New 52 Week Highs

Closing Highs posted each week for Free

Market comments for 14th November 2025

Comments below the chart

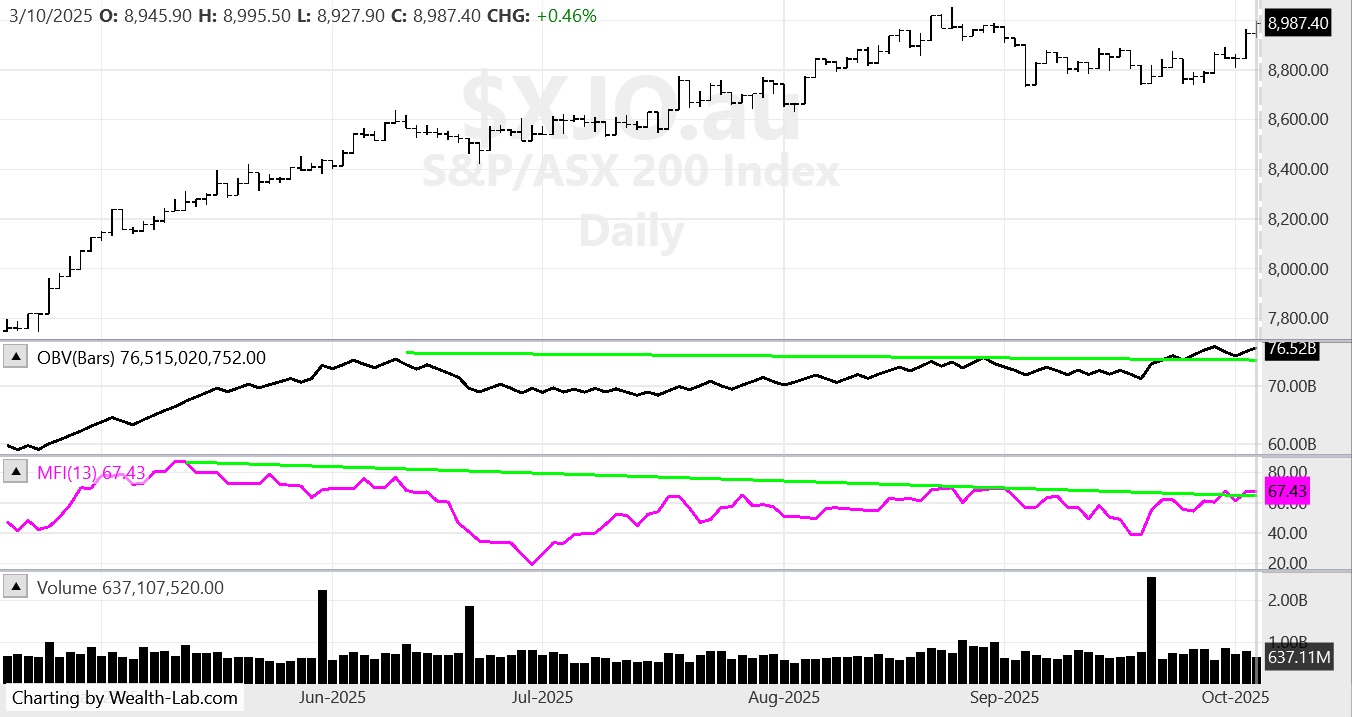

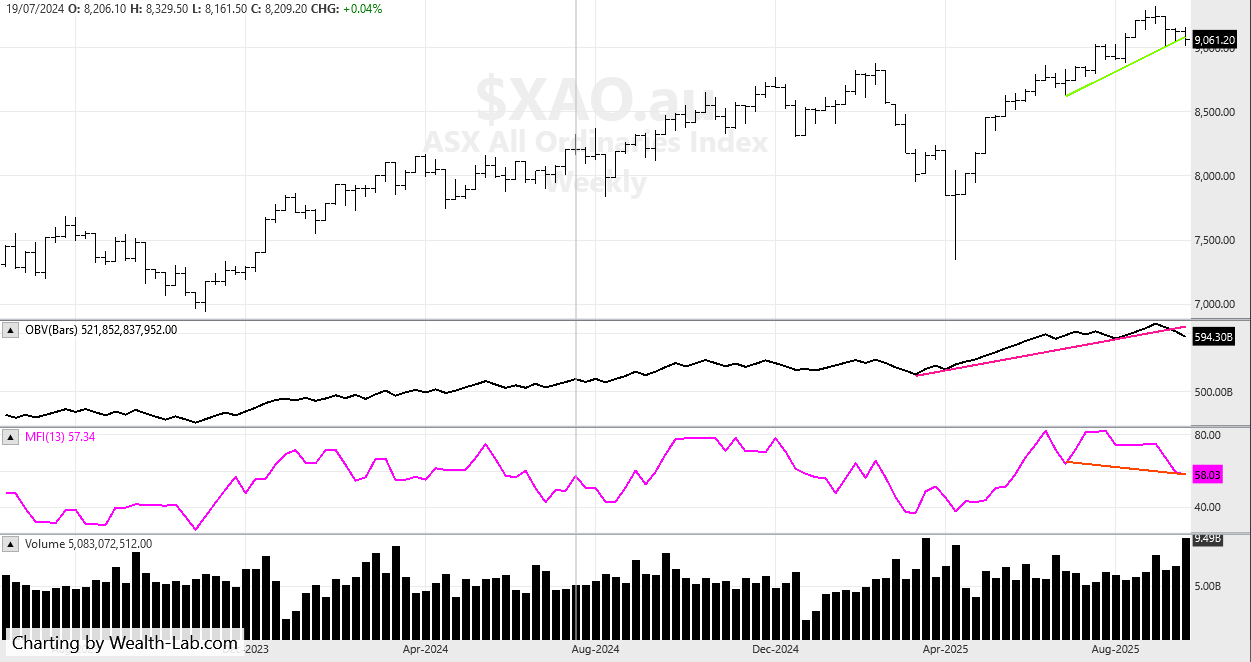

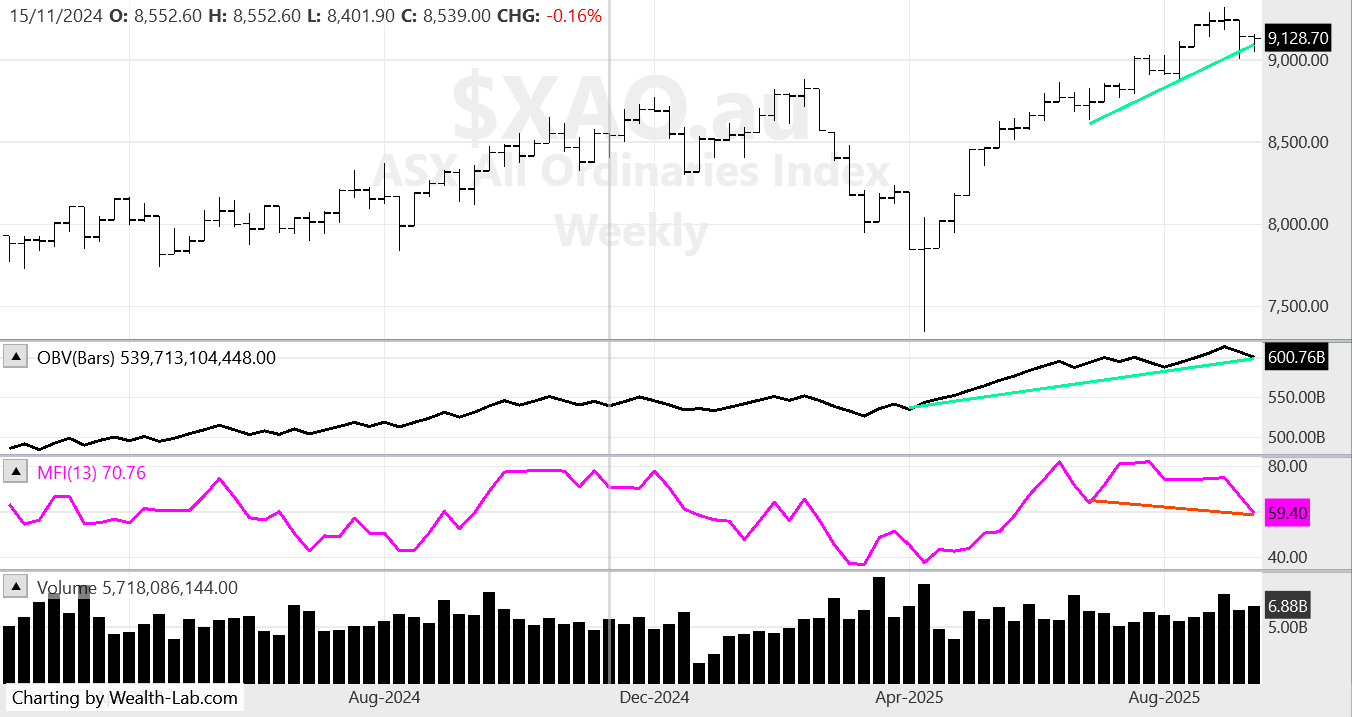

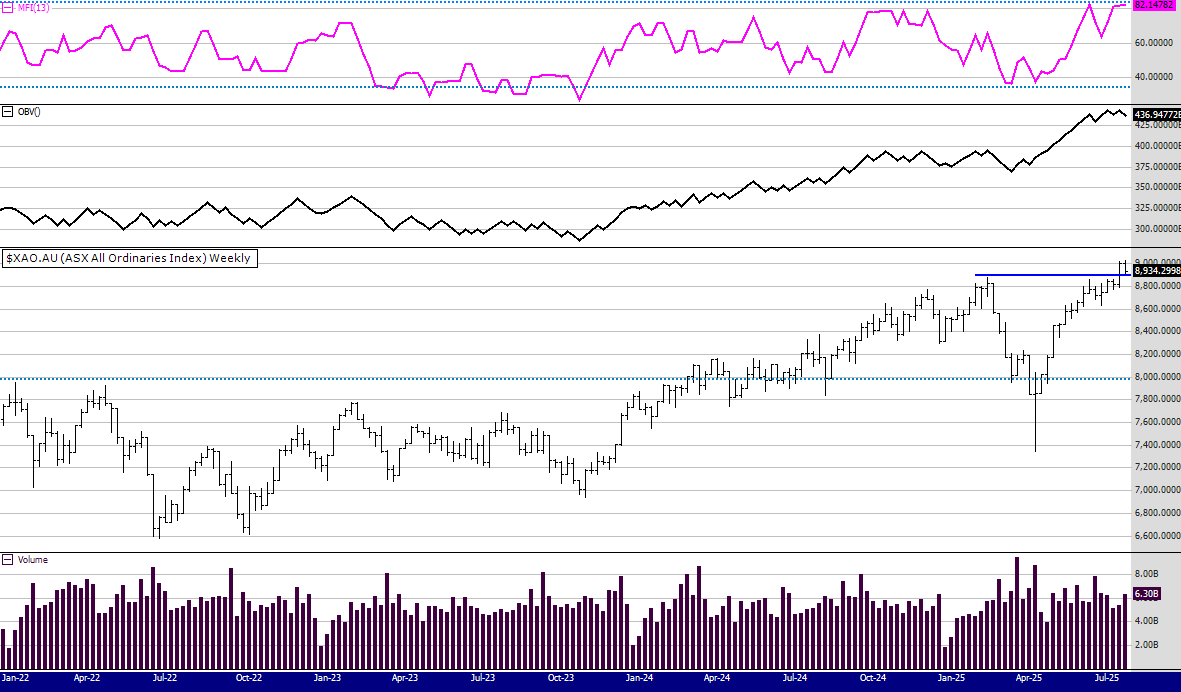

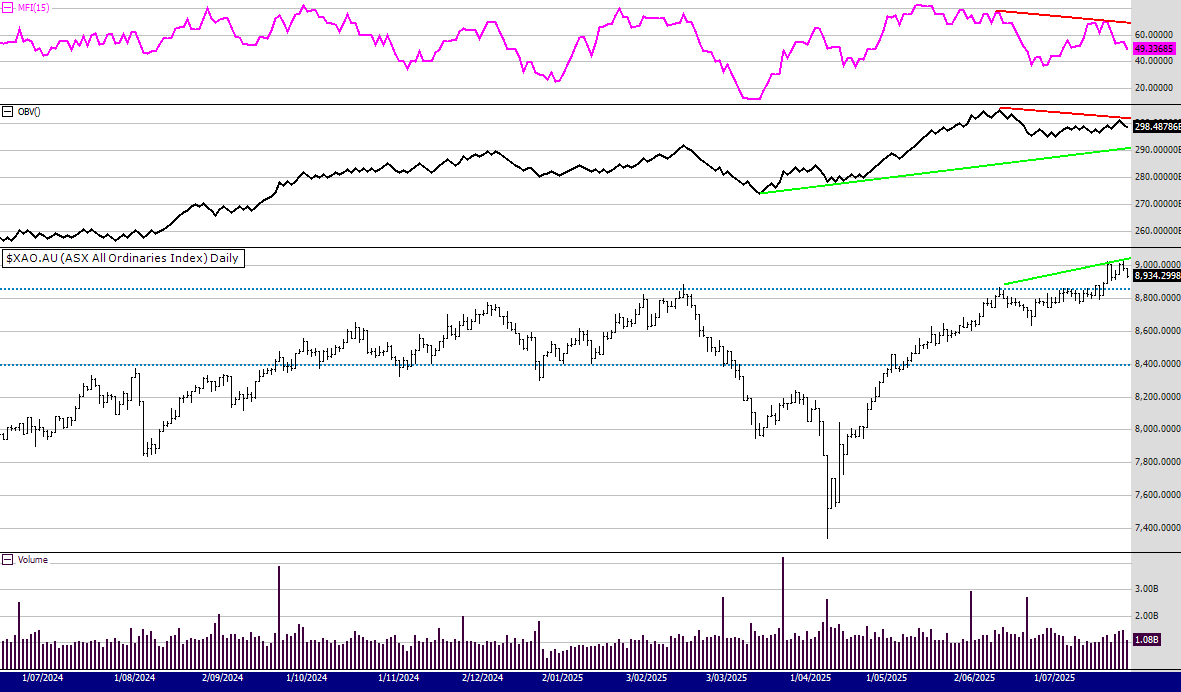

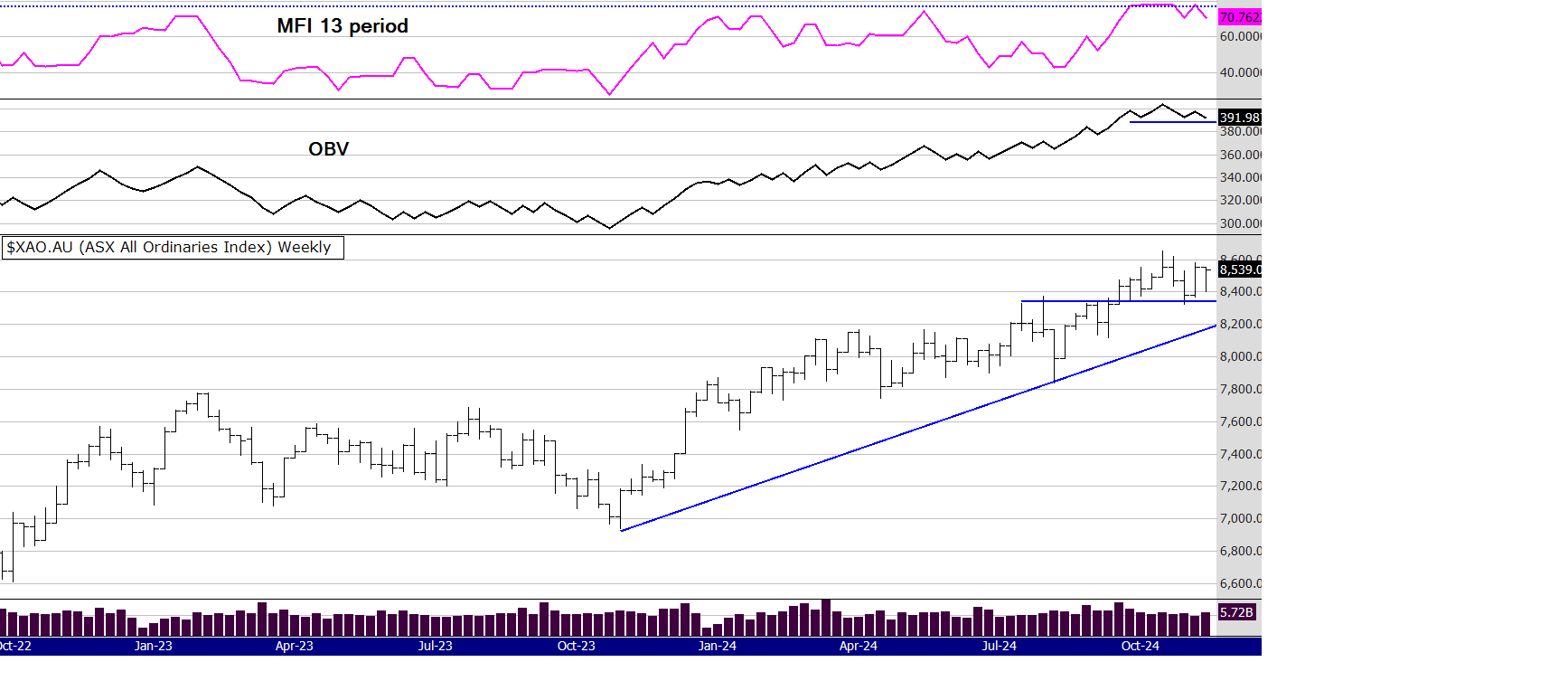

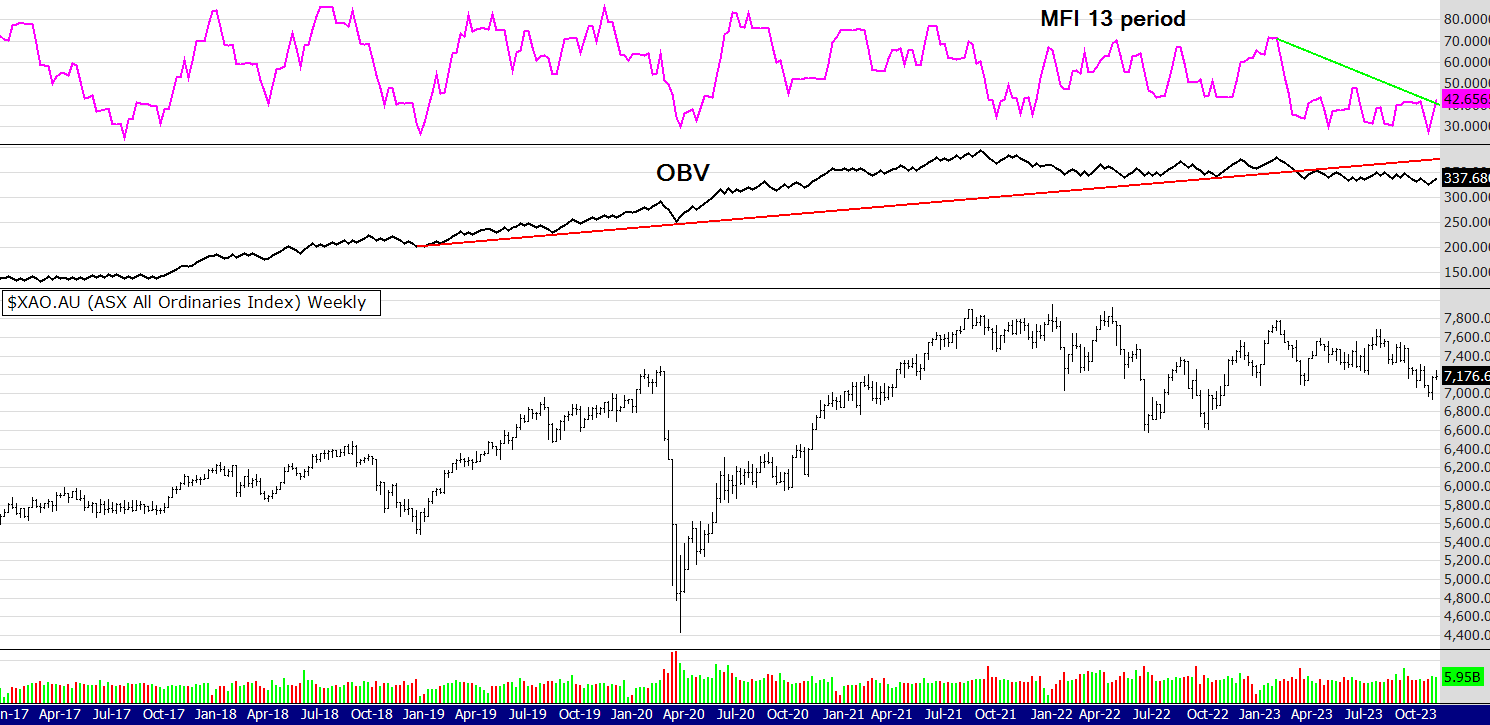

Last week I suggested we would have a bullish day on the Monday - we did, but the market fell away for the rest of the week. The XAO is now 8907 points, which is at the first blue support line I have drawn on the chart. The next support line is 8750.

