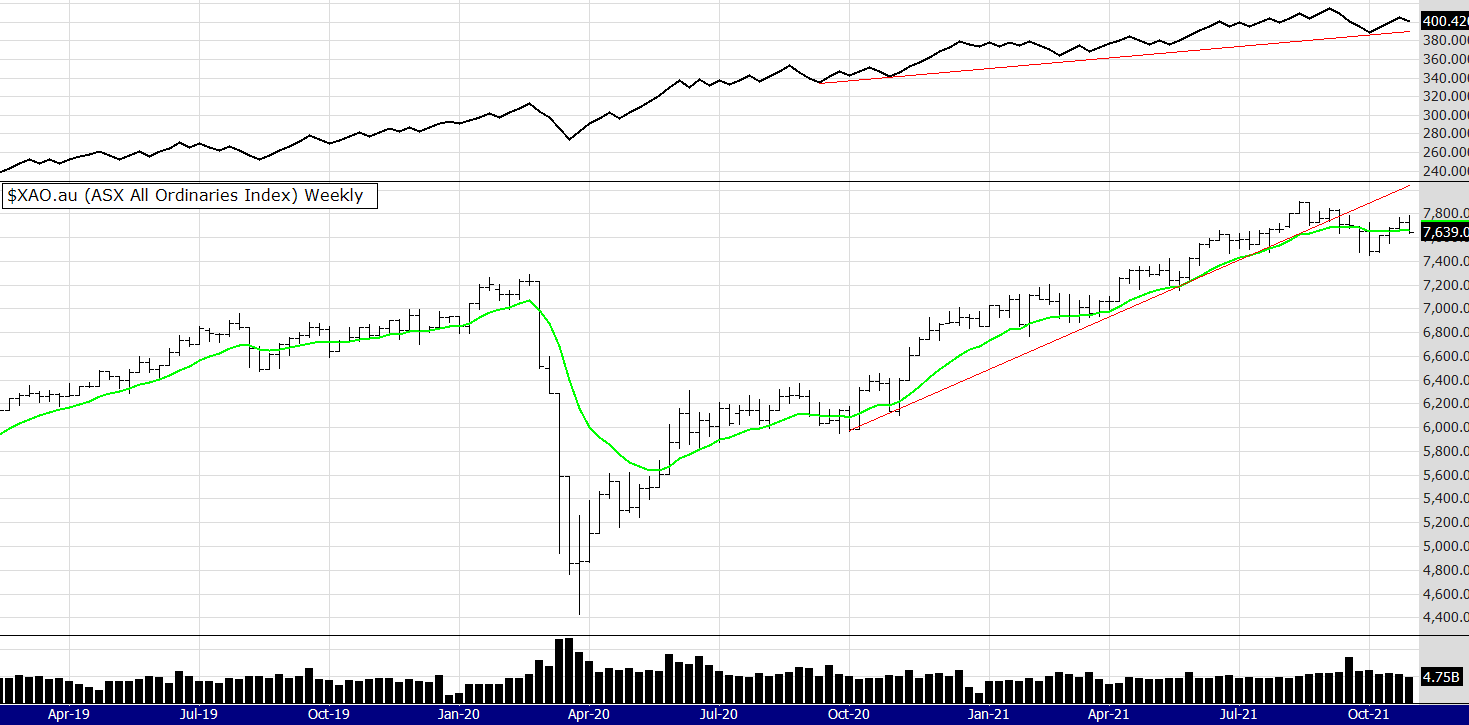

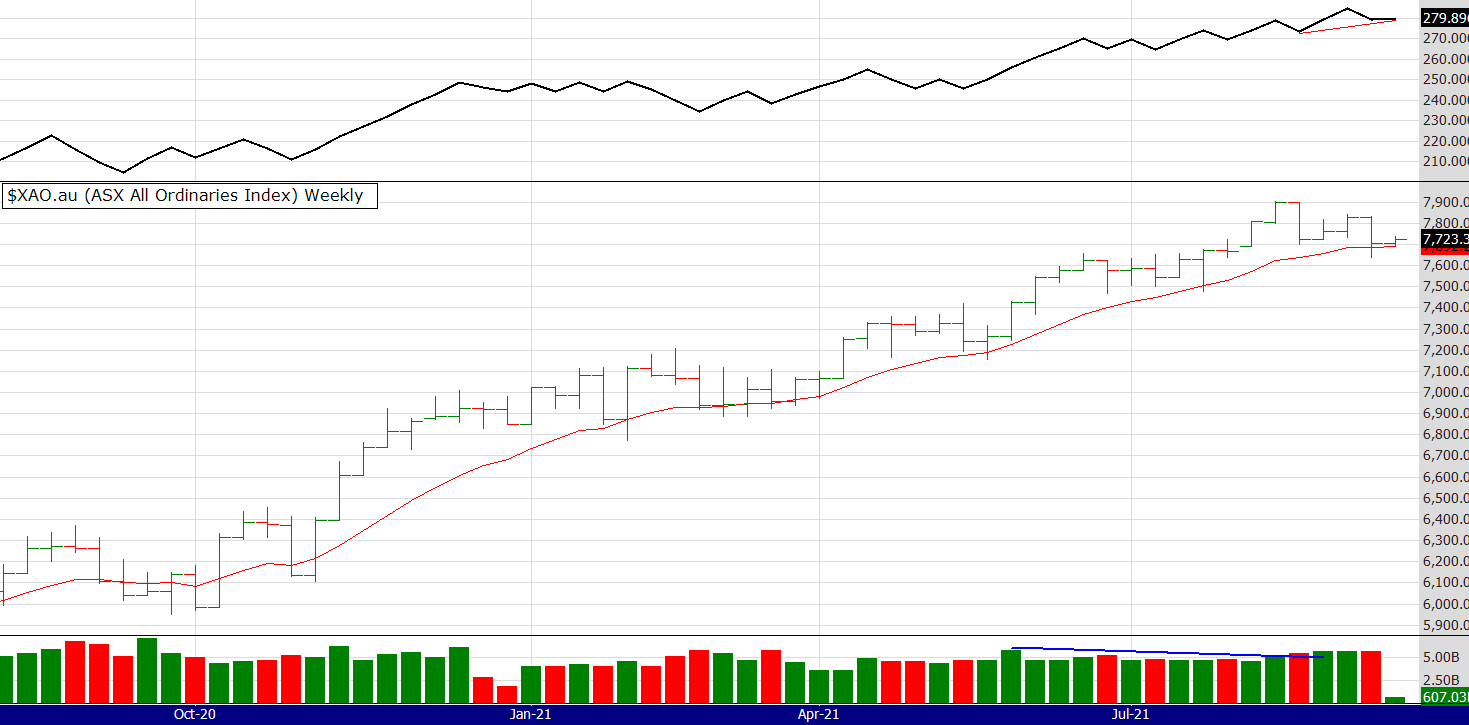

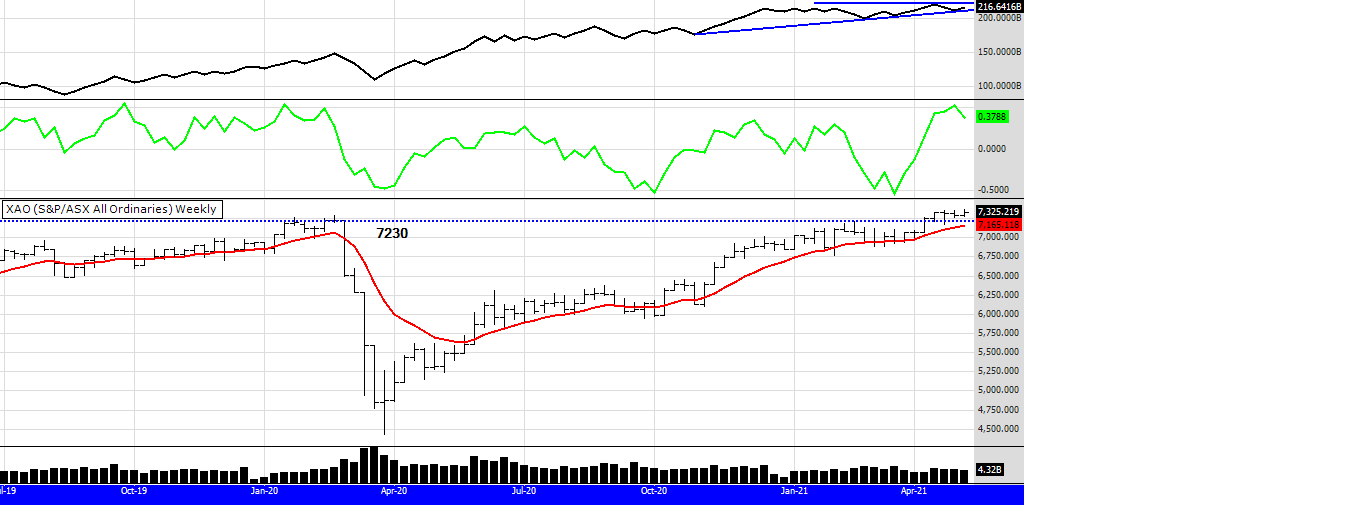

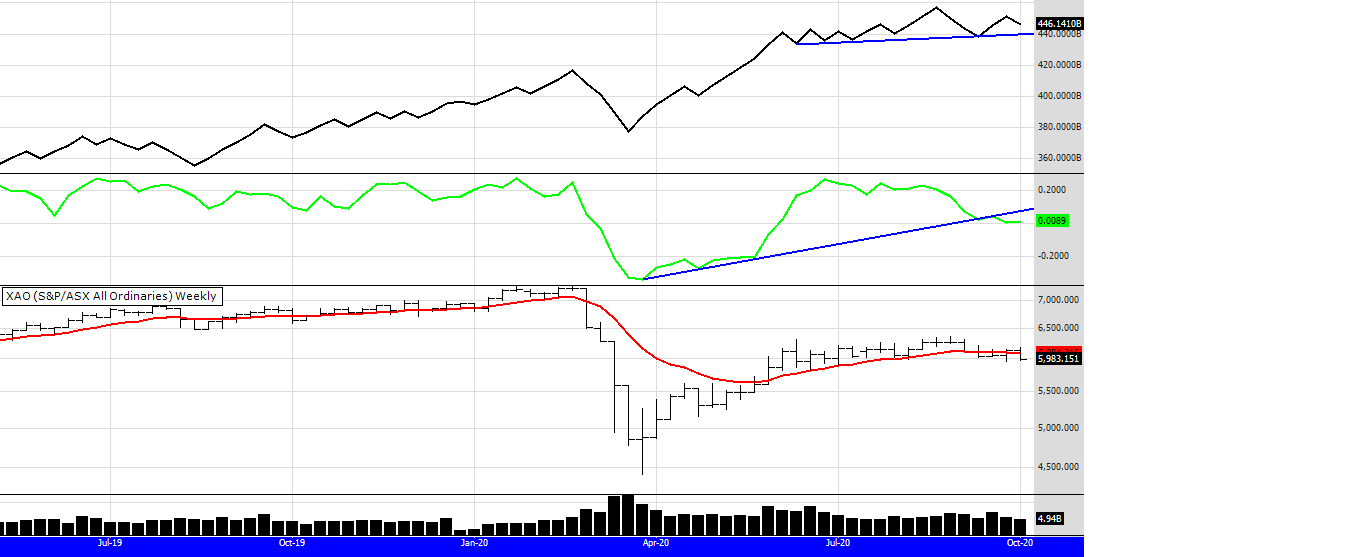

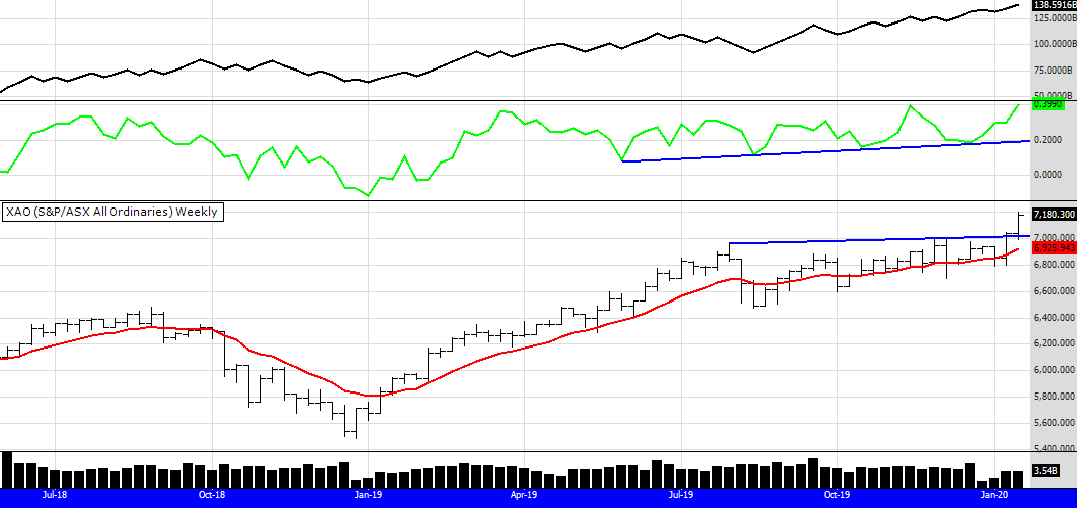

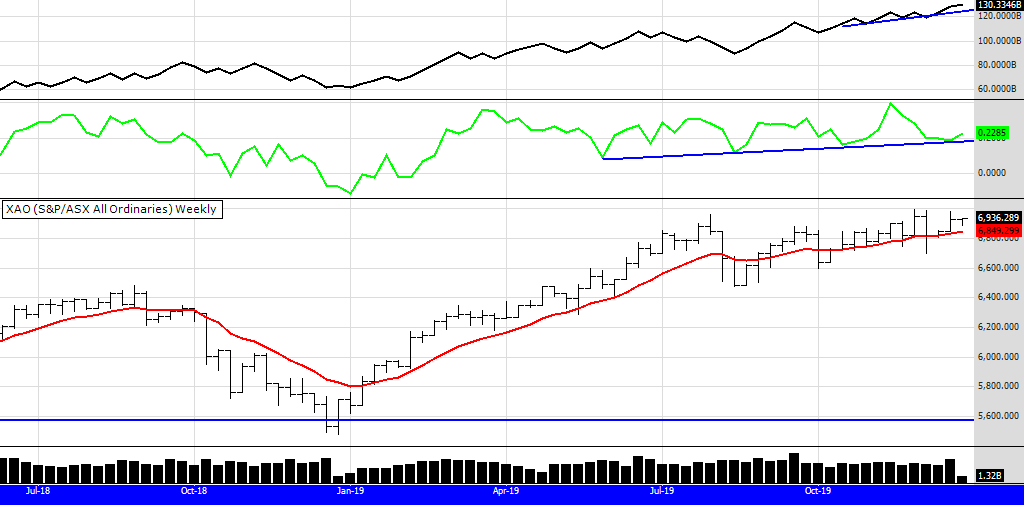

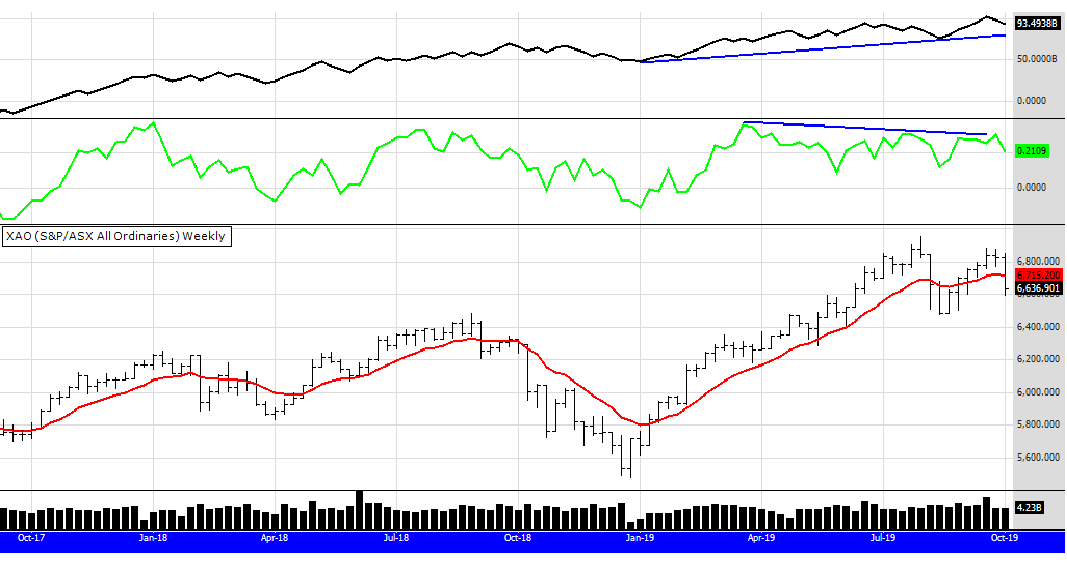

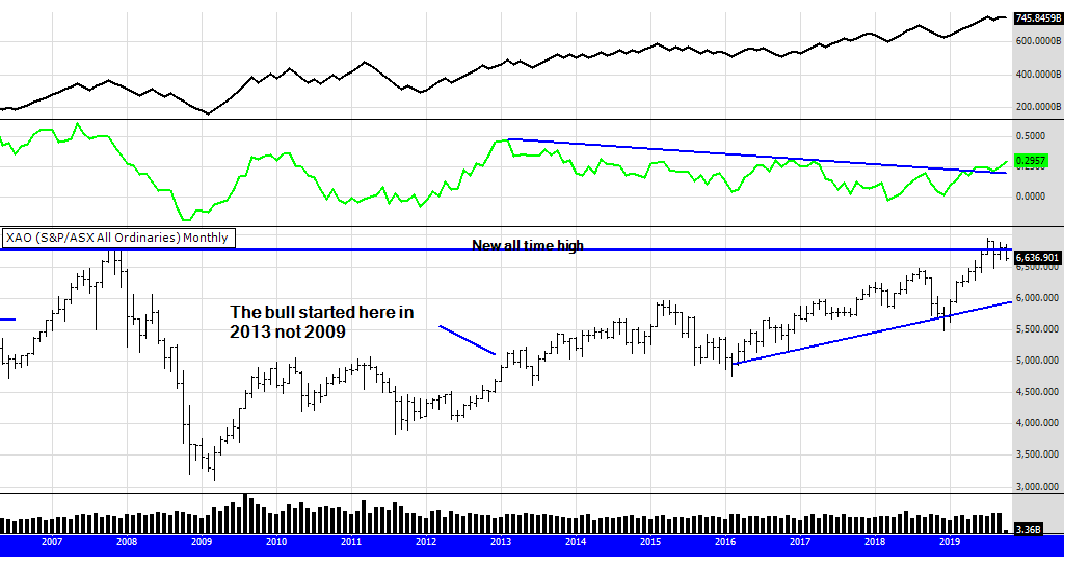

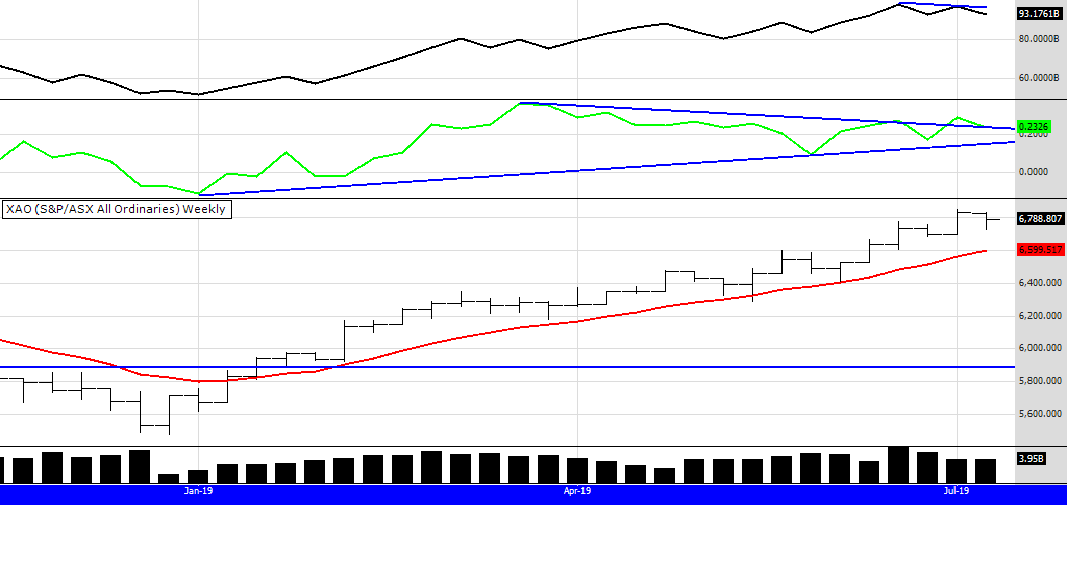

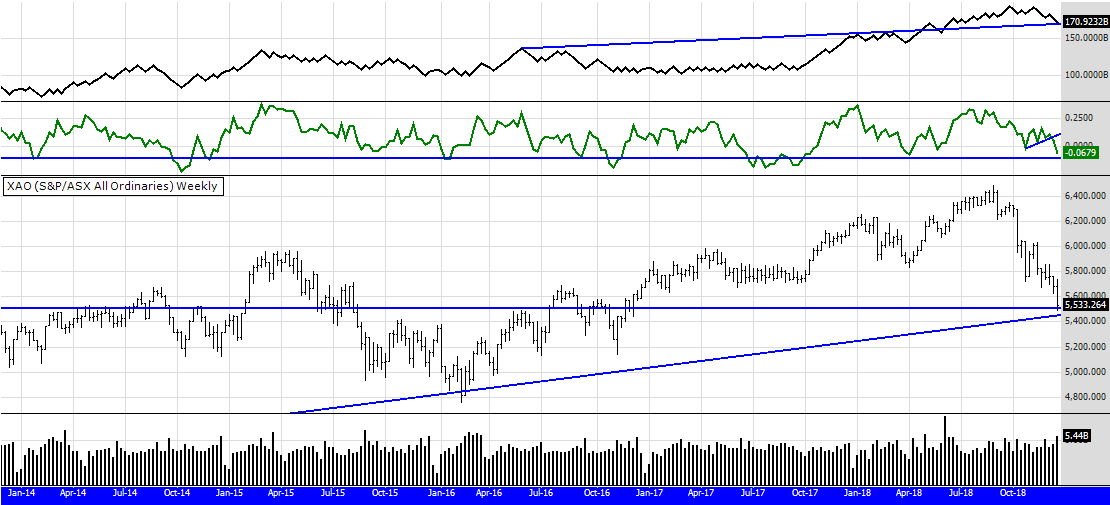

MARKET COMMENTS: As of the close on Friday 26/7/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Keeping with the theme of the last few weeks - which has been

1/ its a bull market.

