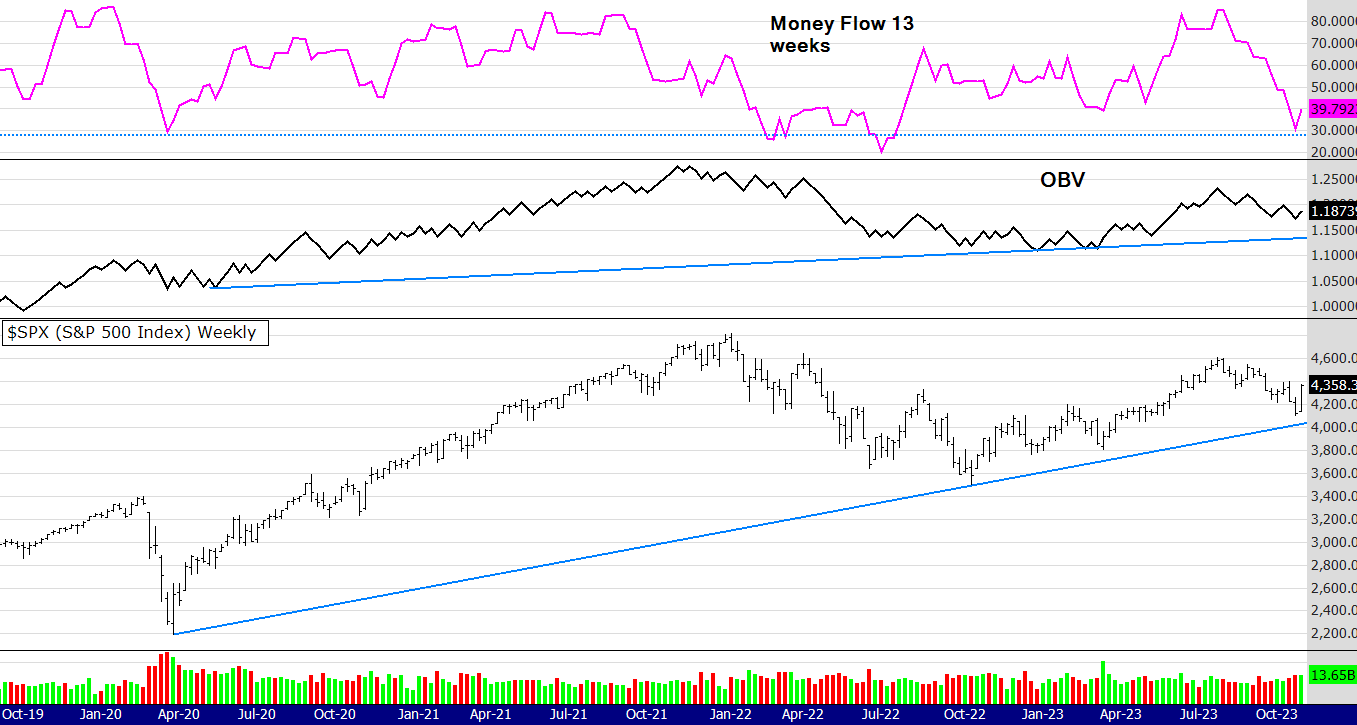

See charts below with an On Balance Volume indicator and the Money Flow indicator

This week I have again decided to focus on the SP500 in the U.S.

I also think its worth repeating last weeks comments.

"You may get bored of me repeating the same thing - we live, trade and invest in the present, not the Armageddon of the future that many believe is inevitable. Keeping that philosophy in mind you can see that there is a strong trend line supporting the price. The OBV also has a trend line and if you look closely you can see a slight (but small) bullish divergence between price and OBV volume at the right edge of the chart.The more dynamic money flow is still trending down but is in over sold territory - the same it was during the Covid crash. It remains to be seen what happens to the above index, 4,000 points seems like a magnet and its not far away. In my opinion if it reaches that level the probability would be for a bounce, I notice some fundamental analysts are starting to call sectors of the market good value.These market corrections can be very difficult psychologically, something I wrote extensively about in my book The Zen Trader (link below). Have a good week and try and keep a mind of interest and observation, not one of panic and despair"

Well what a difference a week can make. After the Fed meeting in the US many now think interest rate rises have peaked there, also they have a strong labour market and inflation is falling. Sounds like Goldilocks economy stuff and the market responded accordingly.

Here in the land of OZ it got pretty good too. Of course we correlate with the US index but with commodity prices rising, banks following the US lead and the $A rising the XAO rallied hard. One could ask, what was all the worry about?

Of course there are still concerns Michelle Bullock and Australian Reserve Bank board will raise interest rates on Tuesday - however it's impossible to predict (as was proven last week) so let's carry on and do our best. Doing our best is having some methodology and doing the best we can at sticking to it.

In saying that there are five 52 week closing highs in the All Ords this week and they are listed below.

All the best,

Peter