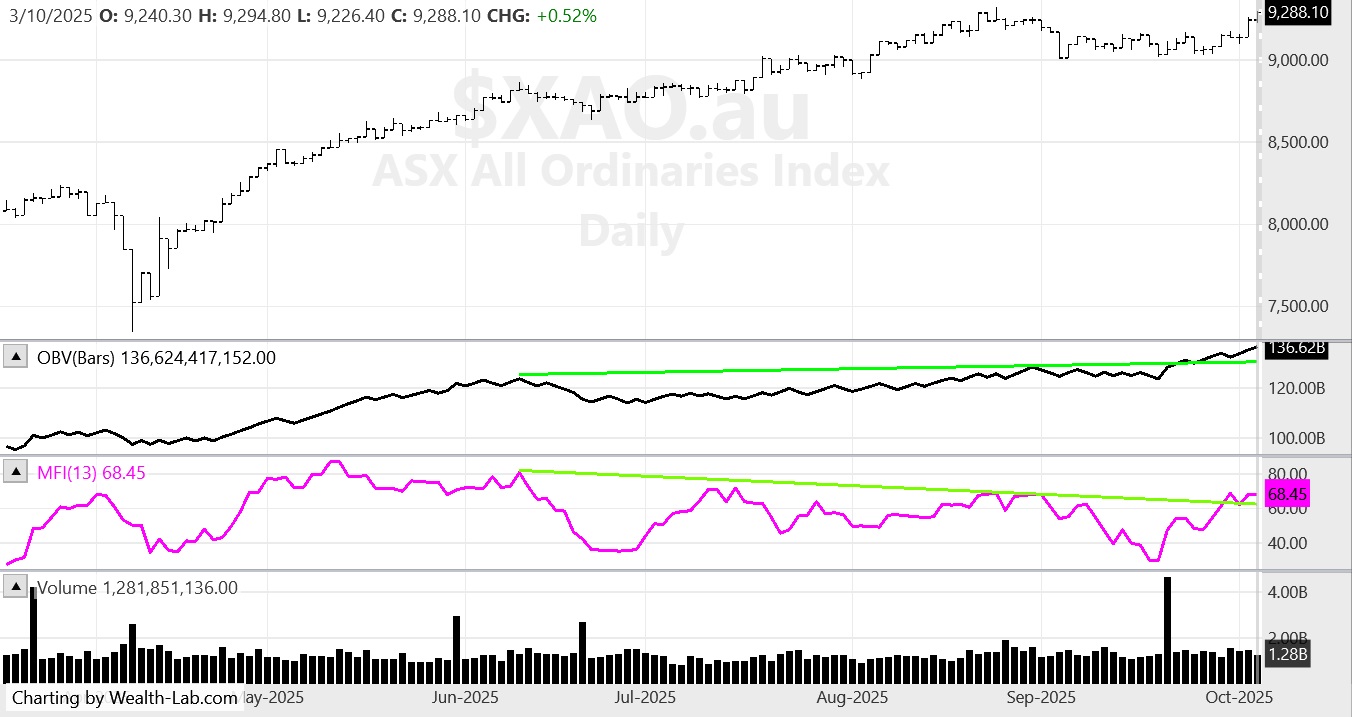

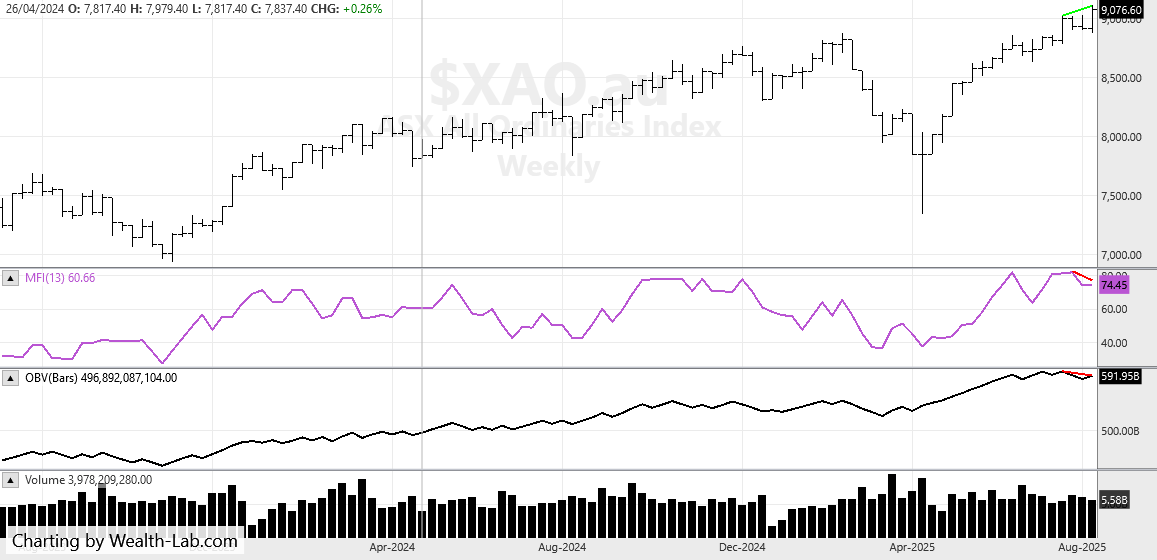

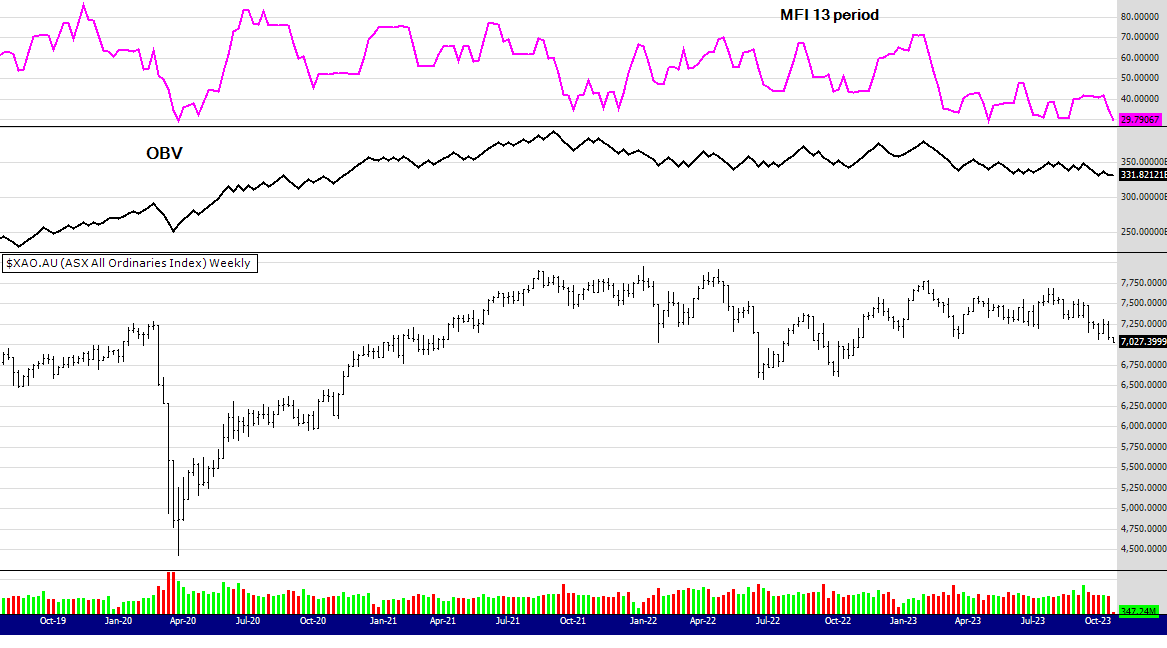

Volumes: we have some bullish support on the OBV, as can be seen by the green uptrend line opposing the red downtrend line on the index price. There are often "buts", and the but is that the MFI looks bearish - as it has been since it topped in early October.

On Friday in the US, the markets had another strong recovery after an intitial sell off, so we may get some positive price action on Monday in the XAO.

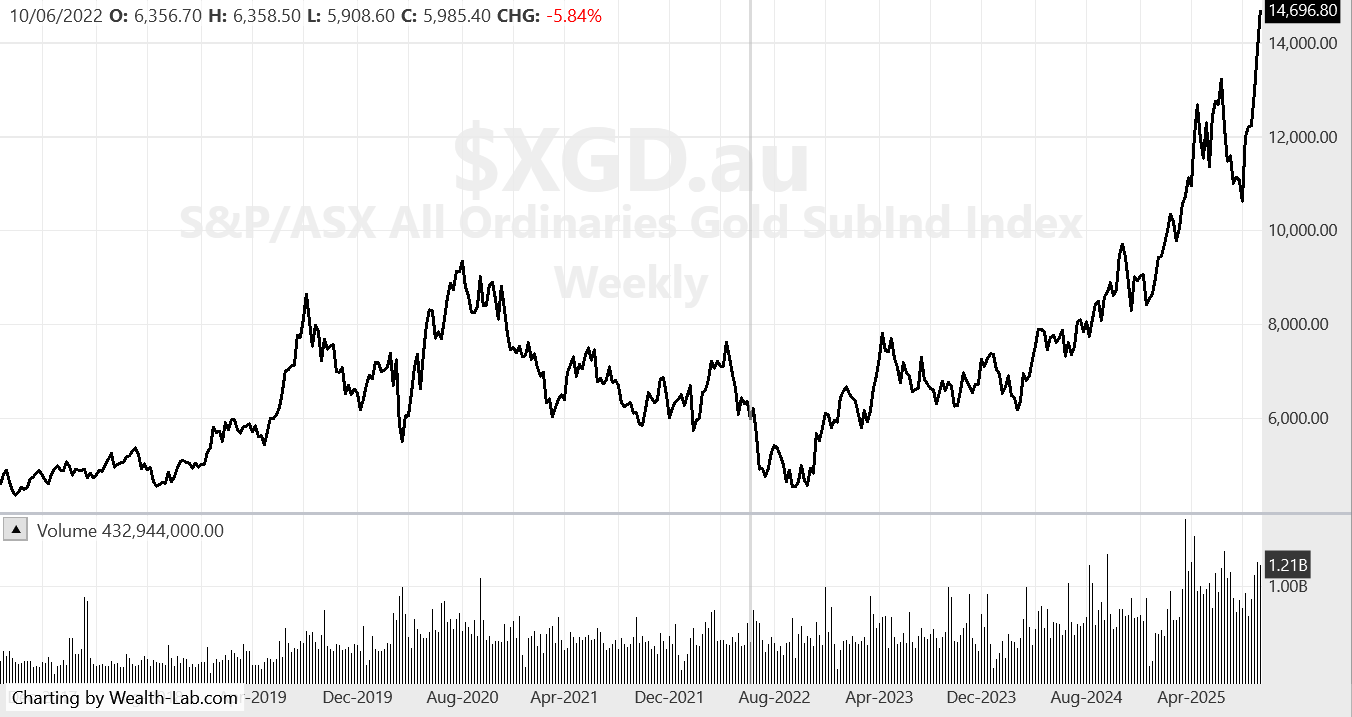

Metals had a strong week last week. The metals sector is one of the strongest in the market (as I discussed last week) so it was not a surprise some investors and traders went back into the sector at cheaper prices.

A comment about the 52 week high alerts this week: I have noticed the rotation (or more interest) in the small caps continues. This week just one alert in the 100 and one in the 100 - 300. But, (there is that word again) five alerts in the 300 to 500. See alerts below.

With "gorilla" stocks like CBA having a bad run of it, this is reflected in the XAO index, so perhaps not surprising some of the smaller caps are doing a little better as investment and trading money searches for higher returns.

Until next week

Peter

The exit used FOR THIS METHOD is the 5/12 EMA crossover. Therefore, some stocks will be re signalling a new high buy signal if they have been recently exited by using the 5/12 exit within the last 12 months. This is important and you need to understand this.

Of course the 5 EMA needs to be above the 12 EMA to make the 52 week high valid, (otherwise we would be selling straight away) nearly always this is the case, but rarely if a stock spikes it is not.

So to repeat, the rules are: USING WEEKLY PARAMETERS!

Entry:

Share price to make a 52 closing (or equal to) week high (when selecting a buy, favour the cheapest stock)

The 5 ema to be above the 12ema

Exit:

if the 5 ema crosses below the 12 ema

The above system contains no position sizing, bull or bear filters or fundamental stock selection, these are discussed and taught to private clients or at my courses.

If you want more information about the Mindful system, or my latest book The Zen Trader, click here

https://www.easysharetradingsystems.com.au/products-and-services/e-books

52 week closing high alerts for 14/11/25

ASX 100: AZJ

ASX 100 - 300: (The Small Ords) BGA

ASX: 300 - 500: CEH ELV FCL GRX QAL

Market comments for 7th Nov 2025

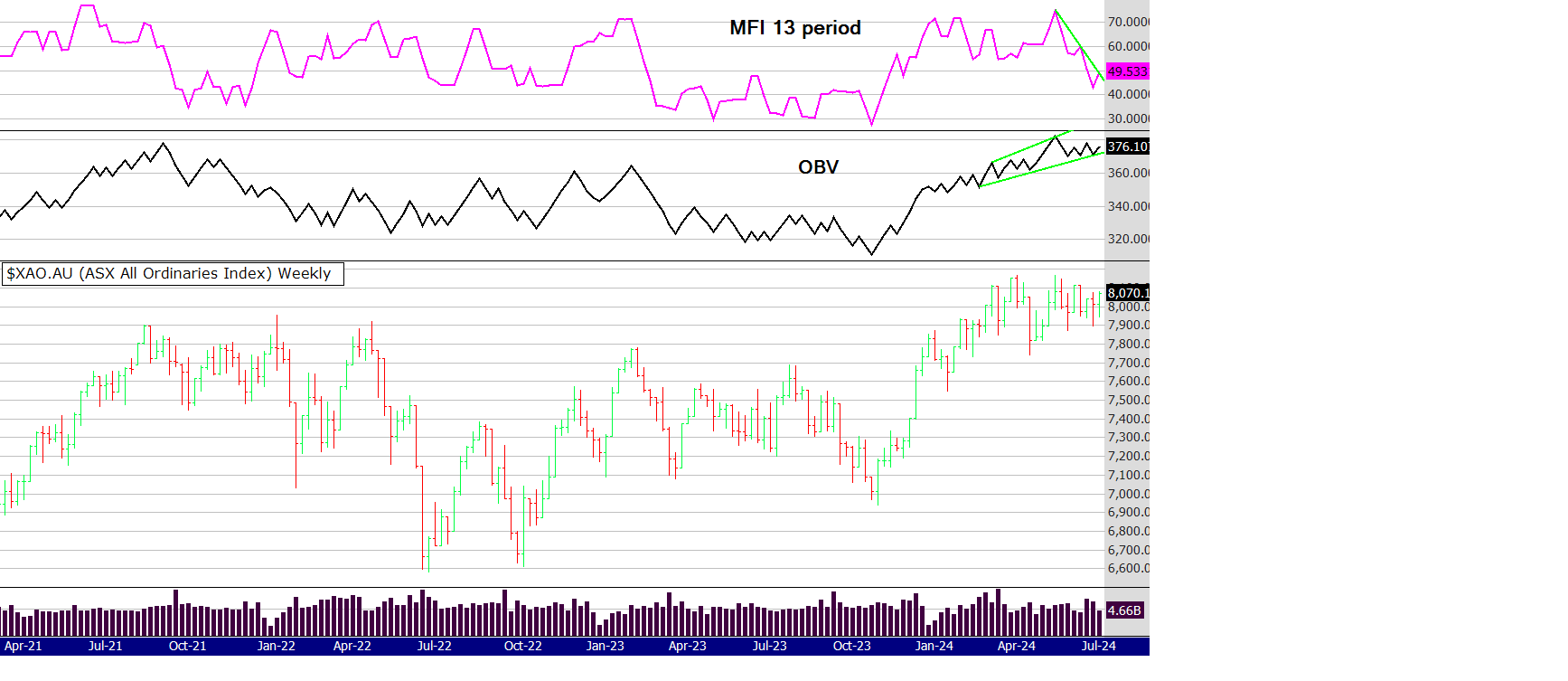

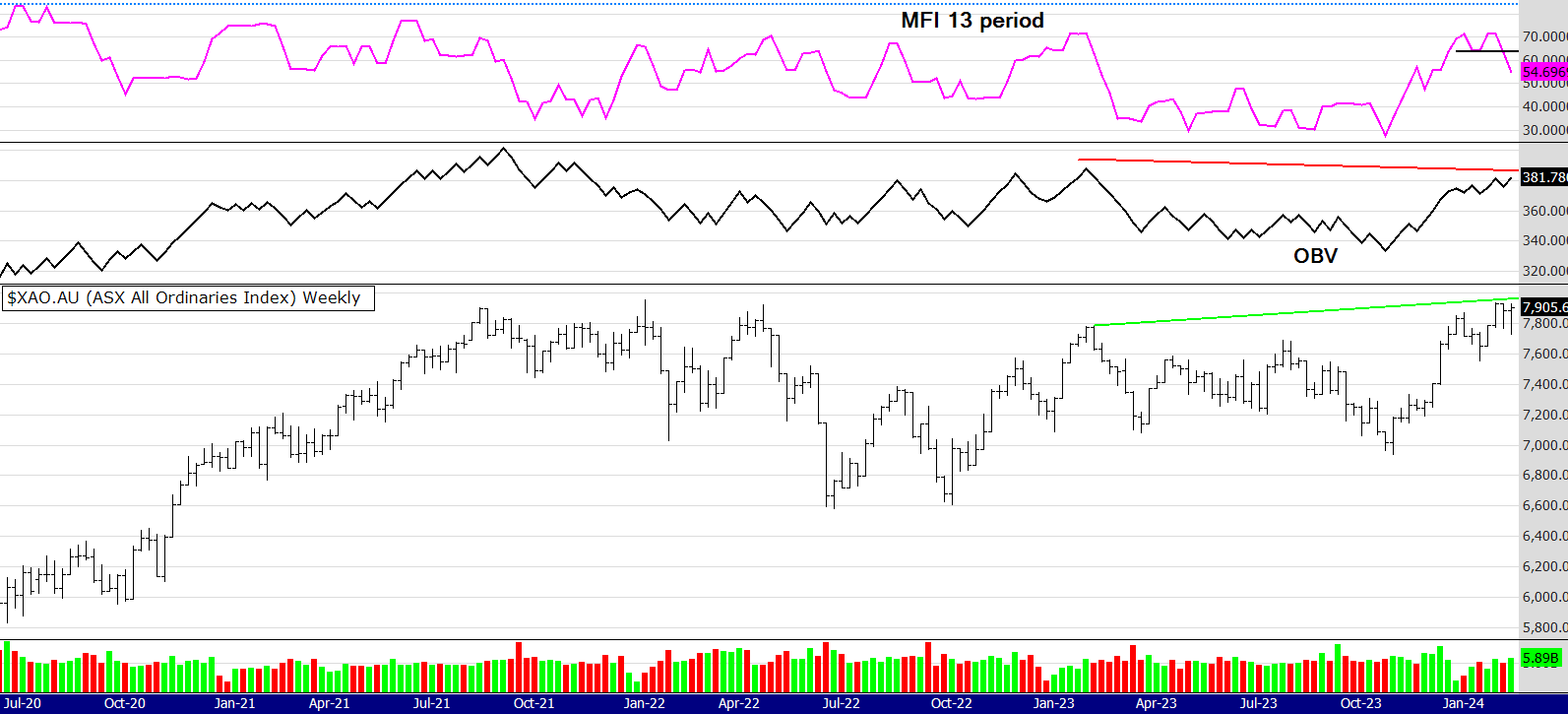

I didn't realise it had been a month since my last update, however sometimes looking back over a longer time frame can show how things play out as we thought. Last month I said "The chart above shows a concerning down trend in the 13 period MFI"

I also said

"HOW FAR the market dips will be the clue to the strength of the metals sector"

So lets have a look at whats happening now -and the hard thing about technical analysis is that it is difficult to see things in real time, but much easier to see things later. Why is this? I think because our thoughts find it difficult to think things may change, so somehow we need to work on our thinking and ask some "what if" questions. So lets ask "what" if now by looking at the XAO chart again.