2/ the top does not appear to be here.

3/ trading is about probability not prediction.

4/ historically there is a strong correlation between the Russell 2000 and the XAO.

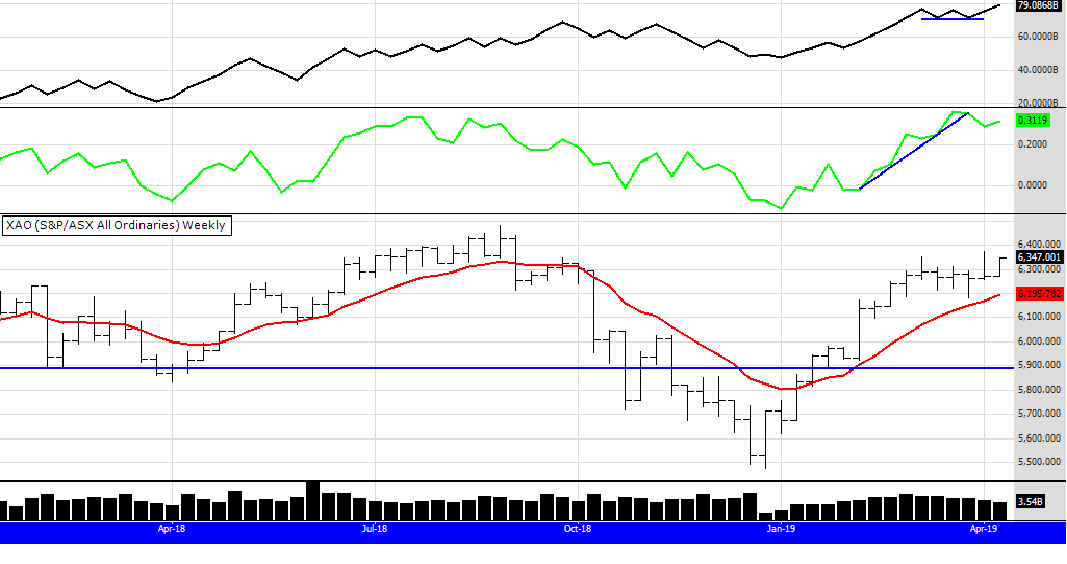

5/ US stocks appear to be rotating from large caps into the Russell 2000 suggesting that stock market breadth in the US is widening - which is bullish.

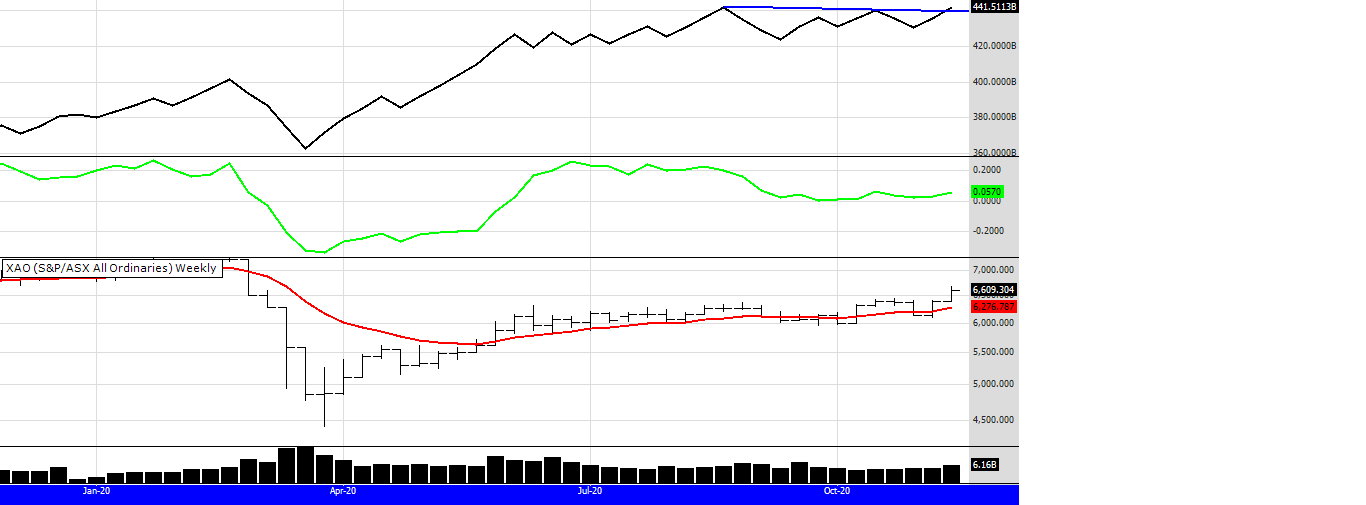

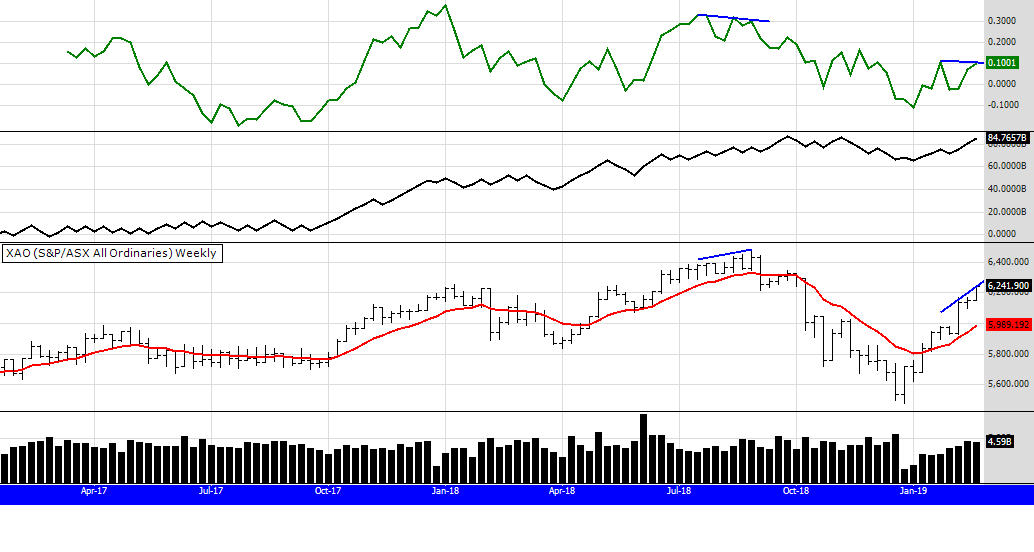

6/ The XAO is lagging the Russell, as seen in the chart above, either the Russell will fall or the XAO will catch up - I think the latter is more probable.

Overall this appears to be a very strong market - a big rally or even a blow off top may be coming, who knows. If a blow off top eventuates we will deal with it at the time.

My experience and intuition tell me this market is similar to the late 1990's. A period when the market produced gains beyond peoples wildest dreams. Its also a very difficult market to trade because moves up, and down, are fast and unsettling. Dips are to be bought (which takes nerve) and big gains after fast rises are to be sold. A strategy I have used over the years is to sell 50% of my holdings after a stock has risen 70% - by tightening the stop, after that I let the rest ride until my primary stop has been hit. I do not re-enter the trade, gnash my teeth over "what may have been" " I should have " "I could have" etc. Rather than re-enter I move on to the next trade. Like a pro tennis or golf player we play one shot at a time. One trade at a time. Let the bad trades and shots go.

Otherwise they are all negative, soul destroying thoughts, often produced by the simple fact the trader had no strategy in mind to deal with the many possibilities the market may throw at us.

So! Have a plan in mind how you will manage your trades if the market rallies hard and even produces a blow off top from here * Also keep an eye on that correlation between the Russell and the XAO, it's an important one IMO. If the XAO plays follow the leader, there are going to be many opportunities in the Aus market, maybe starting as soon as Monday.

Until next time

Peter

* ATR trailing stops, active at all times in the market are an effective tool. At times they will whip you out - but save you if the market plummets suddenly.

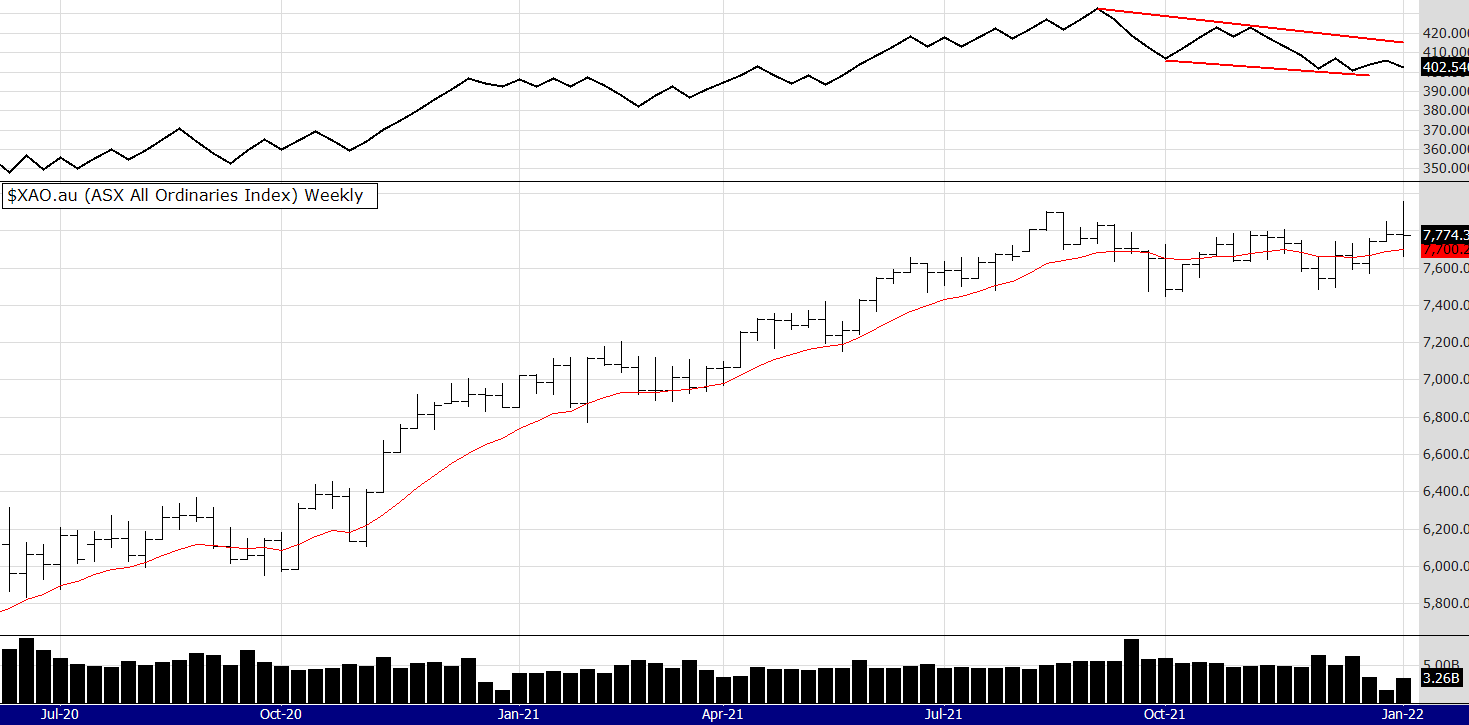

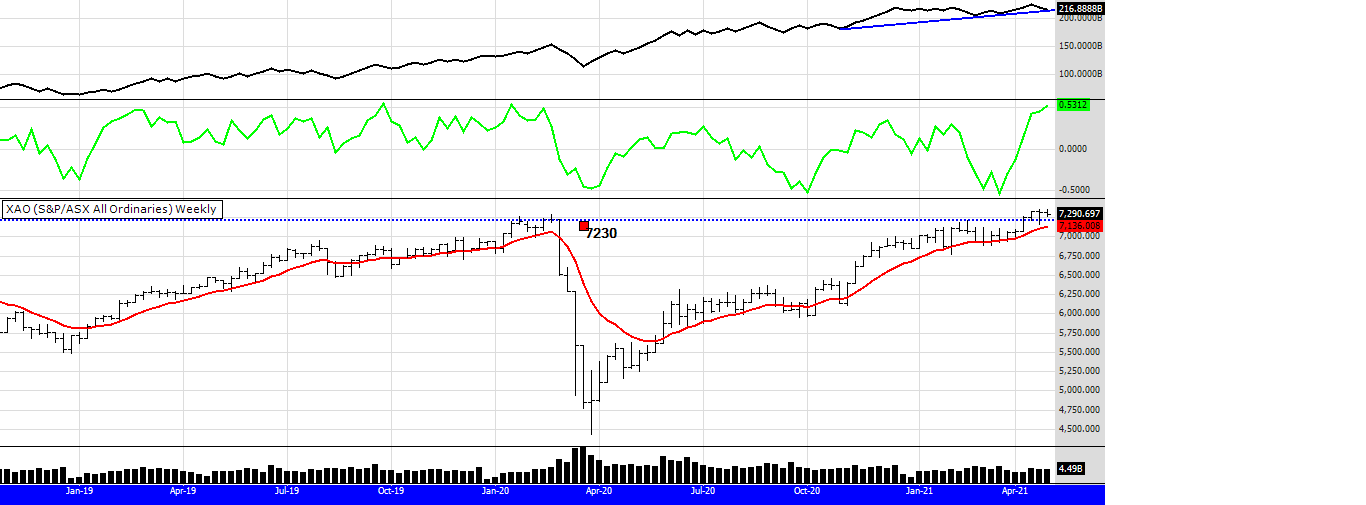

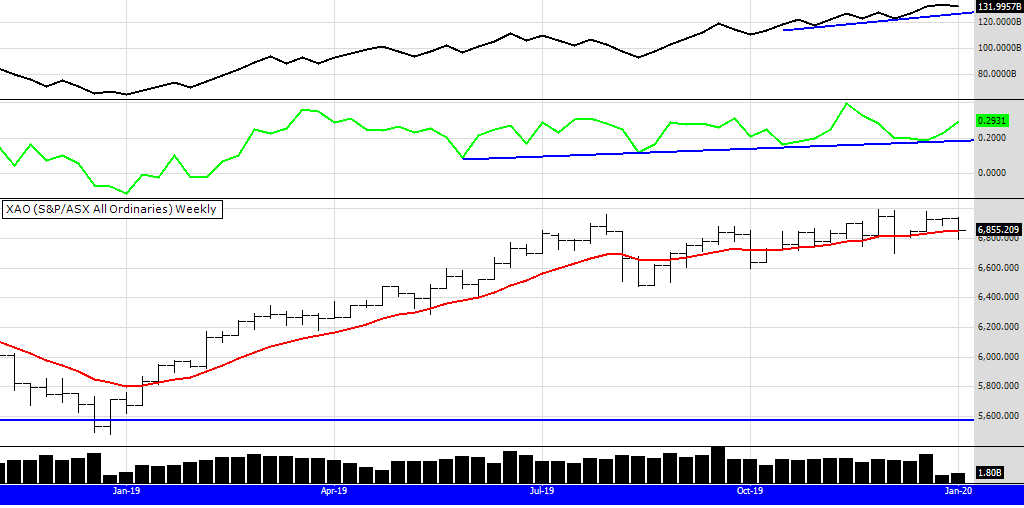

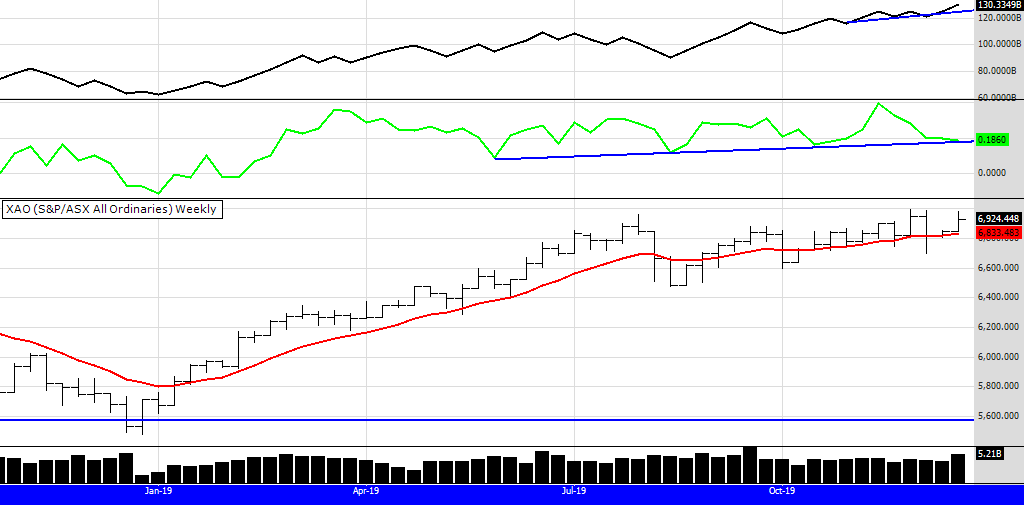

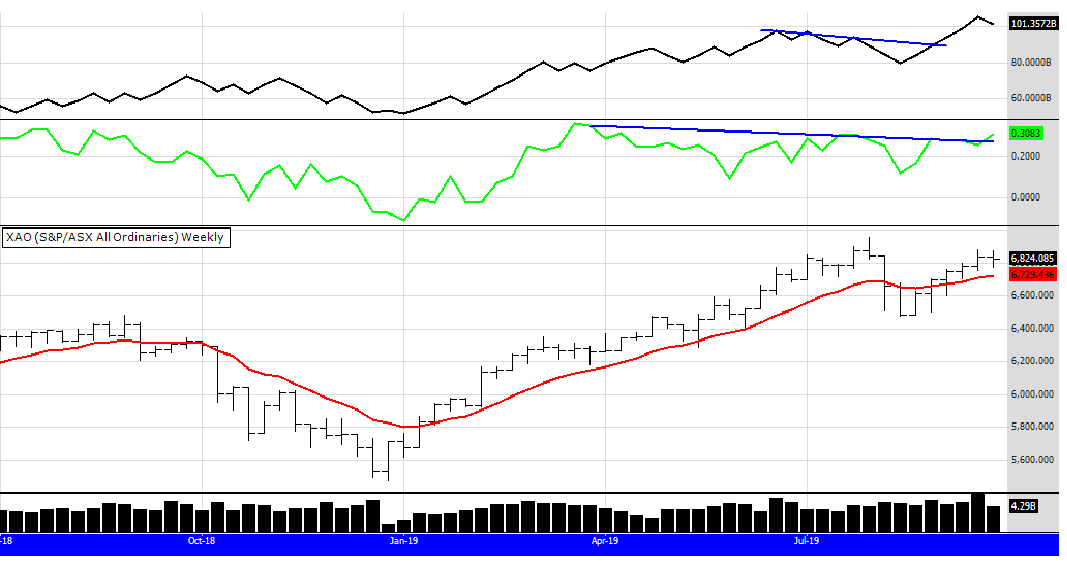

MARKET COMMENTS: As of the close on Friday 19/7/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

