|

Connect with Peter on LinkedIn!

In this News Letter

Peter to speak at Newcastle ATAA 9th of August

then also at Brisbane on the 20th August

Trading Psychology

Trading Courses in Sydney and Perth

Welcome to this news letter

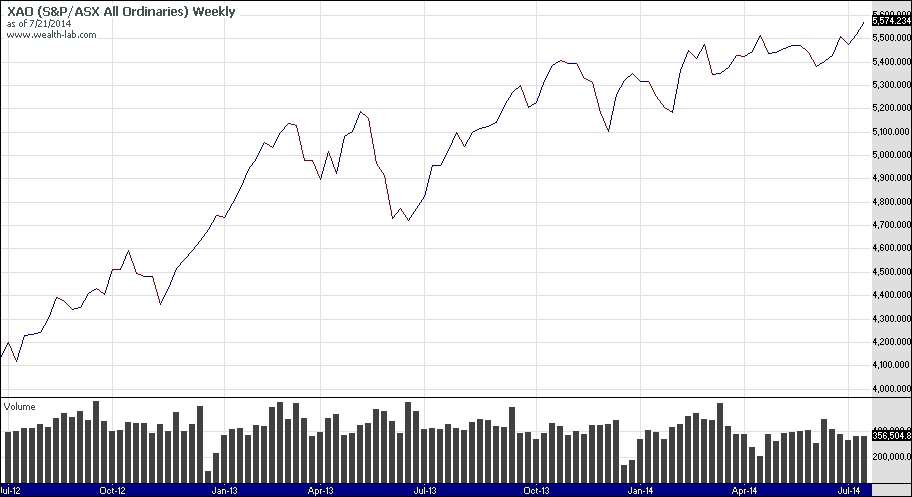

With the recent confirmation of the existing uptrend in the XAO I thought it would be a good time to discuss what goes on between the ears of traders, not just what happens on the charts!

The Trend is your Friend (until it bends at the end)

The trend in the XAO continues up. Probability wins again. I say probability because when a trend is in place , it often continues, and sometimes longer and stronger than many think.... fooling most. There has been an elusive sideways period of the last 6 to 8 months, I say elusive because many kept saying the market was not trending. However perhaps they were looking at too short a time frame and agonising over short term daily charts?

The market has risen almost 500 points in the last 8 months, hardly a sideways move and certainly not a down trend. The best way to play this market has been to stay in, use risk control, cut losers and hold winners. An age old formula that works............if you know how.

Trading can be a simple process, if we want it to be, but many don't, they prefer complication, over control, short term trading, over trading, frustration and steady losses. Perhaps you are doing what Ed Seykota suggested many years ago?

Ed Seykota, the trader featured in the book Market Wizards, coined the phrase above about trends being a friend, the title of this news letter. He had another saying "everyone gets what they want" from the market. Are you getting what you want?

Trading can be and is a stimulating past time. Psychologists and counsellors will tell you something that is stimulating can be very addictive. Just look at the global coffee culture for an example. Ed suggested that many traders got exactly what they wanted...stimulation and excitement, profits were a secondary motivation.

What is your true motivation for trading, and how do you recogonise if your interest is coming from a healthy place?

Successful "healthy traders" do this:

Have a system they understand completely, often a very simple one.

Know what their trading time frame is eg: weekly, daily or even monthly.

Know what sections of the market they are trading. eg: The ASX 300, ASX 500, or a group of carefully selected fundamental stocks.

Do not obsess about the market, are cautious but quietly confident.

Do not check the market on their smart phones every hour! Will monitor the market to suit their time frame, realising that constant checking and gnashing of teeth is distracting, pointless and no good for their mental health.

Stick to the system because they know it gives them the best chance, increasing their probability of succeeding

Losing unhealthy traders do this:

Have no real method or system, do not know the probability of the method they are using, are flying blind most of the time.

Constantly change time frames of trading, buy a short term trade, it doesnt work, so move it into a longer term portfolio. Or, sell a trade in a long term portfolio, grabbing a quick profit, only to see it later double in price.

Keep changing things to trade as each one does not work, they try options, commodities, shares, CFD's, but the problem is them not the "trading vehicle"

Obsess and worry about the market constantly, can't make clear decisions, often have "analysis paralysis" and dont know when to buy or sell.

Check the market on their smart phones every hour! Trade emotionally as the market moves, are very stresssed.

Do not stick to a system, even if they have one, normally because it does not suit them. With all the mistakes happening above, their probability of succeeding is low, the chance of mental health issues are high, impacting their trading even more.

If you recognise in the above some unhealthy patterns in your trading perhaps its time to find an alternative way?

Speaking engagements:

I will be speaking at the Newcastle ATAA on the 9th of August

also at the Brisbane ATAA on the 20th of August

The Australian Technical Analysists Association is an organisation assisting traders to learn about the markets. Entry is free for first timers and then just $30 per visit after that.

Courses in Sydney and Perth

I am teaching trading courses in Sydney on the 6th of September and Perth on the 20th September

If you go to the website and click on any of the tabs about courses all the info is there..or click here

http://www.easysharetradingsystems.com.au/Trading-Course/

Regards

Peter

If Facebook is more you thing, friend him here!

|