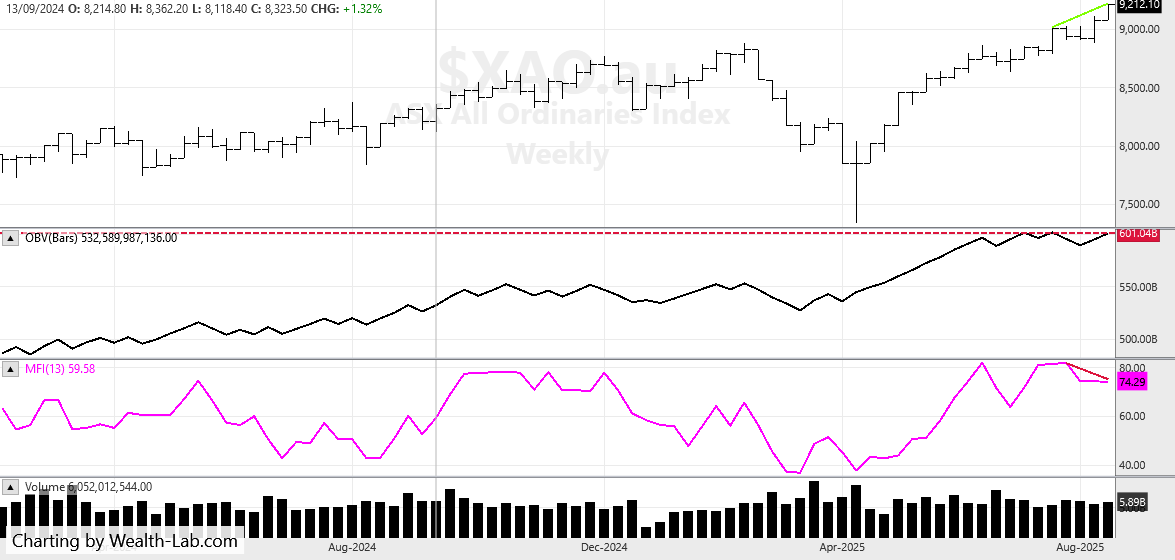

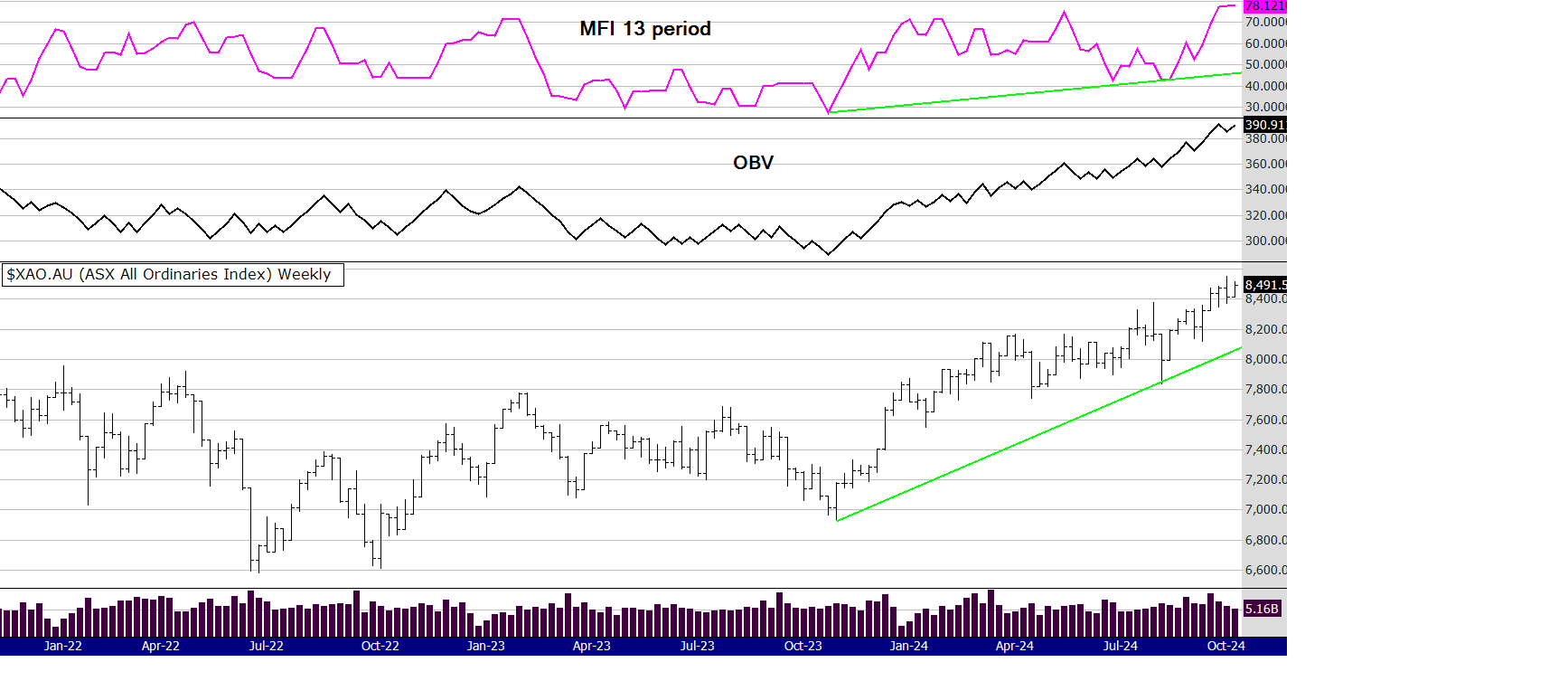

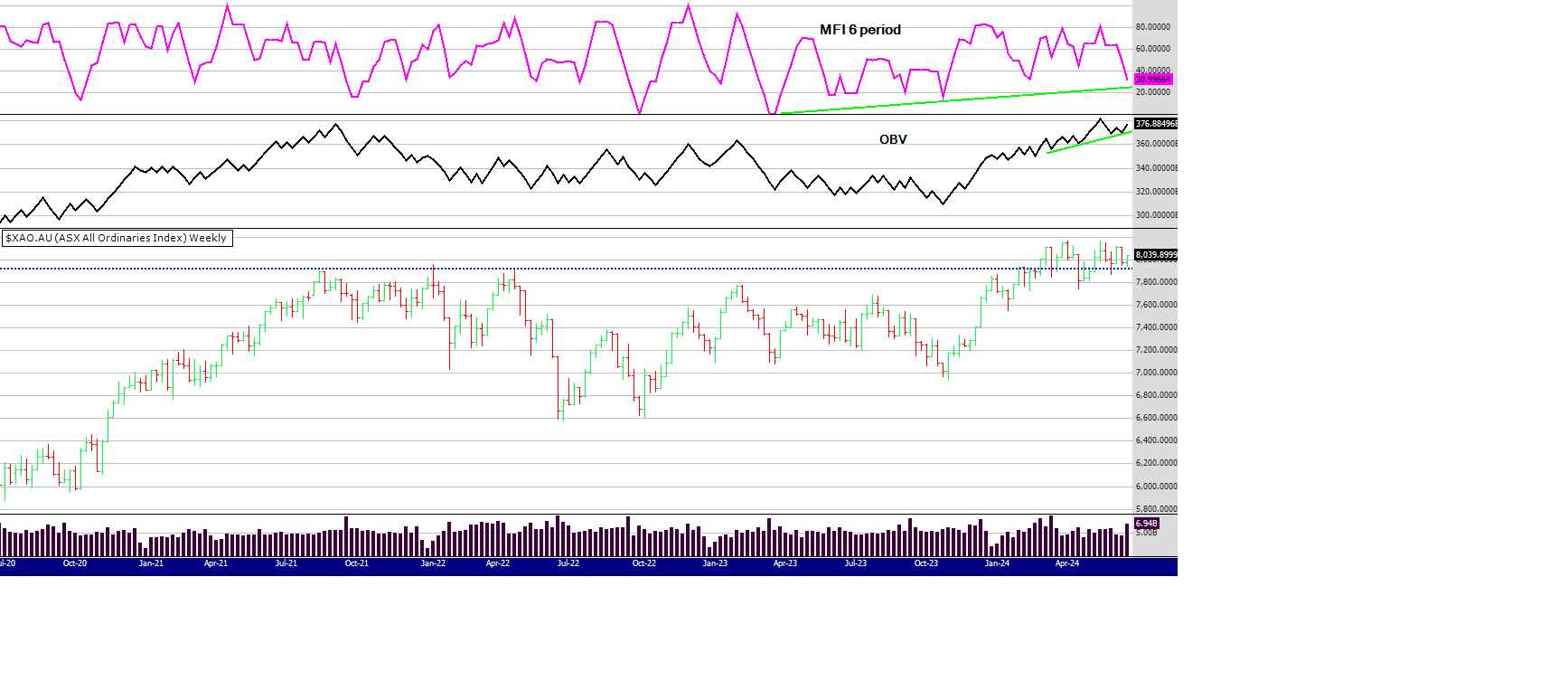

The chart above shows some bullish divergences on both the OBV and the MFI. Bear in mind, they are short term and may not hold, but it does suggest a bounce up. Also we know that the US market on Friday night had a good recovery session after being down but rallying into the close. This does suggest a bullish day in Australia on Monday.

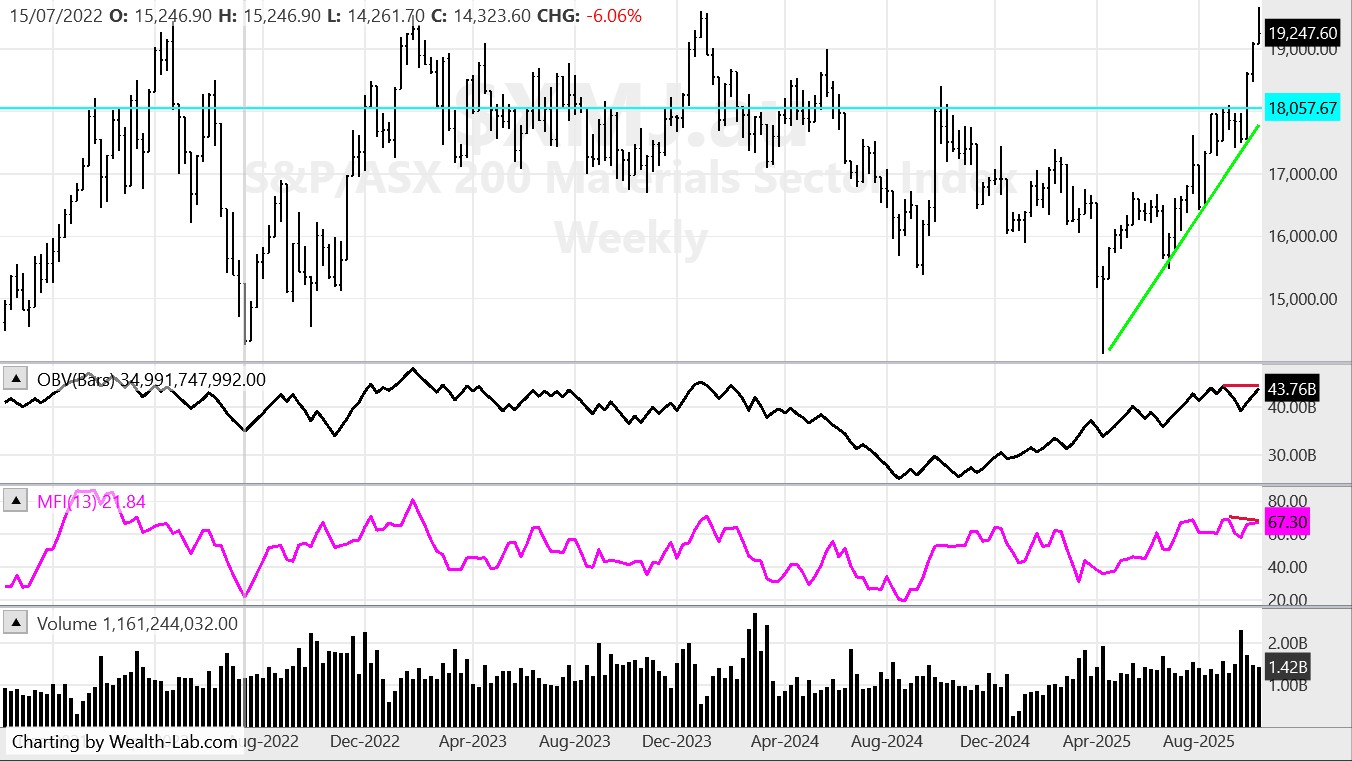

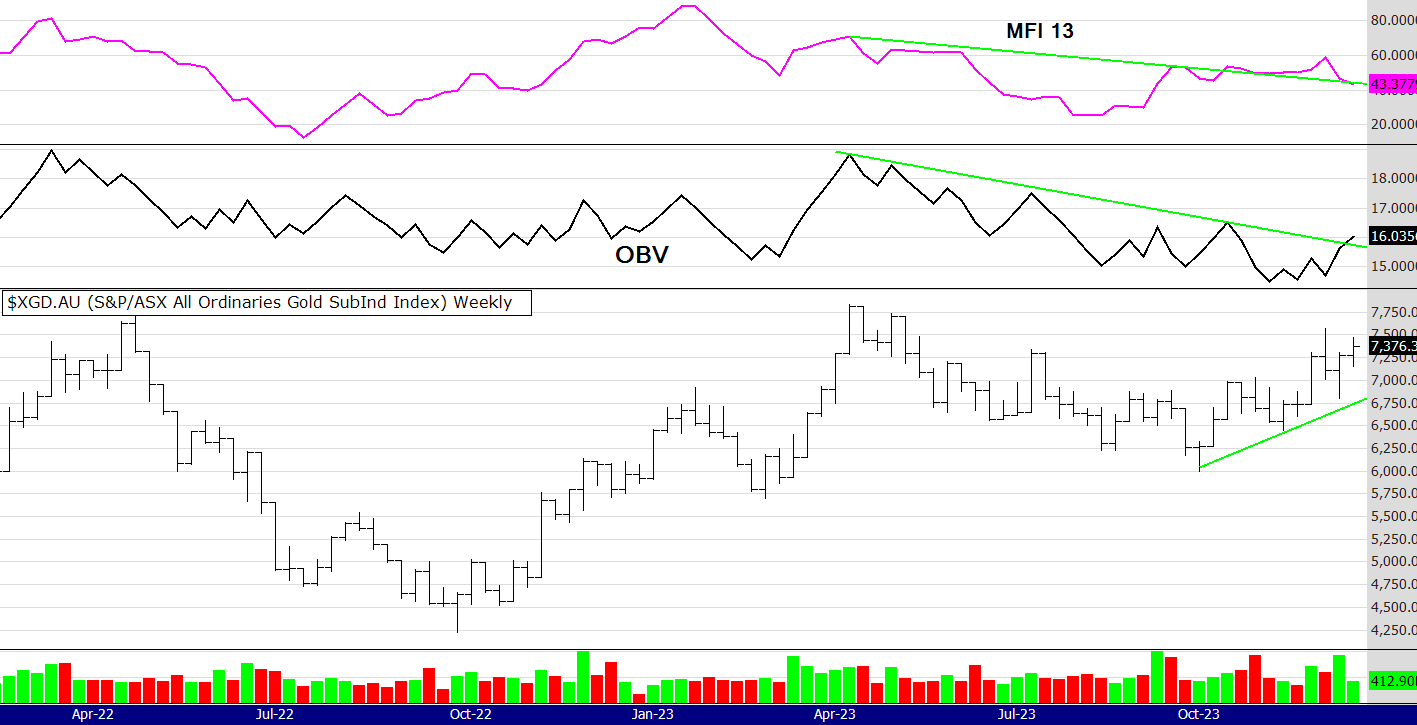

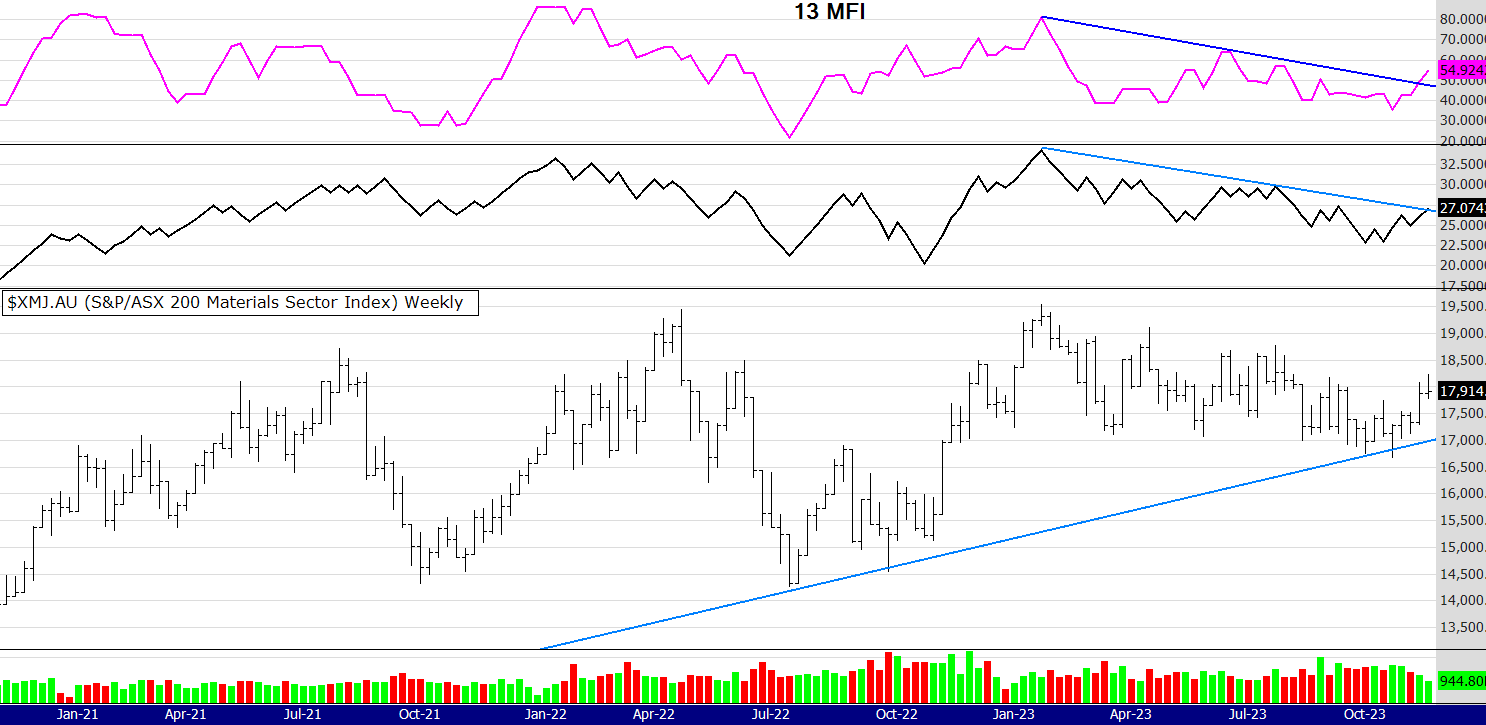

Compare the chart below of the Materials sector to the one I posted a month ago and you can see the sell off this sector had. Despite the bearish looking MFI it has two positives. The OBV looks stong and the price is still within its healthy up trend line. So, it could sell of a little more or start to consolidate and rebuild for the next up move. I think the latter is more probable.

The gold stock sector also looks more positive. Despite a flat gold price hovering and holding around the 4,000 level, the gold stocks are starting to show some life after their recent sell off. Gold stocks tend to move BEFORE the gold price. I know this did not happen for a long time, particularly during the period where the gold price outperformed almost everything. However we may be returning to more "normal" times when the gold stocks give us a lead as to the direction of the gold price. Gold stock traders try to "front run" the gold price and this may be happening now.

Until next time,

Alerts below and not surprisingly a poor showing this week from the 52 week closing high stocks.

52 week closing high alerts for 7/11/25

ASX 100: None

ASX 100 - 300: (The Small Ords) TPG

ASX: 300 - 500: None

Market comments and 52 week high alerts for 10/10/25

It was a quiet week on the XAO. Actually the last 5 weeks shows not a lot of movement - but we know amongst some sectors there has been incedible price gains. This week did not produce many alerts although still more action in the smaller end of the market, as can be seen in the alerts below.

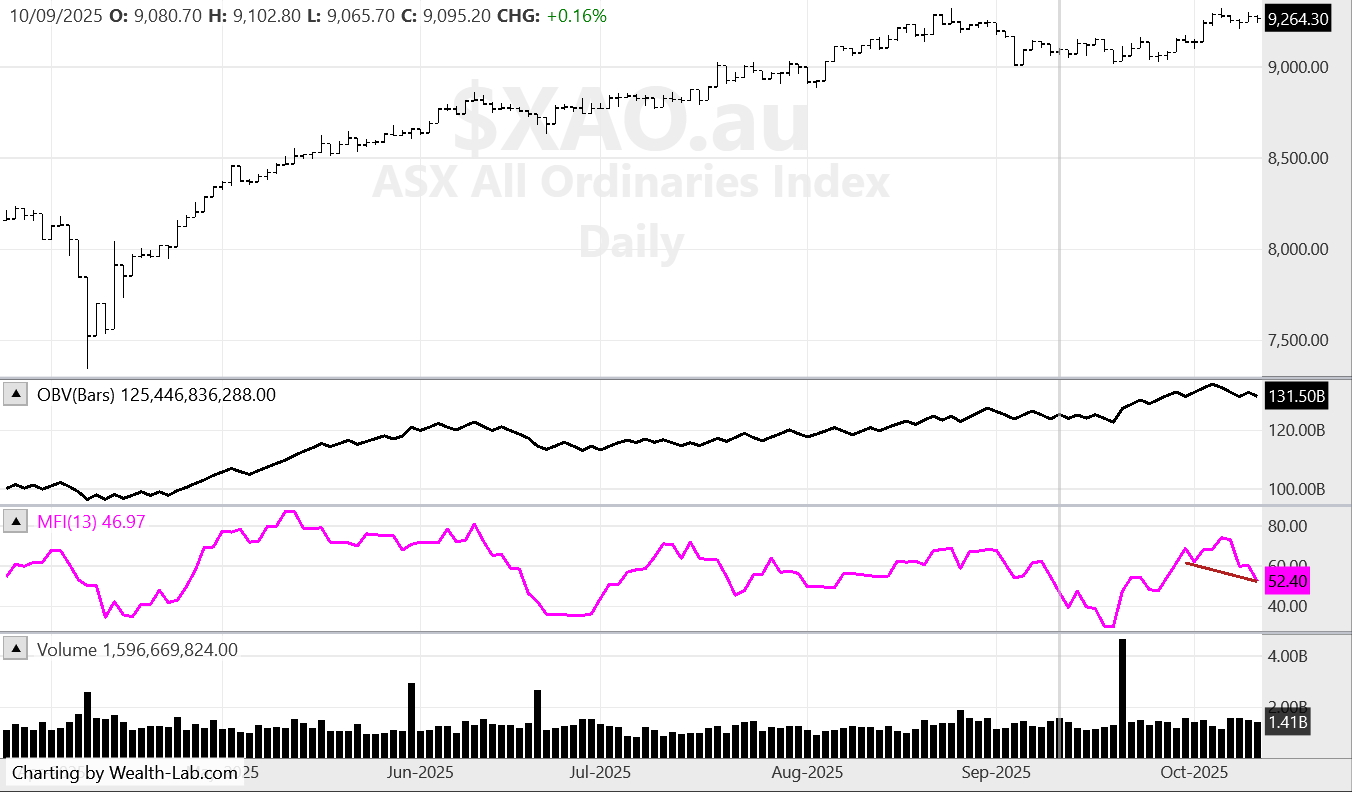

The chart above shows a concerning down trend in the 13 period MFI. The OBV looks ok but the MFI is the more dynamic indicator and tends to move up or down first, sometimes being able to give us an early warning of things to come. I am sure most of you know the US markets had a hefty fall on Friday night - after Trump threatening more tariffs on China. This could be political/transactional politics before his meeting with Chi regarding rare earth supplies (and other things).

So it remains to be seen how the XAO reacts this week. The markets have been on a tear (particularly metals) and this correction could be the time to buy the dip. In FOMO markets dips tend to be bought. I am sure there are many investors on the sidelines waiting for a chance to buy into the metals market.

HOW FAR the market dips will be the clue to the strength of the metals sector. If it gets re-bought quickly then new highs are probable, however if it falls fast, hard and far, this could be the end of that rally for a while. For example, I will discuss the Materials sector below.

This sector has had a strong rally (like many sectors) from the Trump tariff low in April. However you can see its labouring to take out the significant resistance around the 19500 level. The OBV is level, and the MFI is pointing down (bearish). But we know this is the "story" sector with all the narrative around metals, gold, energy, lithium, uranium etc etc. If this sector pulls back and respects the support and resistance lines, and then regathers steam, it could be in for further upside, even a new all time high. But if it falls far and hard, then that's a different matter and a reassessment of the bullish "story" may be needed.

This paragraph will be a test of who reads this page (and get this far). I am thinking of running a Zoom meeting to discuss trading and the markets in general. Please email me if you are interested at

This email address is being protected from spambots. You need JavaScript enabled to view it.