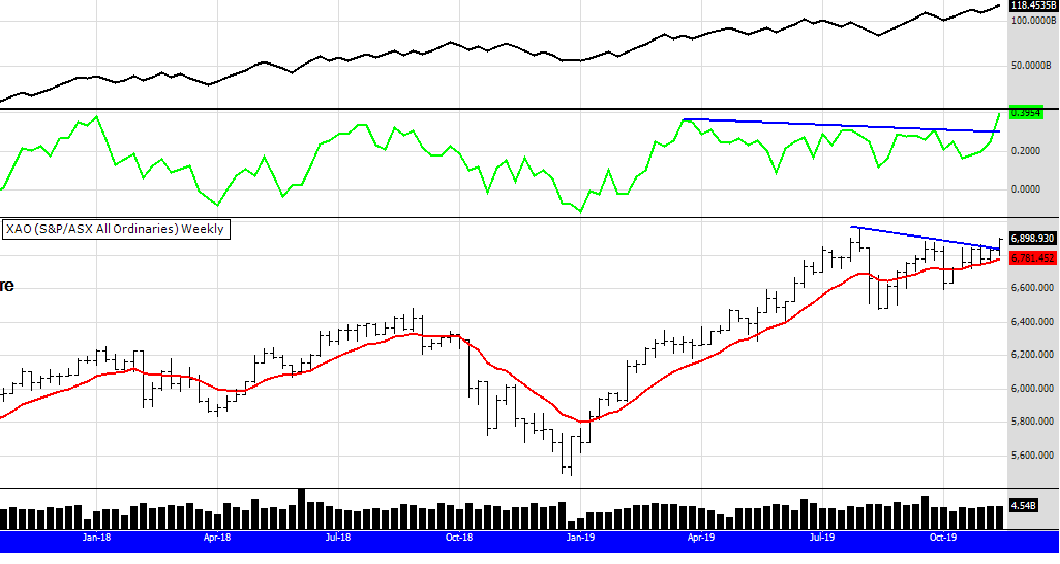

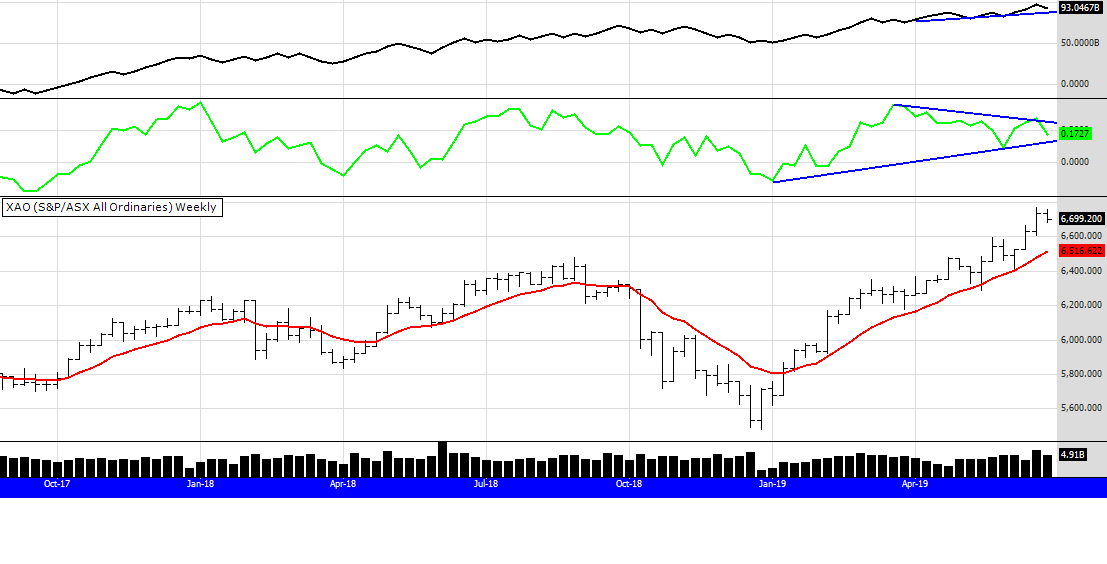

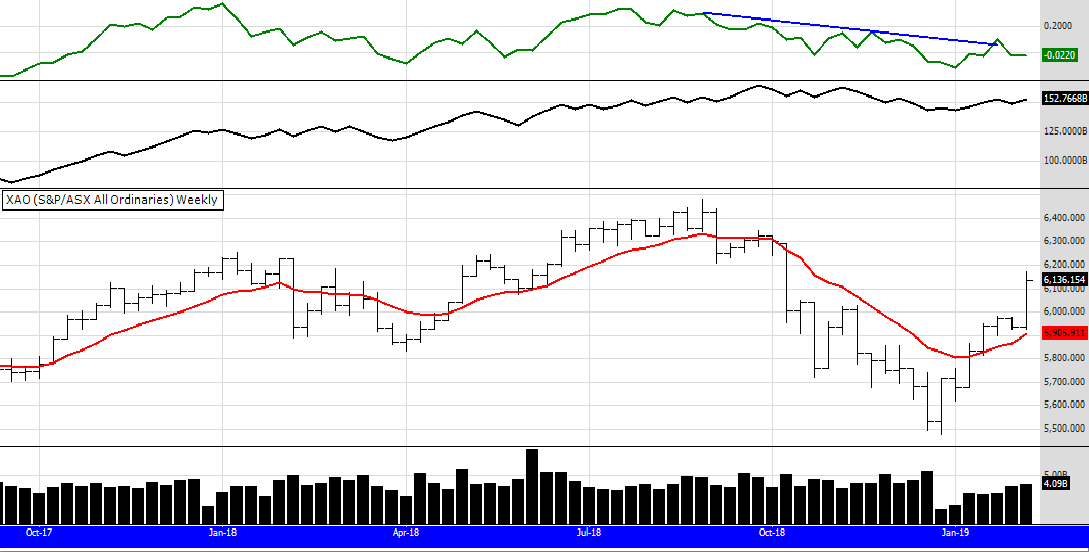

Comments from last week: Trading is based around probability IMO. I think it's probable the XAO will consolidate here for a while, do some "backing and filling" as many readjust their portfolios for the rotational change that has just occurred. That change being a rotation from some bigger overbought stocks into the smaller and midcap stocks that have not been a part of this rally - yet.

The market rallied up fast but then fell to exactly where it opened as consolidation and readjusting of portfolios and the new paradigm took hold. What new paradigm? Probably mostly Trumpanomics, as traders and investors moved money to stocks and sectors that may benefit from a Trump win.

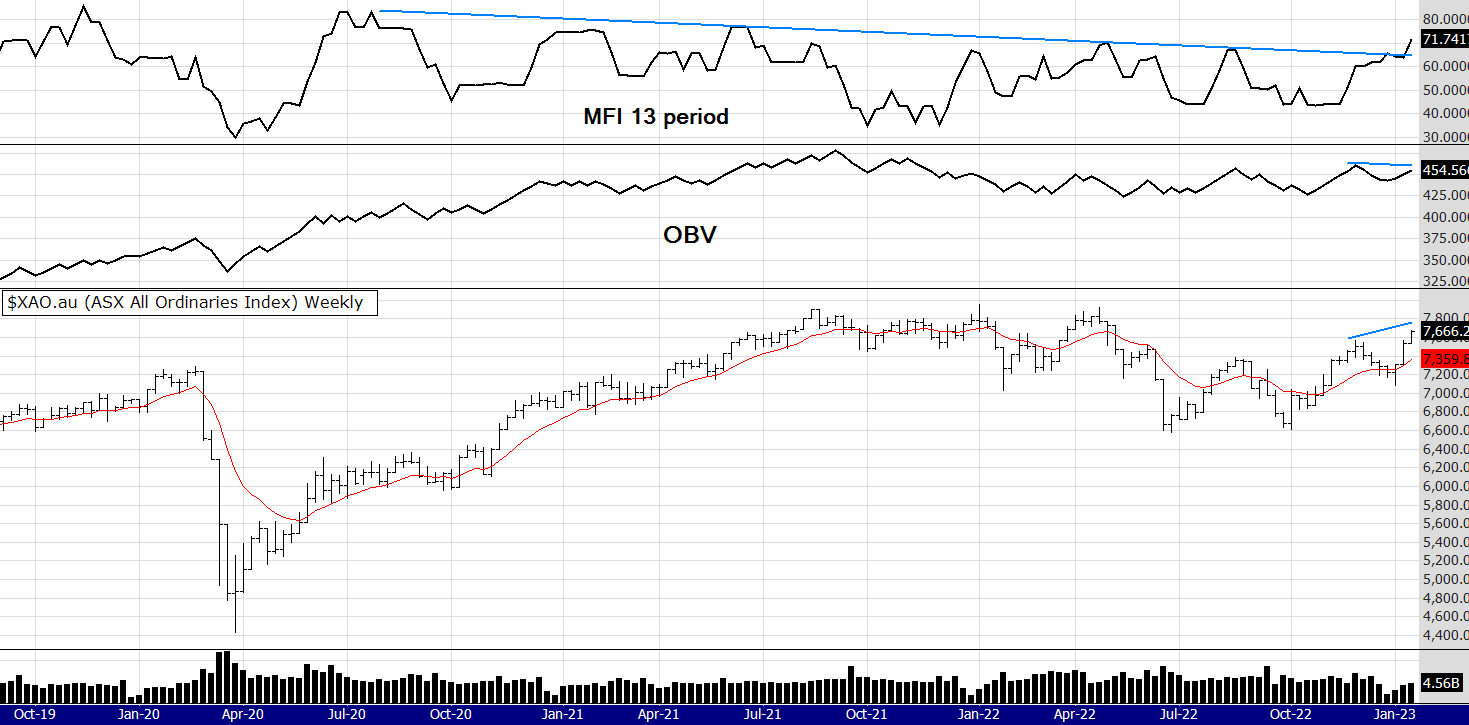

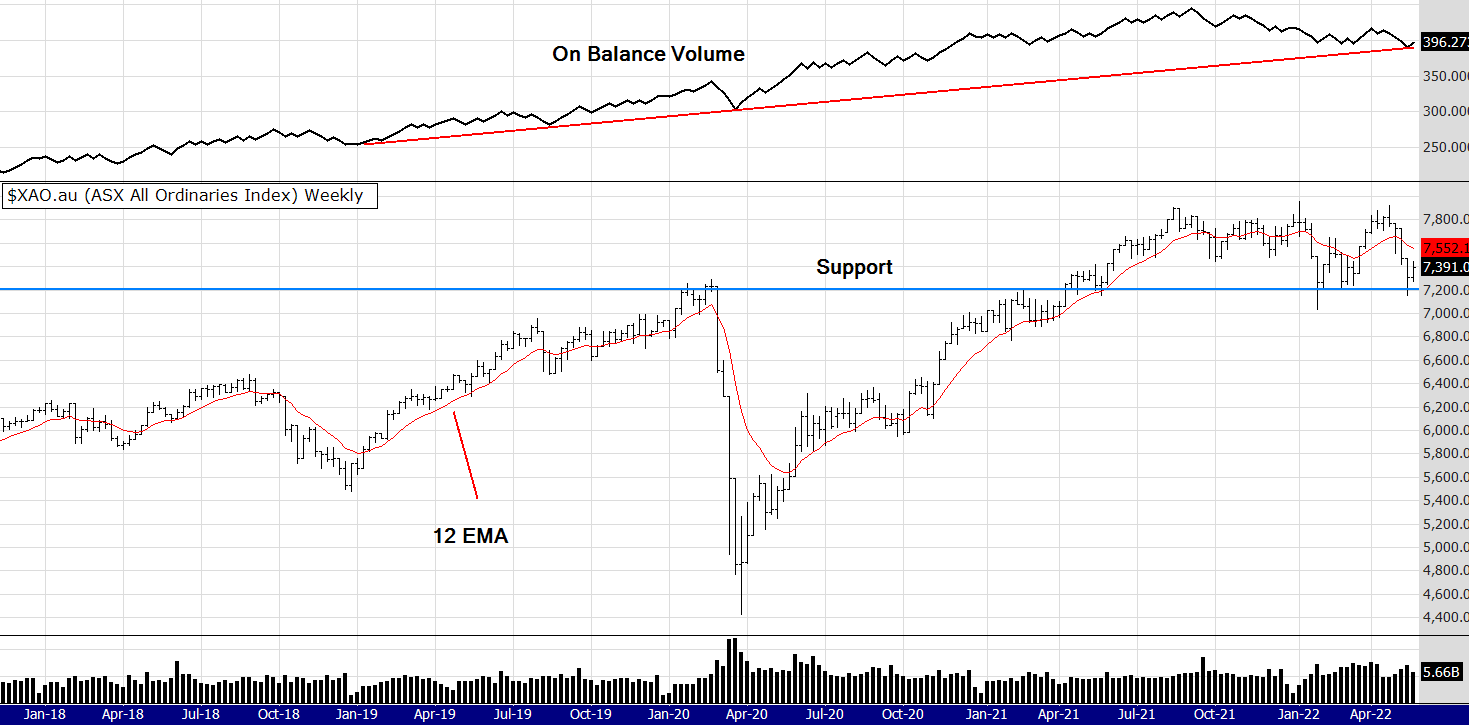

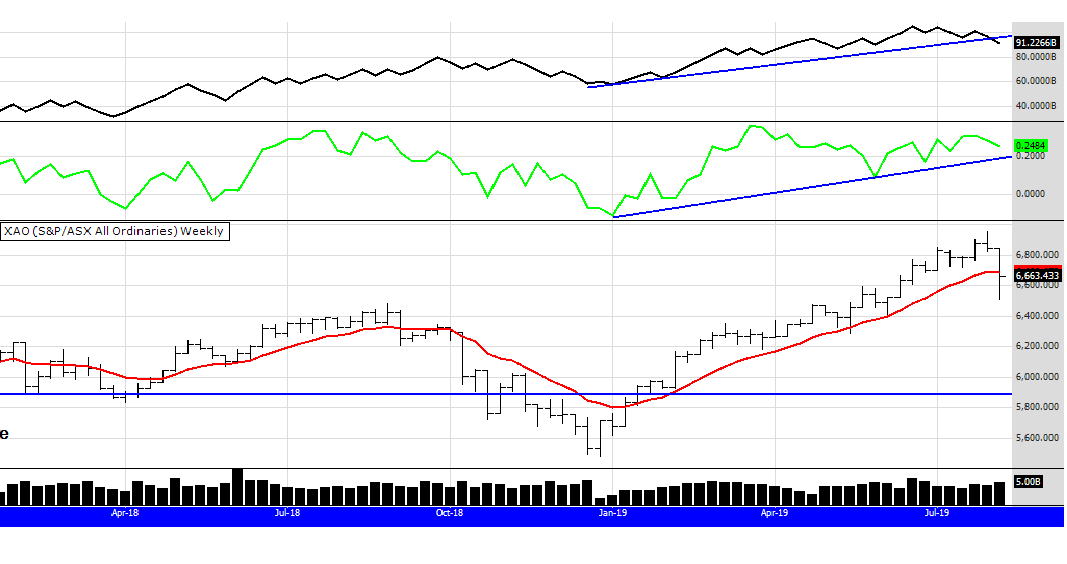

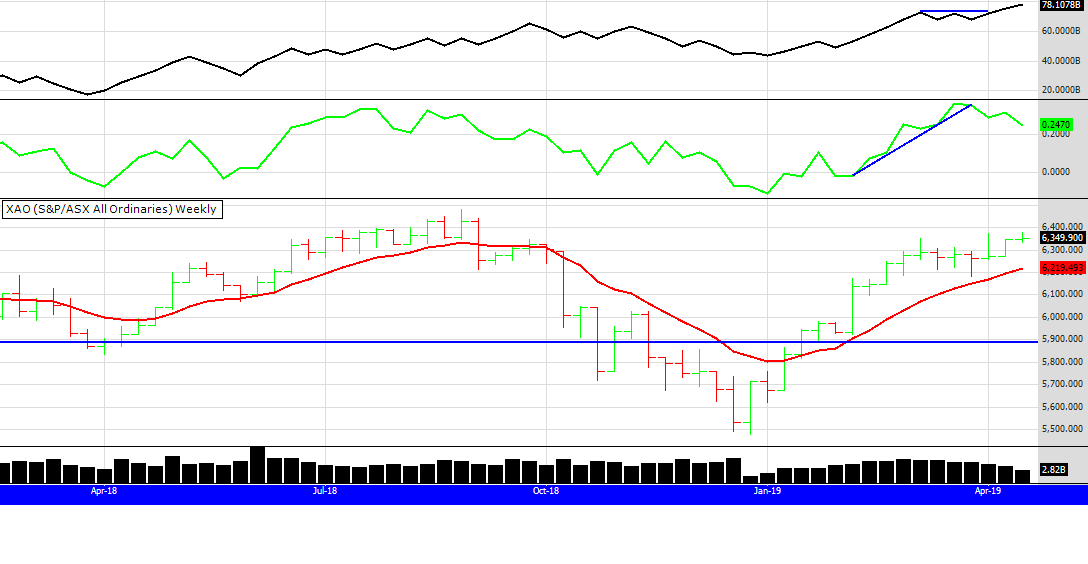

However, looking at the chart it now looks even more bullish than last week. Volumes have increased and the OBV has made an all time new high suggesting price will catch up to volume - that means higher prices.

Back on the 14th June I talked about the correlation between the Russell 2000 in the US and the XAO in Australia. You can scroll down on this page to see the chart and my comments on that date.

Looking at the present price action you can see the XAO is correlating nicely to the Russell as it has often done - except for the extreme times during Covid, but the XAO still went up, just not as much. I know there is a lot of fear and uncertainty at the moment, the main fear being that this bull market can't last much longer and the sell off (reallocation of funds) from the Nasdaq will create a bear market. Well, that's not what I think when I look at longer term price and volume charts of the Russell, but that's another discussion and perhaps next week I will post some charts showing what I mean.

Have a great week

Peter

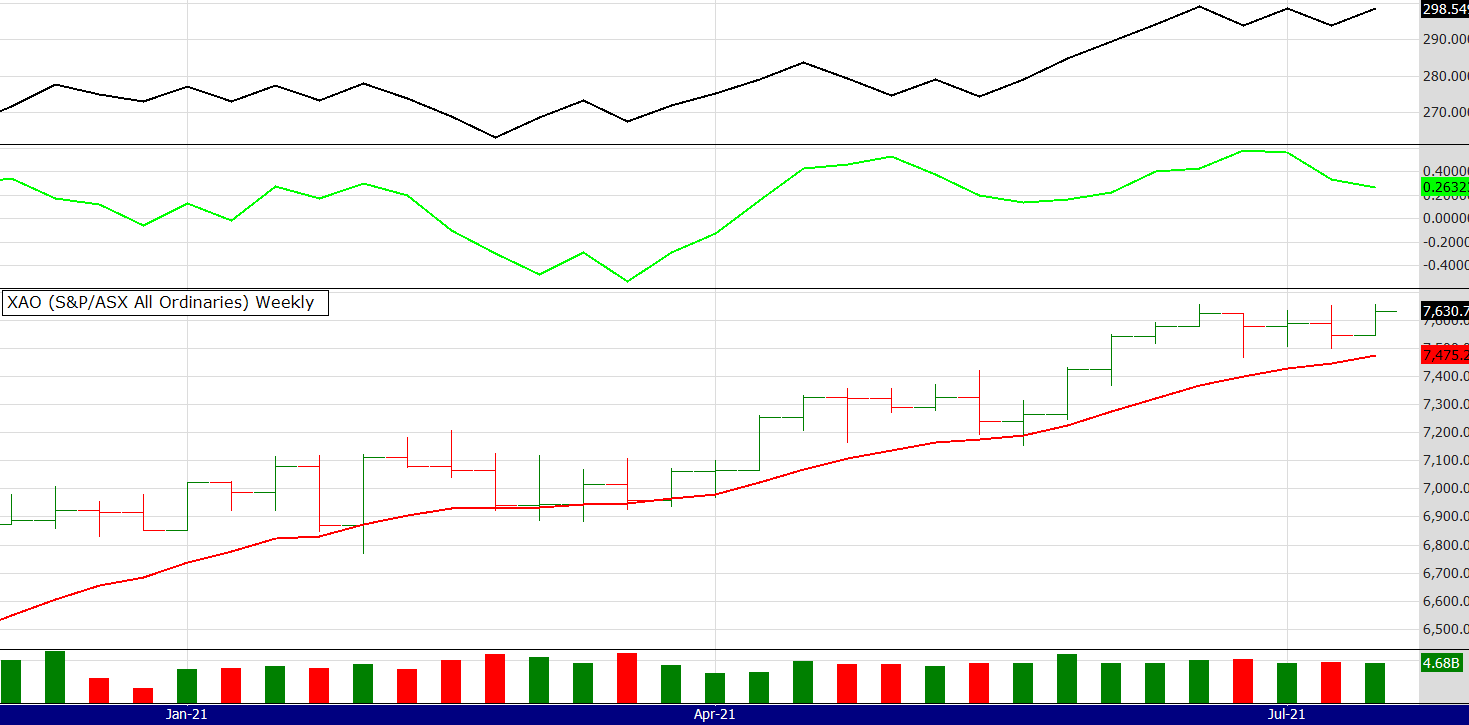

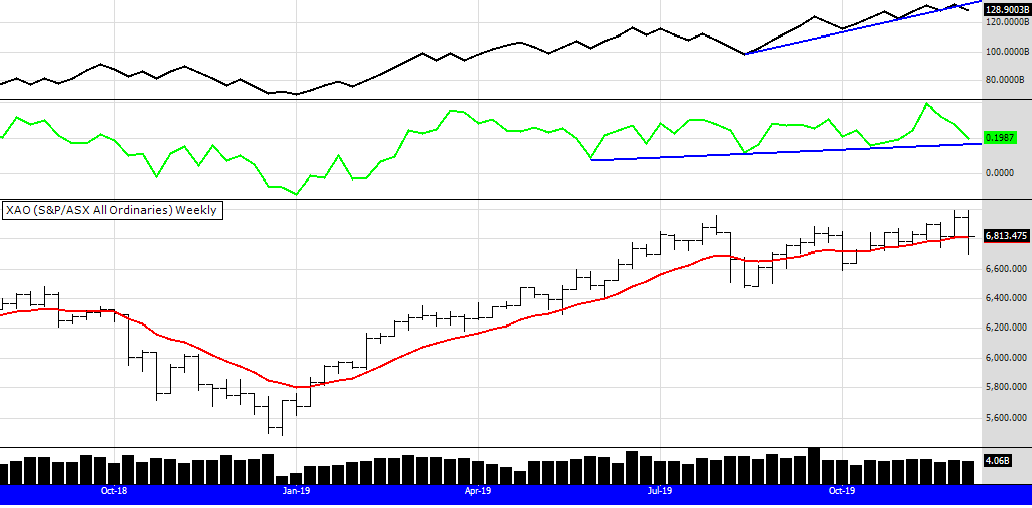

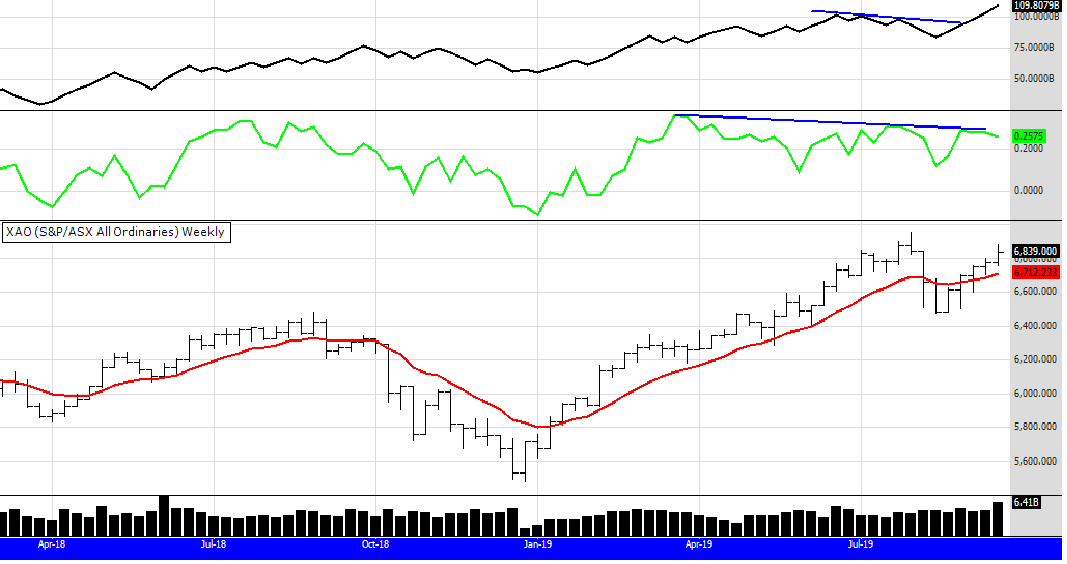

MARKET COMMENTS: As of the close on Friday 12/7/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Last week I said this

"However the Russell 2000 still drags the chain making me wonder what will it take for that index to come to life? Definite, not just rumoured rate cuts perhaps......... the chart above does seem to be improving - and perhaps building for another leg up"

Well what a week! The Russell surged around 6%, the continual expectations of rate cuts in the US encouraged traders and investors to buy the index. I have spoken many times of the correlation between the Russell and the XAO, and this time the correlation again proved itself.

