See charts below with an On Balance Volume indicator and the Money Flow indicator

What stood out to me about this chart was the OBV. After breaking up over its down trend line it has now retraced back to it. The Money Flow Index indicator looks very similar to last week. There were six 52 week closing highs this week in the ASX 500 - see below. Considering the index had a flat week, six alerts is promising showing there are stocks moving up even though the broad based index may not be reflecting that. Bear in mind, and I repeat, the index is driven by resource stocks and banks, if they have a flat week then so does the index. I does not mean to say there are not opportunities in other areas.

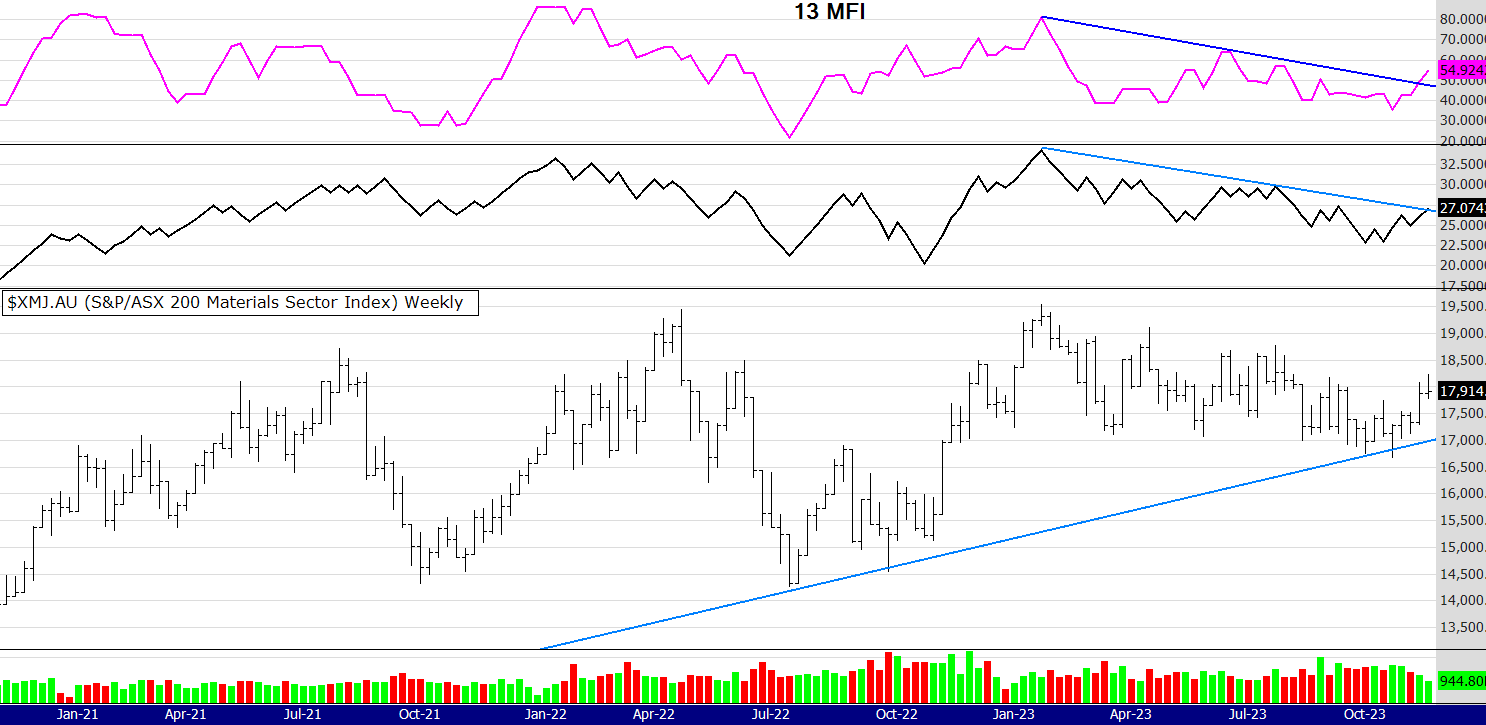

As I said in my video (link below if you have not seen it) the broad based rally appears elusive. I checked the Small Ords chart this morning (not shown here) and it is still struggling to show any conviction. However there has been some good price action in some small resource stocks, perhaps because the XMJ is showing strength. I also mentioned in the video that the XMJ was looking very interesting and could help support and even rally the All Ords. Looking at the chart below you can see that is the case.

What will it take for gold shares to rally? Some had a strong week but others not. Last night in the US gold rose above 2000 yet the gold share indexes went "ho hum". Look at the chart below. It shows the correlation in price between the gold price and the XGD, which is the gold share index in Australia. As you can see it normally correlates closely but recently it has not. now, whats happening? Well either the gold price is overbought or Aussie gold shares are oversold. If the sector decides to play catch up I think there is a quick 10% profit opportunity in the majors and perhaps a lot more in the juniors - so I am watching this space closely.

The other sector also dragging the chain versus its commodity price is uranium. Some of the Aussie uranium miners are not following the commodity price and it is possible that they also play the catch up game.

So that's all a bit to digest and if you find it overwhelming remember the Zen advice of observing and looking with a mind of interest, rather than trying to work it all out. By having a "mind of interest" and not trying to get it all right all the time takes the pressure off. This is a game of probability not right or wrong and your trading plan needs to reflect that philosophy.

I mentioned the video discussing the markets in more detail, its about 2 weeks old now but they are long term charts discussed and still relevant.

Have a great week

Peter