Until next week

Peter

52 week closing high alerts for 10/10/25

ASX 100: None

ASX 100 - 300: (The Small Ords) PDI

ASX: 300 - 500: ARU L1G SYL SYR

Market comments and 52 week high alerts for 3/10/25

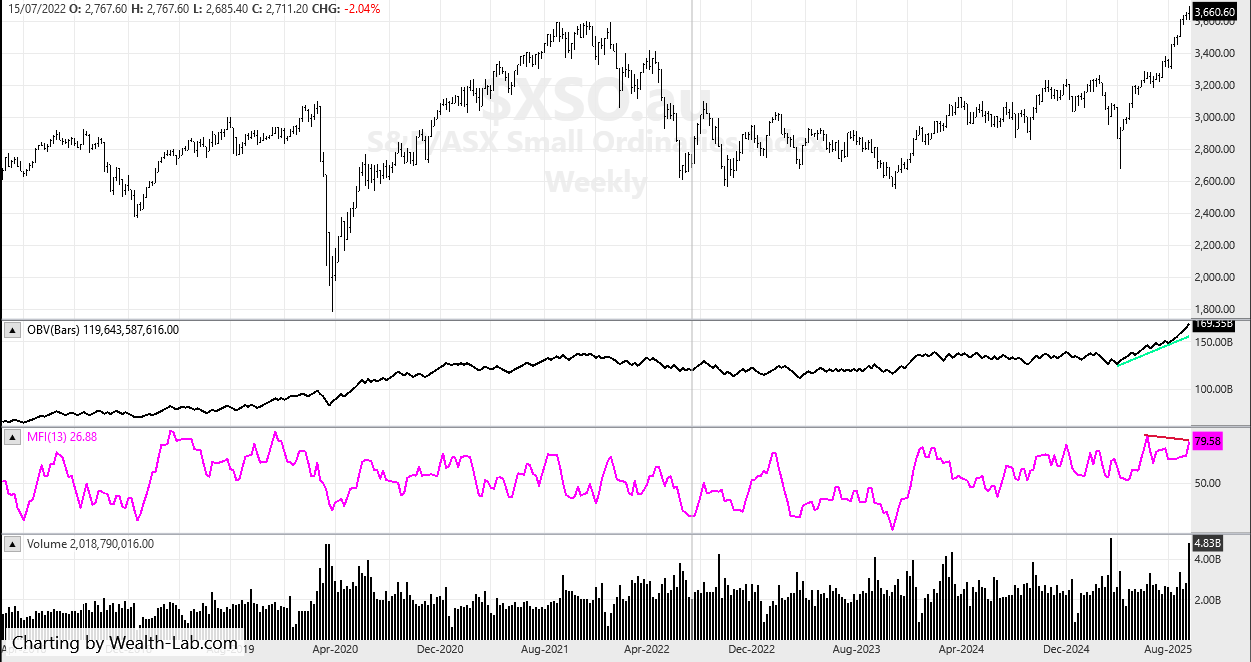

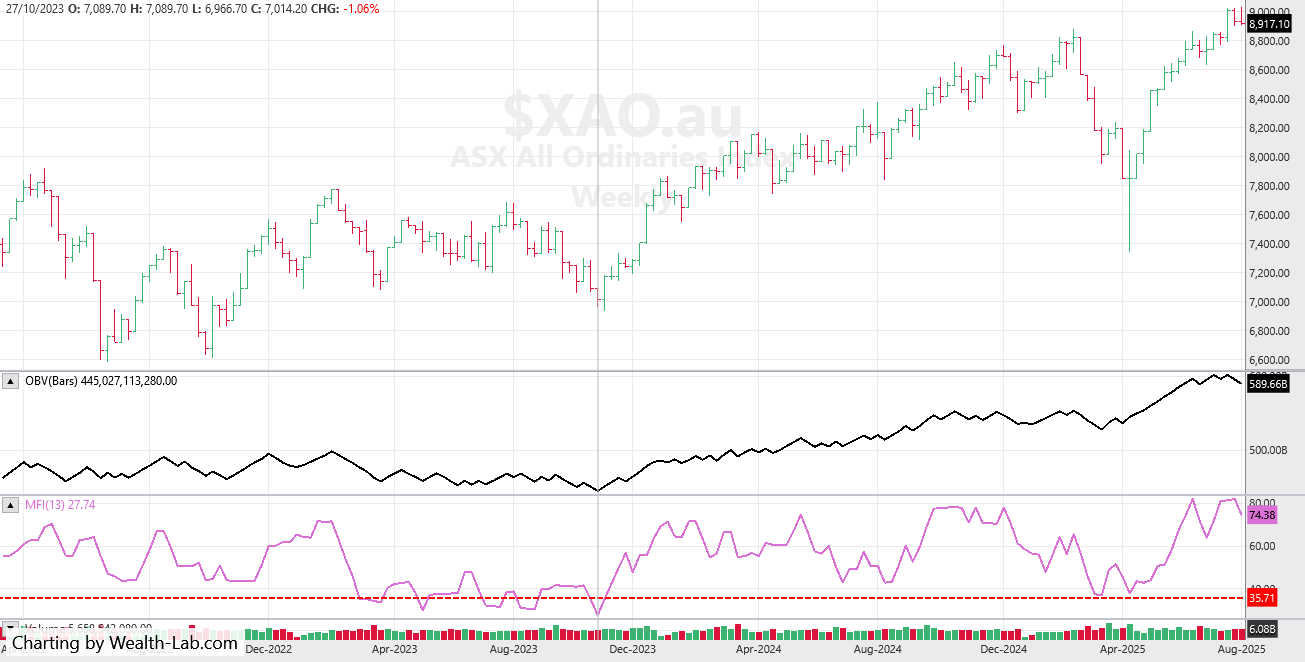

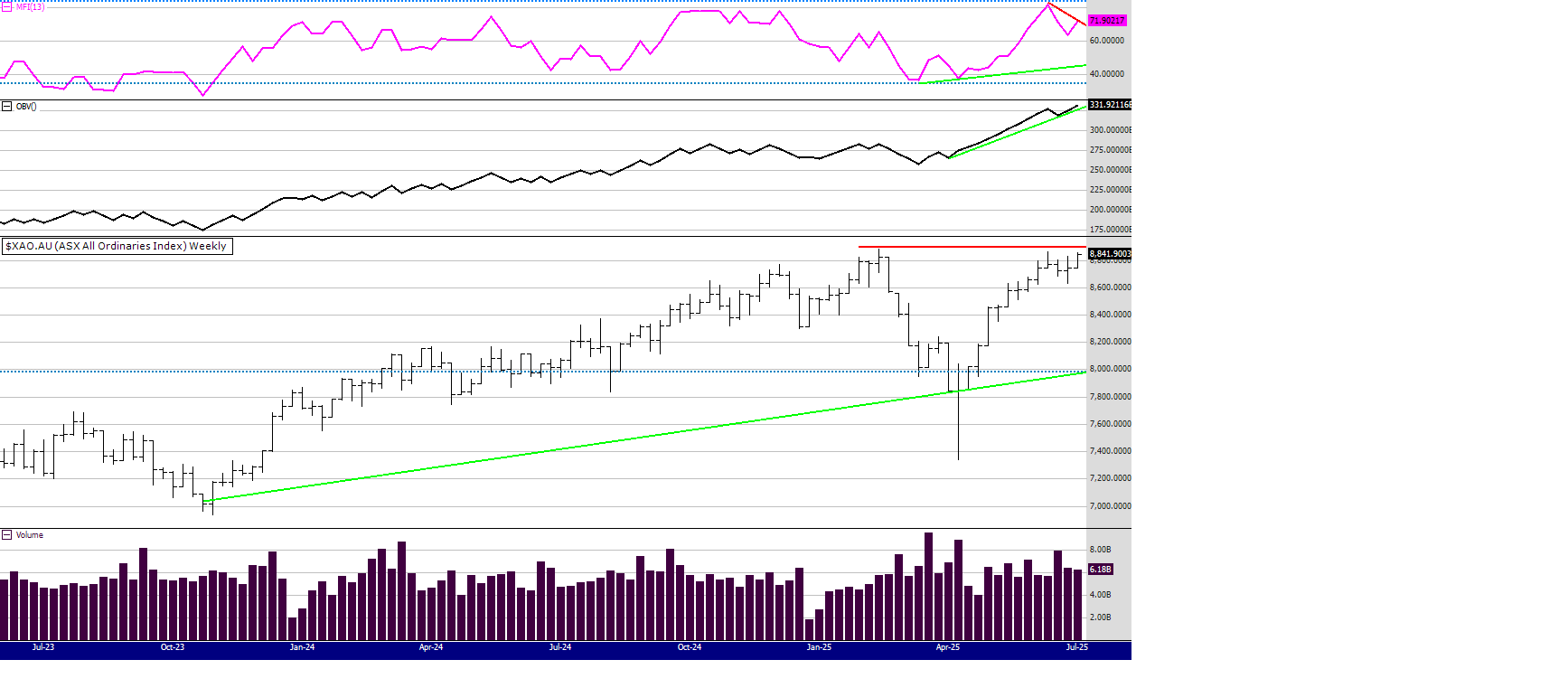

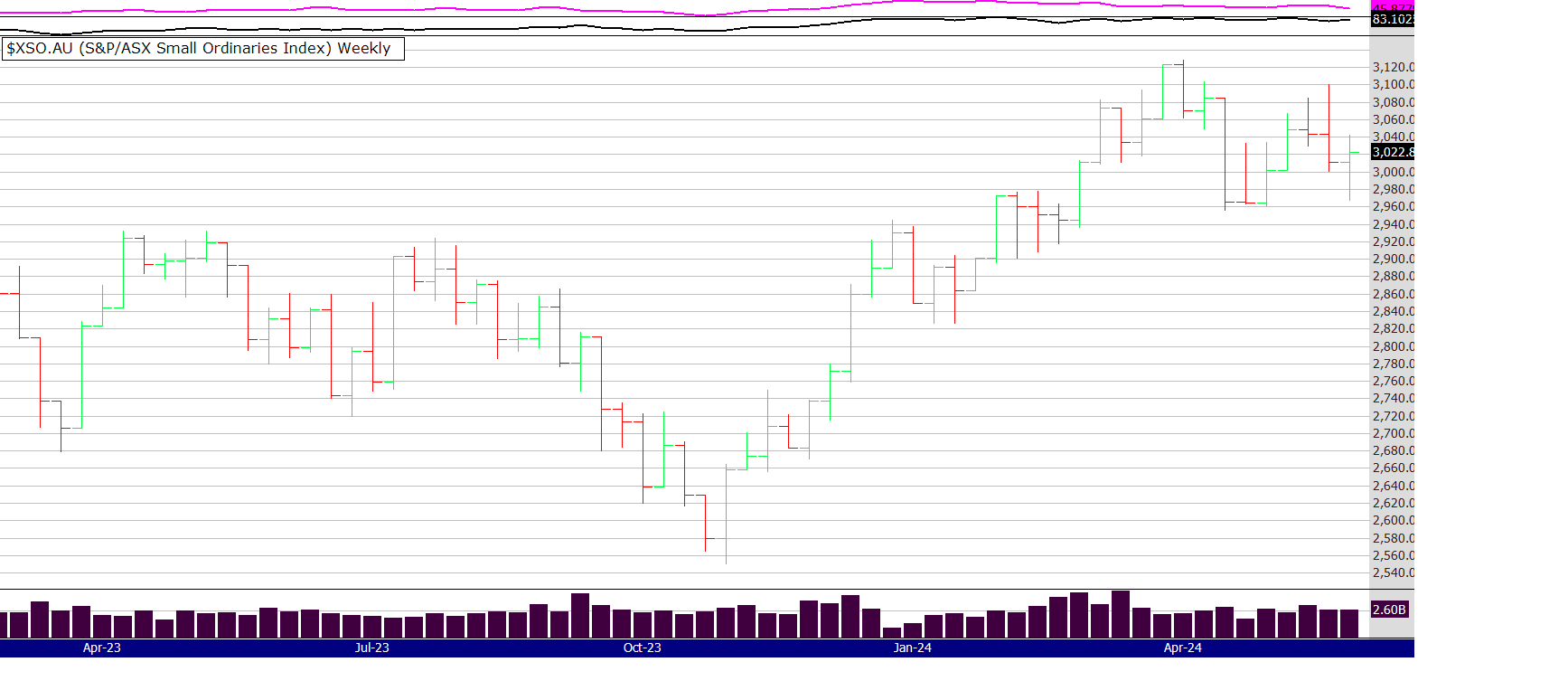

The XAO continues higher, with solid breadth (12 alerts) amongst the 100, 200 to 300 and the 300 to 500, see alerts below. Also I notice the XAO has made a closing all time high - by just 4 points, but a closing high it is. Lets look at the Small Ords chart.

This sector looks similar to the XAO, very close to the ATH, there are some stocks in this sector performing very well. Here a few comments about other sectors.

Discretionary: had a strong week and is close to ATH

Energy: continues to struggle

Finance: had a strong week and is close to ATH

Gold: had another strong week - has been on a tear since making an ATH back in late August

Health: had a bounce this week after consistent falls, having been knocked around by the heavyweights CSL and PME. Some mid cap health stocks bounced hard.

Information Technology: a strong week and close to ATH

Materials sector: a strong week and close to ATH - but needs to break above some hefty past resistance going back 3.5 years

Industrials : a strong week and close to ATH

Real Estate: a strong week and close to ATH. Recently broke above long term resistance going back to 2020 - not a good sign for housing affordability

Consumer Staples: the down trend continues as the risk on mentality in other sectors prevail - this sector does well in defensive or recession times

Communications: has been trending well for a year now, appears to be consolidating after 6 weeks of falls.

Utilities: a down week but it is in a strong weekly uptrend

Ok, thats it from me. The risk on mentality prevails as everything is up apart from Staples and Energy. Health remains to be seen if the recovery continues.

Have a great week

Peter

The exit used FOR THIS METHOD is the 5/12 EMA crossover. Therefore, some stocks will be re signalling a new high buy signal if they have been recently exited by using the 5/12 exit within the last 12 months. This is important and you need to understand this.

Of course the 5 EMA needs to be above the 12 EMA to make the 52 week high valid, (otherwise we would be selling straight away) nearly always this is the case, but rarely if a stock spikes it is not.

So to repeat, the rules are: USING WEEKLY PARAMETERS!

Entry:

Share price to make a 52 closing (or equal to) week high (when selecting a buy, favour the cheapest stock)

The 5 ema to be above the 12ema

Exit:

if the 5 ema crosses below the 12 ema

The above system contains no position sizing, bull or bear filters or fundamental stock selection, these are discussed and taught to private clients or at my courses.

If you want more information about the Mindful system, or my latest book The Zen Trader, click here

https://www.easysharetradingsystems.com.au/products-and-services/e-books

52 week closing high alerts for 3/10/25

ASX 100: CWY DNL RIO

ASX 100 - 300: (The Small Ords) BVS BWP GGP NEC OBM WBT

ASX: 300 - 500: D2O TBN TTT

52 week closing high alerts for 26/9/25

ASX 100: NST

ASX 100 - 300: (The Small Ords) CHN CSC EMR FFM GNC ILU NXG SLX SX2 VGN

ASX: 300 - 500: CVL MLX

MARKET COMMENTS 19/9/25

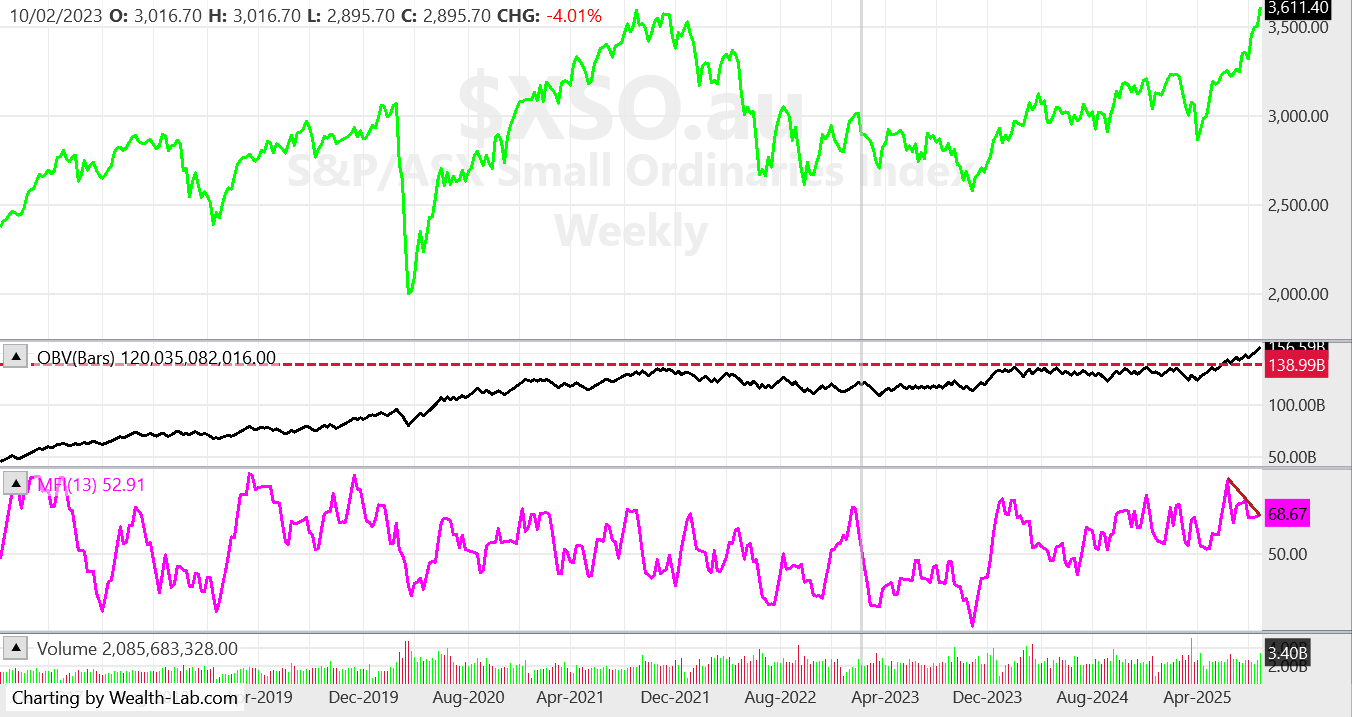

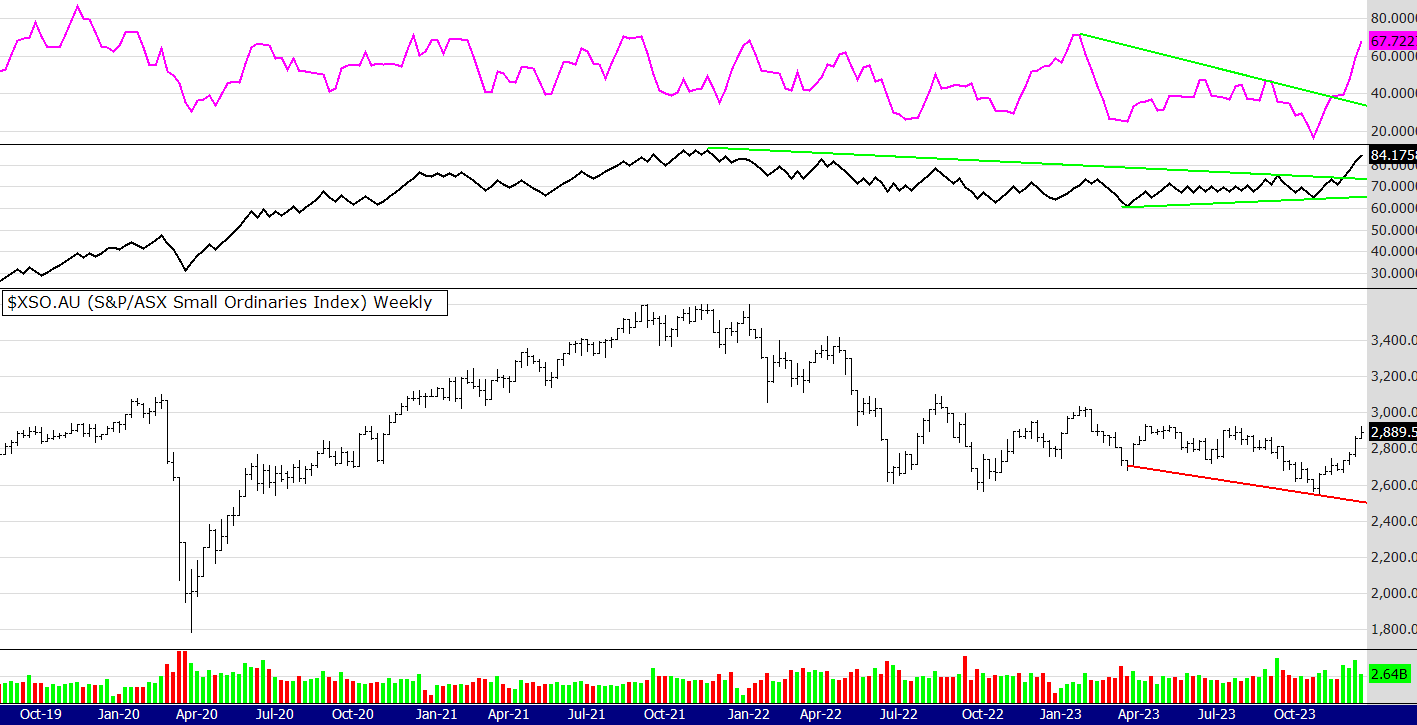

Ok, a picture paints a thousand words - or should I say two pictures, the one above and the one below. Of course there is also the trusty 52 week high signals giving us more information. For some weeks now there have been less alerts in the big stocks and more (many more) in the smaller stocks. It is the same story this week (see alerts below).

I often say this: the XAO chart above shows the top 500 stocks in Australia - but its dominated by the Gorilla stocks in the top 100 (mostly the the top 20). Over the last few weeks and now months, there has been a rotation out of Gorillas to Monkey stocks. Smaller stocks can behave like monkeys, up and down and all over the place. When they run up the tree they run hard, but can come flying down just as quick.

Comparing the two charts you can see the 500 (dominated by Gorillas) has been slowing, but the Small Ords (the chart posted below) has been doing the opposite. Its now made an all time high while the other index has been falling.