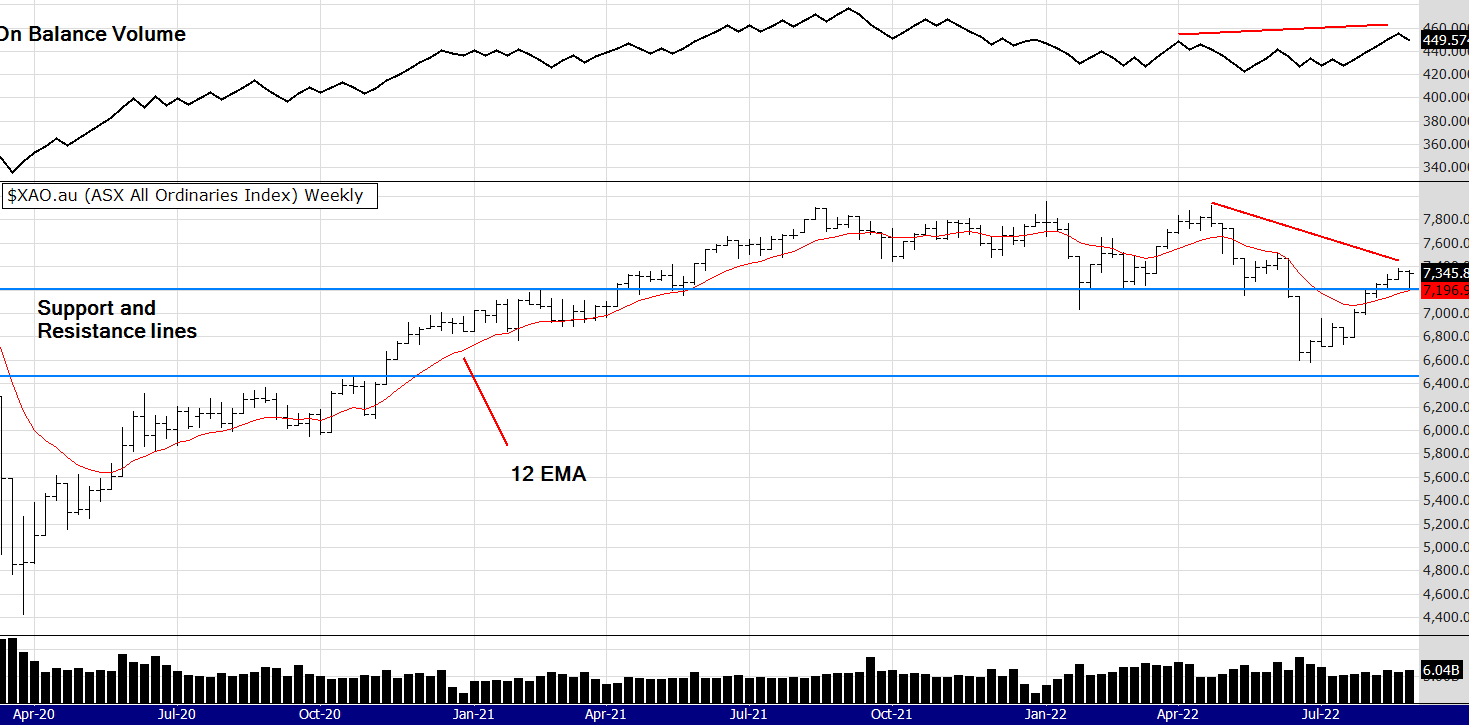

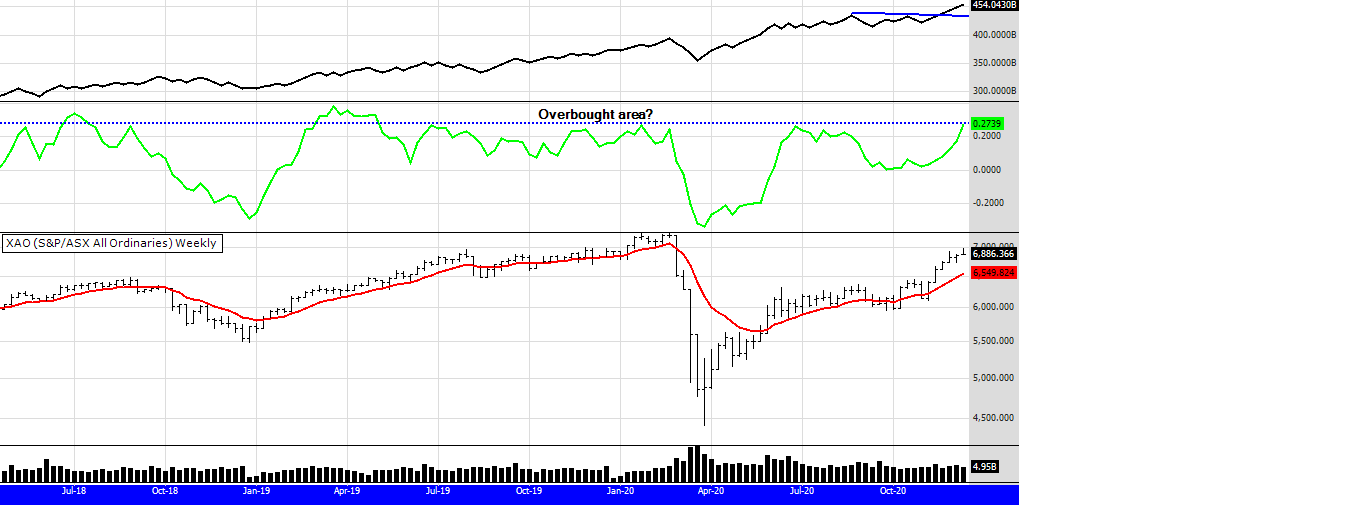

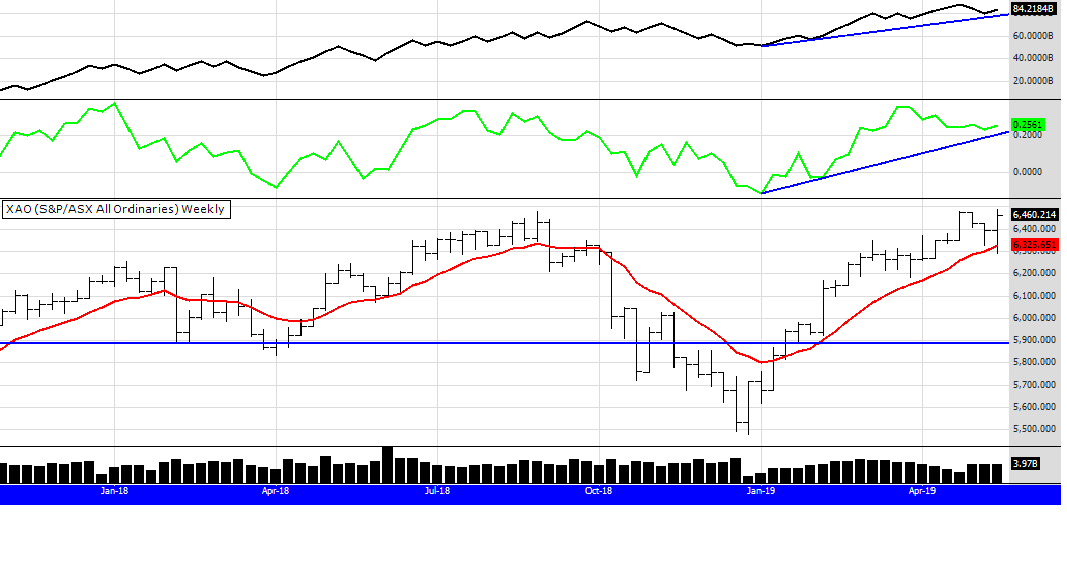

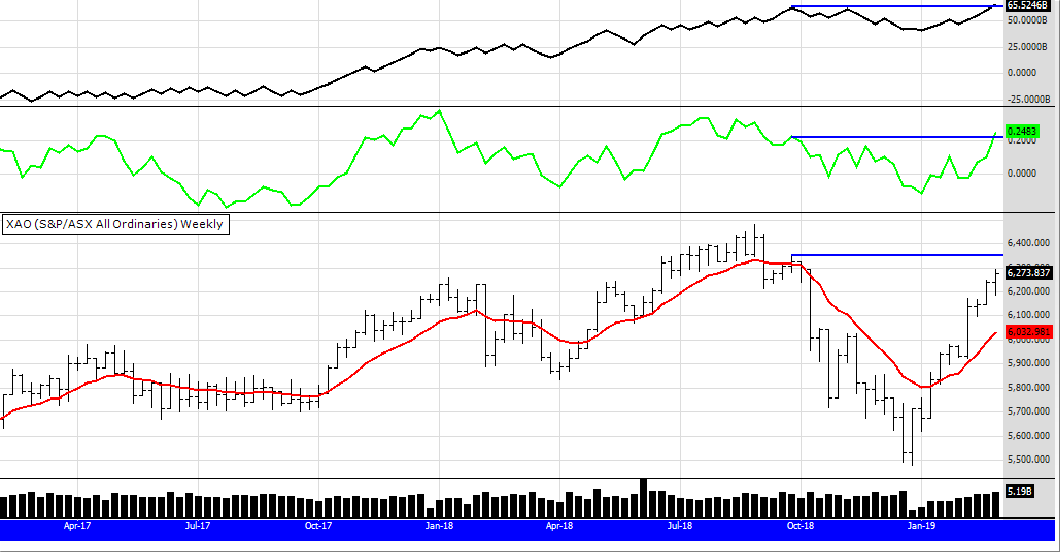

Looking at the chart above you can see clearly the 13 period money flow Index has broken its down trend line, however the less dynamic OBV has some work to do. Trading is based around probability IMO. I think it's probable the XAO will consolidate here for a while, do some "backing and filling" as many readjust their portfolios for the rotational change that has just occurred. That change being a rotation from some bigger overbought stocks into the smaller and midcap stocks that have not been a part of this rally - yet.

Gold exploded again, however some of the gold stocks look a little overbought, but I wouldn't be shorting them. I did lighten up a little on gold stocks this week taking some money off the table - I may have that wrong and they could keep surging but I still hold core positions.

Alerts below and have a good week.

Regards,

Peter

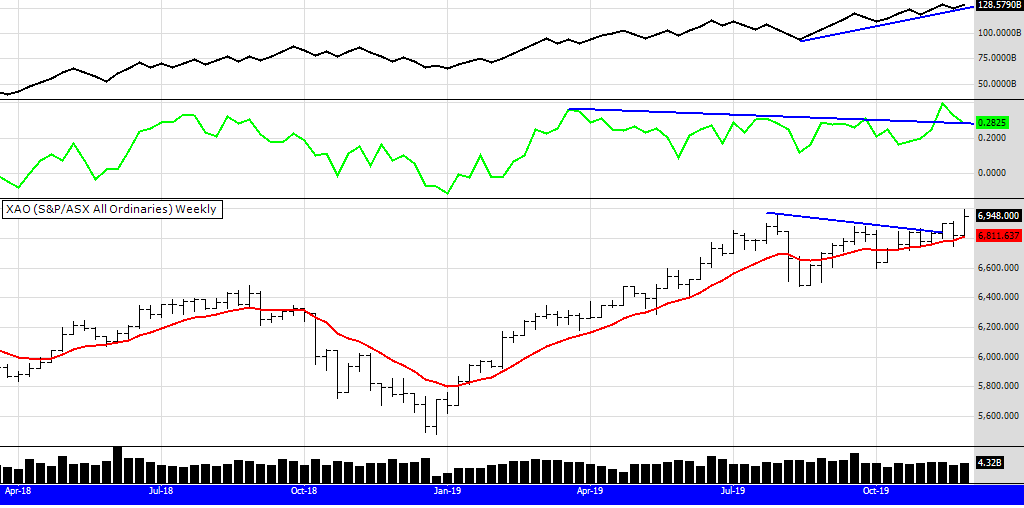

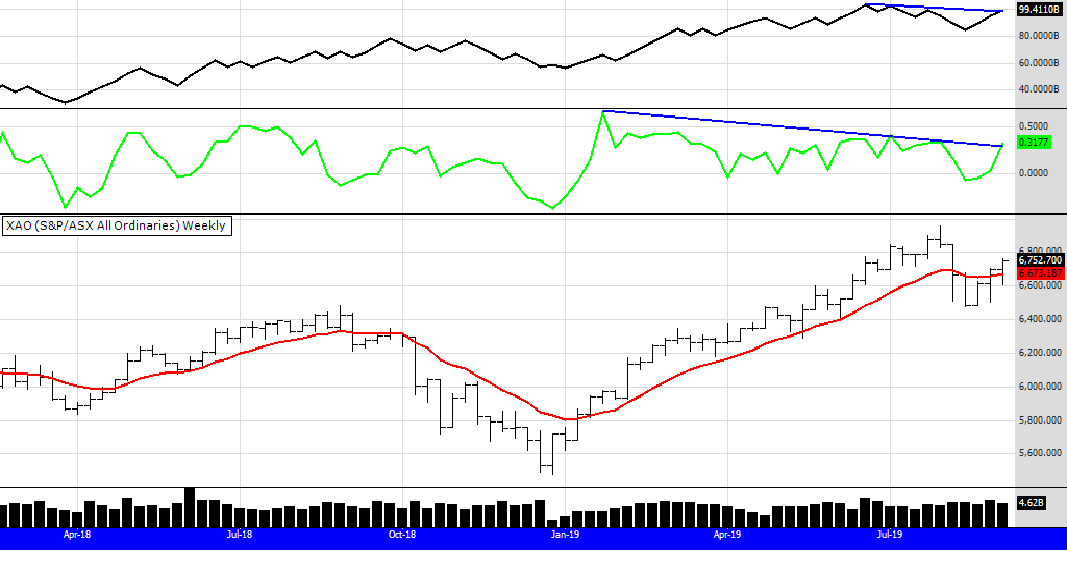

MARKET COMMENTS: As of the close on Friday 5/7/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Well wasn't that an interesting week! On the 1st July money poured into the resources, energy and commodities sectors and made me wonder what do others know that I don't? I found out in a few days as hopes and expectations of a rate cut in the US fueled a rally in the oversold commodities sectors. Gold went along for the ride and had another strong day on Friday in the US. However the Russell 2000 still drags the chain making me wonder what will it take for that index to come to life? Definite, not just rumoured rate cuts perhaps.

The financial sector also had a strong week and what will that sector do if we don't get a rate rise? We will have to wait until the 17th July when the June quarter CPI figures are released and maybe the Aus market will plod sideways until then. Who knows, I am just writing my thoughts about what may happen but we need to stay open minded to possible "good" news as well as "bad" news.

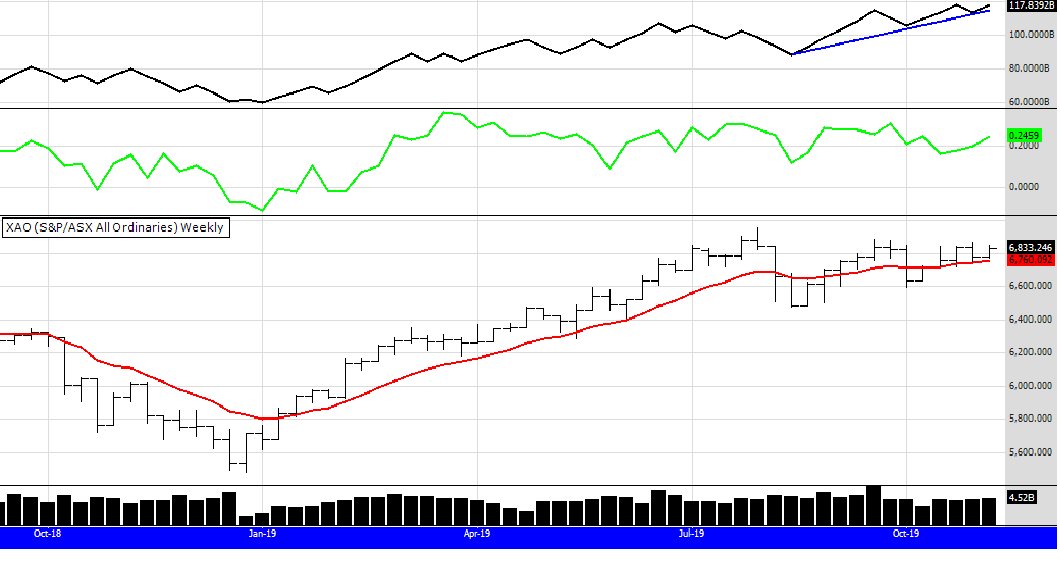

I am a regular listener to the Fear and Greed podcast. Recently they were discussing that banks now made up 31% of the market cap in the All Ords and resource stocks 23%. So 54% of the Aus market is banks and finance. If those two sectors rally, the index rises.

So, looking at the chart above it does seem to be improving - and perhaps building for another leg up. The price action is a little ahead of the OBV, but the MFI is in oversold territory and starting to move up. The 52 WH system is still producing regular buy alerts (five this week) indicating that the market has some strength. A sector that continues to surprise here in Aus and the US is the Consumer Discretionary sector. It seems it takes a lot to stop people spending and the RBA must be wondering what to do next.

Many have there theories about inflation. In 2022 the Australia Institute released a research paper claiming 70% of inflation in Australia was caused by excess corporate profit. It was initially slammed. In 2023 the OECD released a similar finding about Europe! Now this year in 2024 we have the following, claiming US company profits are responsible for over 50% of inflation. See the link below.

Raising rates wont fix the problem if the authors of the three papers are correct. We need fiscal policy not the blunt tool of rate rises in my opinion.

https://www.theguardian.com/business/2024/jan/19/us-inflation-caused-by-corporate-profits

Thanks for reading and until next week

Peter

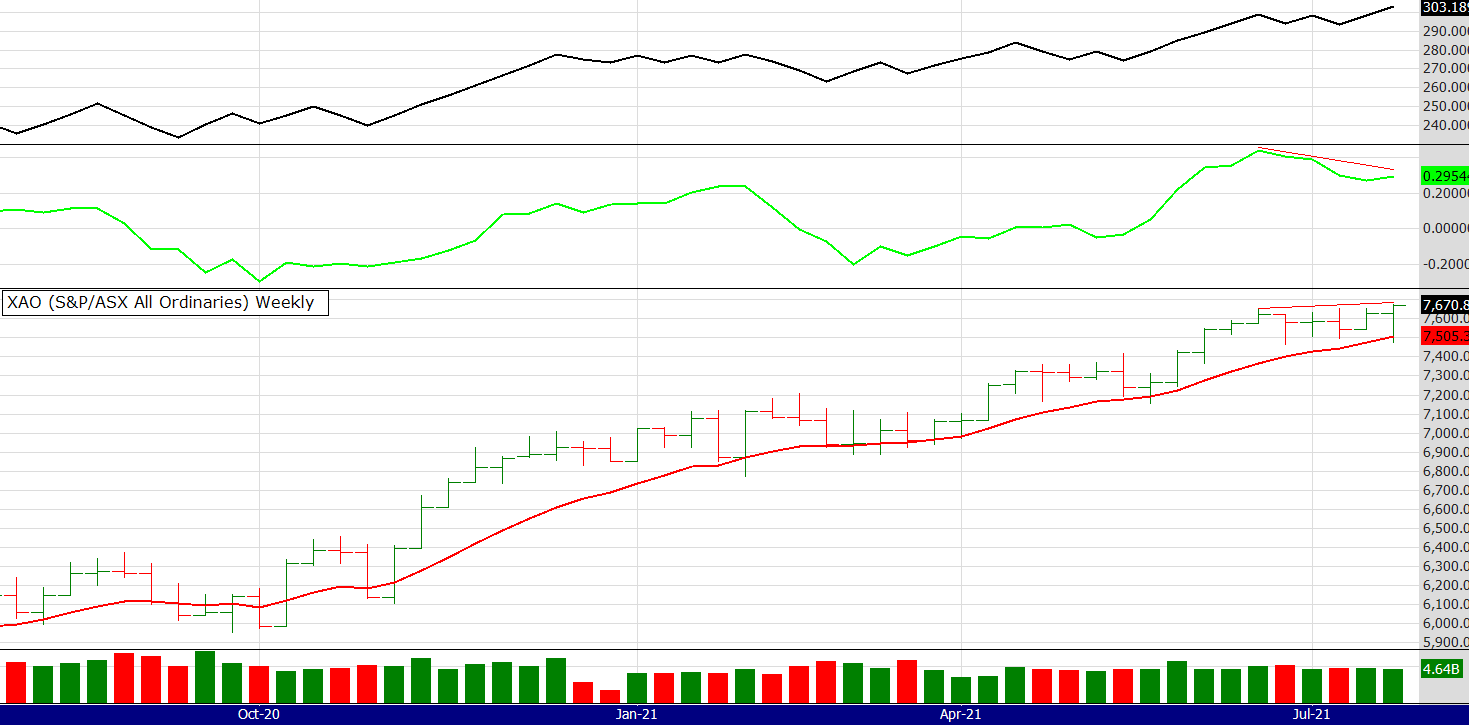

MARKET COMMENTS: As of the close on Friday 28/6/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Not much to say this week. It's a game of wait and see. Obviously the thought of higher rates from the RBA in August did not help the sentiment this week. Price dropped down to the blue dotted support line and then bounced back up. There is a glimmer of hope from the U.S. as the Russell 2000 continues to show some support. I talked about that over the last few weeks - and this week the trend continues of the Nasdaq falling but the Russell rising. Anomally? Or rotation from big tech to the broader market?

