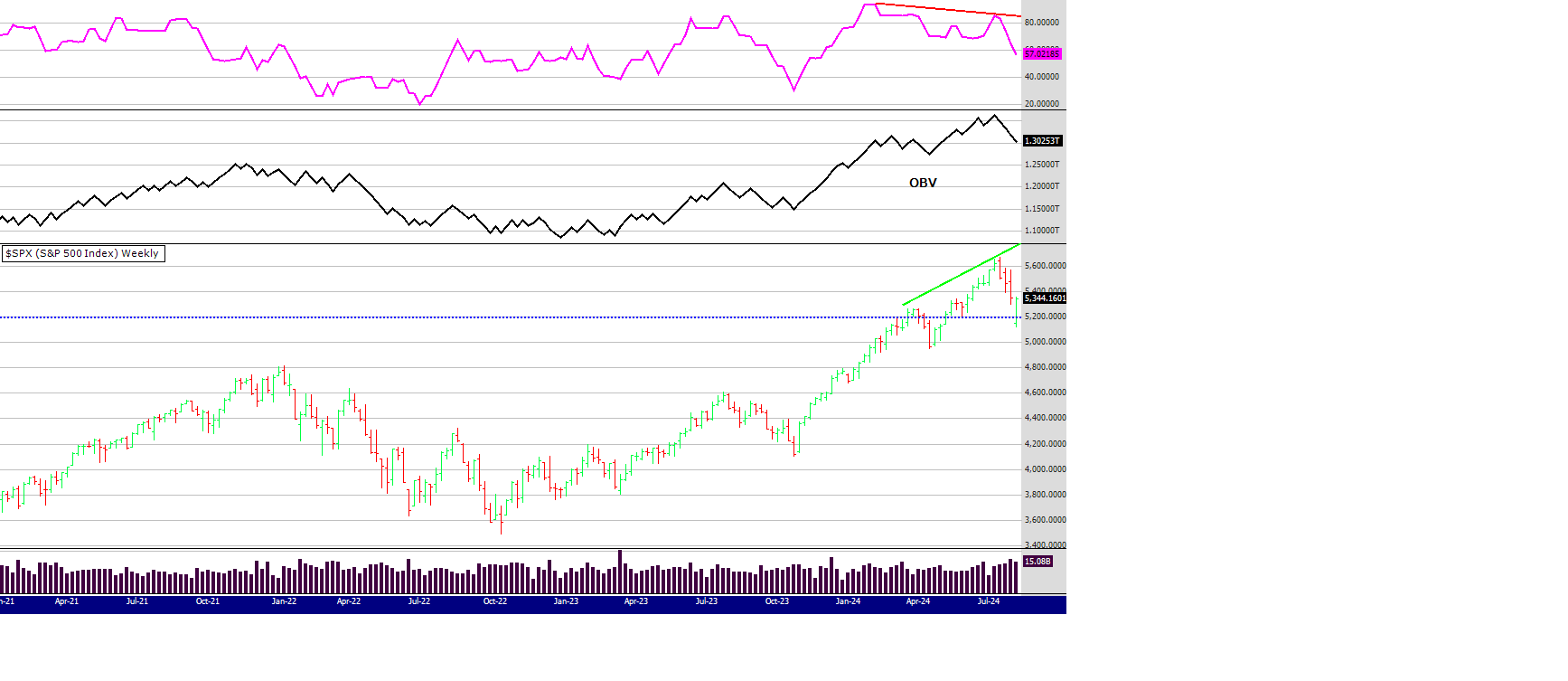

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

This week I will keep it brief. The XAO had a reasonable week considering the big falls on Monday. Volumes are holding OK. It's a wait and see game now as to how next week trades and if buyers return to support the market.

A lot of that will depend on how the US markets perform on Friday their time.

I will update this page on the weekend.

So I wrote the above on Friday night before US trading - and how did it go and how did the indexes close for the week? Below is a chart of the globally dominant SPX.

The MFI 13 period was showing a negative divergence, markets were nervous and all it was going to take for a fall was an event. Well we got one, the Japanese raising rates. However that is the past, what about the present? In my opinion until this index breaks below the low in April of 4953 it is still in a weekly uptrend. Others may disagree but that is the level I think is critical.

The MFI on the SPX is still pointing down but if you change it to a shorter time frame (6 weeks) it is in over sold territory. Also, I like to remind people that "one bar does not make a trend". Although this weeks bar is very positive, the index has more work to do to convince the bears and those nervous about the "what ifs".

Let's now turn our attention to the Russell.

Before this recent correction the focus of many was on the rotation from big caps to small and medium cap stocks. How quickly people forget the current narrative and move to the next! Looking at the chart above it appears that the rotation is still healthy and alive. Which will be good for the ASX as the Aus market is closely correlated with the Russell - as discussed many times here in these comments. (scroll below through previous weeks to find that)

Volume support on the Russell appears stronger that the SPX. This makes sense as the SPX contains the Gorilla stocks (Tesla, Nividia, Apple - the magnificent 7 etc) that were being sold off and funds rotated into the Russell. For example, compare the volume bars of this week between the SPX and the Russell. For every seller there is a buyer and there is obviously many buyers active in the Russell.

I notice too last night in the US that the futures for XJO (top 200) outperformed the US SPX -a sign of things to come? One bar does not make a trend :)

Gold: no chart today but the trend continues up. The GDX in the US was up another 1% last night and one would expect (be careful using that word) that the Aus gold stocks will rise again on Monday.

As you can see there were no 52 WH alerts this week - not surprising. Stepping aside when the market is not giving signals is a feature of that system.

Thats it! Have a great weekend and I am off to help organise a 21st birthday party.

Cheers!

Peter