However! It is now looking a little extended, the OBV is screaming up and the MFI is negatively diverging. Also, look at that huge volume bar last week - big volume bars like that often signal a short term high or a low. Look through the chart and see the big volume bars and how they often correspond with a turn in price.

I am not saying its time to panic, just bear in mind the trend the last 8 or so weeks has been a rotation from big to not so big. The top 100 into the 100 to 300. Can it continue? Probably yes - when a trend starts it often surprises to the upside but it could be a time for some consolidation or perhaps even a pullback in the Small Ords.

Lets see!

Until next week.

Peter

Market Comments 12/9/25

I am back from a 2 week cold, I just couldn't shake it, anyway, here we go with this weeks comments.

The XAO took a breather this week, as always this chart does not reflect whats happening in other sectors. A few went up and a few went down, the stand out sector has been Gold but financials and Real Estate did ok as well. If you want more info on sectors have a look here. Its a good idea to see where the strength is in the market.

https://www.asx.com.au/markets/trade-our-cash-market/overview/indices/real-time-indices

Another way of course is to take note of stocks making 52 week highs, stocks within sectors tend to move together.

The chart above shows the price pullback during the last 2 weeks, the OBV is resting on its trend line and the MFI is pointing down, showing a negative divergence. You can see over the recent 12-14 weeks the MFI was not going up with the price, indicating an overbought situation was happening and increasing the chance of a pullback.

However pullbacks can just be a rotation from one sector to another, as mentioned, the gold sector went nuts and other sectors found support while some fell. Sooner or later the gold sector will be overbought too and it will pull back. See the chart below to see what I mean.

The chart above does represent the major gold stocks on the ASX, as you can see it looks overdone but as I often say trends can surprise to the upside. This week 7 of the 8 alerts are gold stocks. I still think the junior gold stocks have more room to move up as they have lagged the performance of the bigger companies.

If you look in the 52 week high alerts this week, you can see some smaller gold and silver stocks making yearly highs now, where as the bigger companies did this many months ago (some a year ago). If I do a scan across the whole market (1762 stocks) I get 29 fifty two week high alerts, 90% of those are miners. And! that's not including stocks under 10 cents - if I include those I get another 8 alerts.

So, we know where the love is!

Until next week,

Peter

Market Comments 29/8/25

The All Ords just keeps grinding higher. Please have a look at the alerts this week - you can see the smaller stocks are dominating the new high list. A rotation from the gorilla stocks into the mid and small caps, was something talked about a lot over the last few months, by others and myself, often here on this page. Now, it's clearly happening. Please go down to the next chart.

The Small Ords has made an all time high (ATH). The OBV made an ATH back in mid June, giving us an indication that price may follow. There is still some bearish divergence from the more dynamic MFI, as I have drawn on the chart above. However this is a very strong market and apart from a bit of daily and intra week volatility, it does appear that it just wants to continue going up. The MFI is at a level of 68 and its been at 90 previously - think about that :)

Gold: The gold price has been in a consolidation pattern for a few months now but on Friday in the US it broke higher. Gold stocks responded by rising nearly 5%. This should spill over into the gold and resource stocks here in Australia - further supporting the rotation from gorillas to smaller primates.

Alerts below, apologies for missing last week, I had the flu.

Regards

Peter

This weeks 52 week high alerts for 29/8/25

ASX 100: COL

ASX 100 - 300: (The Small Ords) CYL KLS LOV RMS SDR SIQ WAF WGX

ASX: 300 - 500: DUR SMP SPZ SVR

Market Comments 15/8/25

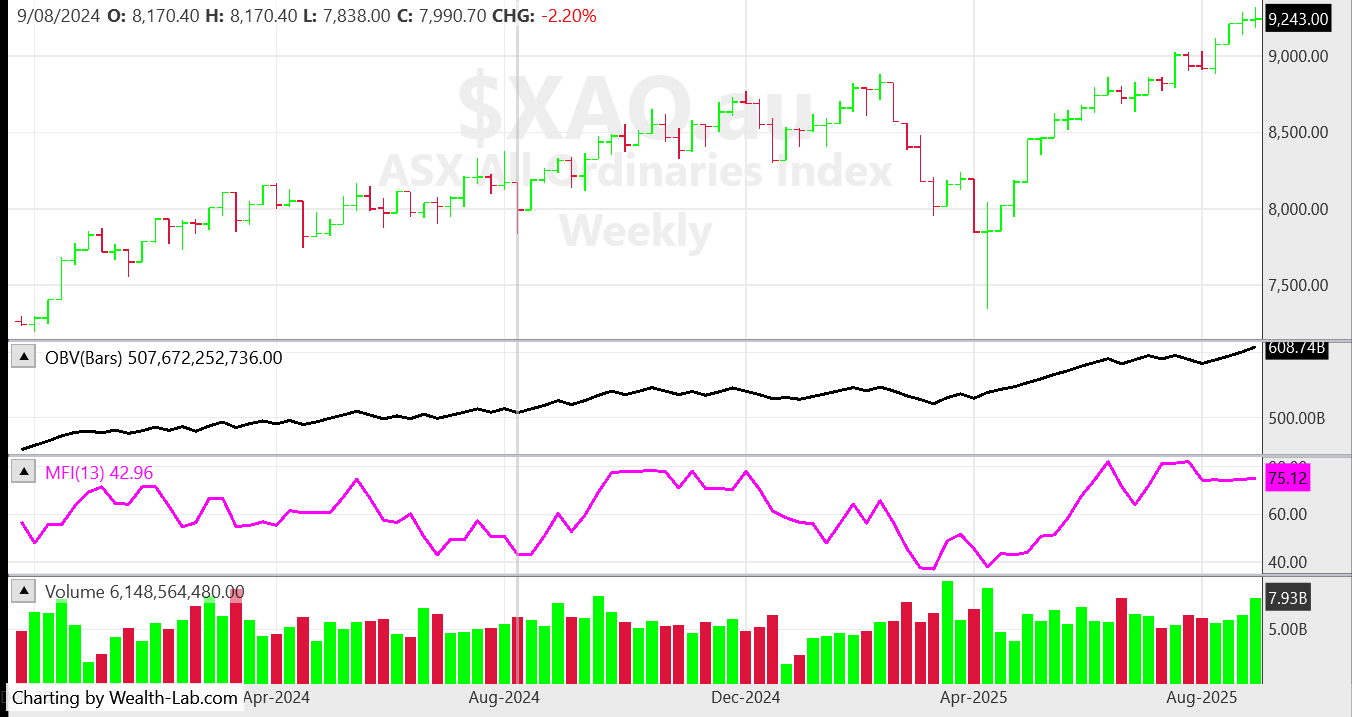

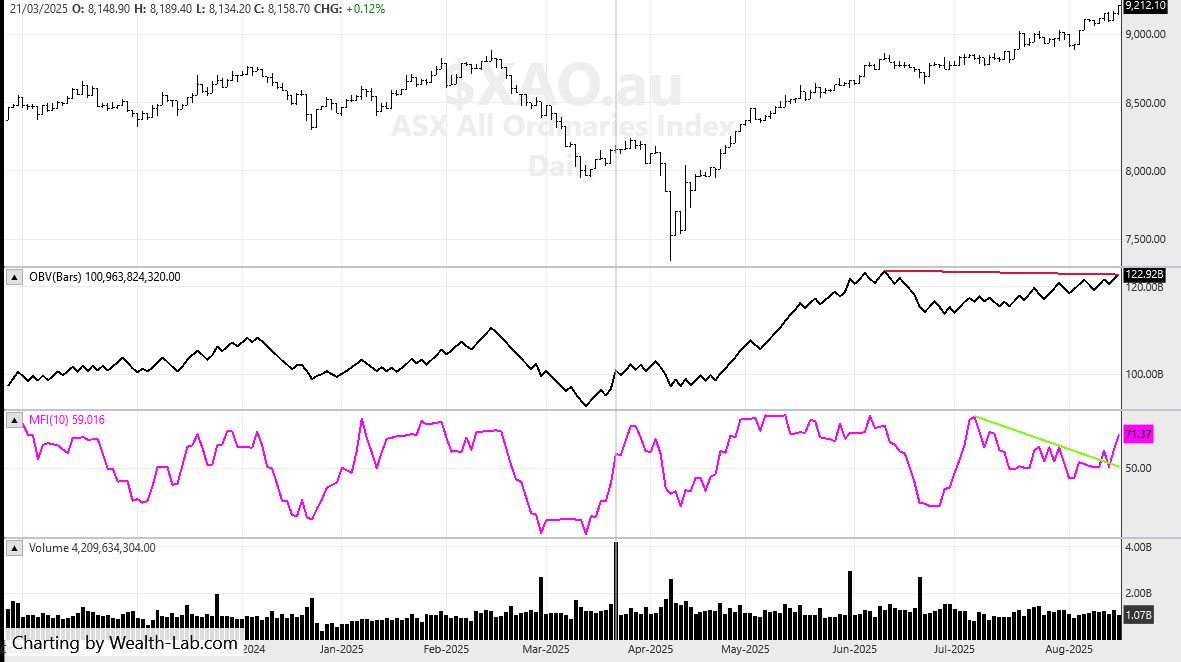

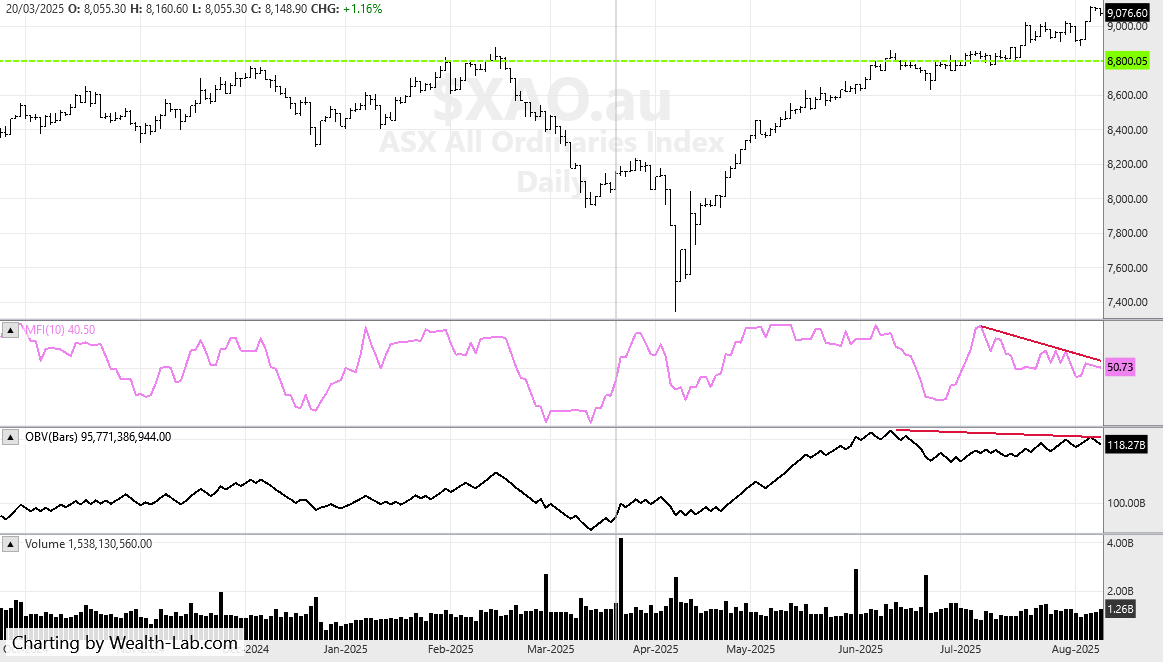

So the index continues to rally, ignoring any bearish indicators. It goes to show that "price is the ultimate indicator". I have posted two charts above, one weekly, one daily. The weekly chart clearly shows volume divergence and a double topping of the OBV. However the daily chart has broken up past the 10 day MFI - but, its still double topping the OBV.

Something I have been mentioning for some time now is the sneaky rally in the smaller cap stocks. This week in the alerts section I have split the grouping more, so you can see what I mean. There were 17 alerts in total this week, but only two 2 alerts from the top 100.

Also, another very important factor, something I have not seen since 2003 to 2007, is the rally in the Materials sector AND Financials and Industrials (and many other sectors) AT THE SAME TIME.

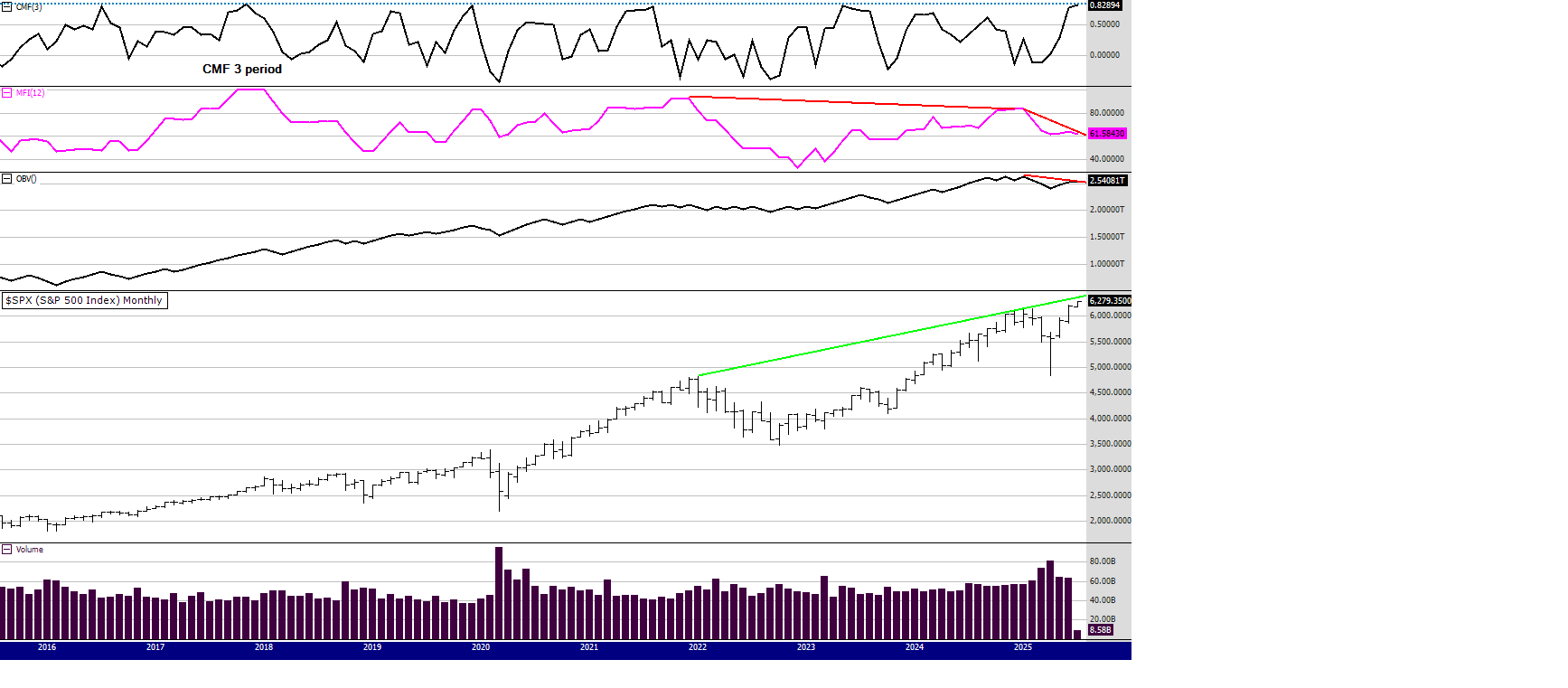

Often in the Australian market, many sectors don't boom together, its more of a rotation between sectors. However occasionally when we get the perfect storm for the Australian economy, the index can keep pace with the US market, which does not normally happen. It is unusual for the XAO to keep pace with the US market because we dont have the Tech heavy stocks. The chart below shows what I mean. The red line is the SPX, the black bar chart is the XAO. You can see how during 2003 to 2007 the XAO kept pace with the US, before then under performing for many years. Are we about to play catch up because all our sectors are rallying in unison?

Looking at the broad based rally happening at the moment, perhaps so.

Alerts below,

have a good week.

Peter

This weeks 52 week high alerts for 15/8/25

ASX 300: ANZ HDN MAF MYS TUA TYR WBC

ASX 100 - 300: The Small Ords: HDN MAF MYS TUA TYR

ASX: 300 - 500: BBN BIS C79 CXO DXC FEX NGI PWR SXE XRF

Market Comments 8/8/25

This chart still looks over bought to me. Scroll down to the daily chart below, where the over bought condition looks more obvious.

Hmm, well the market made a fool of me last week, I was saying the probability was it would fall - but it went up. And! there were 12 buy alerts in the Mindful system in the ASX 500 (see below)

I did notice last night in the US that the Nasdaq rose but the DOW, SPX and Russell all lagged. So maybe the Nasdaq can drag the other indexes up. I have to run - soccer duty calls, come back later for more charts.

Lets watch that 10 MFI closely to see if it breaks back up.

Peter

This weeks 52 week high alerts for 8/8/25

ASX 300: AMP COF CQE DRR GPT GWA IMD

ASX: 300 - 500: ALK ASL BTL JMS LFG

Market Comments 1/8/25

I have an updated charting package, so the chart has a slightly different look.

This week I will go straight to the daily chart as I think at the moment, it is arguably the most telling of what the index is doing. You can read my comments about the weekly chart and longer term picture - by reading last weeks comments. I did comment last week "volumes look stretched".

Going back to the daily chart above, its very easy to see the bearish divergence on the volume indicators. The MFI is using a short term 10 day (2 week trading period) and looks further to fall before reaching over sold (OS) levels. Those OS levels are shown by the red dotted horizonatal line.

You can see too that the OBV has further to fall before reaching its support trend line.

Price: as I often say is the ultimate indicator. Price has long term support at 8,800 points, (see horizontal green line) which is only 1.5% away from Fridays close. That 8,800 points is a very important line in the sand.

Another very important line in the sand is the OBV trend line. I would think for that to be reached, price would fall to around 8600 or 8500. If that line is breached I would have to reassess the situation to see if it had support or looked to fall further.

Coming back to the NOW, 8800 seems very likely in the short term - possibly as early as tomorrow (Monday 4th August).

Consider this too. We are now in early August. The Sell in May cyclical pattern was delayed by the Tariff recovery rally. However September can be a volatile and down month. Don't believe me. Look at the data and chart on this link

https://www.asx.com.au/blog/investor-update/2024/the--best--and-the--worst--months-for-shares

Also, price often moves in 6 week cycles - that's my experience of 30 years of trading. Have a look at the weekly chart from last week and see how often that happens, when price pauses after around 6 weeks. So, we could get a 6 week fall taking us up to early/mid October - when October normally rallies, and sometimes not until late in the month, in preparation for the seasonal Xmas rally. (note again the link posted)

Of course we can speculate until the "cows come home" but the bottom line is, that this market now looks under pressure and so we all need to be diligent in taking our stops - whatever levels they may be at. Despite all my opinions above, there were still buy signals in the Mindful system and they are listed below.

If you have managed to read this far (thank you) I have decided to post the weekly chart. You can see the 13 period MFI (one calendar quarter) and how high it is. If it was to fall to its lower levels like it did in April 2025, the index would be looking at around a 1,000 point fall. Ouch! You can clearly see the negative bias of traders over the last 2 weeks, shown by 2 red down bars - another ouch.

Have a great week, stick to your process and do what you need to stay physically, mentally and emotionally healthy,

Peter

If you want more information about the Mindful system, or my latest book The Zen Trader, click here

https://www.easysharetradingsystems.com.au/products-and-services/e-books

This weeks 52 week high alerts for 1/8/25

ASX 300: MMS NEU NHF STO

ASX: 300 - 500: SGLLV

Market Comments 25/7/25

A small reversal this week on the weekly chart, volumes still looked stretched. Also that was a big volume bar last week, with the bears winning the week as the close ended down towards the bottom of the bars range. I thought this week we might drill down into a daily chart - as the market appears to be at a critical juncture.

I realise that the XAO chart can be misleading as its governed by the large stocks. Particularly banks. If banks fall so does this chart, even though other sectors may be performing well. However on a daily chart, as is posted above, it looks to be under some pressure. The divergence between price and volume is obvious. However there is strong price support at the blue horizontal line and the OBV also has a strong upward trend line. Price may well fall to those levels mentioned and then continue the march onwards and upwards.

Here are a few comments about sectors: financials sold off, energy had another strong week, health had a very strong week, information technology eked out a small gain, materials had a very strong week (supporting the XAO index as banks fell), staples fell as the risk on mentality continues and property fell a little. Despite me willing it on, the Gold sector fell again this week, with the stand outs being the big miners.

Another standout sector was the Small Ords (the 100 to 300) the chart (not shown) looks stronger than the XAO - see alerts below. My explantion for this is it does not contain the big banks - but does contain many smaller resource and Tech companies.

Have a great week, alerts below.

This weeks 52 week high alerts for 25/7/25

ASX 300: ABB EBO HSN IPX LTR PNR PXA RMD WA1

ASX: 300 - 500: ECF FID MGX QOR SKS

Small Ords: All stocks in the 300 alerts section are in the Small Ords except RMD

Market Comments 18/7/25

If ever there was a time to follow the saying "price is the ultimate indicator" it's probably now. The price continues to defy the indicators by breaking to a new all time high. Every sector went up this week (except gold) and health was the standout.

The index is high, it looks over bought, some indicators are diverging, double topping or not confirming the rally - but the price continues going up. I did say last week

" one would expect our index to hold up well, perhaps rally"

but the strength of the rally surprised me.

So, alerts are below, not much in the 300 this week but four in the 300 -500.

I will come back later and post a few more comments

Have a great weekend

Peter

Market Comments 11/7/25

When I ran the scan for the Mindful System on the ASX 500 today - there were 2 buy alerts and 15 sell alerts, so that gives you an idea of the current mood! Price action on the ASX 500 was ok this week, but you can see the MFI has double topped and the OBV has broken its strong uptrend to the downside. Also, we can see price double topped a few weeks ago.