If the XAO tracks the Russell as it historically does we may have a better week but sentiment is waning.

I remain positive until the charts show a clear breakdown. At the moment they are hanging in there.

Regards

Peter

MARKET COMMENTS: As of the close on Friday 21/6/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

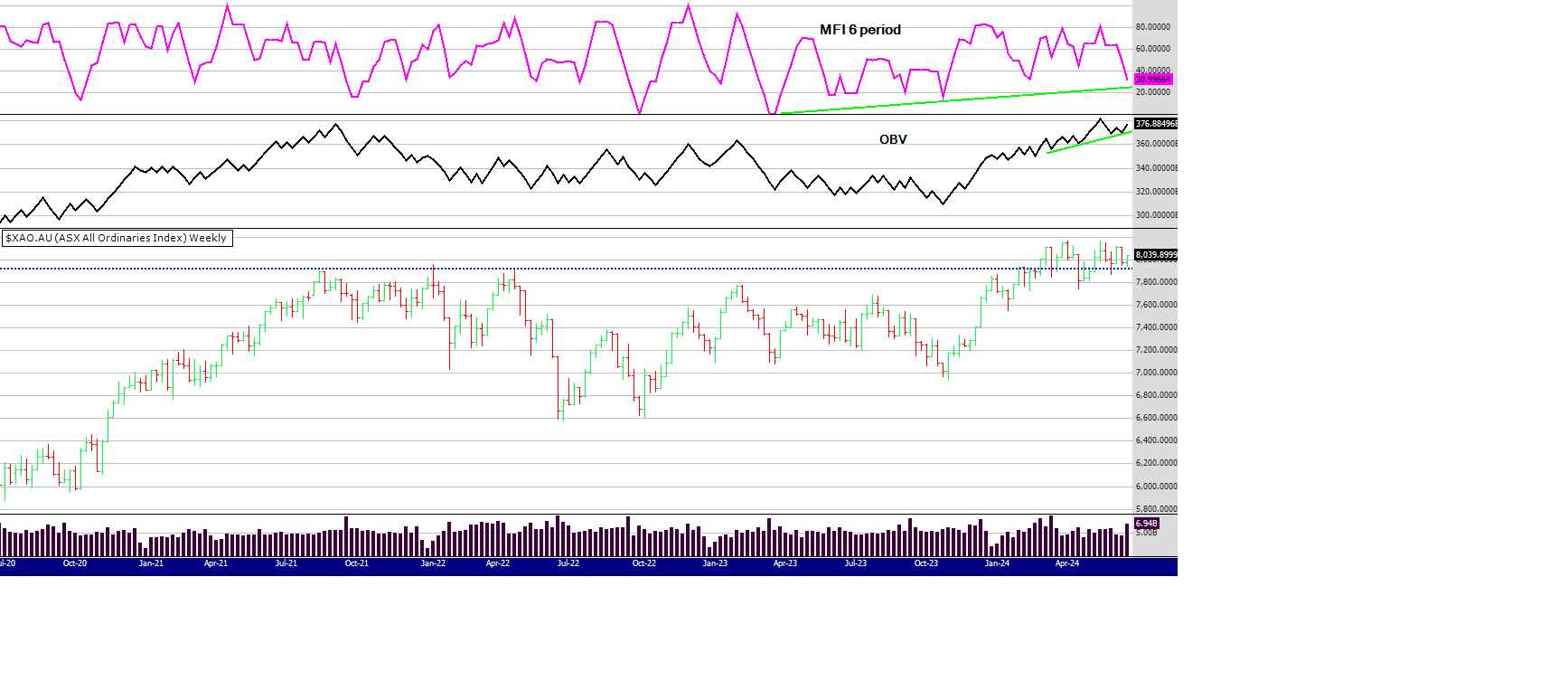

I am going to get a little technical this week so you are either going to love it or hate it :)

The MFI is a more dynamic indicator because of the way its calculated - see here https://www.investopedia.com/terms/m/mfi.asp

Sometimes the MFI can give strange signals - so sometimes (not often) it can help to change the time period of the indicator - to help analyse probability. In the top chart you can see that OBV is looking strong but MFI 13 week period is breaking down, what's that about? In my opinion its because of the big volume bar this week skewing the look of the indicator.

Moving down to the 2nd chart using the 6 period MFI you can see it's in oversold territory. I chose a six period (6 weeks) because that's the time frame (some say 7 weeks) markets or stocks often move up and down, before either taking a pause or reversing. Here is another link here for you to read up about that https://www.tradingview.com/script/kDC1dFjU-7-Week-Rule/

I think this market is still strong - despite the worry and bearishness expressed by some. This week there are 7 new 52WH signals and that is not the sign of a weak market. Of course prediction is not the aim here, but we are trying to glean from the stats and charts the probabilities of market direction.

As often mentioned I am keeping an eye on the Russell in the US. You can see on the chart below how closely corelated the XAO is with the US index. At the moment the XAO is outperforming and it's going to be interesting to see what happens if the Russell picks up the pace. Will the XAO continue to follow its bedmate - or is the XAO overbought? Is the Russell telling the XAO its got ahead of itself?

Or, is the XAO (Aus economy) now the stronger index?

I don't think we will have long to find the answer,

until next week

Peter

MARKET COMMENTS: As of the close on Friday 14/6/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

You either love trading and investing, find it interesting and challenging or it really frustrates you. This week I admit falling into the latter mindset as the market went through its "normal" ups and downs. Normal as in indecision, worry, fear and uncertainty. That mindset is reflected in the fact of only two 52 week highs this week for the Mindful system.

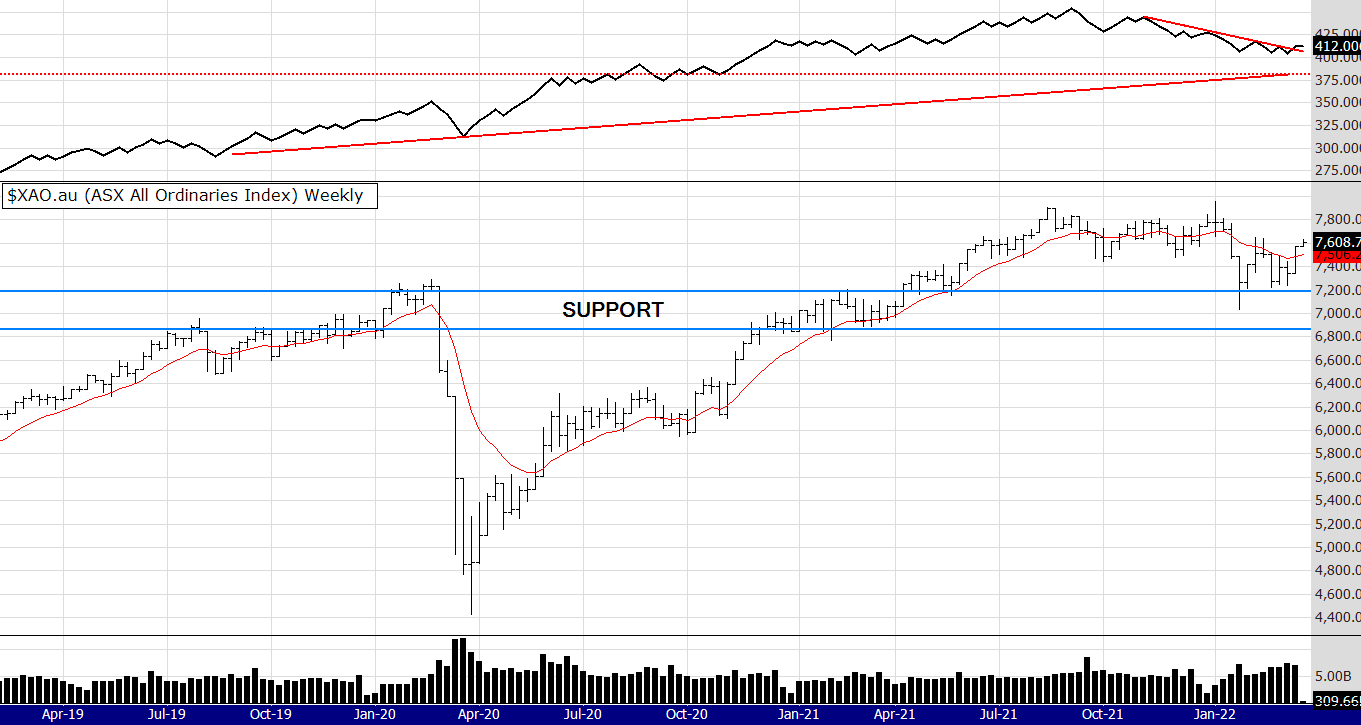

Taking a step back from all the emotion continually surrounding us - is the fact the chart above still shows a strong uptrend. Price has come back to horizontal support of around 8,000 and the volume indicators are hanging on also at supportive trend lines. You can see that the market has gone up and down now for 12 weeks, between 8150 and 7800.

Fears over the direction of interest rates continue and the commodity stocks took a hit as prices in most underlying commodities fell. On Friday night in the US some commodity prices and stocks recovered a little, so we may get a better start to the week on Monday.

Until the market gets some positive news the probability is it will drift sideways to lower. Unless of course the US indexes continue to rally and pulls our indexes along for the ride. Strength still appears to be in the Tech sector - as much as I want to see the Russell in the US perform, it wont happen until it does.

Until next week

All the best

Peter

MARKET COMMENTS: As of the close on Friday 7/6/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Strong price action this week on low volume. This week the top 200 performed well and the Small Ords (100-300) was flat. Also this can be seen not just by looking at the charts, but the 52 week highs confirming. Just one alert in the 300-500 but six in the ASX 300. Three of those six alerts being in the ASX 100, ALL CAR CBA.

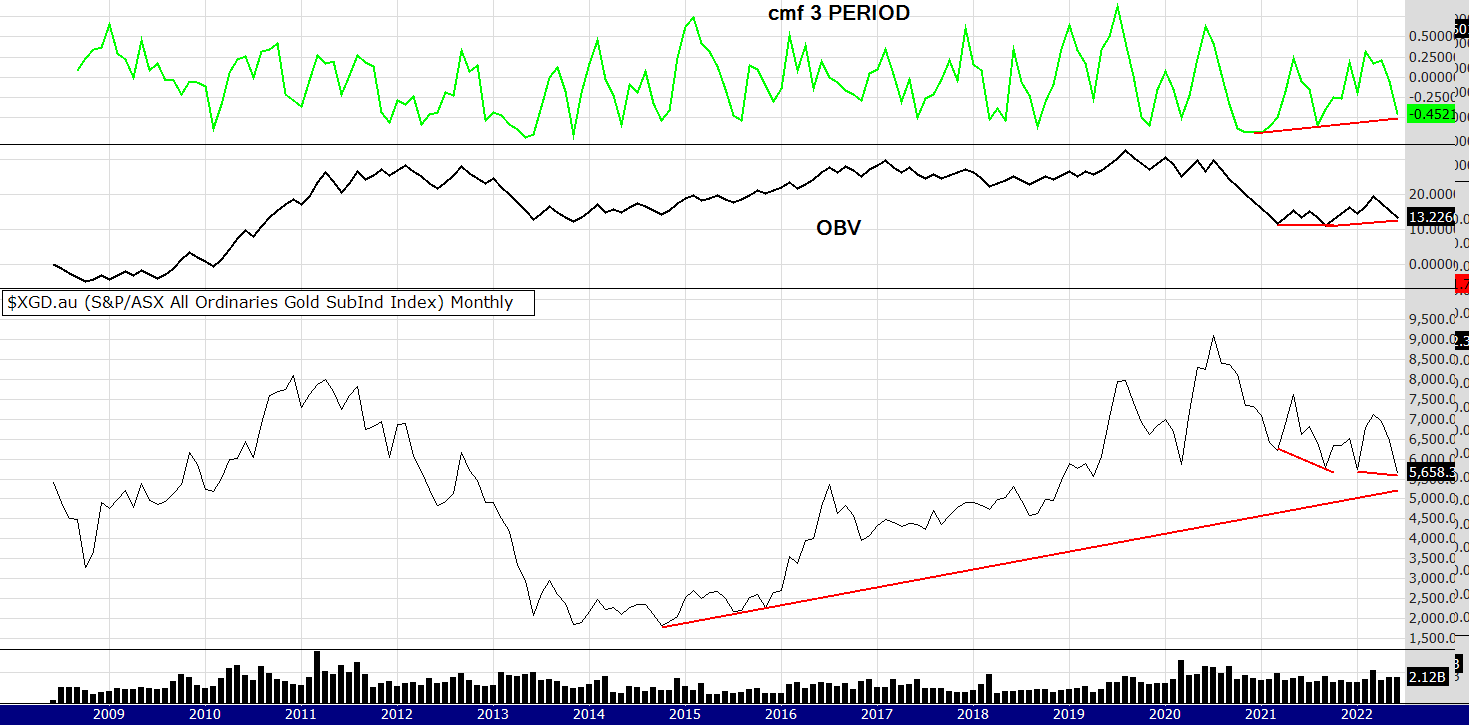

Last night the gold price was sold off heavily, perhaps my comments on the 24/5/24 were correct - scroll down to see the chart of the GDX that I posted a few weeks ago and here is a repeat of my concerns.

"Looking at the Monthly chart of the GDX below I would like to see more volume. May is nearly over, the volume is down a lot compared to April and next week in the US is only a 4 day trading week because of Memorial day on Monday. The OBV is hitting overhead resistance and the 3 period (3 months) MFI is at the top of its range. There is no doubt price is in an uptrend, but to make the price continue its uptrend it needs more love, and the language of love in the markets is money - volume."

So people lie and we all suffer from cognitive bias, but charts do not lie - no doubt some knew about the Chinese factor.

However that comment back in late May, did not stop me getting sucked into the short term rally we had before the Chinese announcement (they bought no gold in May) as I added to some gold stocks on Thursday, but thankfully only a little. We have a holiday here on Monday for Kings Bday so who knows what the market will do when it opens on Tuesday.

Uncertainty prevails around interest rates (not helping gold and commodities) and it seems the debate will continue for the rest of 2024 - until clear data emerges its appears most central banks will play the waiting game - interesting that the ECB bit the bullet and cut last week (which made gold bounce before China stomped on it)

One more chart and a focus on divergences, something I regard as a powerful technical signal. You can see clearly the divergence between price and volume on the gold chart below. The MFI is a faster moving signal than the OBV. It's pointing down quickly and more falls would not surprise me, price could come down a lot more - even as far as major support around 2000. Never forget anything is possible in the markets.

The longer term trend line of the OBV could still hold and price fall a lot more.

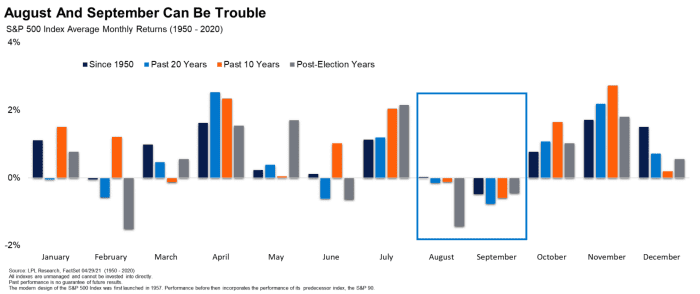

I read an article yesterday claiming the first 2 weeks in July is normally the strongest fortnight in the market - data dating back to 1928. Looking at the price action last week we need one hell of a rally for that record to be maintained.

Enjoy the long weekend and that's all till next week.

Regards

Peter

MARKET COMMENTS: As of the close on Friday 31/5/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

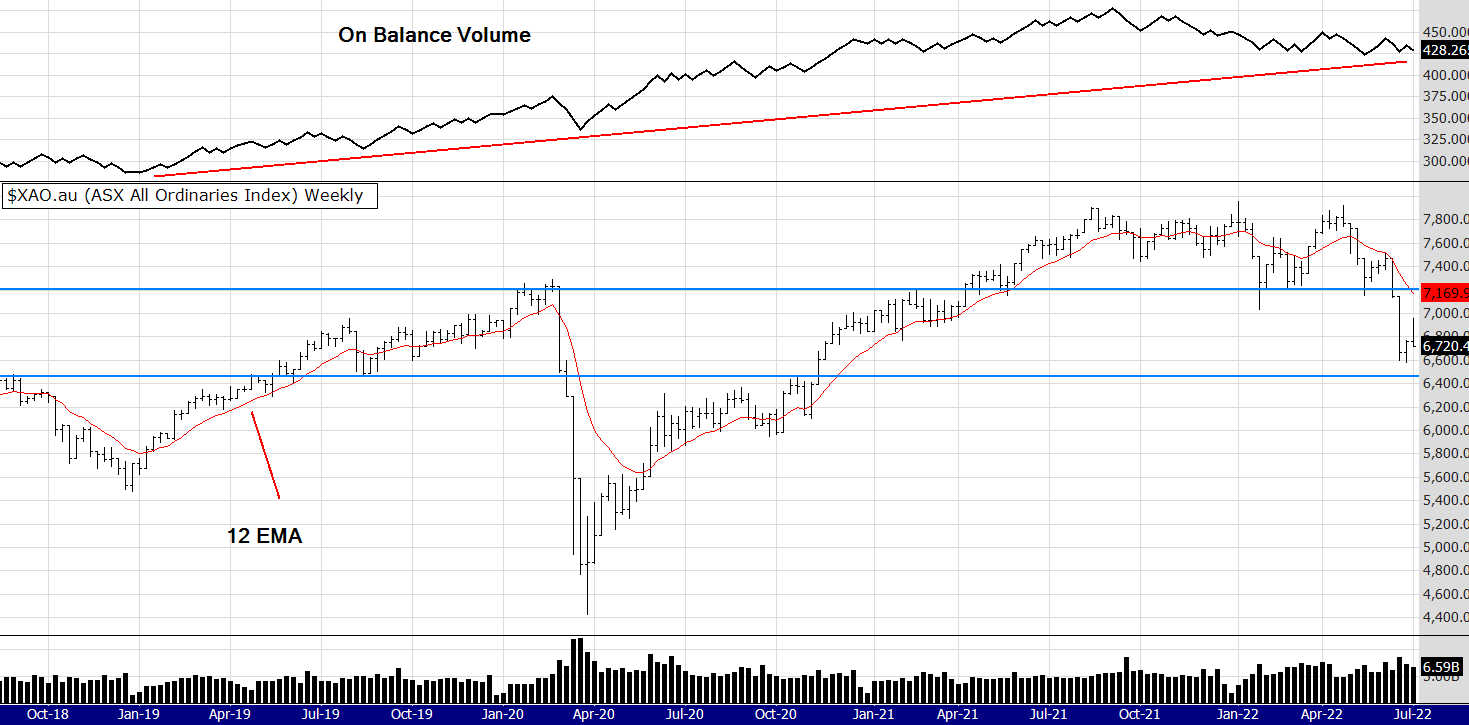

I will discuss the chart above before moving to the one below. The correction from over bought territory continues but volume support remains. Next week will be crucial to see if volumes break to the downside. I suggest you read the last 2 weeks comments about what I think is happening in the markets. Please scroll to the chart below.

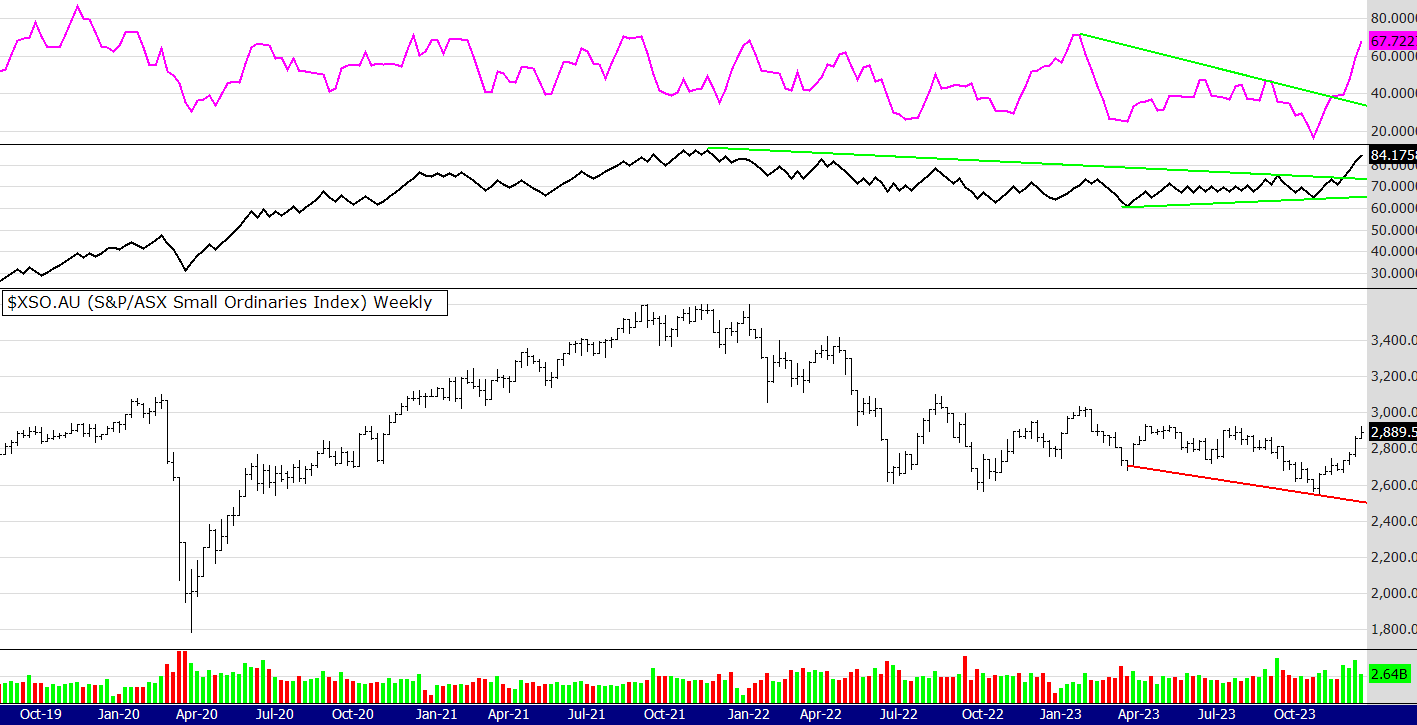

This is a chart of the Small Ords, the index represents stocks in the 100 to 300 range of the ASX. A similar grouping to the Russell 2000 in the US, that index represents stocks in the 1000 to 3000. Note the last bar, its green and the close is up, as opposed to the XAO (that contains the top 100) where the bar is red and the close is down.

