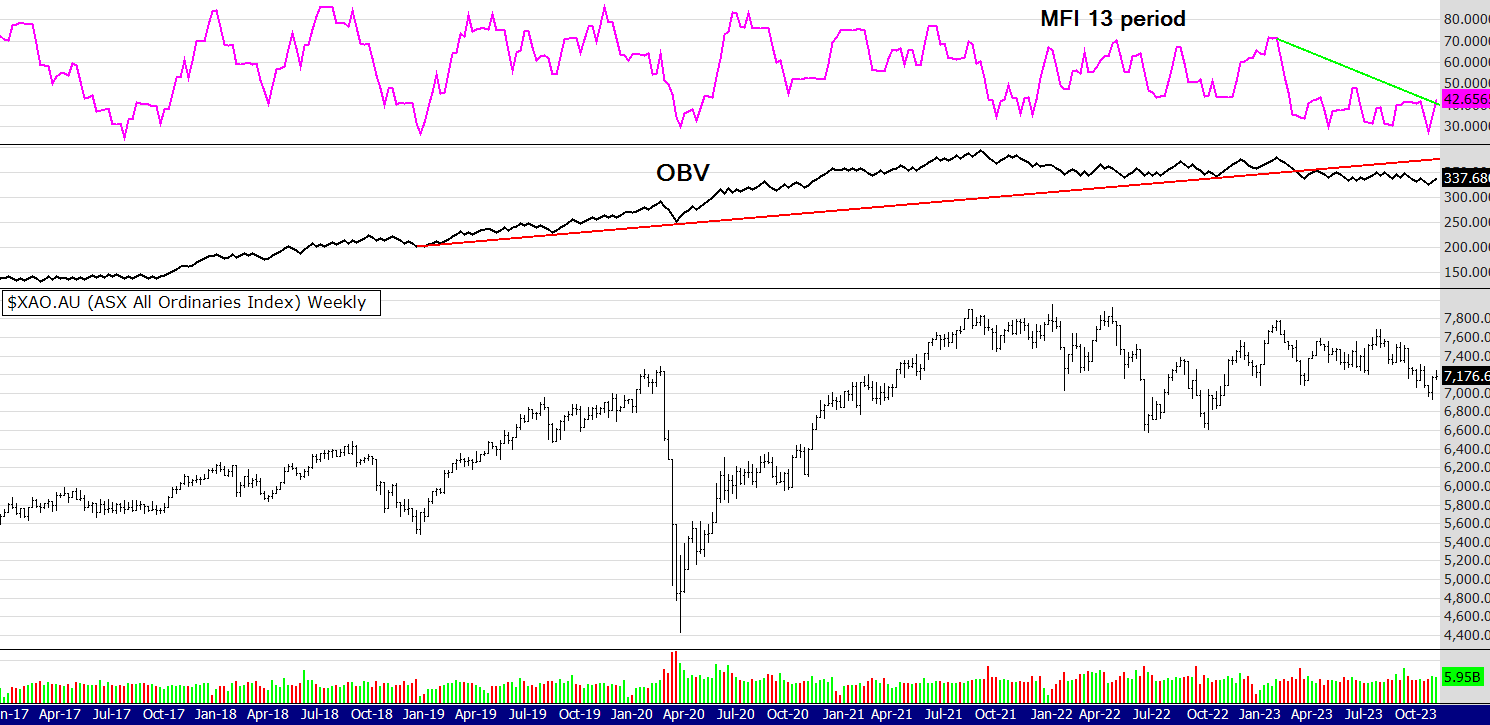

See charts below with an On Balance Volume indicator and the Money Flow indicator

Its been an interesting two weeks on the XAO. First of all we had the "perfect storm" of the US Fed not raising rates and higher commodity prices - the Aus market loved that combination. Then we had the RBA raise rates and commodity prices fell - the Aus market hated that combination and stock prices fell.

Last night in the US the Nasdaq again rose and dragged up the other indexes. The rally in the US is not yet broad based, for example the Nasdaq rose over 2% yet the Russell 2000 could only manage a little over 1%.

Here in Aus the trend is sideways to down - yet the MFI is showing some promise. I think we need a rally in commodity prices and other sectors to to push this index up. Gold and gold shares remain uncertain, as does copper and oil. Its going to be an interesting week.

Until next week stay well.

Peter