Even though the index (ASX 500) is fairly steady, it doesn't show whats happening within the different sectors. Some sectors are falling but the index is being supported by the rotation into the Materials index, Utilities and Energy. I notice too the $A is holding up well, partly because of the surprise hold from the RBA but no doubt also because of the strong commodities market.

On Friday in the US the commodities rally continued with BHP and RIO (listed in the UK and US) both had strong performances. So one would expect our index to hold up well, perhaps rally. Gold and silver also rallied.

It remains to be seen if other sectors like Tech, Finance, Consumer and Industrials can hold up.

Have a great week and..........

If you want any more info just email me by going here.

https://www.easysharetradingsystems.com.au/contact-peter

If you didnt see last weeks post srcoll down for some interesting charts.

Here are the Alerts for this week below,

have a good week,

Peter

This weeks 52 week high alerts for 11/7/25

ASX 300: AEL BSL

ASX: 300 - 500: None this week

Market Comments: 4th July 2025

Apologies for skipping last week, I had a few website problems. on the weekly chart the market really looks like it wants to keep going up. Even though there is a slight divergence on the MFI, the OBV continues to point up. The other consideration for the bull argument is that the 52 WH system keeps pushing out signals, the 300 to 500 in particular is looking strong.

However, some negative news make take the steam out of this rally, so we will have to wait and see if that comes. Next week the RBA meet to decide on interest rates, one would think that will make an impact - one way or another.

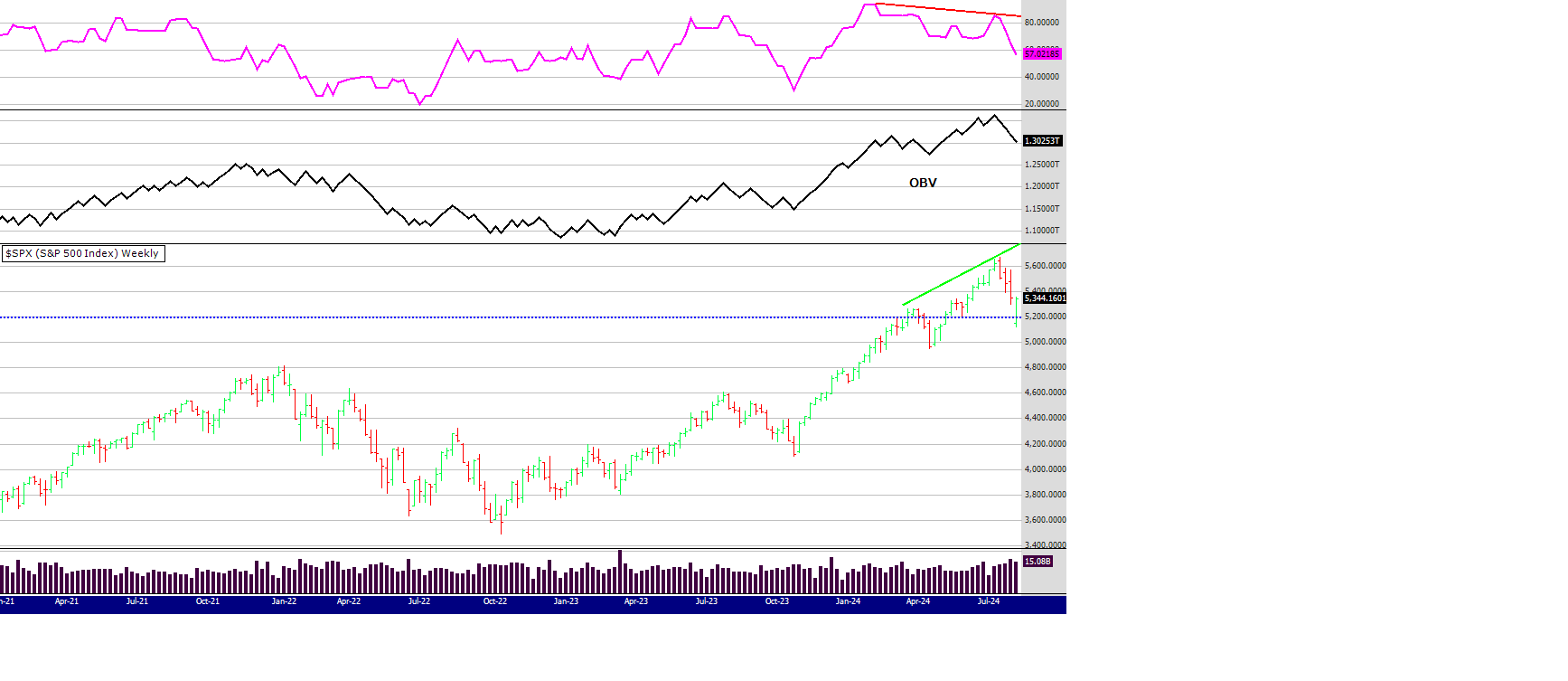

The chart below is a monthly of the SPX in the US. When I look at that I see what the bears are concerned about. Indicators are either diverging or at the top of their range. Nearly every time the CMF (Chaiken Money Flow) gets up to that high point, the market corrects. Its been an amazing rally the last 2 years and its makes one wonder how long it can last. Something I find concerning is all the bullish calls lately, "melt up" etc., always a red flag IMO.

All

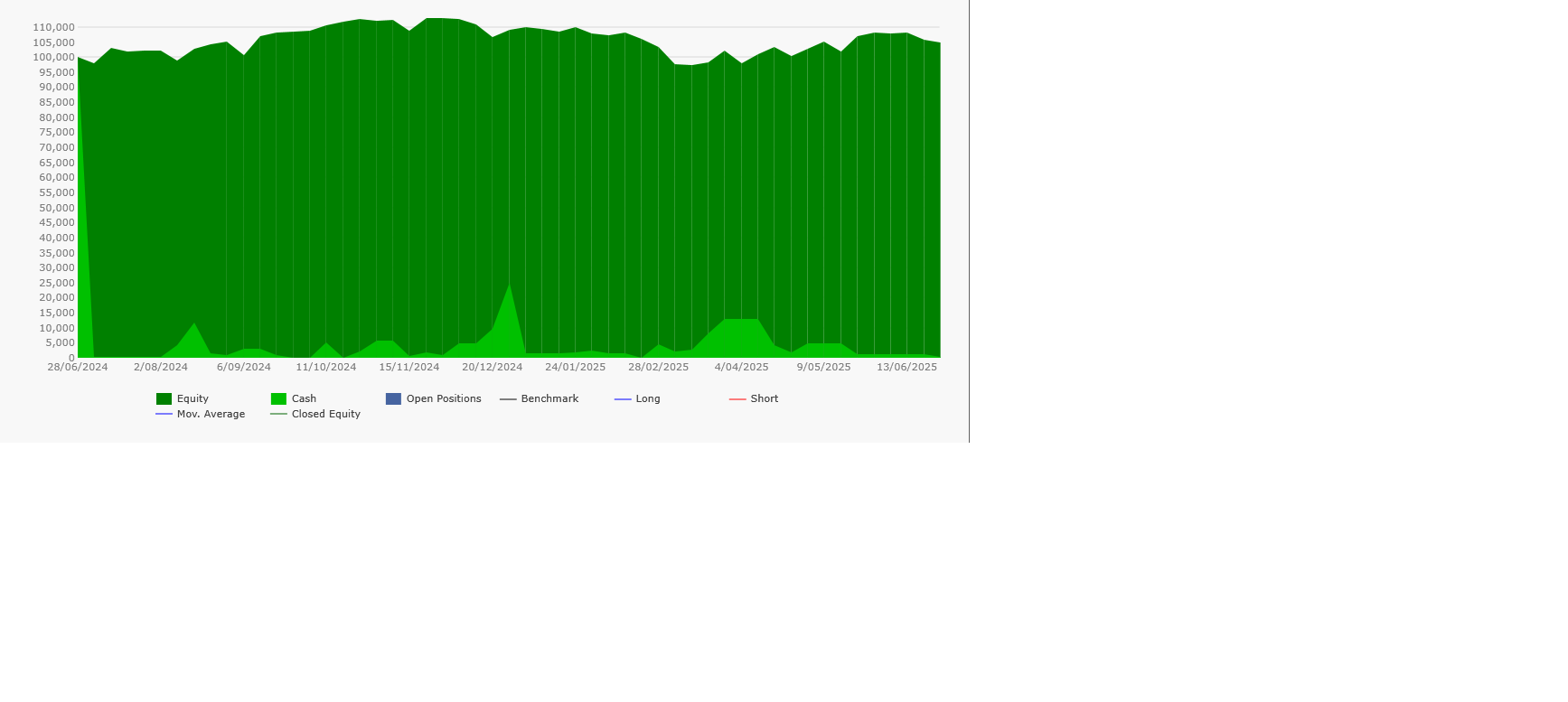

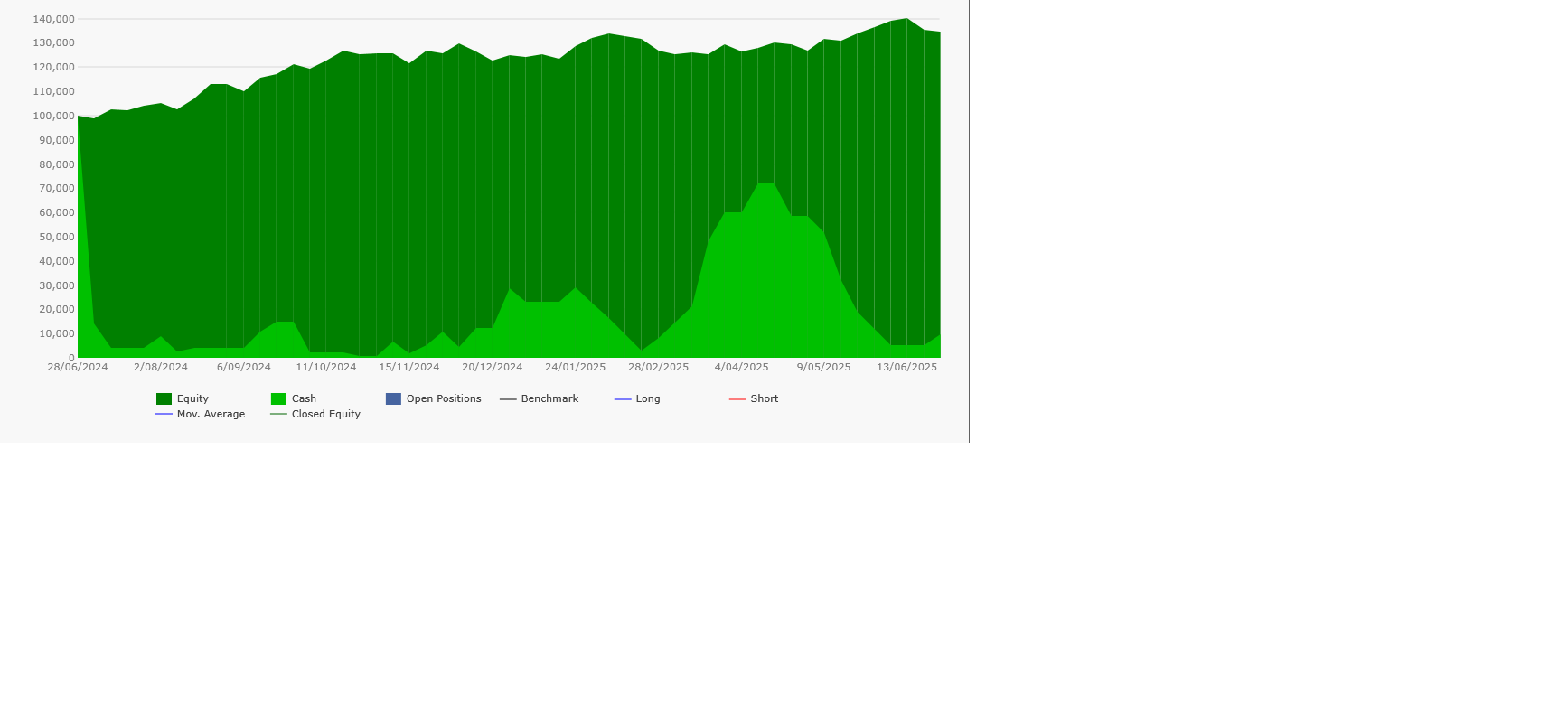

As you know I do teach a longer term approach - I call it medium term, attempting to balance between trading and investing. I posted some result charts for the last 2 years here on this link https://www.easysharetradingsystems.com.au/easy-share-trading-systems/peters-portfolio

As well as charts on that link above, here are some more. The chart below is the Mindful system the last 12 months, not the best year up almost 10%, but bear in mind the year before was a cracker up nearly 85% (see the link above)

Keep scrolling down.

The chart below shows the last 12 months trading a list of fundamental shares (information withheld for private clients) up 35% for the year. Same system, same sizing, same entry, same exit, just a different stock list.

Its the same old story, have a system that has a positive expectancy (like the Mindful system or similar) learn how pick good stocks, work on your psychology and how to mange the trades. Its simple but at times not easy.

If you want any more info just email me by going here

https://www.easysharetradingsystems.com.au/contact-peter

Here are the Alerts for this week below,

have a good week,

Peter

This weeks 52 week high alerts for 4/7/25

ASX 300: PME RUL SCG

ASX: 300 - 500: 3DA CBO GDF LGI MAD URF

Market Comments: 20th June 2025

The chart above is a live chart as of 3.30 pm Monday 23rd June - when I am writing these comments. However as I said last week, it did appear the market looked ripe for a pullback (see last weeks comments below) and with the latest news coming from the Middle East, the trend appears to be coming down - at least in the short term until the charts give us more information.

Looking at the chart above you can see the MFI was overbought and could fall to the 35 area before reaching oversold areas. The OBV is still trending up well but can fall more before it reaches its uptrend support line. The price double topped, and has a possible magnet of around 8000 where there is lots of horizontal support - where I have drawn the blue dotted line. That blue line also meets the green uptrend line - which I have drawn through the weekly closes, not just the weekly bar lows. If I drew the line through the weekly bar low points it reduces support to around 7600, with all that price and volume support at 8000, let's revisit that scenario if it happens.

Trading is about probability and when we consider the short term overbought status of the market, the time of year and the troubles in the Middle East, the probability remains high the XAO index will keep pulling back. But! anything can happen, some may remember what happened in 2003 when the US invaded Iraq, the markets took off like a rocket. However, it had tread water for 3 years and once the uncertainty was over the market rallied. This market is coming off a double top and a V shaped rally so I think its fair to say its a little different scenario.

Markets dislike uncertainty and there is plenty around at the moment. Despite that, the 52 WH system still produced 7 signals this week and they are listed below.

Until next week

Peter

Market Comments: 13th June 2025

This week I have two charts to discuss, the ASX 500 (All Ords) and the Nasdaq. I have mentioned many times how the ASX 500 is a different index as it includes many banking and commodity stocks, the Nasdaq as we know, is mainly Tech stocks. So the two indexes will look and perform differently as the economic cycles change.

However the Nasdaq still effects many other global indexes and the ASX 500 is not immune to the fortunes of the large US indexes. When we compare the two indexes you can see the ASX volumes look more supportive, this makes sense from a fundamental perspective as we know there is currently a big interest in commodity stocks, from both growth (rare earths) and saftey (gold, oil) reasons.

However, the ASX 500 volume indicators are very extended to the upside and the price is double topping.

The Nasdaq is also double topping and the volume indicators are bearish. Does this mean a fall or even a crash? No. It means traders and investors are mindful that this rally has been hard and fast, uncertainty is still there (well, it always is), a pullback and some consolidation is likely more probable - than a continuation of the rally.

Its going to be interesting to see a few things

1/ if the market now pulls back

2/ how far it pulls back

3/ if it keeps going without a pullback

Trading is about probability and I think it will pull back, because we now have an overbought situation where as 10 weeks ago, we had oversold one (being mindful I could be wrong). I am talking about the indexes pulling back when I say that, individual stocks and sectors may well continue to power on.

The thing to watch will be the depth of the pullback, if its shallow and the market turns back up quickly, we may well get the melt up some are predicting. If the pullback is deeper and longer, the market will do its usual slowdown and consolidation for this time of year - and build for a rally around October to December.

Of course black swans can occur, the latest being the threat of an Israel/Iran conflict. That concern helped the gold sector this week, if you scroll down to last weeks comments, I covered that sector there.

Until next week,

Peter

Ths weeks 52 week high alerts for 13/6/25

ASX 300: KAR ORG RIC WGX

ASX: 300 - 500: CGS

Market Comments: 6th June 2025

What happened to Sell in May? What will it take for this recovery to slow down? Looking at the chart above and the positive divergence between price and volume - it appears the bulls are well in control. The MFI is sitting at a reading of 74, the over bought level is around 84, so one would "think" its getting a little over extended. Technically, a double top in price is very close and if there is to be a pause, some profit taking and some "waiting" for prices to fall so traders can reload, it may happen soon.

This is where the psychology of traders rules fundamentals. If the hype (maybe its not) around AI continues and things settle a bit in the US, we could get FOMO send the market on a new leg up. Also, looking at this data of stock seasonality, (click on link)

https://market-bulls.com/seasonal-tendency-market-charts/

you can see that July can be a very strong month.

The Gold market: I notice the large and mid cap sector gold stocks are looking a little tired. (There are a few exceptions) Something that happens towards the final stages of a gold bull run is that junior stocks start to run hard. Look at this chart of the Vaneck Gold stock juniors in the US. It does not show it on the chart - but that's a 15 period RSI, representing 3 weeks of price action. As you can see its been a good run up in this sector, and why not? With gold still looking strong the stocks have (finally) responded. The other thing supporting the theory that the precious metals may be in the final stages (which can be the most dynamic) is the silver price. The silver price has recently made a new high and silver does not normally rally until gold is in its final stages.

However! as I like to say - I wouldn't short it! A small divergence like the one above does not mean this cant go higher - much higher. The weekly chart below shows that.

until next week, Peter

Ths weeks 52 week high alerts for 6/6/25

ASX 300: ALX BKW SGH XRO

ASX: 300 - 500: EOS KSL QAL

Market Comments: 23rd May 2025

This week I have gone back to a chart with comments. I have missed the last few weeks and I will be missing again next weekend as I am away on a Zen retreat.

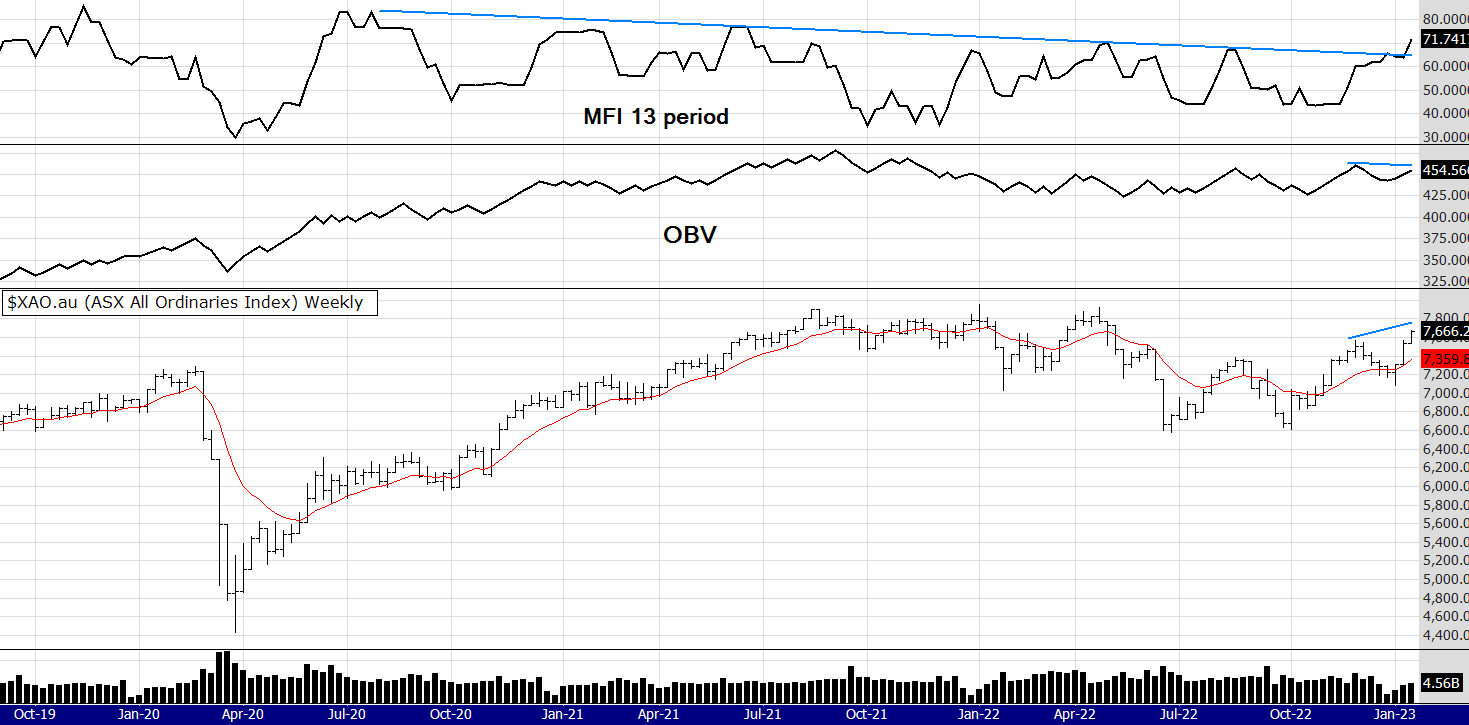

I remember saying I wanted to see a decisive break up on the volume indicators before I was convinced this rally had real merit. The chart above shows now we have that. The OBV has made an all time high and the MFI 13 has broken its downtrend. Also the 52 week high Mindful trading system continues to produce buy signals which is always a positive sign. Lets look at another chart from the US, the SP500.

This index does not look as strong to me as the ASX does. I was a little surprised this week to watch a video produced by Marcus Padley saying that the XAO was not the place to invest but he preferred the US. I do agree with him that for the ASX to outperform the US we need a resources rally. So I suppose that's the bet isnt it? Will the resources market continue to rise?

Anyway, getting back to the chart - even though the MFI looks positive the OBV looks line ball to bearish, and no where near as strong as the ASX. Also last weeks bar looks to be a reversal - but - low volume so perhaps not a lot of conviction yet from the bears.