This price action shows to me that interest in the smaller stocks is increasing, traders are rotating out of large caps looking for opportunity elsewhere. Also the market remains strong with eight 52 week closing highs. For more detail on my thinking re read the last 2 weeks comments, nothing has changed - yet.

Short and sweet this time

Have a great week

Peter

MARKET COMMENTS: As of the close on Friday 24/5/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Looks like I jinxed the market saying last week it looked over bought with the 13 period MFI at the top range of the chart. The market is nervous at the moment, interests rates , inflation, sell in May cyclical theory, low growth, strained consumers etc. The market does climb a wall of worry so it's all nothing new. However the chart above still looks healthy IMO. It could correct down a bit more but until price and volume break down more - I see last weeks price action as a normal correction after 4 strong weeks.

I notice this week the 300-500 has generated four 52WH signals and the top 300 just two. Is this a sign that the market is rotating into the smaller caps? If so its a good sign and indicates market breadth.

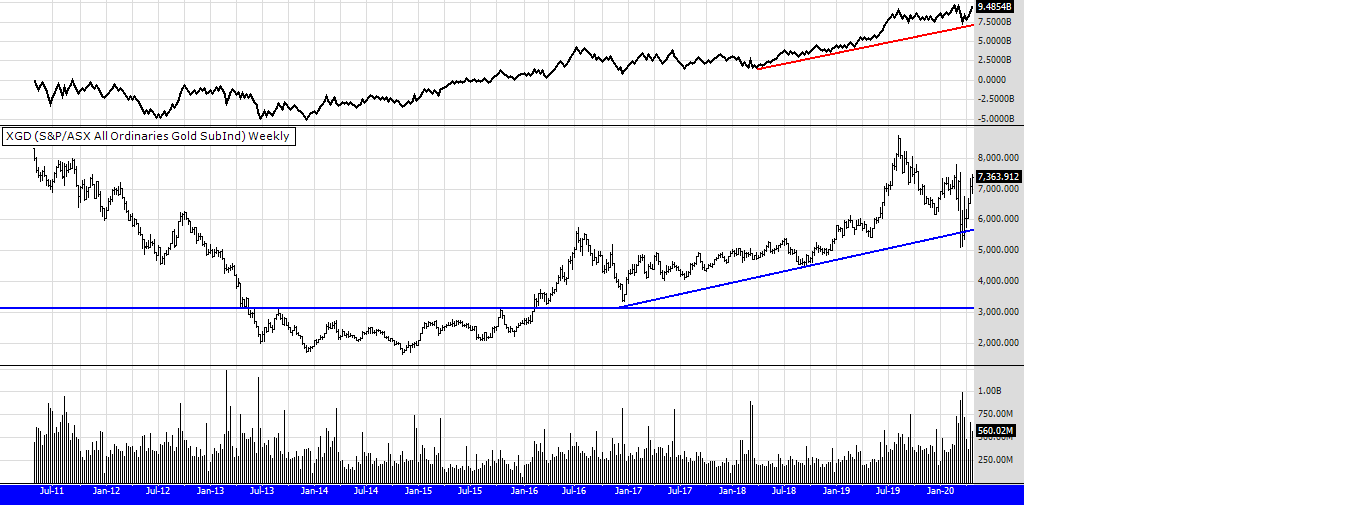

Last week I said I had a flat week. This week my portfolio did well on the back of gold stocks, although the rally faded late in the week and it remains to be seen what happens this coming week. Actually, looking at long term charts of the US GDX and the Aussie XGD (the gold sectors for US and Aus) I have doubts as to the longevity of the gold stock rally (for the time being) The hype in the sector is often a warning sign that a correction is near. Lets hope I am not jinxing all those gold stock holders out there!

Looking at the Monthly chart of the GDX below I would like to see more volume. May is nearly over, the volume is down a lot compared to April and next week in the US is only a 4 day trading week because of Memorial day on Monday. The OBV is hitting overhead resistance and the 3 period (3 months) MFI is at the top of its range. There is no doubt price is in an uptrend, but to make the price continue its uptrend it needs more love, and the language of love in the markets is money - volume.

Perhaps fund managers will support the gold indexes with the end of month shenanigans that sometimes happens...........

Until next week

Peter

MARKET COMMENTS: As of the close on Friday 17/5/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

This week I have changed the chart for the candle stick devotee's. Looking at the chart above you can see the OBV has blasted to new all time highs, (blue dotted line). However the MFI is in overbought (OB) territory , again see the blue dotted line. I dont see a problem with that. As often mentioned the MFI is a more dynamic indicator and it can stay in OB territory for some time before correcting. EG: look at July 2021.

My week was interesting. I hold mostly small and mid cap stocks and my portfolio went sideways. It was a week for the Gorilla stocks, Gorilla stocks mainly in Resources and Materials. Other sectors seemed reluctant to join the rally so perhaps some disbelief about the market amongst investors still prevails. Even gold stocks, despite the recovery in the gold price, seemed reluctant to join in.

However!

I notice a big rally in gold stocks (lithium, copper and uranium too) last night in the US so Monday on the ASX will be interesting. Those stocks should take off like an Elon Musk rocket - but we all know sometimes those rockets fail :) Some more comments on Gold below.

I have reposted above, an updated version of the gold chart that I posted last week. Also here are my comments from last week...

"Looking at the chart above I have included the Fibonacci - taken from the breakout at long term resistance at 2050. I am not particularly a fan of any dead Italian mathematician, but it does show something important.

The amount of pull back the trend has. Also, it's a line chart, so much easier to read are they not?

As you can see the price has hardly retraced and this is important - for it shows how keen the buyers are, not wanting to wait (FOMO) for more falls before getting in.

Why?

They are AFRAID the price will rally without them so they do not let the price dip much at all. So, I intend to add to my gold stock positions next week, wish me luck!"

So, FOMO did not really kick in for many of the gold stocks last week, lets see if it does this week. The reason I am focusing on the gold price is that when gold rallies, often does the resource sector in general - as seems to be happening now. Also, many gold stocks also mine copper and I would be surprised if you have not heard the constant talk about copper demand.

So much happening at the moment I could write a lot more but soccer duty calls (as I write on a Sat morning),

have a good week and see you back here next week!

PS: The book Zen Trader has been offered a Taiwanese publishing contract to be printed in Traditional Chinese. This means the book will now circulate through all Chinese speaking countries except the mainland (which may still happen as a result of this offer). Of course it's still a huge market without the mainland and I am pleased to announce this is now the 3rd other language (the others being Spanish and German) apart from English that the book is now produced.

Thanks again to all who have purchased the book to make this possible.

Regards

Peter

MARKET COMMENTS: As of the close on Friday 10/5/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

I often say trading is about probability not prediction, however I did stick my head on the chopping block last week and say I thought the correction was over - why? There was so much volume coming into the market and perhaps more importantly, the volume was not dropping off with the price, creating a bullish divergence. So we got a rally this week, now what?

If you have ever read the book about Jesse Livermore there is a character in the book called "old Mr. Partridge". He used to hang around the brokers office never seeming to do a lot. When asked by younger traders what he was doing, he would reply "well its a bull market!"

What he was attempting to teach the younger traders was this: in a bull market try not to panic, buy the dips, stick to the trend and your method. Let others lose their heads but you keep your cool.

Easier said than done I know.

It does appear this market will continue up. The ASX is primarily a commodities based index (BHP alone represents around 12% of the top 200) and commodities are on a tear. Speaking of being on a tear, the gold price is on one. Looking at the chart below I have included the Fibonacci - taken from the breakout at long term resistance at 2050. I am not particularly a fan of any dead Italian mathematician, but it does show something important.

The amount of pull back the trend has. Also, it's a line chart, so much easier to read are they not?

As you can see the price has hardly retraced and this is important - for it shows how keen the buyers are, not wanting to wait (FOMO) for more falls before getting in.

Why?

They are AFRAID the price will rally without them so they do not let the price dip much at all. So, I intend to add to my gold stock positions next week, wish me luck!

Until next week,

Peter

MARKET COMMENTS: As of the close on Friday 3/5/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

In my opinion the correction is over. When I wrote that statement I thought "hang on Pete, you don't make predictions". However based on the probability of the price action in the chart above, it appears that price has found support at the long term blue dotted line and volumes are clearly breaking up. Price should now follow. Particularly now that the US markets had a strong close to the trading week.

Over the last 2 weeks the signals for the 52 week highs have slowed, that's understandable considering the recent market price action. The alerts for this week and last week are below. I was busy with school holiday commitments the previous week and I plain forgot about the updates!

The graph below shows the performance of the 52 week high system on the ASX 300 for the last 12 months. Before the recent correction it peaked at 25% return but now its around 16%. In the last year its done 56 trades (around one a week) and has a 42% win rate. Those results do not include dividends but also do not take into account brokerage costs - so it would pretty much even out. The biggest winner was AD8 (chart below) and it was only just stopped out last week. The win rate and return percent p.a., can be improved if trading a stock list with strong fundamentals.

For example, the same 52 week high method used on a list of stocks with high ROE and EPS growth has returned 28% (peaked at 37% before the recent pullback) and has a 60% win rate. It also did less trades with 45 compared to 56.

No rocket science, trade trending stocks with good fundamentals and the bull market does the heavy lifting. You just need to get out of the way.

Have a good week, it should be a good one - unless we get another economic curve ball,

All the best

Peter.

MARKET COMMENTS: As of the close on Friday 19/4/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Despite the falls in price, the OBV and MFI are showing support. The price has come back to the longer term support line (blue dotted line). A very interesting development in the US is the sell off on the Nasdaq (driven by AI stocks) yet price support in the Russell 2000.

There are many reasons for the market volatility and uncertainty, I am sure you know them all. The most important things to watch in my opinion is price and volume on the charts. At the moment the chart above still looks quite strong, sure, its had a sell off buts its been on a tear for some time and markets do not go up in a straight line.

The commodities are rallying and Australia is a commodity based economy. Its going to be interesting to see how it responds to the rotation of funds (Tech to other industries) affects the Aussie market and economy.

Have a good week

Peter

PS: I used candles in the chart for a change, I am aware many people use candles now rather than bars, let me know what you think at This email address is being protected from spambots. You need JavaScript enabled to view it.

MARKET COMMENTS: As of the close on Friday 12/4/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

The first full 5 day trading week after Easter and volumes understandably increased. This weeks trading produced an "inside bar" which indicates uncertainty. Will the market continue up or fall down? An inside bar suggests that is the question on traders and investors minds.

The OBV continues going up but the MFI is hitting its overhead resistance line, you can see I have drawn that overhead down trend line on the chart. This MFI has been suggesting for a few weeks now that uncertainty prevails, well tell us something we don't know! :)

On Friday in the US the market fell across all indexes, including gold and crypto. Gold appears to have indicated a blow off top and the probability is - it will fall to support. How much that fall is and what support it respects (near or far) will be a big indicator as to the real strength of the gold rally. Below is a chart of the Gold miners ETF in the US (which the Aus market follows closely). You can see the big reversal bar and massive volume indicating a change of mind from traders. If it can hold support around 32.00 that will be a good indicator of strength. The less the fall before going back up, the stronger the market IMO. One to watch with interest but not prediction.

Anyway, that's it for this week. 52 week high alerts are below

Have a great week

Peter

MARKET COMMENTS: As of the close on Friday 5/4/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

A down bar, but one bar does not make a trend. The rally in commodities, particularly gold continued. Bear in mind it was another 4 day trading week being post the Easter break. Not much to say except let's see what next week and a full 5 days trading can show. This week was one of uncertainty and positioning as money continues to rotate around the sectors looking for the best opportunities (which appears to be commodities).

In the US on Friday, the markets recovered a little of their losses from earlier in the week. The markets are still trending strongly and it wouldn't surprise me to see more upside from here, even though the markets look over bought. One would expect fireworks in some of the junior gold and resource stocks next week as they play catch up to a rampaging gold and copper price. The gold price also looks over bought, but if FOMO kicks in - and I have a feeling it may - then it's probably the sector to look at for continuation set ups. Be careful though as many gold stocks have already rallied 30% or so and when they reverse they do so very quickly. Control risk and perhaps set wider stops, as gold stocks swing around more than others. You need to preserve capital and sanity.

ps: its probably worthwhile reading last weeks comments regarding the resources rally

Until next week

Peter

MARKET COMMENTS: As of the close on Friday 28/3/24: (Easter Thursday 28th was the last trading day of the week)See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Inflection point that I discussed for the last 2 weeks was clearly resolved this week. The price of the index went up. There was low volume, no doubt some of the reason was the 4 day trading week, and people shooting through early from work on Thursday for the holiday break. However it could also be a lack of conviction? A concern the market is overbought?

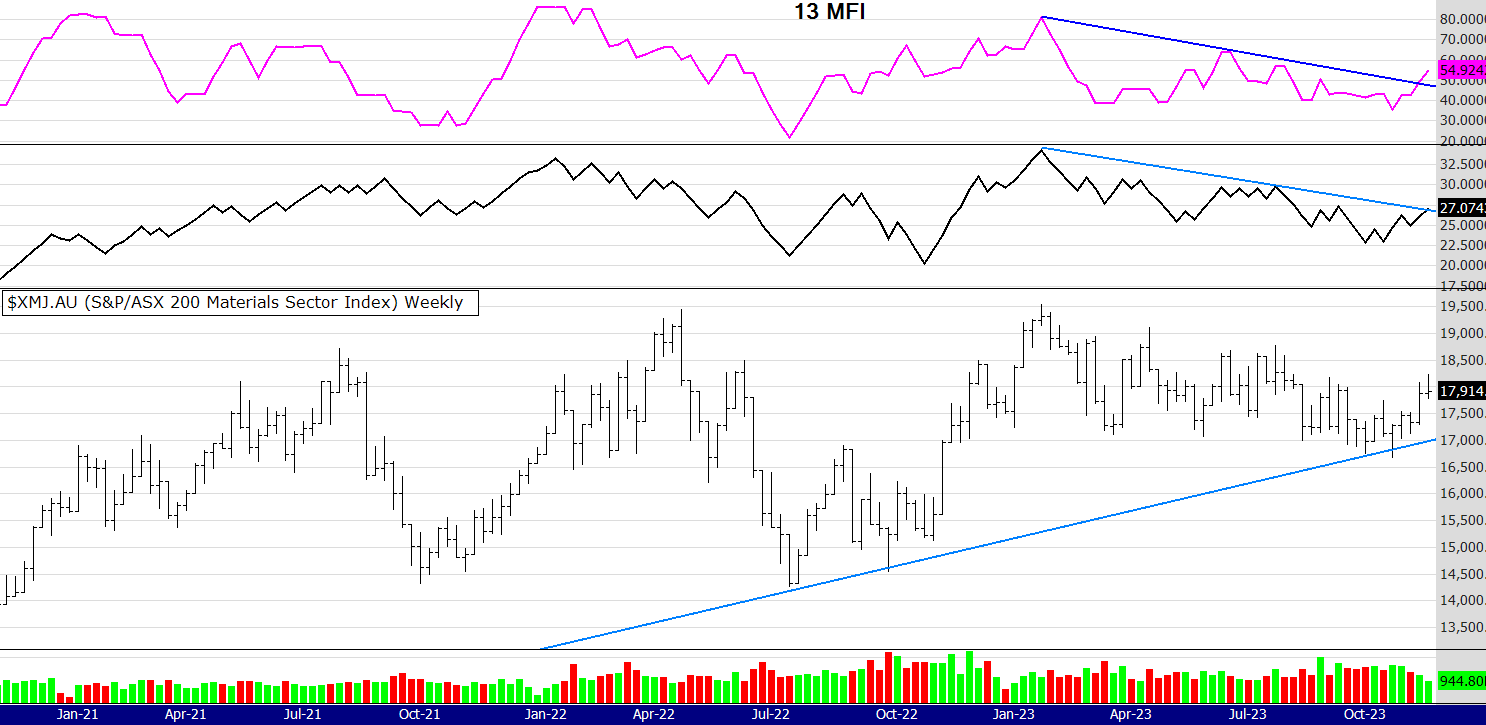

The true and steady (although at times lagging) OBV is clearly up, however the more dynamic (yet not always accurate) MFI is still pointing down and showing a negative divergence compared to the price. Is that a worry? It's too early to tell, also as I mention often, this index at times is not a true reflection of whats happening amongst sectors within the market. Money appears to be rotating back into resources, you can see that with the rally in the big mining stocks like BHP, RIO, FMG etc. Some sectors such as I.T. , Health and Consumer Discretionary are either taking a break or slowing as money rotates back into Materials, Resources, Utilities, Oil, Copper and Gold. Since the Covid rally stalled in late 2022 Consumer staples has performed poorly as people return to "normal" and risk on takes over risk off.

So it's a very interesting time, if the markets globally are overbought and there are concerns about growth - then why the rotation into stocks that supply the basics of growth? One of the biggest bull markets we had on the ASX was when miners rallied hard between 2003 and 2008 (before the famous GFC crash) . See chart below of the benchmark miner - BHP

After rallying from $10 in 2003 to $25 and then falling to $20 in 2007, many thought it was all over for the big Australian, but then it rallied to nearly $40 before the GFC. Many believe we are in the final stage of a bull market - Stage 3. The final and most aggressive move up. So over the final stage can BHP almost double again from around 40 to 80? Also what will that do to the small and mid cap miners? If you were trading around the early 2000's you will remember the explosive returns that some of those stocks achieved.

As mentioned last week keep an eye on the Russell 2000 in the US, also the GDX - the gold miners index, if these continue to rally and FOMO kicks in we could be having a repeat (to some degree) of 2003 to 2006, or more likely 2006 to 2008. A two year rally will take us to 2026, the year that many believe will be the end of the long term 18 year cycle that started in 2008. See link below for more info about that.

https://propertysharemarketeconomics.com/18-point-6-property-share-market-economics/

Food for thought (and research)

Happy Easter

Until next week

Peter

MARKET COMMENTS: As of the close on the 22/3/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

This recent weeks price action on the XAO (All Ords) resulted in what is called an "Inside Bar" - when the current bar or candlestick is neither higher or lower than the bar before. You can google if you like but it means indecision or consolidation in the minds of market participants. Makes sense when you think that traders and investors are not sure if to push the market higher or lower, a bit like a Mexican standoff where no one is prepared to shoot first!

Last week I said.... "Inflection point! I have been saying for a few weeks now (reread previous comments) the MFI 13 period was not behaving in a bullish manner, it was pointing down whilst price and OBV were pointing up"

That situation remains, this week the price did bounce up from the longer term dotted blue support line. I am still bullish on this chart, the All Ords is still producing regular 52 week closing highs ( see below) and it appears to be a broad based rally with many stocks performing well, not just the big gorillas that often dominate the Aussie market index ( big banks, big resources, big health etc).

Another bullish sign coming from the US, is the support for the Russell 2000. A concern from some, has been the fact that the bull market is driven by the gorillas in the US too - being a handful of stocks in the Nasdaq. Very interesting is the look of this chart below when comparing to the XAO. The price and OBV are clearly trending up but the MFI shows some uncertainty for the time being. In my opinion the chart below could be the most important one of all. If this index - representing a much broader reflection of the US economy (which affects the world) continues to strengthen, this bodes well for the All Ords here in Australia.

Until next week

Peter

MARKET COMMENTS: As of the close on the 15/3/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Inflection point! I have been saying for a few weeks now (reread previous comments) the MFI 13 period was not behaving in a bullish manner, it was pointing down whilst price and OBV were pointing up. Now we have the small correction many were talking about. The price has pulled back to the support of the the previous highs - going back nearly 3 years. There was a huge red volume bar last week, but for every seller is a buyer and some will see this as a buy opportunity, betting that this is a small pullback in a larger move up.

A bullish fact is the OBV sitting on its trend line. As often mentioned here the OBV is a slower indicator, but often more reliable than its faster moving cousin the MFI. I dont predict but I do attempt to gauge the probability of the next move. Price is on long term support and the OBV is on short term support. The MFI has not taken out its previous low. This bodes well for a pause in the price falling more, while the market waits for more news and data. A big one being interest rates and the other the fortunes of China. The Shanghai index has bounced up around 15% in the last 5 weeks. It is still in a solid down trend but early signs of recovery are evident. One would think this will imbue the western markets with more confidence. An interesting space to watch IMO.

Until next week,

Peter

52 week closing highs as of the Fridays close 15/3/2024

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: COE RDX RED VCX

300-500: EML LGI MAH NXL

Please note: in the eBook I wrote in 2016 (available for purchase on this website on the link below) I have made some changes to the system. If you have bought the eBook I am happy to email you a PDF explaining the changes I made, which from testing and trading does improve the system.

Here is the link to the eBook Mindful Trading using Winning Probability written in 2016 -

and the internationally published The Zen Trader (2022) - now in three languages.

IMPORTANT POINTS TO CONSIDER

A new 52 week high for this system is classified when the stock price is at its highest close (or equal to the highest close) counting back 52 weeks.

If a stock continues to make new highs, for example in the 53rd and 54th week, they are now regarded as ROLLING highs, not NEW 52 week highs.To clarify again, the buy signal for THIS system discussed is a NEW 52nd week or 1 year closing high, not a rolling high as is often given elsewhere.

The signals provided are WITHOUT A BULL FILTER.

The exit used FOR THIS METHOD is the 5/12 EMA crossover. Therefore, some stocks will be re signalling a new high buy signal if they have been recently exited by using the 5/12 exit within the last 12 months. This is important and you need to understand this.

Of course the 5 EMA needs to be above the 12 EMA to make the 52 week high valid, (otherwise we would be selling straight away) nearly always this is the case, but rarely if a stock spikes it is not.

