|

Connect with Peter on LinkedIn!

The rain has come to many parts of the country, a welcome relief to many, seemingly breaking the drought, but the rain isn't all that's been falling. This week I received quite a few emails from people concerned about the recent volatility in the US market and the impact on the Australian market. I decided to take a good look at the index of the Aussie 500, the chart is below.

An old trading friend of mine thinks I am a little obsessed about the On Balance Volume indicator. Those of you that have been following me for years will know I attempt not to give preference to any idea, only ones that seem to have a record of probability.

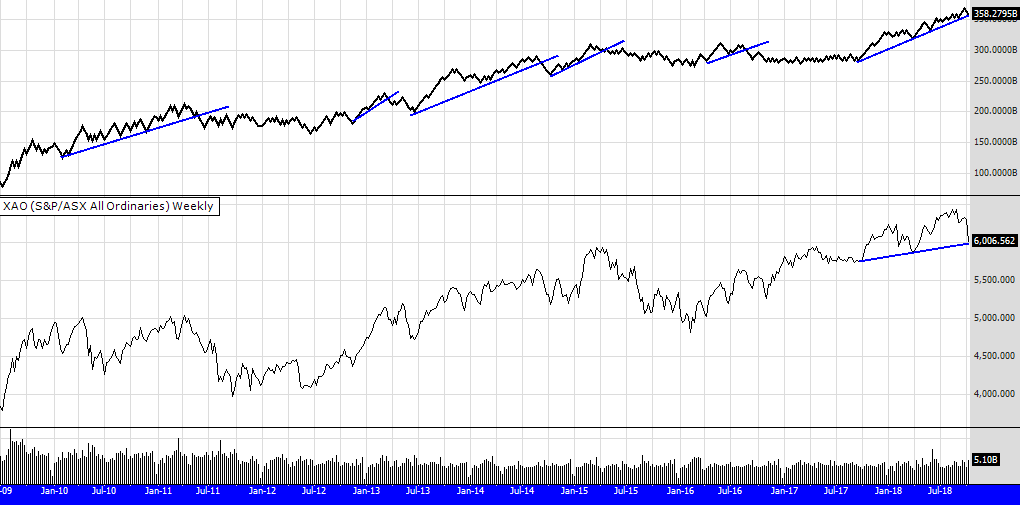

The chart above shows weekly price action on the Australian market over the last nine years, the period since the GFC. Above the price chart is the on balance volume indicator. Everytime the OBV has broken its uptrend line the market has fallen. As of now it hasn't broken, suggesting that despite the savage falls in price, sellers lack commitment. This could well be a typical volatile pullback in a bull market.

The other thing to notice is the price of the Aussie 500 is holding its trend line too.

When the market falls quickly like it has this week, it can be very challenging for those with money in the market. Here are some technical tips to help you cope, for now or in the future.

1/ Have a plan or a method. The market can be a chaotic volatile place. People that work in chaotic environments (think police, fireman, emergency wards etc) all have plans and systems to fall back on.

2/Learn how to size your trades. Small size trades or volatility based sized trades reduce pullbacks in portfolios.

3/Learn about stock fundamentals. Stocks with good economic fundamentals tend to hold up better in falling markets, reducing pullbacks in portfolios.

and some trading psychology

1/ Trade with a amount of money that reduces your temptation to panic and sell. This amount is often half what your first thought was.

2/Do not screen watch. If you trade a daily, weekly or monthly system and you are committed to acting on daily, weekly or monthly decisions, then screen watching during the day, week or even intra day, (very tempting with a smartphone) will just drive you crazy and tempt you to break your rules.

3/ Learn acceptance. Accept that the market can change quickly, either up or down. Accept that trading has an unknown outcome. Attaching to an outcome, having expectations or making predictions will drive you crazy. Your energy is better being put to work on process, not worry or attempting prediction.

4/ Look after yourself physically and mentally. Eat well, get enough sleep, exercise. Get away from the screens often. Being a Zen practitioner I recommend meditation. To trade well you need to be calm and think clearly, meditation will help achieve the appropriate state of mind.

Take a breath, try your best to stick to and trade your method. Keep good records so you can review your decisions later. We can only analyse in the now, and it looks ok.

Winston Churchill, when once asked what would happen about the war, famously said "we shall await events".

Peter

If Facebook is more you thing, friend him here!

|