We are now at a critical point IMO. The price and indicators are suggesting a pause in what has been a quick recovery from the Trump tariff sell off. We are in May (almost June) and seasonally its a bearish time for the market. The important thing to watch is that OBV on the SPX, if that breaks to the downside IMO it will be a bearish sign - for the US market anyway. The ASX could continue to peform if our banks and resource stocks hold up well.

So, I will be back in two weeks, in the mean time good luck and trade well.

Peter

Ths weeks 52 week high alerts for 23/5/25

ASX 300: ADT CDA CGF CLW PRN SRG VNT

ASX: 300 - 500: CDP MAU VNT

Market Comments: 2nd May 2025

Below is a link to a video with market comments, then below that are the the 52 week high alerts. I have also posted an equity curve result of the Mindful Trading system (scroll down a little). This week is very strong with 13 alerts in the ASX 300 and 9 in the ASX 300 to 500.

*Please scroll down for one year results of the system.

So despite the market pullback and volatility it's still giving buy signals.

I hope you enjoy the videos and please let me know what you think so I can make improvements.

If you want to know more about this system and others go here:

https://www.easysharetradingsystems.com.au/products-and-services/e-books

ps: if you decide to buy the eBook please email me and ask for the appendix

Also more charts and info here:

https://www.easysharetradingsystems.com.au/easy-share-trading-systems/peters-portfolio

This weeks video

2nd May 2025

25th April

Ths weeks 52 week high alerts for 2/5/25

ASX 300 : ALQ BGA CAT CBA DVP JBH MGR NCK SGP TCL TLC TPG WES

ASX: 300 - 500: AGI CWP D20 DXB FCL DBI GNP OBL PPM

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 25/4/2025

ASX 300 : AFG VCX

ASX: 300 - 500: COG SVR

52 week closing highs as of the Fridays close 18/4/25

ASX 300 : BOQ CQR LYC NEM RMS SLC VAU

ASX: 300 - 500: ARU DXC SX2

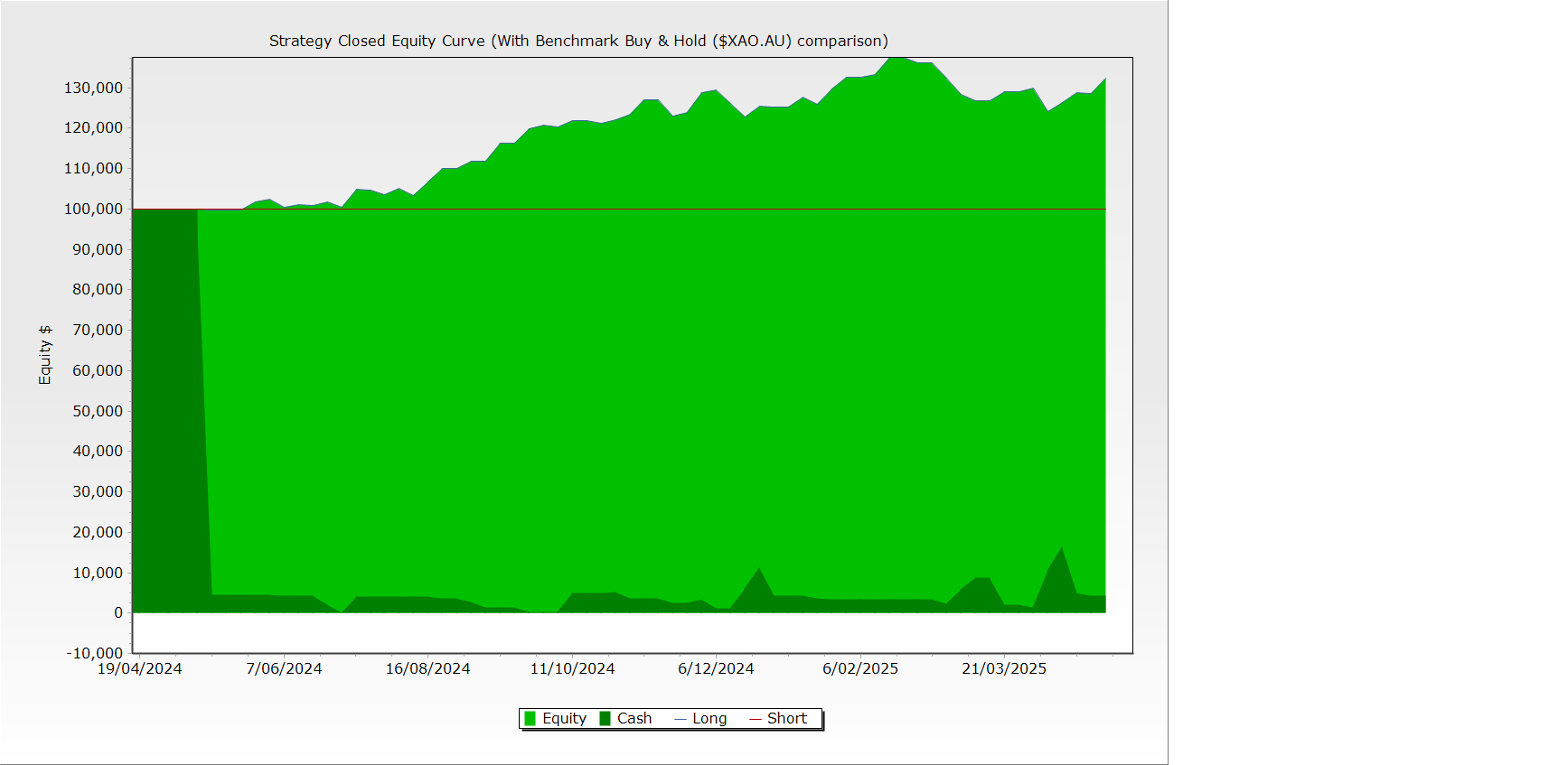

Below is the equity curve of the Mindful Trading system over the last 1 years.

System return over the year is 32% - not including dividends

If you want to know more about this system go here:

https://www.easysharetradingsystems.com.au/products-and-services/e-books

ps: if you decide to buy the eBook please email me and ask for the appendix

Also more charts and info here:

https://www.easysharetradingsystems.com.au/easy-share-trading-systems/peters-portfolio

Hi to regular readers. I am taking a break for 3/4 weeks. On the 1st March my partner (of 7 years) and I have decided to tie the knot. In the lead up to the big day we have lots of prep and then a break afterward. I should be back here around the 2nd week in March.

Until then stay safe and trade well,

Regards,

Peter and Cynthia.

ps: you know about me but if you're interested here is a link to Cynthia's website https://thrivingself.com.au/about/

Market Comments: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period for 7/2/25

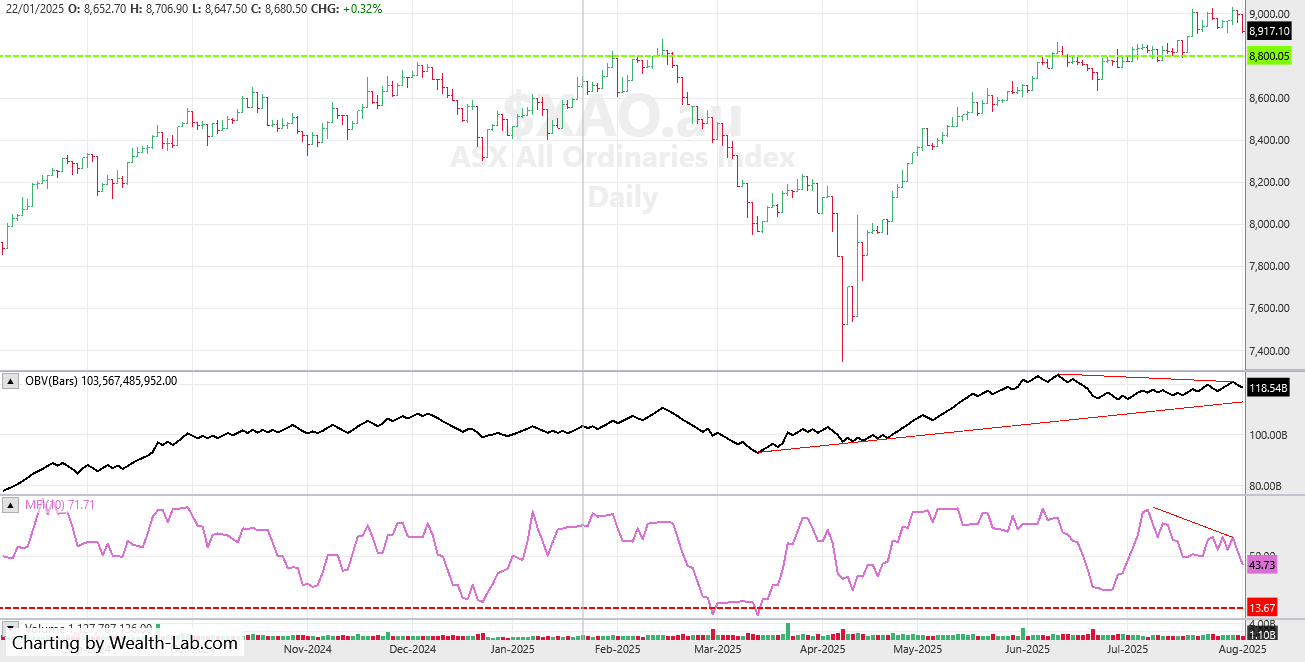

This week I have something to discuss as the charts are showing a change of mindset from traders. Look at the right side of the chart. The price is trending up, shown clearly by the green line I have drawn. However the OBV has "double topped" and the MFI is now showing a clear negative divergence - you can see the red line I have drawn showing a down trend. Time to panic?

No.

However, looking at the chart it appears price has got ahead of itself. Certainly ahead of volume. It was still a very positive week with the index closing up near its highs but it now appears it wants to take a breather. This coming week we may not see the continual uptrend we have the last 6 to 7 weeks.

Alerts are below, showing some interesting developments.

Until next week

Peter

52 week closing highs as of the Fridays close 7/2/25

ASX 300 : AFG MAF NCK PDI (all of these in the 100 - 300. (I suggest you read last weeks comments about rotation from large cap stocks to the smaller ones)

and more interest in this sector too........

ASX: 300 - 500: ABA DUR PNR SSR

Market Comments: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period for 31/1/25

My comments are getting to sound a little like the movie Groundhog Day - the movie where every day is a repeat of the previous except I am discussing a weekly occurrence. Some overhead resistance is looming on the 13 period MFI but until that is reached its onward and upward so the chart suggests.

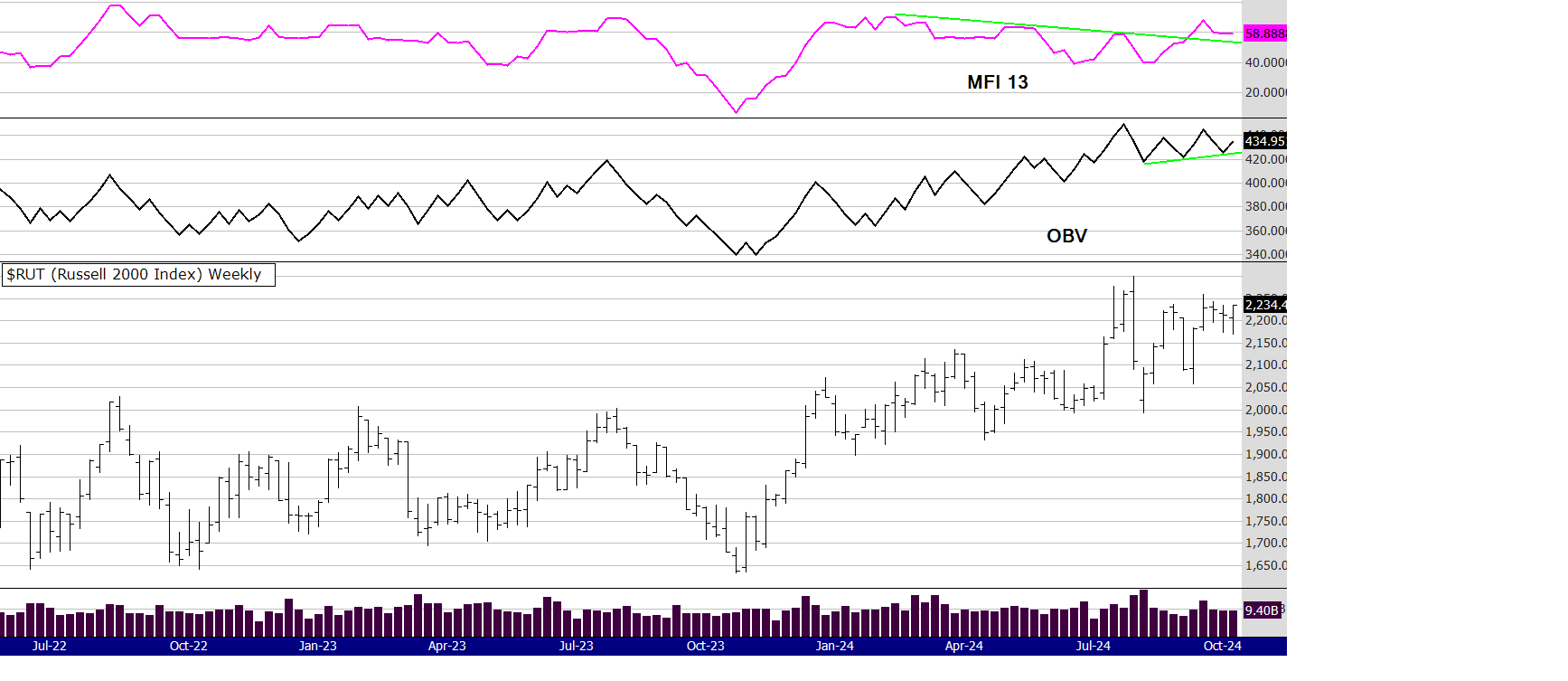

Something I have mentioned many times here before is the rotation of money out of the Nasdaq 100 and into the Russell 2000. I am not going to show the charts as they are easy enough to google but I will say this.

The Nasdaq looks a little toppy and overbought but the Russell appears to be trending upward more steadily. This is a big deal in my opinion. The fear (always plenty of that) has been that the overbought Nasdaq will crash the markets. But, or maybe I could say "however " - if money flows out of the Nasdaq 100 and into the more broad based Russell of 2000 stocks, this can only be a good thing for the US and ultimately the global economy?

Food for thought.

Another comment is this: The Russell 2000 has a strong correlation with the ASX 500 - makes sense when you think that Australia does not have a big Tech sector as the US does - largely represented by the Nasdaq 100. As the Russell goes so often does the ASX 500.

The strong performance this week in the US by the Russell shows up in the ASX 500 alerts this week with 10 alerts for the 52 week high system - all in the ASX 300 sector and 7 from the Small Ords sector (100 to 300 on the ASX and the index similar to the US Russell) .

Now that should tell you something.

Have a great week

Peter

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 31/1/25

ASX 300 : ACL EBO EMR HVN MPL NAB RIC RMS URW WES (7 of these in the 100 - 300)

ASX: 300 - 500: None

Market Comments: See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period for 24/1/25

Before reading this weeks comments I suggest you read last weeks, for not a lot has changed. The market continues to be strong. Price and volume action are trending up well from oversold areas on the chart. The next challenge for the price will be a double top but volumes have a while to go before getting back into over bought territory and if I was going to predict (as you know I don't) the probability is price will exceed the previous high.

Lets see!

I hope you are all having a nice long weekend break and that the good vibes continue in the market.

ps: my suggestion for the Australia Day controversy is to keep the date but change the name.

Recognition Day is my suggestion which hopefully covers every ones feelings.

All the best

Peter

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 24/1/25

ASX 300 : COL MQB OPT

ASX: 300 - 500: SFC

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period for 17/1/25

IMO the index above looks strong. Price support lines are holding well. The OBV support line is holding well. The weeks price has closed to the upper range of its bar. The volume bar levels are improving. The MFI is oversold and holding its trend line. So, it appears the mindset of traders and investors is becoming less fearful. Seemingly driven by some positive economic data coming from the US (high employment) and talk (hope) of an interest rate cut here in Australia because inflation is falling - many householders would disagree with that one!

The investing world now waits for President Trumps 2nd inauguration to decide if or where to invest. I find it amusing many are concerned about what he will say, or not say during his acceptance speech. Whatever he says (maybe he will say little?) no doubt interpretations will be made.

However, if we are to remove the noise from the media and their interpretations, and just look at the chart, it looks bullish. We may have low volumes again this week because the US market only has a 4 day trading week due to the Martin Luther King Jr public holiday (an unfortunate clash with President Trumps inauguration day).

Have a good week,

Peter

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 17/1/25

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: INA

300 : BFL

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period for 10/1/25

Its hanging in there this index. We STILL have low volumes this week. The U.S. markets had a 4 day trading week because of Jimmy Carters funeral, so we did have one day on the ASX "without a lead" from the U.S. We really do play follow the leader. The ASX had six new 52 week closing highs which did surprise me a little as trading this week seemed insipid. Lets look at the U.S.

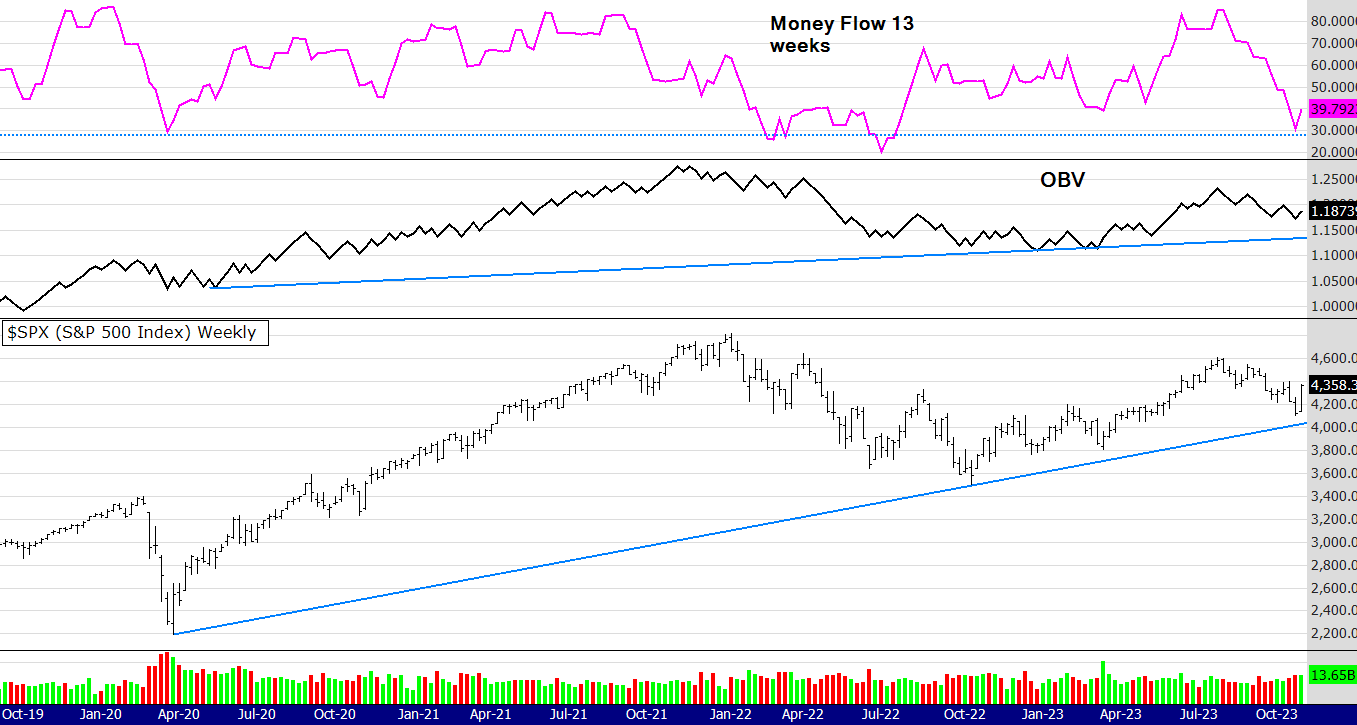

The SP500 looks to be weakening. Although the price is still trending up quite well, volumes have broken down. There is a bearish divergence between price and OBV. Also the MFI 13 period (one calendar quarter) has broken below its trend line. They are not big divergences or big breakdowns - but small breakdowns can quickly develop into big ones. Of course we know the SPX in the US is dominated by big tech, but the ASX appears to be holding up better with the resources, energy and materials sector which all had a strong week.

It appears inflation is the big fear at the moment - resulting in LESS cuts from the Fed than the market wants or expects. I read today the following script below, taken from this link here

https://tradingeconomics.com/united-states/stock-market

US Equities closed sharply lower on Friday, following a stronger-than-expected jobs report that dampened expectations for further interest rate cuts by the Federal Reserve in 2025. The S&P 500 and Nasdaq 100 both dropped 1.5%, while the Dow Jones plunged almost 700 points. The December jobs report showed a robust labor market, with 256,000 new jobs and a decline in the unemployment rate to 4.1%, surpassing forecasts. This raised concerns that the Fed could keep rates elevated for a longer period.

So it's a strange world, but that's markets. Despite a very strong employment report (the fear was it would be otherwise) the markets focus is really on rates. Until we get more certainty on this matter the markets may continue to flounder. As mentioned last week the big event is probably Trumps inauguration. What will he say to trigger the markets up or down?!

Have a great week

Peter

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 10/1/25

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: MND LTM SHV TPW

300 - ARX CYC

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period for 3/1/25

I am still in holiday mode :) and volumes are very low, so I wont say a lot this week about Indexes until we get more data to show which way this market will go, up, down or sideways.

I am writing this on Monday 6th Jan after the Mondays close, so that explains the odd last bar with extra low volume, as its only one days trading. The 2 shortened trading weeks over Christmas and New Year were actually quite bullish - but again the low volumes may not account for much of an indication. The OBV indicator looks supportive however the 13 period is trending down.

At the end of this week with a full weeks trading we will have more of an idea of how this index and others are looking. Some things I have noticed over the holiday season are the following:

Oil has had a bounce off its recent lows.