So to repeat, the rules are: USING WEEKLY PARAMETERS!

Entry:

Share price to make a 52 closing (or equal to) week high (when selecting a buy, favour the cheapest stock)

The 5 ema to be above the 12ema

Exit:

if the 5 ema crosses below the 12 ema

The above system contains no position sizing, bull or bear filters or fundamental stock selection, these are discussed and taught to private clients or at my courses.

MARKET COMMENTS: As of the close on the 8/3/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Price and OBV look good, the only concern is that bearish divergence on the 13 period MFI. As I said last week strong bull markets are a mixture of extreme optimism, FOMO and fear. Pullbacks can be sharp but they are often quick, then the market takes off again. Everyone (well not all but many) are trying to pick the top. That's bloody impossible.

The best thing is to manage risk by either taking some profit off the table but leaving a bit on to run. You can tighten stops too, if you are really getting nervous. The best thing of course (here we go again Pete you think) is to have a system and stick to it.

Until next week, I hope you enjoyed the news letter about divergences, here it is

https://www.easysharetradingsystems.com.au/products-and-services/archive

Peter

MARKET COMMENTS: As of the close on the 1/3/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Because the US market is flying so is ours. One of the challenges we have of analysing the chart above is that at times it may not be the best indicator of how the Aus market is really performing. The Index above is dominated by a few sectors, mainly resources and banking so if those two sector rise so does this index. For example, the last 9 weeks BHP (and many other resource stocks) have been in a short term down trend. That price action in one of the biggest sectors - affects the look of the Index above.

If you consider that over the last few weeks (probably months) the Mindful system has been giving many buy signals across other sectors apart from the two big ones mentioned above. This indicates a broad based rally not being shown in the XAO Index.

Last week I mentioned I could see a rotation perhaps occurring. Last night in the US and UK there was a big rally in commodity stocks. Gold, Uranium, Lithium, Oil, Copper and others - all rose, one of the few laggards was Iron ore. One would "expect" a rally in those stocks on Monday, bearing in mind we should not expect anything, as anything can happen in the market. Your focus needs to be on probability and risk control not expectations and predictions.

So, the chart above. Well I often say price is the ultimate indicator - and in this case its leading the volumes. I suspect the indicators on the chart above will look a lot stronger after Mondays close.

Alerts below - lots of em.

Cheers

Peter

MARKET COMMENTS: As of the close on the 23/2/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

I have been mentioning the volume indicators for a few weeks now - they still look indecisive. Traders and investors are still deciding what to do, buy, sell or hold. There could be a rotation on in my opinion, as money looks for the best place to be. There is weakness in the Materials and Energy sectors which are some of the biggest sectors, its dragging down the XAO. Even Health had a fall this week but that was probably largely impacted by PME. But there is huge strength in other sectors like Tech, Discretionary, Industrials and Finance. This "rotational" strength is reflected in the number of 52 week closing highs this week.

PME: well I mentioned it last week and it bounced well rising over 12% this week. In my opinion it shows the value of learning to read oversold bullish divergences like PME was showing last week. I think I should write a paper on it for those interested - let me know if that's a good idea by writing to me here....

This email address is being protected from spambots. You need JavaScript enabled to view it.

Apologies: to those who logged in last week to Go Markets seminar to hear me present. A combination of technical and family occurrences made it impossible for me to attend. Mike Smith from Go Markets has kindly organised a special "catch up" conference this coming Wednesday night at 8pm. Below is the seminar link for Wednesday night

https://register.gotowebinar.com/register/8843010719428854103

Until next week, 52 week closing high alerts below - lots of them.

Peter

MARKET COMMENTS: As of the close on the 16/2/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

This week we have a conflicting signal on the volume indicators. You can see the MFI is coming down, but the OBV still looks strong. Also the ultimate indicator, which is the price, has finished the week strongly. So "two out of three ain't bad".

This week the Russell 2000 in the US was strong, although it looks a little overbought the rally is one to notice. Last night the US indexes slowed a little but commodities had a strong night, even lithium and gold rallied a bit, giving some hope to the suffering traders holding some of those stocks.

It's been another strong week for 52 week closing highs, they are listed below.

The chart below is PME, it's one of the feature charts in my presentation tomorrow. It took quite a hit, breaking decisively through the first line of support being the horizontal green line. It's very difficult emotionally when this happens, particularly if you have been disciplined and riding the trend since the entry. As you can see the moving average exit from the Mindful Trading book has not signaled a sell. You can see an older trade where it did around May 2023. Technically the MFI looks bearish but the more robust OBV looks ok, in fact it is showing a bullish divergence. The black EMA on the chart is the 24 (or 120 daily), price can often bounce off this level so for shorter term traders this is a stock to watch, in my opinion. This is not financial advice.

A reminder about my presentation, here is the link - I am on at 1pm

https://www.gomarkets.com/au/trading-mastery-2024/

Until next week!

Peter.

MARKET COMMENTS: As of the close on the 9/2/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Not a lot of change from last week. The rally has slowed a bit while the market (traders and investors) take a breath. Money flow and OBV has pulled back as stops are tightened and some selling has happened, traders becoming more cautious. The indicators last week did suggest there could be a reversal or either some consolidation. It can be a tough time when markets are strong but fear kicks in, many sell too early to lock in profits, to then see the market rally again. That experience then results in frustration and FOMO, traders jump back in and then get caught with buying the top.

The answer? Have a method and stick to it, know your exit and your risk (trade sizing) should have been pre-planned BEFORE you bought. It will be interesting to see what happens this week, if the market kicks up again, consolidates (like this week) or falls. Speaking of dealing with emotion etc, please read the note below and check out the link.

Until next week!

Peter

PLEASE NOTE: I have been invited to be a presenter, with four other traders for a free webinar on the 17th Feb. The conference is sponsored by Go Markets and runs between 11am to 4pm and I will be speaking at 1pm. Registrations can be made on the link below and my talk is "Trading with a Zen Mind" a talk I gave at the ATAA National Conference last year and also in Shanghai (online) last weekend.

https://www.gomarkets.com/au/trading-mastery-2024/

MARKET COMMENTS: As of the close on the 2/2/24: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Hi all, I am back. Well what a month its been. The talk was bullish, then bearish, now uncertain. Crikey! If ever there was a good example to ignore the news and follow your process its been the last month!

I said in my comments a month ago that the MFI could rally all the way up to the 80 reading, it still looks strong at the moment. However the OBV is showing a bearish divergence and price is hovering around old resistance, so it's a probability that there will be a pullback or some consolidation soon. Despite those things, the market is certainly still bullish and it is good to see the markets going up. There are 15 buy alerts this week for the eBook system Mindful Trading using Winning Probability. Wow, that is a lot, so the market certainly is raging.

PLEASE NOTE: I have been invited to be a presenter, with four other traders for a free webinar on the 17th Feb. The conference is sponsored by Go Markets and runs between 11am to 4pm and I will be speaking at 1pm. Registrations are not yet open but when they do I will post the link here. I will also send an email soon with more details. Hope to see you online.

Until next week, all the best

Peter

Hello folks, I am way on holidays for all of January. I will return to posting 52 week highs and market comments on my return.

Good luck with your trading and investing , Regards Peter

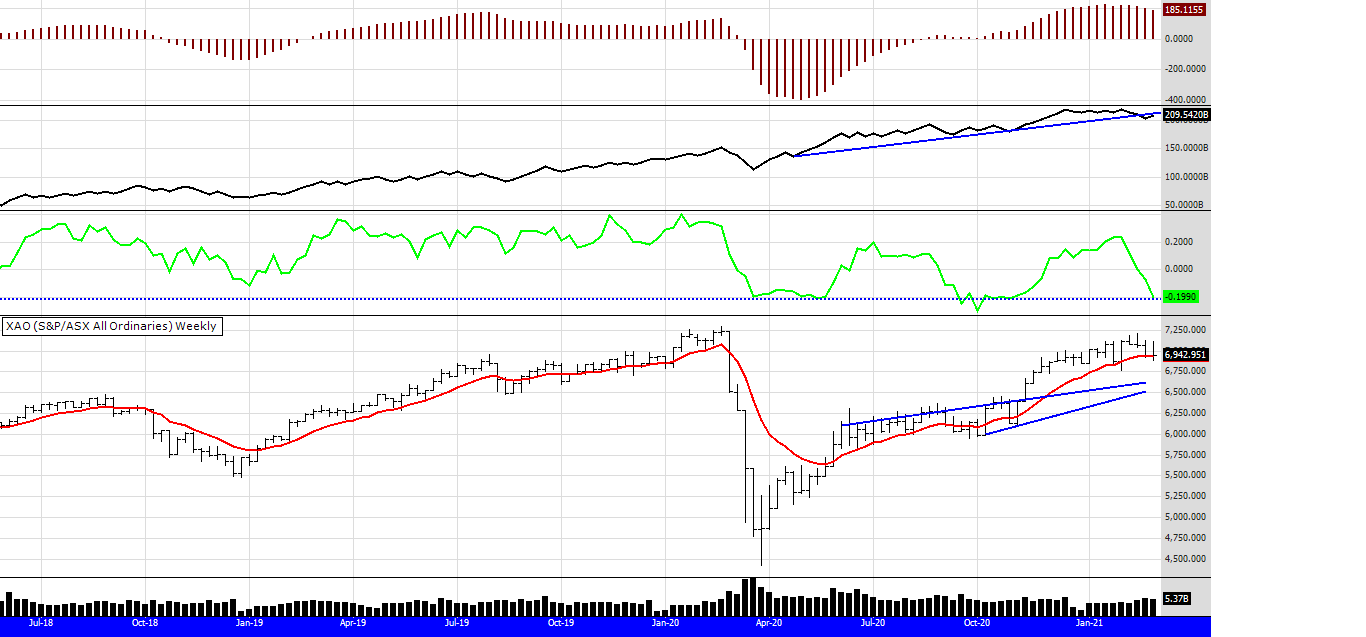

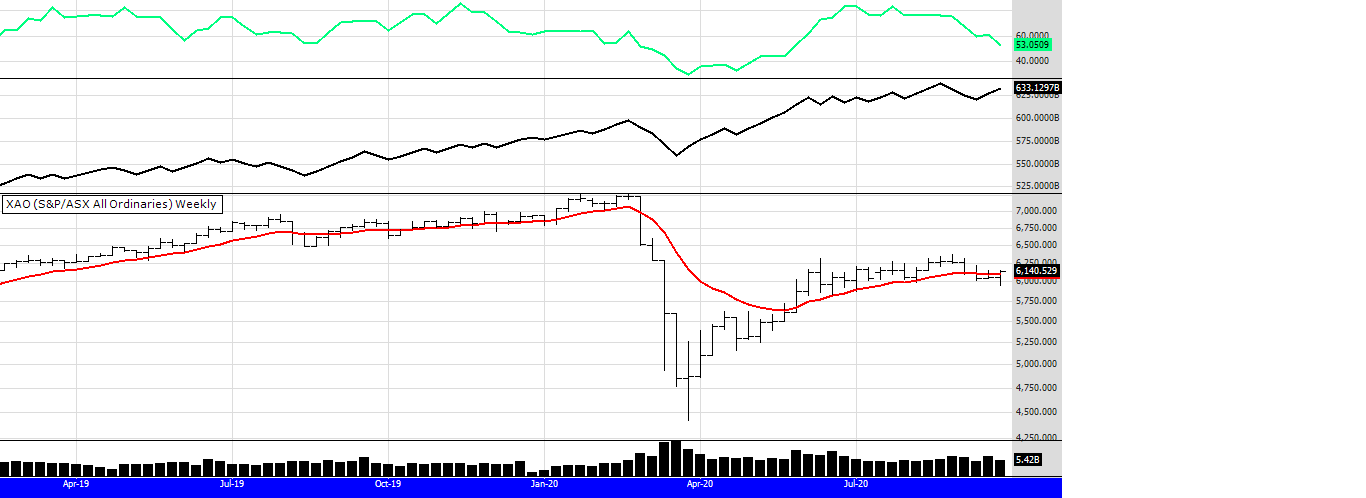

MARKET COMMENTS: As of the close on the 29/12/23: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

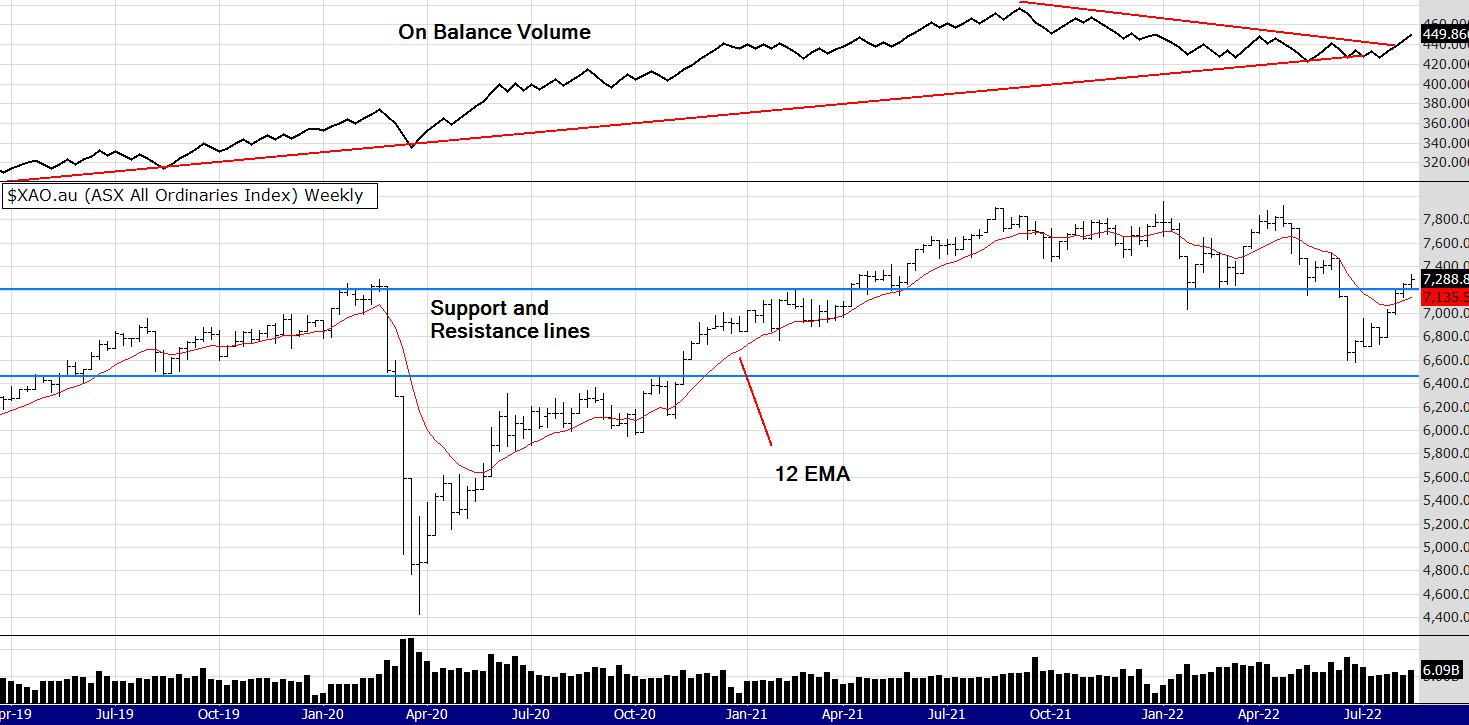

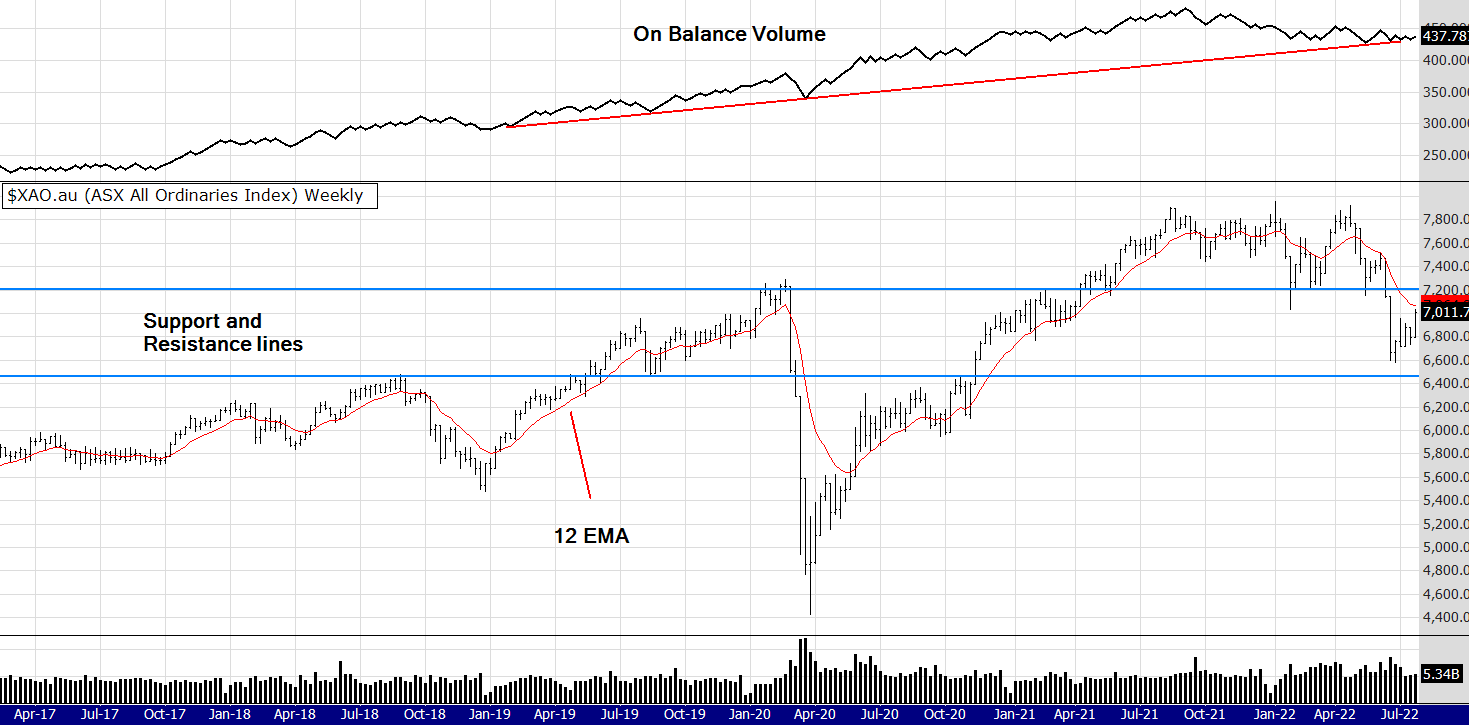

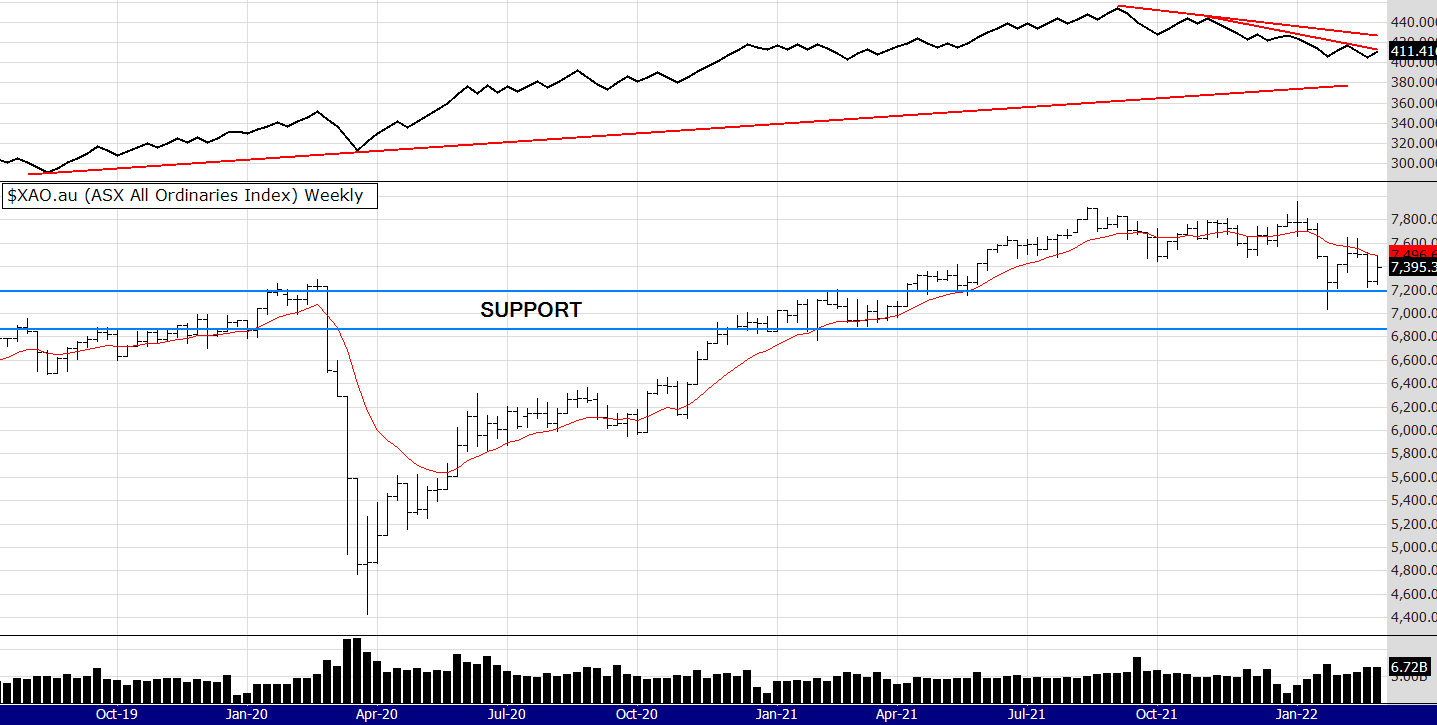

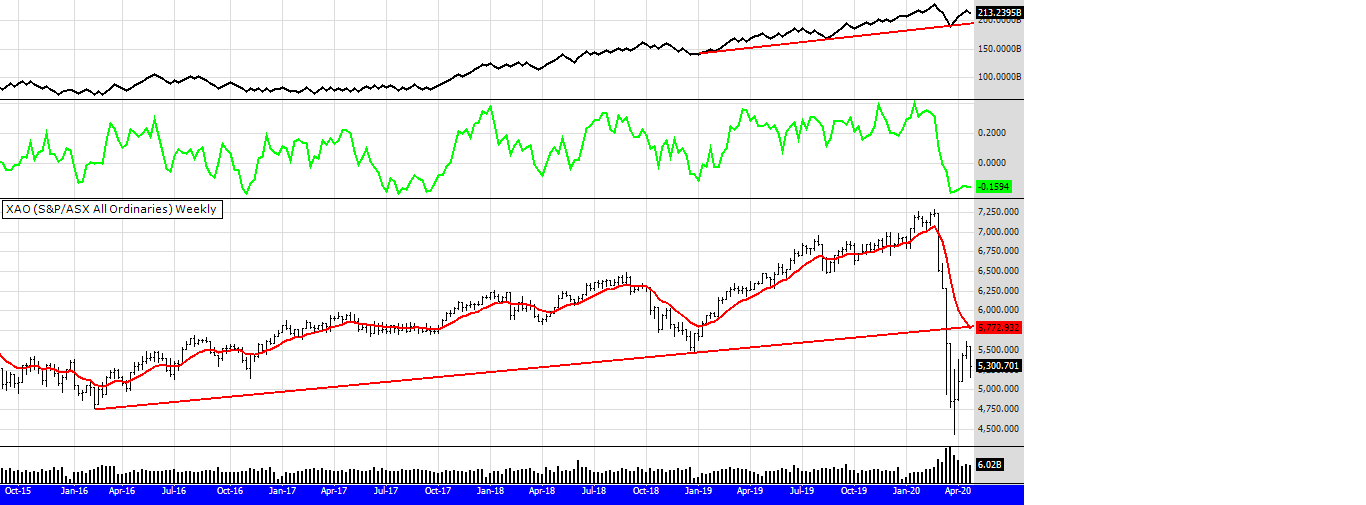

When we look at longer term charts (which very few people do) and take a moment to reflect, one could be entitled to ask the question "what was all the fuss about?

