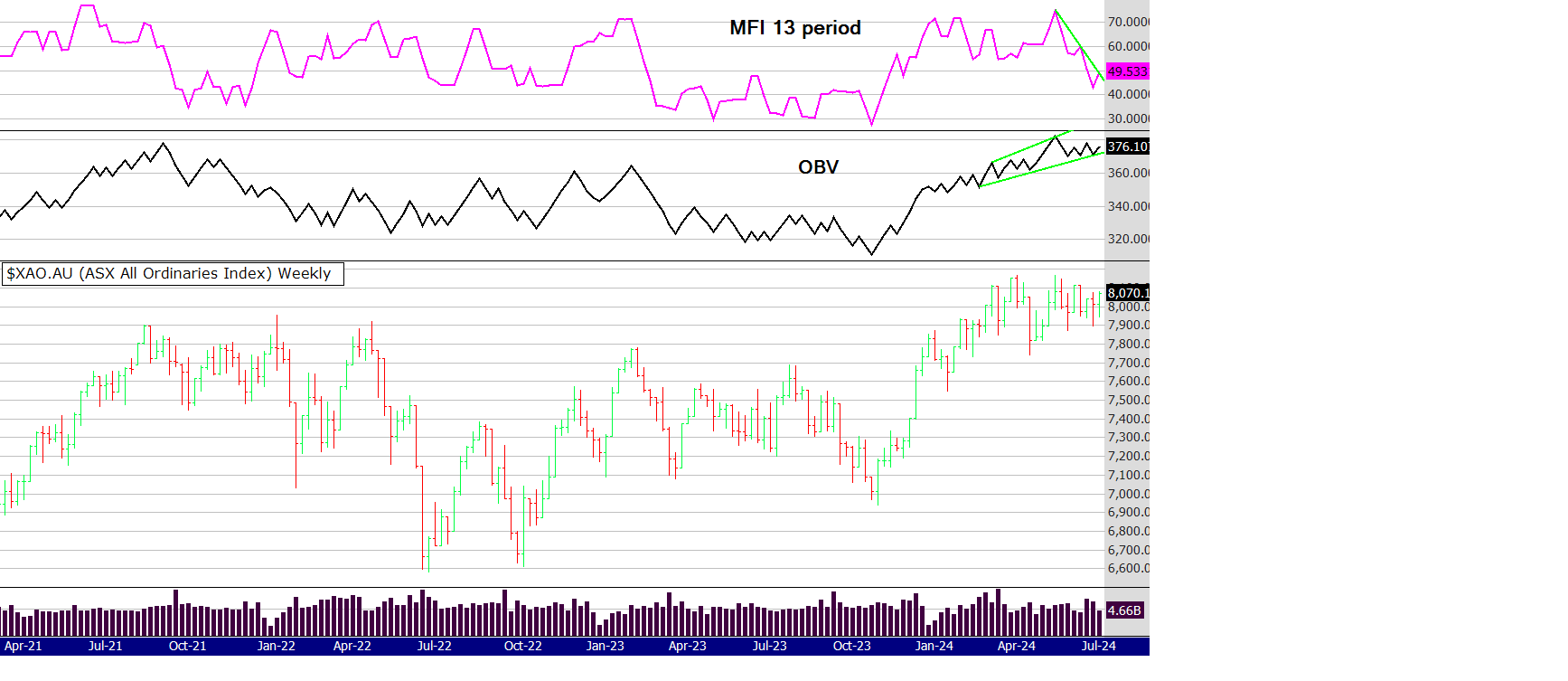

See charts below with an On Balance Volume indicator and the Money Flow Indicator using a 13 period

Well wasn't that an interesting week! On the 1st July money poured into the resources, energy and commodities sectors and made me wonder what do others know that I don't? I found out in a few days as hopes and expectations of a rate cut in the US fueled a rally in the oversold commodities sectors. Gold went along for the ride and had another strong day on Friday in the US. However the Russell 2000 still drags the chain making me wonder what will it take for that index to come to life? Definite, not just rumoured rate cuts perhaps.

The financial sector also had a strong week and what will that sector do if we don't get a rate rise? We will have to wait until the 17th July when the June quarter CPI figures are released and maybe the Aus market will plod sideways until then. Who knows, I am just writing my thoughts about what may happen but we need to stay open minded to possible "good" news as well as "bad" news.

I am a regular listener to the Fear and Greed podcast. Recently they were discussing that banks now made up 31% of the market cap in the All Ords and resource stocks 23%. So 54% of the Aus market is banks and finance. If those two sectors rally, the index rises.

So, looking at the chart above it does seem to be improving - and perhaps building for another leg up. The price action is a little ahead of the OBV, but the MFI is in oversold territory and starting to move up. The 52 WH system is still producing regular buy alerts (five this week) indicating that the market has some strength. A sector that continues to surprise here in Aus and the US is the Consumer Discretionary sector. It seems it takes a lot to stop people spending and the RBA must be wondering what to do next.

Many have there theories about inflation. In 2022 the Australia Institute released a research paper claiming 70% of inflation in Australia was caused by excess corporate profit. It was initially slammed. In 2023 the OECD released a similar finding about Europe! Now this year in 2024 we have the following, claiming US company profits are responsible for over 50% of inflation. See the link below.

Raising rates wont fix the problem if the authors of the three papers are correct. We need fiscal policy not the blunt tool of rate rises in my opinion.

https://www.theguardian.com/business/2024/jan/19/us-inflation-caused-by-corporate-profits

Thanks for reading and until next week

Peter