Bitcoin is back up towards US 100K - 99,250 as I write.

The smaller cryptos have also bounced from their recent sell off.

Gold is trading sideways and there are still quite a lot of gold stocks running well in the 52WH system.

The Russell in the US looks to be consolidating - will it attract more buying if the rotation from big caps to mid caps picks up steam?

The markets will probably worry their way towards Trumps inauguration on the 20th Jan. I expect that narrative to gather momentum over the next two weeks so some increased volatility is more probable IMO.

In the last month the CRB index (commodities) has risen 4% and made a 52 week high.

Alerts below, have a great week.

52 week closing highs as of the Fridays close 3/1/25

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: None

300 - 500: EBR

Have a good trading/investing week.

Peter

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period for 27/12/24

A few things to remember when looking at this index of the ASX 500. Its dominated by the top 50 - even more by the top 20. Also we have had only a 3 day trading week, one of those days a shortened trading day of Christmas eve. Note the low volume.

In saying that there were warning signs of it being overbought - the OBV and the MFI were diverging down as can be seen with the red lines I have drawn on the chart. This is still a healthy looking and trending chart, there are no serious volume to price divergences and price has bounced off support. But. Its too early to tell if this is a correction or something more serious - particularly with such low volume and not a full weeks trading. The coming week will be similar with another shortened 3 day trading week. Below is a chart of the Small Ords which is the 100 to 300.

What stands out to me on this chart is the positive divergence from the OBV during the recent pull back. Longer term trend and volume support lines are holding. But again, we need more information to make a call. Of course, this index, along with any others in the ASX that are showing support, are at the mercy of US markets. Below is a 2 year chart in weekly format of the SP500 in the US.

The negative divergence on the 13 period MFI was and is obvious. However the slower and arguably more reliable OBV is still trending strongly and not diverging. Price is also trending strongly. Lets talk a little market psychology:

Many agree the markets were overbought before the recent Fed meeting. When markets are over bought and many are bearish and fearful, it doesn't take much for a sell off to occur. The Fed cut the expected 0.25 % but the narrative about inflation from the Fed chairman spooked the market. As Ed Seykota once famously said "everyone gets what they want form the market". The "market" (people) got what they wanted - a reason to sell. However, as with the XAO chart, I think its too early to tell if this recent pull back is a correction (as in August 2024) or the beginning of something more sinister.

Times like this is when the individual trader/investor needs to decide what their plan is. I know people 100% invested, 50% invested or 100% in cash because they think the risk is too high. Also, are you the trader that uses weekly charts, daily charts, waits for confirmation from either of those time frames or - sells earlier based on other reasons?

Have a plan and stick to it is often the best way.

So, to repeat, it is too early IMO to make a call on the probability of what this market will do - lets see what the next few weeks will bring, alerts below...

cheers,

Peter.

52 week closing highs as of the Fridays close 27/12/2024

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: HLI

300 - 500: BOT NZM

Have a good trading/investing week.

Peter

I am taking a 2 - 3 week break so there will be no comments or charts to discuss.

However I have posted the 52 WH alerts below for this week and if I have internet will do so the following week/s.

52 week closing highs as of the Fridays close 29/11/2024

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: GTK QUB

300 - 500: EHR PAR SGF SVR

Have a good trading/investing week.

Peter

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period for 22/11/24

I have said many times here "price is the ultimate indicator". All other indicators (which are mostly gleaned from price and volume) are a guide, price is the boss and its best to do what the boss tells you. Looking at the chart above the volume indicators are lagging the price - a little. However considering last nights huge rally in the Russell I would think Mondays XAO performance will mirror that. Of course I have learnt not to "expect" but the correlation between the Russell and the XAO is significant. Last week I said this:

the Russell is still showing a strong break out despite this weeks pullback. I would think some buy opportunities will exist if the price falls more and THEN goes back up after bouncing off support. The Russell could still fall more - perhaps down to the 2200 area. At that price the OBV and MFI will be sitting on support lines and unless the market gets really bearish, the probability is it would be a good buy zone.

Of course it may not fall that far, it could just power on............

You can scroll down to last weeks chart of the Russell but if you go to many of the free chart providers (stock charts, big charts, trading view) you can see the last 4 days of the Russell was nothing but up.

A few other big things happened through the week. Gold bounced but the shares still languish its performance. I do think its only a matter of time before good quality gold juniors play catch up, but until then we cant force or expect it. There is a saying in Zen "nothing is forced or controlled" and that is certainly the case with gold shares at the moment. In fact its a great saying to keep in mind with all your trading. Be in flow - don't fight whats happening even though you "think" it "should" be different.

Bitcoin and some of the altcoins had a strong week. I do wonder if the interest in crypto is pulling capital away from the gold sector. In the past the place to speculate was gold shares but now its altcoins? Could be.

The bull market in 52 week closing highs - is back in town. There are eight signals this week in the Australian top 500.

Have a good trading and investing week,

all the best

Peter

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 22/11/2024

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: ALQ ASX MYS NXG ORG SQ2

300 - AVJ CBO

The exit used FOR THIS METHOD is the 5/12 EMA crossover. Therefore, some stocks will be re signalling a new high buy signal if they have been recently exited by using the 5/12 exit within the last 12 months. This is important and you need to understand this.

Of course the 5 EMA needs to be above the 12 EMA to make the 52 week high valid, (otherwise we would be selling straight away) nearly always this is the case, but rarely if a stock spikes it is not.

So to repeat, the rules are: USING WEEKLY PARAMETERS!

Entry:

Share price to make a 52 closing (or equal to) week high (when selecting a buy, favour the cheapest stock)

The 5 ema to be above the 12ema

Exit:

if the 5 ema crosses below the 12 ema

The above system contains no position sizing, bull or bear filters or fundamental stock selection, these are discussed and taught to private clients or at my courses.

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Last week I mentioned low volume but this week made up for it. The two volume indicators on the chart above look "toppy" but the price had a strong week. The bulls won the week over the bears - note how the price closed up at the end of the week after being down earlier. That sort of price action is positive, it indicates people are still buying despite the Trump election euphoria backing off in the US. You can see this clearly in the chart below.

I have mentioned many times the correlation between the Russell and the XAO and it is why I often discuss this Index. For the broad based rally in the US to continue this index really needs to perform - not just the Nasdaq or SP500.

After the initial euphoric rally, price reversed this week on the Russell. You can see how the reliable 13 period MFI was flashing a bearish divergence and price responded accordingly. However, the Russell is still showing a strong break out despite this weeks pullback. I would think some buy opportunities will exist if the price falls more and THEN goes back up after bouncing off support. The Russell could still fall more - perhaps down to the 2200 area. At that price the OBV and MFI will be sitting on support lines and unless the market gets really bearish, the probability is it would be a good buy zone.

Of course it may not fall that far, it could just power on and I will be keeping an eye on the daily chart to see if that happens.

Below is the gold chart.

Gold looks oversold and the gold stocks are suffering because of it. Price is sitting on the first horizontal support line but it could fall more to the second support line around 2500. The short term 10 period MFI is oversold. In the past each time that indicator has got so low the price has bounced, but a bounce is not necessarily a rally or a new trend, so we will have to wait and see how this one plays out. IMO there are still positives for gold and gold shares but it depends - the US$ is having a rally and it needs to back off, money is pouring into tech and crypto, doubts have now emerged about the speed and amount of rate cuts (low rates favour gold).

So, a lot happening at the moment. You are either finding it all interesting and perhaps exciting or the amount of unknowns are stressing you out.

Remember to have a plan, know your risk tolerance, take your stops, don't ride the losers, try not to have stops too tight - its a good way to die from a thousand cuts.

Have a great week - it will be an interesting one!

Peter

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 15/11/2024

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: GMG HSN QBE VUL

300 - 500: LGI

The signals provided are WITHOUT A BULL FILTER.

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

This is a similar chart to the one from last week - except the price has bounced off support levels. I do notice something, not a lot of volume from last week. I suppose the Aus market did have 3 days of uncertainty before the election result was certain. Looking at a daily chart (not shown) volume on Thursday and Friday was a lot more than Monday to Wednesday.

It remains to be seen if the market follows through with more buying next week. Regardless of that this is a very strong market and as Ed Seykota once quipped "the trend is your friend until it bends at the end".

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 8/11/2024

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: BEN CPU NWS

300 - 500: KPG

Comments and charts from 1/8/24

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Last week I said this: " markets do not go up in a straight line and at some point in time this market will correct. At the moment you can see the MFI is now in overbought territory and the OBV is sitting on its trend line. When markets get toppy they get nervous and it won't take a lot for this market to correct - just some worrying news. Next weeks US election (Nov 5th) may well be the catalyst. First support sits around 8300 and then 8200 and then of course the round number of 8000"

Well we didn't really get any worrying news (maybe a little about company earnings faltering) but the concerns about the U.S. election is the big thing on peoples minds. A dip down next week to that support area around 8200 would not surprise me. I am going to digress a little and have some fun......

Sometimes it helps to put our "imagination hat" on. For example here are some scenarios about next week in circus land - remember, Americans love a show.

1/ Trump wins with a solid margin

2/ Harris wins with a solid margin

3/ The election is very close and uncertainty prevails for 2 weeks

4/ Trump loses and kicks up a fuss and markets fall (or rise because it was expected)

5/ Trump wins but markets fall on worry he is a loose cannon

6/ Trump wins and markets rise on thoughts he is good for the economy

7/ Harris wins and markets rise on a "same as before, steady as she goes" mentality

8/ Harris wins and markets fall on worries the democrats cant manage the economy and Trump will continue to cause problems

9/ Whatever happens markets rise from a relief rally that we know who is president and the election is over

points 10, 11, 12 and so on...........

So, how does anyone know what will happen? In my opinion it's a waste of time trying to predict, and where am I going with this little rave? Regular readers have guessed. Have a plan, your risk tolerance and methodology worked out so you know what to do in any scenario. I know people that are 100% in cash, 65%, 50% etc. I know people that are "all in" 100% invested. These are the times its so important to know your plan and stick to it. Don't have a plan?

I suggest you first read my eBook Mindful Trading and then follow up with The Zen Trader. Link to those books is below

https://www.easysharetradingsystems.com.au/products-and-services/e-books

So, let us see how the circus all unfolds next week and I look forward to writing about it next week!

Regards

Peter

COMMENTS AND ALERTS as of the Fridays close 25/10/2024

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

I have been saying for quite a few weeks now that we have a strong bull market. However, markets do not go up in a straight line and at some point in time this market will correct. At the moment you can see the MFI is now in overbought territory and the OBV is sitting on its trend line. When markets get toppy they get nervous and it won't take a lot for this market to correct - just some worrying news. Next weeks US election (Nov 5th) may well be the catalyst. First support sits around 8300 and then 8200 and then of course the round number of 8000.

As you can see this week was down but on low volume. One bar does not make a trend and next week we will certainly have more information from the price and volume. That will give an indication of how strong this market really is.

The Russell in the US paints a similar story. It's pulled back and it remains to be seen if this is just a consolidation period or something more sinister. Volume indicators are holding OK, but the index needs some good news to rise . Again the same story applies, the next two weeks in the US is pivotal to the fortunes of this index.

Until next week

Peter

COMMENTS AND ALERTS as of the Fridays close 18/10/2024

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

It's a bull market. Price is up, both volume indicators are up and are showing no divergence. I will be Zen about this index and say nothing more - as there is not anything more to say :)

However, I will discuss the Russell, as I have often mentioned the correlation it has with the XAO and the importance of this index to show if the rally in stocks is broad based or not.

For simplicity I have chosen to show a line chart. Line charts are calculated from the closes, being a weekly chart it shows the closing price of each week. This analysis is considered by some as more telling, rather than confusing the mind with Bar, Candle or Heiken Ashi charts (to name just a few of the more popular). So, back to the chart - although volume appears to have a little work to do, price has broken a 2.5 year down trend. Obviously there is strong resistance at 2400. "If" this index gets the volume (buying) that it needs to continue its uptrend, the measured move once it takes out the high of 2400 - is..... wait for it ..... 3200.

Will this happen? How do I know! :)

What I do know is, rates are falling, so is inflation, the $US is falling which can be good for US stocks, oil is cheap which is good for many businesses, the US election is an unknown - but it would not surprise me to see markets settle and then rally once it's over. Employment is steady too. So, on the other side of the bears are the bulls, maybe even the "Goldilocks economy bulls". A saying once quipped by Alan Greenspan (ex Fed chairman) before the 2007/8 crash and GFC.

Of course we have risks, the Middle East, Taiwan, US debt, unemployment could rise. The list is long and the market climbs a wall of worry. How do we manage all this diversity of thinking and feelings?

Trade within your means, manage risk, have a plan - particularly an exit plan. Stay healthy, exercise, eat well, hang out in nature to remind ourselves there is something bigger than just us and the markets "out there".

PS: if you scroll down and look at last weeks chart comparing the XGD with the Gold price and my comments about them tracking each other - the XGD is now (this week) outperforming the Gold price. With last nights rally in precious metals in the US, this trend will continue until buyers are exhausted. I will discuss the gold and gold stocks next week, as I want to wait and see how gold and the gold stock sector performs this coming week. I expect gold stock juniors to go bannanas but I have also learnt to expect nothing.

Until next week

Peter

COMMENTS AND ALERTS as of the Fridays close 11/10/2024

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

The XAO is still trending up. A little less volume the last few weeks which is understandable. The market climbs a wall of worry and the current worry is the US election in early November. Many economists are concerned about a Trump win, why? Too much unknown. Markets prefer certainty and therefore prefer a Harris win. That would mean "steady as she goes" ( no pun intended) and not so much change. I think markets may rally after a Harris win but I am not one to predict, just a gut feel. I want to discuss the Russell 2000 again this week, as it is the most correlated US index with the XAO.

As you can see its looking quite strong. Despite the doom and gloom from some analysts, this index which reflects more the health of Main street not just Wall street, appears quite healthy. It is showing that the rally in stocks is becoming more broad based and that it is no longer just the magnificent 7 driving the market. One more chart - comparing gold with the Australian gold share index.

A frequent comment I hear is that gold stocks are not keeping pace with the gold price - or that the stocks are not outperforming the gold price as they "should". Well, there are no "shoulds" in trading, just what's happening. As you can see stocks ARE tracking the gold price and very closely since March. In the past (which is not the present) there have been times when gold stocks HAVE outperformed the gold price. Will they start to outperform again?

How do I know ! :)

What I do know is that it could happen, and if it does happen, the place to be is in the mid and small cap gold miners that are yet to perform.

That's it for me this week. Apologies for missing last weeks post.

All the best,

Peter

Alerts for this week are below,

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 11/10/2024

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: MAF TPW

300 - 500: BLX BVS RPL

The signals provided are WITHOUT A BULL FILTER.

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

I am writing this Monday 30th September - a bit late this week as I was away for the weekend facilitating a Zen workshop. Unfortunately with some of the recent bugs on the site I have managed to accidentally delete some previous weeks comments, so I will repeat some comments here.

What appears outstanding with this recent rally is the OBV - it's strong, very strong. Its outpacing the price, what normally happens here is one of two things.

1/ the price plays catch up.

2/ the price slows or even falls a bit to revert back to the "normal" correlation between price and volume.

Looking at the 13 period MFI you can see it's made a 52 week high, its much higher than it was in Sept 2023 and is now approaching the over bought (OB) area which was way back in July 2020. However! Interestingly you can see the price continued on from that high in July 2020 to rally another 2000 points or around 35%, from 6000 to 8000. That is a great example of how indicators - be they technical or fundamental, do not predict the price. Indicators provide some essence of probability but -

price is the ultimate indicator.

Here is another chart to discuss, that I think has very big ramifications for the Australian stock market in the near future (weeks to months perhaps years).

For quite a few years now the discussion amongst many analysts has been that the market, both here and in the US, has not been broad based. It's been dominated by the Gorilla stocks such as the Magnificent 7 in the US and the big stocks here in Australia. Eg: CBA, WES, WOW, RIO etc., which are all in the top 20. The narrative was, that what the market (and the economy) needs is to see the mid cap and smaller companies start to perform. What was holding back these companies? You probably guessed - interest rate cuts.

So, the chart above is clearly breaking to the upside. The XSO represents the stocks in the ASX 300 that sit between 100 to 300, It cuts out the top 20 of course as well as the remaining top 80, excluding completely the top 100, focusing on the mid caps and smaller companies.

The price has broken a 2.5 year down trend, the last 2 weeks of volume have been very bullish and the volume indicators are responding. Every alert this week from the ASX 300 (ten of them) is from the 100 to 300, that should tell you something, it's obvious, that is where the strength in the market is.

Now, even though the MFI is approaching the OB area, as we have seen before, price can continue. IMO there is now something of great importance to watch closely, the OBV. If, (trading has lost of if's) the OBV makes an all time high - which is not far away, this will be another huge bullish sign for this sector, the stock market, the economy, politics, macro economics, the works. Of course there is much discussion about how long this rally will last, all based around the many indicators be they technical or fundamental, but markets are strange beasts and they will do what they want. Once human emotion takes over and FOMO kicks in prices can go to very high levels. Those of us that traded during the dot.com years of 1995 - 2000 know this well. So, one more chart and you are going to think I am crazy.

The chart below is the SPX from the US. It's a quarterly scale to take out the noise. In 1996 when this index made a new all time high, it doubled in 2 years from 500 to 1000, it tripled in 4 years (1996 to 2000) from 500 to 1500.

A doubling from the recent all time high of 4,800 will take the market to 9,600, a tripling in 4 years will take it to almost 15,000. Can't happen?

It has before! And, the chart below (for effect) is NOT in log scale, do yourself a favour and look at it in that format allowing for % gain, it looks more probable.

Food for thought,

have a great week,

Peter.

Alerts for this week are below,

ALERTS FOR THIS WEEK POSTED BELOW

52 week closing highs as of the Fridays close 27/9/2024

Below are the alerts from a scan of the ASX 300 and the 300 to 500

300: A4N DEG IDX INR LYC PXA RUL SDR SFR TUA

300 - 500: FWD

Please note: in the eBook I wrote in 2016 (available for purchase on this website on the link below) I have made some changes to the system. If you have bought the eBook I am happy to email you a PDF explaining the changes I made, which from testing and trading does improve the system.

Here is the link to the eBook Mindful Trading using Winning Probability written in 2016 -

and the internationally published The Zen Trader (2022) - now in three languages, English, Spanish, German and in 2025 Traditional Chinese.

IMPORTANT POINTS TO CONSIDER

A new 52 week high for this system is classified when the stock price is at its highest close (or equal to the highest close) counting back 52 weeks.

If a stock continues to make new highs, for example in the 53rd and 54th week, they are now regarded as ROLLING highs, not NEW 52 week highs.To clarify again, the buy signal for THIS system discussed is a NEW 52nd week or 1 year closing high, not a rolling high as is often given elsewhere.

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

This week I will keep it brief. The XAO had a reasonable week considering the big falls on Monday. Volumes are holding OK. It's a wait and see game now as to how next week trades and if buyers return to support the market.

A lot of that will depend on how the US markets perform on Friday their time.

I will update this page on the weekend.

So I wrote the above on Friday night before US trading - and how did it go and how did the indexes close for the week? Below is a chart of the globally dominant SPX.

The MFI 13 period was showing a negative divergence, markets were nervous and all it was going to take for a fall was an event. Well we got one, the Japanese raising rates. However that is the past, what about the present? In my opinion until this index breaks below the low in April of 4953 it is still in a weekly uptrend. Others may disagree but that is the level I think is critical.

The MFI on the SPX is still pointing down but if you change it to a shorter time frame (6 weeks) it is in over sold territory. Also, I like to remind people that "one bar does not make a trend". Although this weeks bar is very positive, the index has more work to do to convince the bears and those nervous about the "what ifs".

Let's now turn our attention to the Russell.

Before this recent correction the focus of many was on the rotation from big caps to small and medium cap stocks. How quickly people forget the current narrative and move to the next! Looking at the chart above it appears that the rotation is still healthy and alive. Which will be good for the ASX as the Aus market is closely correlated with the Russell - as discussed many times here in these comments. (scroll below through previous weeks to find that)

Volume support on the Russell appears stronger that the SPX. This makes sense as the SPX contains the Gorilla stocks (Tesla, Nividia, Apple - the magnificent 7 etc) that were being sold off and funds rotated into the Russell. For example, compare the volume bars of this week between the SPX and the Russell. For every seller there is a buyer and there is obviously many buyers active in the Russell.

I notice too last night in the US that the futures for XJO (top 200) outperformed the US SPX -a sign of things to come? One bar does not make a trend :)

Gold: no chart today but the trend continues up. The GDX in the US was up another 1% last night and one would expect (be careful using that word) that the Aus gold stocks will rise again on Monday.

As you can see there were no 52 WH alerts this week - not surprising. Stepping aside when the market is not giving signals is a feature of that system.

Thats it! Have a great weekend and I am off to help organise a 21st birthday party.

Cheers!

Peter

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Lets talk about the chart of the XAO. One bar does not make a trend IMO. Sure, its got a bearish look to it - this weeks bar, but I repeat, one bar does not make a trend so we need more information to make a bearish or bullish call. Probably the most difficult thing about being a market participant is uncertainty. All we really have is the present because no one knows what the future holds, there is probability and you can manage your portfolio around that, but no one knows whats going to happen. If you want to read a little about my thoughts of "what if" and "don't know" click on the link for a newsletter I wrote back in 2015.

https://www.easysharetradingsystems.com.au/products-and-services/archive/listid-1/mailid-79-what-if

So whats happening in the now? Coming back to the chart we can see its still trending up, volumes are holding and despite this weeks volatility, this weeks low and this weeks close, are still higher than the week before. Also there are 6 stocks making 52 week closing highs this week in the ASX 500, so some stocks are performing well.

Last week I said " Its also a very difficult market to trade because moves up, and down, are fast and unsettling.

And

"So! Have a plan in mind how you will manage your trades ............."

Speaking of plans here is the performance of the eBook system on the ASX 500 the last 12 months. 16% without dividends included.

I acknowledge its not knocking it out of the park, but its not losing either. I checked my recent 3 month portfolio performance last night, up 2 % since late May. It was up 7% , but this week it got knocked around. Its been a tough time and I admit to feeling exasperated as I am sure many are.

Lets look at arguably the most important index. Nasdaq 100.