During Covid the OBV remained in an uptrend, it did so again 2 months ago when the market hovered around 7,000. At that time the MFI was deeply oversold and now it is approaching an over bought level. However, it could easily stretch up to the 80 level. Then the price could continue more and the MFI might then show a negative divergence as it has in the past (April 2019 and July 2020) . Of course that is all conjecture, although its worth remembering that nothing goes up in a straight line and at some point buyers will take a breather as they start to believe the market is too extended in the short term.

Only 2 months ago the talk was doom and gloom and recession - now its bull market into 2024 and beyond! I agree at the moment the chart looks strong, price and volumes are up and there appears to be no weakness. Volume last week was low as it was only a 3 day trading week and the same will happen for this coming 1st week in January. The low volume hasn't stopped a strong performance from the 52 week high system, registering another twelve this week. They are listed below.

Only one chart this week, hey its holiday time! Speaking of holidays I am overseas for most of January and Cynthia has told me I am not allowed to trade or be on the computer :)

I will do my best to post the weekly charts but if I don't, you know why!

Happy New Year

Peter

52 week closing highs as of the Fridays close 29/12/2023

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: ADT BHP BKW CBA CIA NXT PMV QUB SFR

300-500: BLY GQG QOR

Please note: in the eBook I wrote in 2016 (available for purchase on this website on the link below) I have made some changes to the system. If you have bought the eBook I am happy to email you a PDF explaining the changes I made, which from testing and trading does improve the system.

Here is the link to the eBook Mindful Trading using Winning Probability written in 2016 -

and the internationally published The Zen Trader (2022) - now in three languages.

IMPORTANT POINTS TO CONSIDER

A new 52 week high for this system is classified when the stock price is at its highest close (or equal to the highest close) counting back 52 weeks.

If a stock continues to make new highs, for example in the 53rd and 54th week, they are now regarded as ROLLING highs, not NEW 52 week highs.To clarify again, the buy signal for THIS system discussed is a NEW 52nd week or 1 year closing high, not a rolling high as is often given elsewhere.

The signals provided are WITHOUT A BULL FILTER.

The exit used FOR THIS METHOD is the 5/12 EMA crossover. Therefore, some stocks will be re signalling a new high buy signal if they have been recently exited by using the 5/12 exit within the last 12 months. This is important and you need to understand this.

Of course the 5 EMA needs to be above the 12 EMA to make the 52 week high valid, (otherwise we would be selling straight away) nearly always this is the case, but rarely if a stock spikes it is not.

So to repeat, the rules are: USING WEEKLY PARAMETERS!

Entry:

Share price to make a 52 closing (or equal to) week high (when selecting a buy, favour the cheapest stock)

The 5 ema to be above the 12ema

Exit:

if the 5 ema crosses below the 12 ema

The above system contains no position sizing, bull or bear filters or fundamental stock selection, these are discussed and taught to private clients or at my courses.

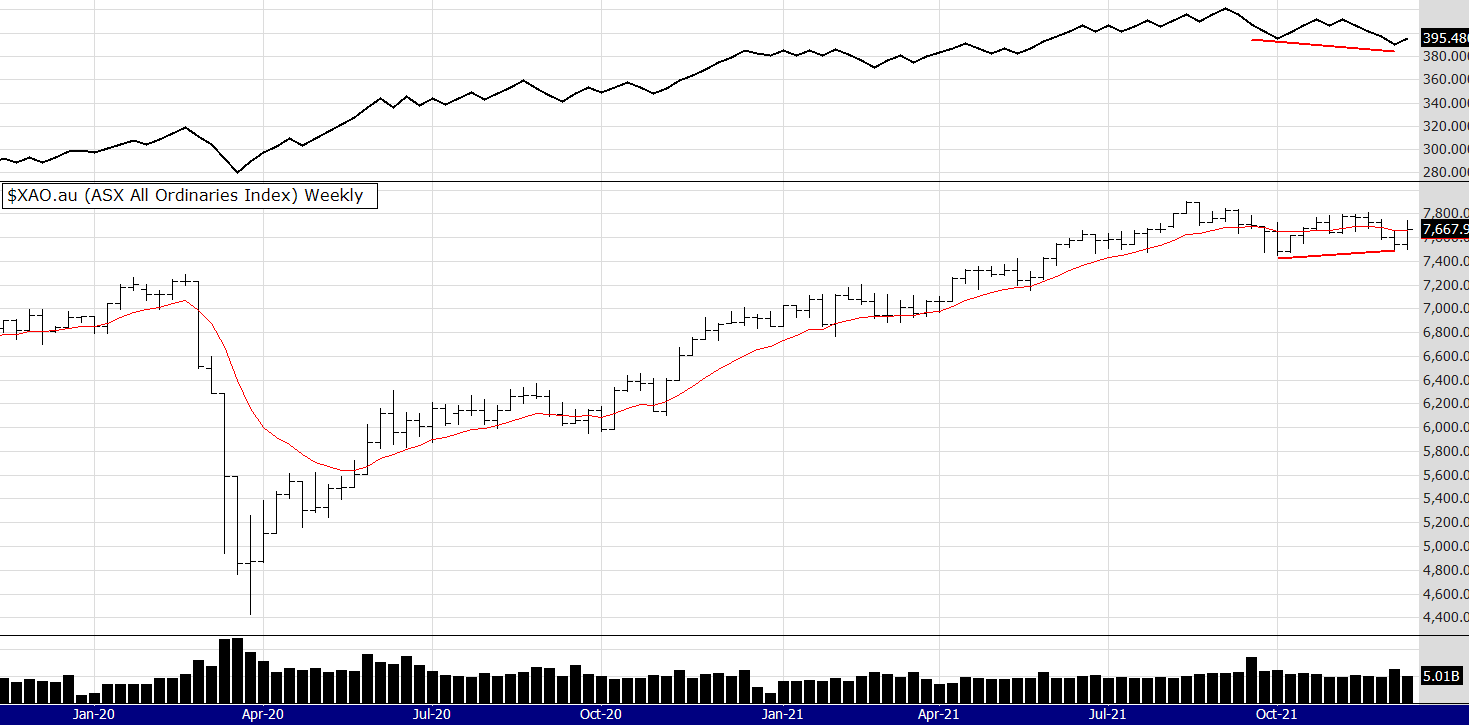

MARKET COMMENTS: As of the close on the 22/12/23: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Well the rally continues! A pause was not what we got but a continuation. Another example of how difficult it can be to pick tops or bottoms and "going with the flow" is the most profitable but also the most difficult psychologically.

The price price blew through that overhead dotted trend line (producing twelve new 52 week closing highs) and dragged the volume indicators along for the ride. With no divergences to speak of the next resistance seems higher up the chart, perhaps around 6900. Next, let's look at the Small Ords index.

My trading friends will know I watch this index closely. That is because I tend to trade this sector more than the large caps as I think that is where more opportunities are - but I have been wrong so don't take my word for it! This sector was showing a strong bullish divergence around 9 weeks ago and its been straight up since then. It is a good sign to see this sector rally as it indicates a broad based rally in the market, something that has taken a while to happen. Next, the Russell 2000 in the US.

The Russell has finally broken above the 18 month resistance indicated by that dotted trend line, however it does appear over stretched to me with some negative divergence showing on the volume indicators - but I said that last week and the price just blew up past the neg divergence. However the SP500 (chart not shown) in the US looks like it could be double topping so we still need to be mindful that this rally has been strong and nothing is permanent. One more chart!

I did say last week I wanted to see more volume in this index of the gold stocks in Australia. The OBV has obliged and broken its down trend line but it's not the most convincing price and volume action. However during the Xmas trading season volumes in the spot gold market are thin because many traders are on holidays. This can result in some big moves in the gold price and also this sector, so I will be watching closely.

Merry Christmas,

Until next week

Peter

MARKET COMMENTS: As of the close on the 15/12/23: See charts below with an On Balance Volume indicator and the Money Flow indicator

Last week was quite a rally. I wont go into details as to why as I am sure many of you have read or heard the reasons. Focusing on the now it appears the index is approaching some resistance. The OBV is trending up well but it has not reached the high it made it January. Last week I mentioned a slight divergence between the price and the MFI. That divergence still exists and considering the rally the question needs to be asked "will we get a pause?" If market prediction is about probability I would think the answer is yes. Gold stocks.........

I often get questions about the gold stocks and I too find this an interesting sector. The price recovered strongly this week from an earlier pull back. The MFI is back testing the trend line, but - I would really like to see that OBV get stronger. Until that gets a clear break to the upside I think gold stocks will remain in a sideways pattern. Gold stocks do not always respond to a rising gold price, it depends on other factors such as general market strength, interest rates, the US dollar, inflation and others. It remains to be seen if the stars align for a Xmas gold stock rally.

Until next week

Peter

MARKET COMMENTS: As of the close on the 15/12/23: See charts below with an On Balance Volume indicator and the Money Flow indicator

MARKET COMMENTS: As of the close on the 8/12/23: See charts below with an On Balance Volume indicator and the Money Flow indicator

I often say trading is not about being right, but sizing risk, exits and sticking to a method. However it is nice to get a call correct now and again. Last week I said...

"With the recent rally in the Russell the XSO is playing follow its leader. I suggest you keep a close eye on the Russell for it may well tell us if the spec end of the Aus market will finally rally. Or has it started with the 14 buy signals?"

This week I have posted 2 charts, the XAO and the XSO. I will start with the XAO - you can clearly the volume coming into the index which is a bullish sign, stocks can't go up without buyers. There is a slight bearish divergence between the MFI and the price, however it is slight and to be expected after a big rally.

Moving on to the spec end of the market and the XSO, well it did follow the Russell up but the price is still in a technical down trend, however the volumes look very bullish particularly the OBV which has been trending up for a while and has now broken the down trend line I have drawn. Volumes in this index look even stonger than the XAO.

This week was another strong performance in the 52 week closing high system with 11 alerts.

Have a great week

Peter

MARKET COMMENTS: As of the close on the 1/12/23: See charts below with an On Balance Volume indicator and the Money Flow indicator

Well, I like to say "keep a mind of interest" not judgement. It certainly was an interesting week. The XAO above looks strong and it appears that the bull market is becoming more broad based. I say that because below you can see fourteen, yes 14, new 52 week closing highs. Last week I mentioned gold and so let's look at the Aussie gold index the XGD.

The reason I use the money flow index is that it is a more dynamic (faster) indicator than the slow old OBV. You could see a break up about 6 weeks ago signalling perhaps (no indicator is completely right or wrong) something was afoot. What I see now is a lack of follow through comparing the MFI to the price. Also a bearish divergence on the OBV when comparing that indicator with the price. You can see I have drawn those lines on the chart. Therefore some consolidation or even a pullback in the XGD would not surprise me.

One more opinion this week and its about the Russel 2000 in the US compared to the Aus Small Ords (XSO).

There has been much gnashing of teeth as to why the mid caps and small end of the Aussie market have not responded to the recent rally, so here is my reasoning. The Russell in the US has not joined in the rally and its been lagging the SPX, Nasdaq and the DOW. But! the correlation between the Russell and the XSO is obvious. Below is the chart of the Russell and the XSO

With the recent rally in the Russell the XSO is playing follow its leader. I suggest you keep a close eye on the Russell for it may well tell us if the spec end of the Aus market will finally rally. Or has it started with the 14 buy signals?

Until next week, Peter

PS: the Russel versus the XSO chart

MARKET COMMENTS: As of the close on the 24/11/23: See charts below with an On Balance Volume indicator and the Money Flow indicator

What stood out to me about this chart was the OBV. After breaking up over its down trend line it has now retraced back to it. The Money Flow Index indicator looks very similar to last week. There were six 52 week closing highs this week in the ASX 500 - see below. Considering the index had a flat week, six alerts is promising showing there are stocks moving up even though the broad based index may not be reflecting that. Bear in mind, and I repeat, the index is driven by resource stocks and banks, if they have a flat week then so does the index. I does not mean to say there are not opportunities in other areas.

As I said in my video (link below if you have not seen it) the broad based rally appears elusive. I checked the Small Ords chart this morning (not shown here) and it is still struggling to show any conviction. However there has been some good price action in some small resource stocks, perhaps because the XMJ is showing strength. I also mentioned in the video that the XMJ was looking very interesting and could help support and even rally the All Ords. Looking at the chart below you can see that is the case.

What will it take for gold shares to rally? Some had a strong week but others not. Last night in the US gold rose above 2000 yet the gold share indexes went "ho hum". Look at the chart below. It shows the correlation in price between the gold price and the XGD, which is the gold share index in Australia. As you can see it normally correlates closely but recently it has not. now, whats happening? Well either the gold price is overbought or Aussie gold shares are oversold. If the sector decides to play catch up I think there is a quick 10% profit opportunity in the majors and perhaps a lot more in the juniors - so I am watching this space closely.

The other sector also dragging the chain versus its commodity price is uranium. Some of the Aussie uranium miners are not following the commodity price and it is possible that they also play the catch up game.

So that's all a bit to digest and if you find it overwhelming remember the Zen advice of observing and looking with a mind of interest, rather than trying to work it all out. By having a "mind of interest" and not trying to get it all right all the time takes the pressure off. This is a game of probability not right or wrong and your trading plan needs to reflect that philosophy.

I mentioned the video discussing the markets in more detail, its about 2 weeks old now but they are long term charts discussed and still relevant.

Have a great week

Peter

MARKET COMMENTS: As of the close on the 17/11/23: See charts below with an On Balance Volume indicator and the Money Flow indicator

Well it was an interesting week for sure! Price continues to rise and the volumes look strong, in fact both the volume indicators are leading price - as you can see from the fact they are both breaking their down trend lines to the upside. Also there are 5 new 52 week closing highs this week, see below.

I notice some strength too in the lower end of the market, namely the Small Ords. Mind you it is still in a downtrend but volumes are increasing and it looks promising. Will we finally get a broad based rally? Too early to say but the bears have certainly been pushed back into their caves for the time being.

I have recorded a video discussing the markets in more detail, if you want a look click here.

Have a great week

Peter

MARKET COMMENTS: As of 10/11/23: See charts below with an On Balance Volume indicator and the Money Flow indicator

Its been an interesting two weeks on the XAO. First of all we had the "perfect storm" of the US Fed not raising rates and higher commodity prices - the Aus market loved that combination. Then we had the RBA raise rates and commodity prices fell - the Aus market hated that combination and stock prices fell.

Last night in the US the Nasdaq again rose and dragged up the other indexes. The rally in the US is not yet broad based, for example the Nasdaq rose over 2% yet the Russell 2000 could only manage a little over 1%.

Here in Aus the trend is sideways to down - yet the MFI is showing some promise. I think we need a rally in commodity prices and other sectors to to push this index up. Gold and gold shares remain uncertain, as does copper and oil. Its going to be an interesting week.

Until next week stay well.

Peter

MARKET COMMENTS: As of 4/11/23: See charts below with an On Balance Volume indicator and the Money Flow indicator

This week I have again decided to focus on the SP500 in the U.S.

I also think its worth repeating last weeks comments.

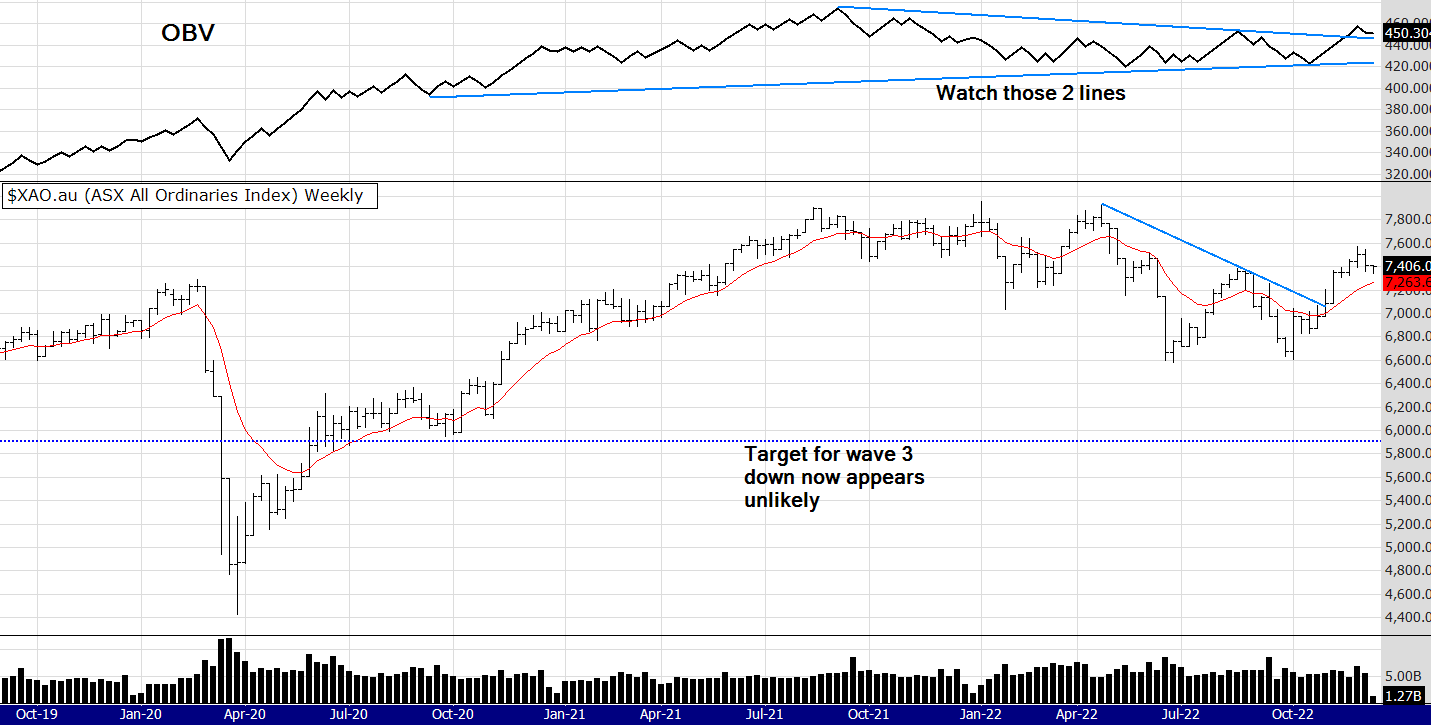

"You may get bored of me repeating the same thing - we live, trade and invest in the present, not the Armageddon of the future that many believe is inevitable. Keeping that philosophy in mind you can see that there is a strong trend line supporting the price. The OBV also has a trend line and if you look closely you can see a slight (but small) bullish divergence between price and OBV volume at the right edge of the chart.The more dynamic money flow is still trending down but is in over sold territory - the same it was during the Covid crash. It remains to be seen what happens to the above index, 4,000 points seems like a magnet and its not far away. In my opinion if it reaches that level the probability would be for a bounce, I notice some fundamental analysts are starting to call sectors of the market good value.These market corrections can be very difficult psychologically, something I wrote extensively about in my book The Zen Trader (link below). Have a good week and try and keep a mind of interest and observation, not one of panic and despair"

Well what a difference a week can make. After the Fed meeting in the US many now think interest rate rises have peaked there, also they have a strong labour market and inflation is falling. Sounds like Goldilocks economy stuff and the market responded accordingly.

Here in the land of OZ it got pretty good too. Of course we correlate with the US index but with commodity prices rising, banks following the US lead and the $A rising the XAO rallied hard. One could ask, what was all the worry about?

Of course there are still concerns Michelle Bullock and Australian Reserve Bank board will raise interest rates on Tuesday - however it's impossible to predict (as was proven last week) so let's carry on and do our best. Doing our best is having some methodology and doing the best we can at sticking to it.

In saying that there are five 52 week closing highs in the All Ords this week and they are listed below.

All the best,

Peter

MARKET COMMENTS: As of 27/10/23: See charts below with an On Balance Volume indicator and the Money Flow indicator

This week I decided to focus on the SP500 in the U.S.